Blockchain Analytics Leader Chainalysis Boosts AI With Alterya Acquisition

Table of Contents

Enhanced AI Capabilities for Blockchain Investigations

The integration of Alterya's advanced AI and machine learning (ML) technologies into the Chainalysis platform represents a quantum leap in blockchain investigative capabilities. This translates to several crucial improvements:

Improved Transaction Monitoring

The enhanced AI will allow for significantly faster and more accurate identification of suspicious transactions. This is crucial for detecting illicit activities such as money laundering, terrorist financing, and other forms of financial crime that leverage the anonymity offered by blockchain technology. The improved speed and accuracy directly impact investigative efficiency.

Enhanced Risk Scoring

Chainalysis's risk assessment models will become far more sophisticated. This means more accurate risk scoring for cryptocurrency exchanges, custodians, and other businesses operating within the digital asset ecosystem. This improvement is vital for compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Streamlined Investigative Workflows

AI-powered automation will streamline many investigative tasks. This frees up human analysts to focus on more complex investigations requiring nuanced judgment and strategic thinking. The increased efficiency allows for a greater volume of investigations and faster response times.

- Reduced false positives: Advanced anomaly detection significantly minimizes false positives, improving the accuracy and efficiency of investigations.

- Improved accuracy in identifying high-risk entities and transactions: The AI algorithms can identify subtle patterns and anomalies that might be missed by human analysts alone.

- Enhanced collaboration tools for investigators: Improved data sharing and collaboration tools facilitate teamwork and speed up the investigative process.

Expanding Chainalysis's Market Reach and Product Offering

The Alterya acquisition is not just about technological improvement; it's also a strategic move to expand Chainalysis's market reach and product offerings.

Attracting New Customers

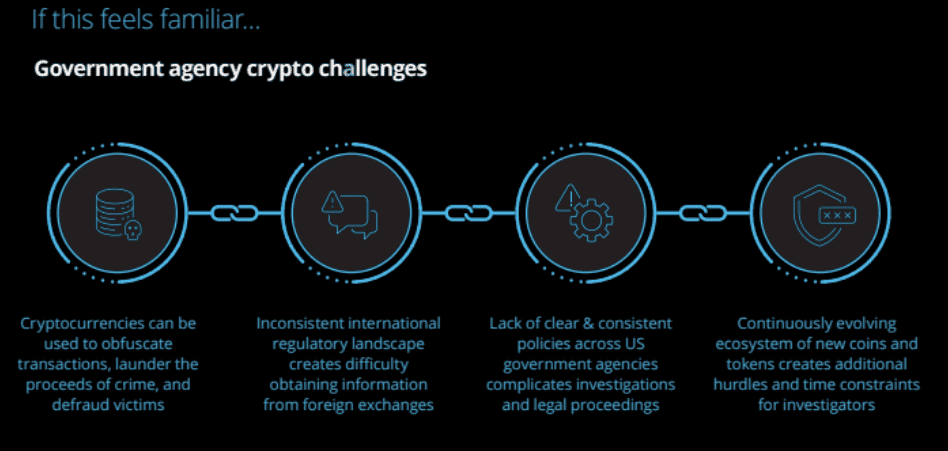

The enhanced AI capabilities make Chainalysis's solutions even more attractive to a wider range of clients. Government agencies tasked with combating financial crime and private sector companies needing robust blockchain analytics will find the improved platform invaluable. This increased attractiveness translates to a larger customer base.

Expanding Product Portfolio

The acquisition opens doors for Chainalysis to develop new products and services leveraging Alterya's technology. This could extend into areas such as predictive analytics and proactive fraud prevention, offering even more comprehensive solutions to its customers. This diversification strengthens the company's market position.

- Increased market share: The enhanced capabilities will allow Chainalysis to capture a larger share of the growing blockchain analytics market.

- Diversification of revenue streams: New product offerings create new revenue streams and reduce dependence on existing services.

- Enhanced customer satisfaction: Improved products and services translate to increased customer satisfaction and loyalty.

The Strategic Significance of the Alterya Acquisition for the Blockchain Industry

The Chainalysis-Alterya merger highlights the increasing importance of AI in combating financial crime within the cryptocurrency sector.

The Increasing Sophistication of Blockchain Crime

Criminal activities using blockchain technology are constantly evolving, requiring equally sophisticated tools to combat them. AI-powered blockchain analytics are becoming increasingly critical in staying ahead of these evolving threats. The sophistication of the tools directly impacts the ability to combat crime.

The Role of AI in Regulatory Compliance

Improved blockchain analytics powered by AI will be a significant aid to regulatory bodies in monitoring and enforcing compliance within the cryptocurrency ecosystem. This enhances transparency and accountability within the industry. Enhanced compliance tools lead to greater regulatory oversight and stability.

- AI-powered blockchain analytics as a critical component of a robust AML/KYC framework: AI plays a vital role in building strong anti-money laundering and know-your-customer frameworks.

- Improved transparency and accountability within the cryptocurrency industry: Better analytics increase transparency and facilitate greater accountability among participants.

- Enhanced cooperation between law enforcement agencies and private sector companies: Improved tools foster better collaboration and information sharing among all stakeholders.

Conclusion

The acquisition of Alterya by Chainalysis is a watershed moment for the blockchain analytics industry. By incorporating advanced AI and machine learning, Chainalysis significantly enhances its capacity to fight financial crime and ensure regulatory compliance in the dynamic cryptocurrency market. This strategic move positions Chainalysis to continue its leadership in blockchain analytics, ensuring its solutions remain innovative and effective. To learn more about how Chainalysis utilizes cutting-edge blockchain analytics technology and its impact on the fight against financial crime, visit their website today.

Featured Posts

-

Trumps Trade Wars A Threat To Us Financial Leadership

Apr 22, 2025

Trumps Trade Wars A Threat To Us Financial Leadership

Apr 22, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

Access To Birth Control The Otc Revolution After Roe V Wade

Apr 22, 2025

Access To Birth Control The Otc Revolution After Roe V Wade

Apr 22, 2025 -

Hegseths Military Plans Disclosed In Signal Chat

Apr 22, 2025

Hegseths Military Plans Disclosed In Signal Chat

Apr 22, 2025 -

Razer Blade 16 2025 Ultra Thin Gaming Laptop A Comprehensive Review

Apr 22, 2025

Razer Blade 16 2025 Ultra Thin Gaming Laptop A Comprehensive Review

Apr 22, 2025