Bitcoin's Rise: US-China Trade Talks Fuel Crypto Rally

Table of Contents

The Impact of US-China Trade Uncertainty on Global Markets

Trade wars, like the ongoing US-China trade dispute, create significant economic uncertainty and volatility. Tariffs and trade restrictions disrupt established supply chains, impacting businesses and consumer confidence. This uncertainty leads investors to seek safe haven assets – investments perceived as relatively stable during periods of market turmoil.

- Increased market volatility due to trade tariffs: The imposition of tariffs leads to price fluctuations and unpredictable market behavior in various sectors.

- Decline in investor confidence in traditional markets: Uncertainty about future trade policies erodes confidence in traditional stock markets and bonds.

- Search for alternative investment options: Investors actively seek assets that are less susceptible to the negative impacts of trade disputes.

This search for stability often pushes investors towards assets perceived as less correlated with traditional markets, leading to increased interest in alternative investments like Bitcoin. The decentralized nature of Bitcoin, discussed further below, adds to its appeal during times of geopolitical instability.

Bitcoin as a Safe Haven Asset

A "safe haven asset" is typically characterized by its stability and low correlation with other asset classes during times of economic or political uncertainty. Gold, for instance, is a classic example. Increasingly, some investors view Bitcoin as possessing similar characteristics.

- Decentralized nature, reducing reliance on government policies: Unlike traditional currencies or stocks, Bitcoin's value isn't tied to a single government or central bank, making it less vulnerable to geopolitical risks.

- Potential for price appreciation independent of traditional market fluctuations: Bitcoin's price can appreciate even when traditional markets are declining, offering a potential hedge against losses.

- Limited correlation with traditional assets: Empirical evidence suggests a relatively low correlation between Bitcoin's price and traditional assets like stocks and bonds.

This decentralized nature and potential for independent price appreciation contributes to Bitcoin’s appeal as a potential "digital gold," offering a store of value during periods of geopolitical instability such as those fueled by the US-China trade tensions.

Increased Institutional Interest in Bitcoin

The recent Bitcoin price rally isn't solely driven by individual investors. Institutional interest has significantly increased, further fueling the price surge.

- Grayscale Bitcoin Trust's growth: The Grayscale Bitcoin Trust, a publicly traded investment vehicle, has seen substantial growth, indicating increasing institutional adoption.

- Increased participation of hedge funds and other large financial institutions: More and more large financial institutions are allocating a portion of their portfolios to Bitcoin.

- Growing acceptance of Bitcoin as a legitimate asset class: Bitcoin is gaining acceptance as a diversifying asset within institutional portfolios, signifying a shift in the perception of cryptocurrencies.

This institutional investment brings increased liquidity and potentially greater price stability to the Bitcoin market, contrasting with its historically volatile nature.

Technical Factors Contributing to the Bitcoin Rally

Beyond macroeconomic factors, technical elements also contribute to Bitcoin's price fluctuations.

- Bitcoin halving event and its impact on supply: The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, creates scarcity and can positively influence price.

- Technological improvements and network upgrades: Upgrades to the Bitcoin network enhance security and efficiency, potentially boosting investor confidence.

- Increased adoption of Bitcoin by businesses and individuals: Growing adoption, through increased merchant acceptance and individual holdings, fuels demand and price appreciation.

The interplay between these technical factors and macroeconomic conditions like the US-China trade tensions creates a complex dynamic impacting Bitcoin's price.

Conclusion: Bitcoin's Rise: A Reflection of Global Uncertainty and Growing Acceptance

The recent Bitcoin price surge is a compelling example of the interplay between global economic uncertainty, specifically the US-China trade talks, and the growing acceptance of Bitcoin as a potential safe haven asset and a legitimate investment. While the cryptocurrency market remains volatile, the increased institutional interest and the perceived stability relative to traditional markets during times of geopolitical risk point to Bitcoin's evolving role in the global financial landscape. Stay informed on the evolving relationship between Bitcoin and global economic events. Understanding Bitcoin's rise in the context of US-China trade talks is crucial for navigating the complex world of cryptocurrency investment. Consider further researching Bitcoin's potential as a long-term investment or hedge against market uncertainty.

Featured Posts

-

Four Inter Milan Players Out Of Contract In 2026 A Detailed Look

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 A Detailed Look

May 08, 2025 -

Should You Invest In Uber Technologies Uber A Detailed Look

May 08, 2025

Should You Invest In Uber Technologies Uber A Detailed Look

May 08, 2025 -

Ethereums Bullish Run Analyzing Current Price Strength And Future Outlook

May 08, 2025

Ethereums Bullish Run Analyzing Current Price Strength And Future Outlook

May 08, 2025 -

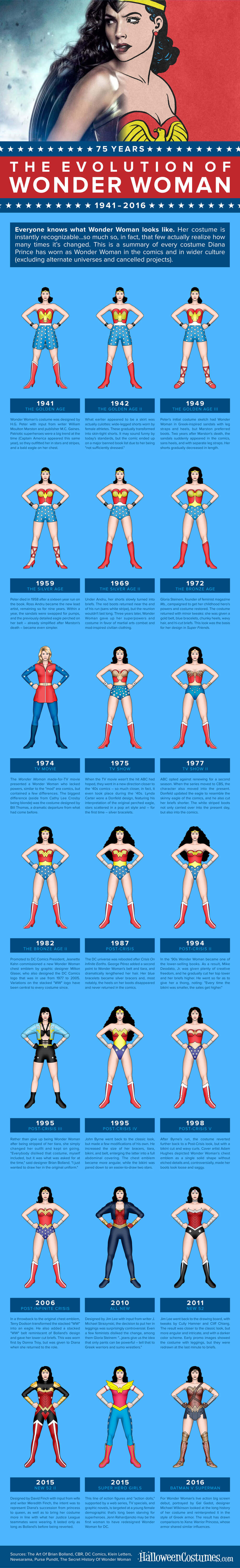

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

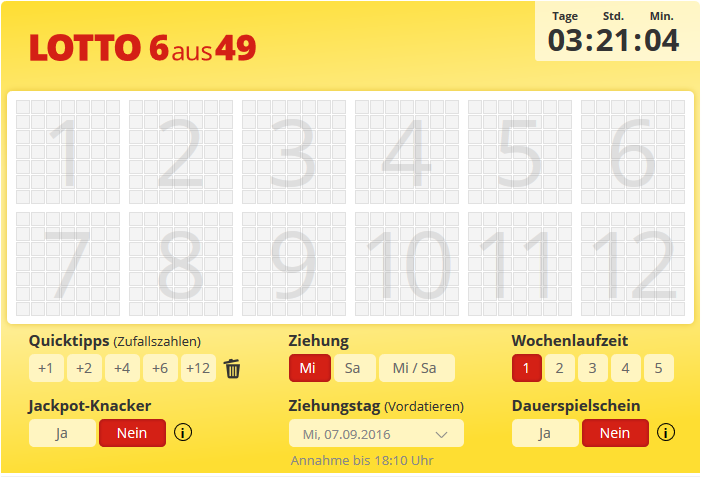

Die Lotto 6aus49 Ergebnisse Des 19 April 2025

May 08, 2025

Die Lotto 6aus49 Ergebnisse Des 19 April 2025

May 08, 2025