Ethereum's Bullish Run: Analyzing Current Price Strength And Future Outlook

Table of Contents

Analyzing Ethereum's Current Price Strength

Key Technical Indicators

Several key technical indicators point towards bullish momentum for Ethereum. Analyzing these indicators provides valuable insight into the current market strength and potential future price movements. For example, the Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 generally suggests an overbought market, while a reading below 30 suggests an oversold market. Currently, a positive RSI reading above 50 might suggest further upward momentum, but it's crucial to consider this in conjunction with other indicators.

The Moving Average Convergence Divergence (MACD) is another momentum indicator that shows the relationship between two moving averages. A bullish crossover (when the MACD line crosses above the signal line) often signals a potential price increase. Similarly, moving averages themselves, such as the 50-day and 200-day moving averages, can indicate trend direction. A "golden cross," where the 50-day moving average crosses above the 200-day moving average, is often interpreted as a strong bullish signal. [Insert chart showing RSI, MACD, and moving averages for ETH].

Significant support and resistance levels also play a crucial role. Breaking through key resistance levels often indicates a stronger bullish trend. Identifying these levels through chart analysis is vital for assessing the strength of the current rally.

- Increased trading volume

- Breaking through key resistance levels

- Positive RSI readings

- Golden cross pattern (if applicable)

Fundamental Factors Fueling the Bull Run

Beyond technical indicators, several fundamental factors contribute to Ethereum's bullish run. The improving scalability of the Ethereum network, largely driven by the ongoing implementation of sharding, is a significant factor. Sharding promises to drastically increase transaction throughput and reduce fees, making Ethereum more efficient and attractive for a wider range of applications.

The booming Decentralized Finance (DeFi) ecosystem built on Ethereum continues to attract substantial investment and user activity. The growth of DeFi applications, from lending and borrowing platforms to decentralized exchanges, drives demand for ETH. Similarly, the Non-Fungible Token (NFT) market, heavily reliant on the Ethereum blockchain, remains a significant driver of network activity and ETH demand.

Upcoming Ethereum upgrades, such as the Shanghai upgrade, are anticipated to further enhance the network's capabilities and unlock new possibilities, potentially boosting investor confidence and driving further price appreciation. Finally, increasing institutional investment in Ethereum signifies growing confidence in its long-term prospects and contributes to price stability and potential growth.

- Increased DeFi activity

- NFT market growth

- Upcoming network upgrades

- Growing institutional adoption

- Positive regulatory developments (if any)

Market Sentiment and Media Influence

Positive market sentiment plays a crucial role in driving the price of Ethereum. A surge in positive social media sentiment, favorable media coverage, and influencer endorsements can significantly boost investor confidence and fuel further price increases. Major partnerships or collaborations involving Ethereum also contribute to the overall positive sentiment. Conversely, negative news or regulatory uncertainty can quickly reverse this positive sentiment.

Significant news events and announcements directly impact the price of Ethereum. For example, positive regulatory developments or announcements related to major partnerships can cause short-term price spikes. Conversely, negative news regarding security breaches or regulatory crackdowns can lead to sharp price drops. Monitoring news and sentiment is therefore crucial for informed investment decisions.

- Positive social media sentiment

- Favorable media coverage

- Influencer endorsements

- Major partnerships or collaborations

Potential Future Outlook for Ethereum

Factors that Could Sustain the Bull Run

Several factors could sustain Ethereum's bullish run in the long term. Continued growth in the DeFi ecosystem, widespread adoption of Ethereum 2.0 (with its improved scalability and efficiency), increased institutional investment, and further technological advancements are all potential catalysts for sustained price increases. The successful implementation and adoption of layer-2 scaling solutions will also play a significant role in enhancing Ethereum's performance and attracting more users.

Furthermore, the development of new applications and use cases for Ethereum, such as the expansion of Web3 technologies, could further drive demand and fuel price appreciation. The emergence of new decentralized applications (dApps) built on the Ethereum network is a positive indicator of the long-term potential for growth.

- Continued DeFi growth

- Mass adoption of ETH 2.0

- Increased institutional investment

- Further technological advancements

Risks and Challenges to Consider

Despite the current bullish momentum, several risks and challenges could impact Ethereum's future price. Regulatory uncertainty remains a significant concern, as governments worldwide grapple with how to regulate cryptocurrencies. Market volatility is inherent to the cryptocurrency market, and sudden price corrections are always a possibility. Competition from other layer-1 blockchains vying for market share also poses a challenge. Finally, potential security vulnerabilities, although rare, could trigger significant price drops.

- Regulatory hurdles

- Market volatility and corrections

- Competition from other layer-1 blockchains

- Security concerns

Realistic Price Predictions (with caveats)

Predicting future prices in the volatile cryptocurrency market is inherently challenging. However, based on current trends and fundamental analysis, a cautious optimistic outlook is possible. Factors like the adoption rate of ETH 2.0, the growth of DeFi, and institutional investment will significantly influence future price targets. [Insert cautiously optimistic price predictions with clear disclaimers about the uncertainty of the crypto market]. Remember that these are only potential scenarios, and actual price movements may differ significantly.

Conclusion

Ethereum's bullish run is driven by a confluence of factors, including strong technical indicators, substantial growth in the DeFi and NFT sectors, and increasing institutional investment. While the current trend looks promising, investors must carefully consider potential risks, including regulatory uncertainty, market volatility, and competition. We've examined both the technical indicators suggesting upward momentum and the fundamental factors contributing to Ethereum's growth. While the current bullish trend looks promising, investors should carefully consider potential risks before making investment decisions.

Call to Action: Stay informed about Ethereum's price movements and future developments. Understanding the factors influencing Ethereum's price is crucial for navigating this dynamic market. Continue your research on Ethereum's bullish run and make informed investment decisions. Learn more about the factors impacting Ethereum’s price and future prospects.

Featured Posts

-

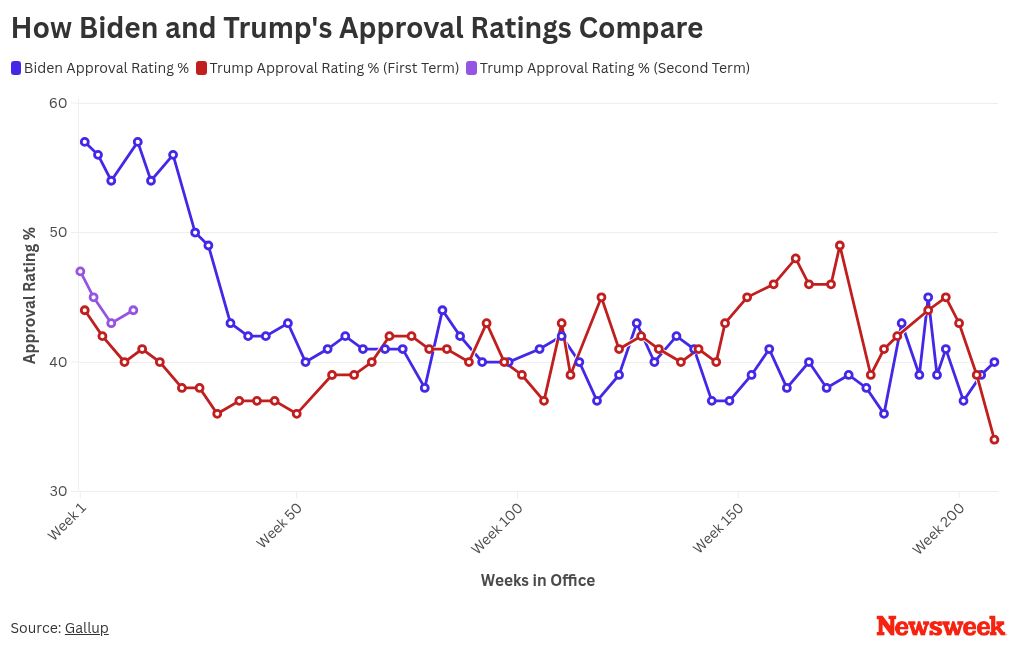

Trumps 100 Day Economic Plan Impact On Bitcoin Price

May 08, 2025

Trumps 100 Day Economic Plan Impact On Bitcoin Price

May 08, 2025 -

Analyzing The Canadian Dollars Overvaluation Against The Greenback

May 08, 2025

Analyzing The Canadian Dollars Overvaluation Against The Greenback

May 08, 2025 -

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025 -

Bitcoin Son Dakika Fiyat Hareketleri Ve Etkileyici Haberler

May 08, 2025

Bitcoin Son Dakika Fiyat Hareketleri Ve Etkileyici Haberler

May 08, 2025 -

29 Ays Pyz Awr Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Pnjab Pwlys

May 08, 2025

29 Ays Pyz Awr Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Pnjab Pwlys

May 08, 2025