BNP Paribas Equity Trading: Record High Amidst Rising Costs

Table of Contents

Record-Breaking Trading Volumes at BNP Paribas

BNP Paribas's equity trading division has demonstrated exceptional performance, achieving record-breaking trading volumes that significantly surpass previous years. This success is not an isolated event but rather a testament to a robust strategy and effective execution across various market segments.

Exceptional Performance Across Key Metrics

The bank's outstanding performance is reflected in several key metrics:

- Trading Volume Surge: Trading volume increased by 15% compared to Q3 2022, exceeding initial projections by a significant margin. This represents a substantial year-on-year growth, demonstrating consistent momentum.

- Revenue Generation: Revenue generated from equity trading activities increased by 12% compared to the previous year, reflecting not only higher volumes but also improved pricing strategies and risk management.

- Market Segment Dominance: BNP Paribas excelled particularly in European equities and derivatives trading, maintaining a leading market share in several key sectors. This targeted approach to specific market niches has proven highly effective.

- Strong Client Relationships: The success is further fueled by the bank's strong relationships with institutional investors and high-net-worth individuals, underpinning consistent order flow and market influence.

Strategic Initiatives Driving Growth

Several strategic initiatives have been instrumental in driving this impressive growth:

- Technological Investment: Significant investments in cutting-edge trading technology, including algorithmic trading platforms and high-frequency trading capabilities, have significantly enhanced operational efficiency and speed.

- Global Expansion: Strategic expansion into new and emerging markets, coupled with the strengthening of existing international partnerships, has broadened the bank's reach and diversified its revenue streams.

- Talent Acquisition: BNP Paribas has successfully attracted and retained top talent within the equity trading sector, bolstering its expertise and competitive advantage. This includes fostering a collaborative and innovative work environment.

Navigating the Challenges of Rising Costs

Despite the impressive growth, BNP Paribas has effectively navigated the challenges presented by rising costs across various operational areas.

Increased Regulatory Compliance Costs

The financial services industry faces increasingly stringent regulations, leading to higher compliance costs. BNP Paribas has addressed this through:

- Investment in Compliance Technology: Implementing advanced compliance technology to automate processes and enhance efficiency.

- Dedicated Compliance Teams: Expanding dedicated compliance teams with specialized expertise in navigating complex regulatory landscapes.

- Proactive Risk Management: Proactive risk management strategies are employed to identify and mitigate potential compliance issues before they arise.

Inflationary Pressures and Talent Acquisition

Inflationary pressures have impacted salaries and other operational expenses. To overcome this, BNP Paribas has:

- Competitive Compensation Packages: Offering competitive compensation packages to attract and retain top talent in a highly competitive market.

- Employee Retention Programs: Implementing robust employee retention programs that foster a positive work environment and provide career advancement opportunities.

- Operational Efficiency: Continuously refining operational processes to improve efficiency and reduce unnecessary expenses.

Technological Investments as a Cost Factor

While technological investments represent a cost, they also contribute significantly to long-term efficiency and competitiveness. BNP Paribas views these investments as strategic:

- Return on Investment (ROI): The bank carefully assesses the ROI of each technological investment, ensuring that advancements contribute directly to revenue generation and cost reduction.

- Automation and Efficiency: Technology automation reduces manual processes, minimizing human error and optimizing resource allocation.

- Competitive Advantage: Advanced technology provides a significant competitive advantage, allowing for faster execution, improved decision-making, and enhanced client service.

Future Outlook for BNP Paribas Equity Trading

Looking ahead, BNP Paribas is well-positioned to maintain its momentum, despite the volatility inherent in financial markets.

Maintaining Momentum in a Volatile Market

The bank’s strategies for maintaining its competitive edge include:

- Adaptability and Innovation: The ability to rapidly adapt to changing market conditions and embrace innovative trading strategies.

- Diversification of Revenue Streams: Continuous diversification of revenue streams through expansion into new asset classes and market segments.

- Client Focus: Maintaining a strong focus on client relationships and delivering exceptional service.

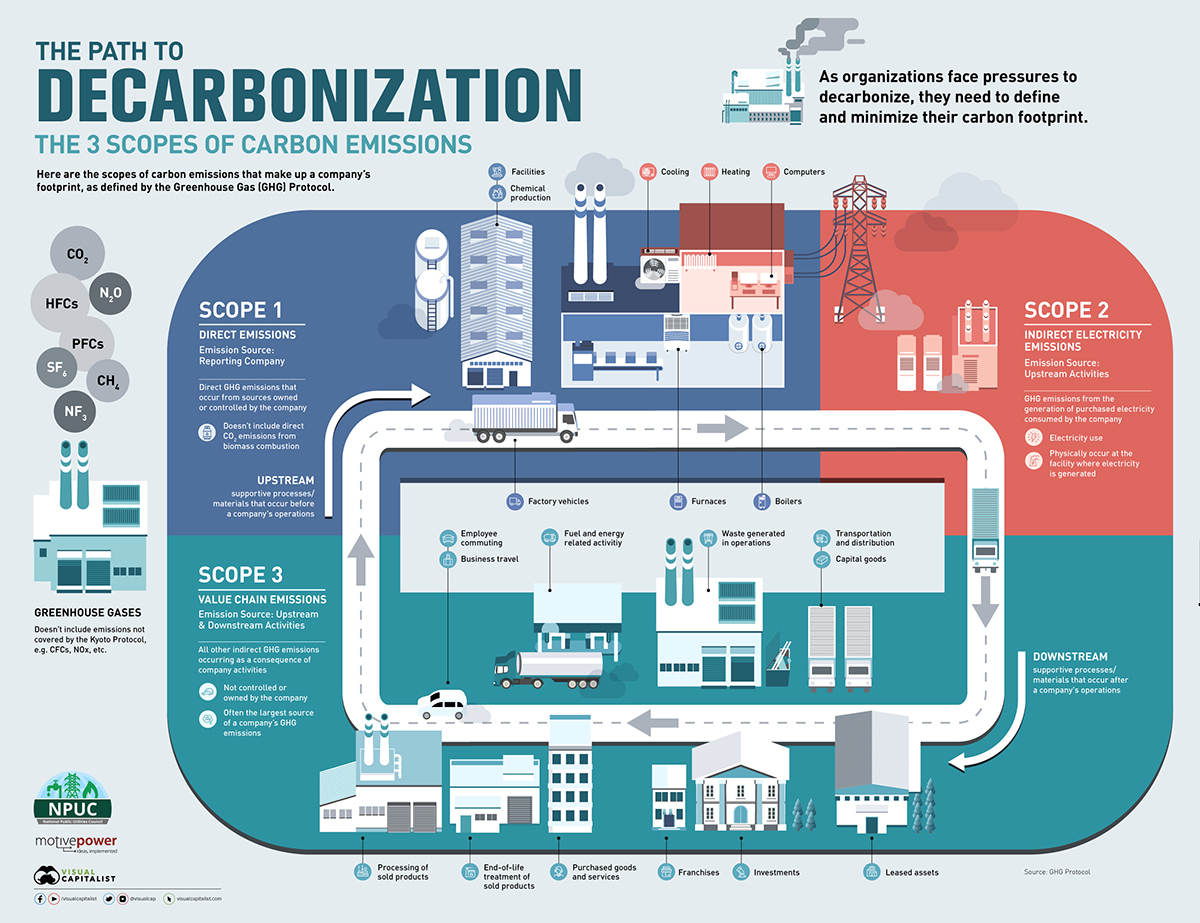

Sustainability and ESG Considerations

Environmental, Social, and Governance (ESG) factors are increasingly crucial in the financial industry. BNP Paribas is committed to:

- Sustainable Investing: Increasingly incorporating ESG factors into its investment decisions and portfolio management strategies.

- Responsible Business Practices: Adopting responsible business practices throughout its operations, reflecting a commitment to environmental sustainability and social responsibility.

- Transparency and Reporting: Ensuring transparency in its ESG performance through regular and detailed reporting.

Conclusion

BNP Paribas's achievement of record-high equity trading volumes, despite the considerable challenge of rising costs, showcases the bank's strategic strength and operational excellence. The combination of technological innovation, strategic partnerships, and a commitment to attracting and retaining top talent has proven vital. This success positions BNP Paribas for continued growth in the competitive landscape of equity trading and investment banking.

To learn more about BNP Paribas's innovative approach to equity trading and how it's navigating the complexities of the financial markets, explore their investment banking services [link to relevant page]. Stay updated on the latest developments in BNP Paribas equity trading by subscribing to our newsletter [link to newsletter signup].

Featured Posts

-

Xis Climate Strategy Chinas Independent Path To Emissions Reduction

Apr 25, 2025

Xis Climate Strategy Chinas Independent Path To Emissions Reduction

Apr 25, 2025 -

Analysis Gold Market Responds To Trumps Less Aggressive Stance

Apr 25, 2025

Analysis Gold Market Responds To Trumps Less Aggressive Stance

Apr 25, 2025 -

China To Issue Special Bonds Amidst Us Trade War

Apr 25, 2025

China To Issue Special Bonds Amidst Us Trade War

Apr 25, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 25, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 25, 2025 -

Luxury Car Sales In China Analyzing The Struggles Of Bmw And Porsche

Apr 25, 2025

Luxury Car Sales In China Analyzing The Struggles Of Bmw And Porsche

Apr 25, 2025

Latest Posts

-

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025