Bitcoin Reaches New Peak Amidst Positive US Regulatory Outlook

Table of Contents

H2: Positive US Regulatory Signals Fuel Bitcoin's Rise

The evolving US regulatory approach towards cryptocurrencies is playing a pivotal role in Bitcoin's price increase. Reduced regulatory uncertainty is bolstering investor confidence and attracting significant institutional participation. This clearer regulatory framework is a game-changer for the Bitcoin market.

-

Increased Clarity from Regulators: Recent statements from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) suggest a more nuanced and potentially less restrictive approach to regulating cryptocurrencies. While specifics are still developing, the move towards clearer guidelines reduces the ambiguity that has previously deterred institutional investment.

-

Attracting Institutional Investors: Clearer regulatory frameworks significantly reduce the risk associated with Bitcoin investment, encouraging institutional players, such as hedge funds and investment firms, to allocate a portion of their portfolios to this asset class. This influx of capital directly impacts Bitcoin's price and market stability.

-

Examples of Positive Developments: The ongoing discussions regarding Bitcoin ETFs (exchange-traded funds) and the increasing acceptance of cryptocurrencies by major financial institutions are indicative of a more favorable regulatory environment. These positive developments contribute to the narrative of growing mainstream acceptance.

-

Future Regulatory Changes: While current signs are positive, the regulatory landscape remains fluid. Future developments, including potential legislation and court rulings, will continue to shape the Bitcoin market and investor sentiment.

H2: Increased Institutional Investment Drives Bitcoin Demand

The growing participation of institutional investors is a key driver of Bitcoin's recent price surge. Large-scale investments are significantly impacting liquidity and driving up demand.

-

Institutional Adoption Accelerates: Major financial institutions, hedge funds, and asset management companies are increasingly adding Bitcoin to their investment portfolios. This diversification strategy reflects a growing recognition of Bitcoin's potential as a valuable asset.

-

Reasons for Institutional Interest: Institutional investors are drawn to Bitcoin for several reasons, including its potential as an inflation hedge, its limited supply, and its relative independence from traditional financial systems.

-

Impact of Large-Scale Buying: The sheer volume of institutional buying exerts significant upward pressure on Bitcoin's price, contributing directly to its recent peak. This buying pressure increases liquidity within the market, making it more accessible to smaller investors.

-

The Role of Bitcoin ETFs: The potential approval of Bitcoin ETFs would drastically increase accessibility for institutional investors, potentially leading to even greater price appreciation. This would allow for simpler and more regulated entry into the Bitcoin market.

H2: Macroeconomic Factors Contributing to Bitcoin's Growth

Global macroeconomic instability is further boosting Bitcoin's appeal as a safe haven asset and a hedge against inflation.

-

Bitcoin as a Safe Haven: Amidst increasing global uncertainty, investors are seeking alternative stores of value, leading to increased demand for Bitcoin. Its decentralized nature and finite supply make it an attractive hedge against traditional financial risks.

-

Inflationary Pressures: Rising inflation rates in many parts of the world are prompting investors to seek assets that can preserve purchasing power. Bitcoin's limited supply makes it potentially resistant to inflationary pressures.

-

Correlation with Traditional Markets: While Bitcoin's price is volatile, its correlation with traditional markets isn't always consistent. This relative independence is appealing to investors looking for diversification.

-

Limited Supply and Long-Term Potential: Bitcoin's capped supply of 21 million coins is a crucial factor driving its long-term value proposition. As demand grows, the scarcity of Bitcoin is likely to continue pushing its price higher.

-

Managing Risk: While Bitcoin offers significant upside potential, it’s vital to acknowledge its inherent volatility. Investors need to carefully assess their risk tolerance before investing in Bitcoin.

H3: Technical Analysis: Examining Bitcoin's Chart Performance

A brief technical analysis reveals strong positive momentum in Bitcoin's price. While this is not financial advice, examining key indicators such as moving averages and relative strength index (RSI) can provide context to the current price action. Recent trading volume has also been substantial, suggesting strong market participation. Current support and resistance levels should be monitored for insights into potential future price movements. However, predicting precise future price points remains speculative.

3. Conclusion:

Bitcoin's recent surge to a new peak is a result of a combination of positive US regulatory signals, a significant influx of institutional investment, and broader macroeconomic factors. The reduced uncertainty around regulation, coupled with increased institutional adoption, has created a powerful catalyst for price appreciation. This convergence of factors suggests that the current Bitcoin bull market has significant momentum.

Call to Action: The cryptocurrency market, particularly Bitcoin, remains a dynamic and evolving space. Staying informed about regulatory changes, institutional investment trends, and macroeconomic conditions is crucial for anyone interested in understanding Bitcoin's trajectory. While potential rewards are substantial, it's essential to conduct thorough research and approach Bitcoin investment with caution and a well-defined risk management strategy. Stay tuned for further updates on Bitcoin's journey as it navigates this positive regulatory environment and continues to reach new peaks.

Featured Posts

-

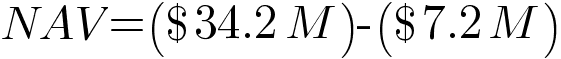

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025 -

Nrw Eis Ranking Der Favorit Aus Essen Ueberrascht Alle

May 24, 2025

Nrw Eis Ranking Der Favorit Aus Essen Ueberrascht Alle

May 24, 2025 -

Whats Open On Memorial Day 2025 In Michigan Your Guide To The Federal Holiday

May 24, 2025

Whats Open On Memorial Day 2025 In Michigan Your Guide To The Federal Holiday

May 24, 2025 -

Cyberattack To Cost Marks And Spencer 300 Million Full Impact Assessment

May 24, 2025

Cyberattack To Cost Marks And Spencer 300 Million Full Impact Assessment

May 24, 2025

Latest Posts

-

Joe Jonas Surprise Fort Worth Stockyards Concert Fans React

May 24, 2025

Joe Jonas Surprise Fort Worth Stockyards Concert Fans React

May 24, 2025 -

First Look Sylvester Stallone Suits Up For Tulsa King Season 3

May 24, 2025

First Look Sylvester Stallone Suits Up For Tulsa King Season 3

May 24, 2025 -

Tulsa King Season 3 Set Photo Features Sylvester Stallone In A Suit

May 24, 2025

Tulsa King Season 3 Set Photo Features Sylvester Stallone In A Suit

May 24, 2025 -

Columbus Man Convicted On Child Sex Abuse Charges

May 24, 2025

Columbus Man Convicted On Child Sex Abuse Charges

May 24, 2025 -

Memorial Day 2025 Checking Florida Store Hours Publix Etc

May 24, 2025

Memorial Day 2025 Checking Florida Store Hours Publix Etc

May 24, 2025