BofA On Stock Market Valuations: A Reason For Investor Confidence

Table of Contents

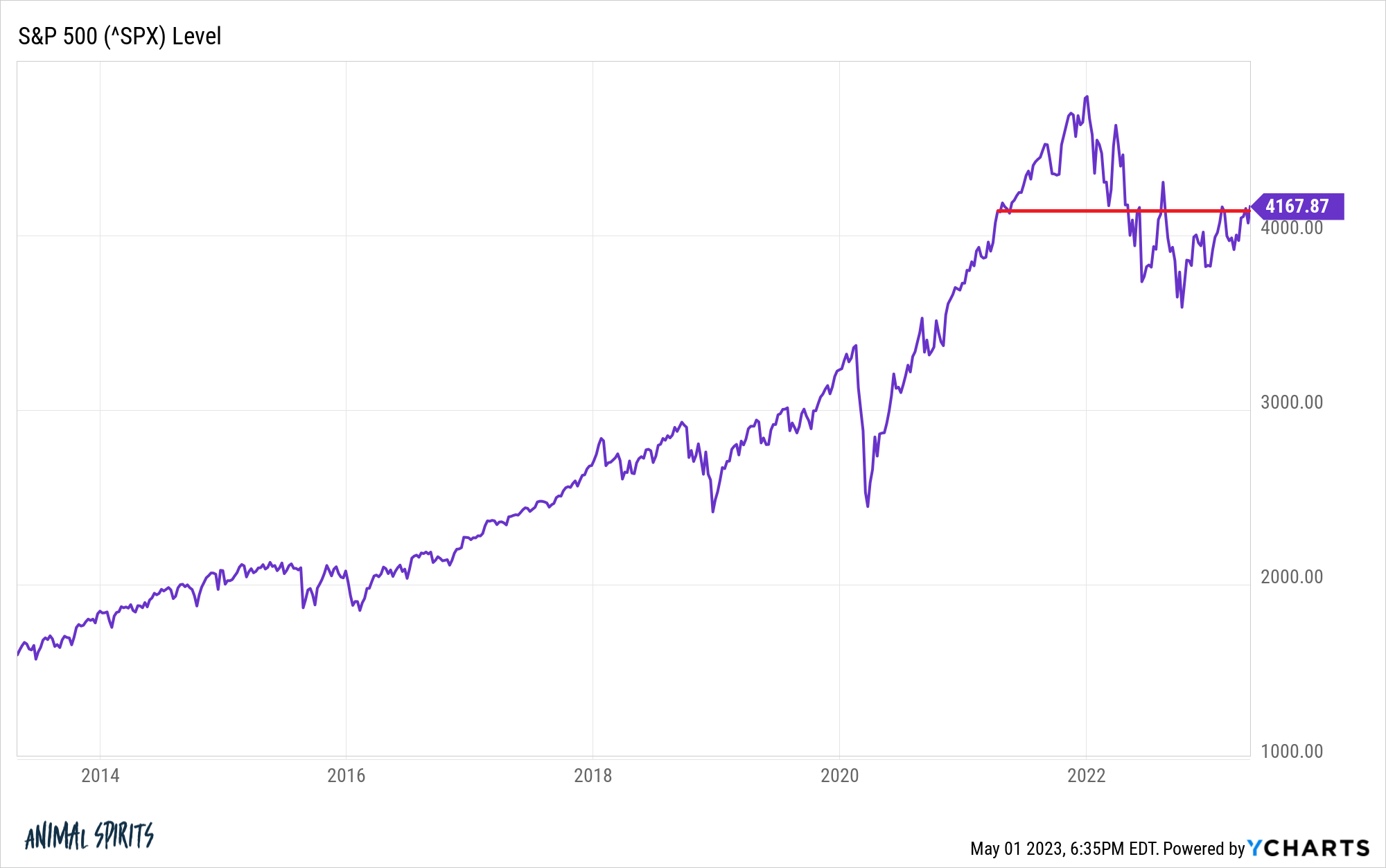

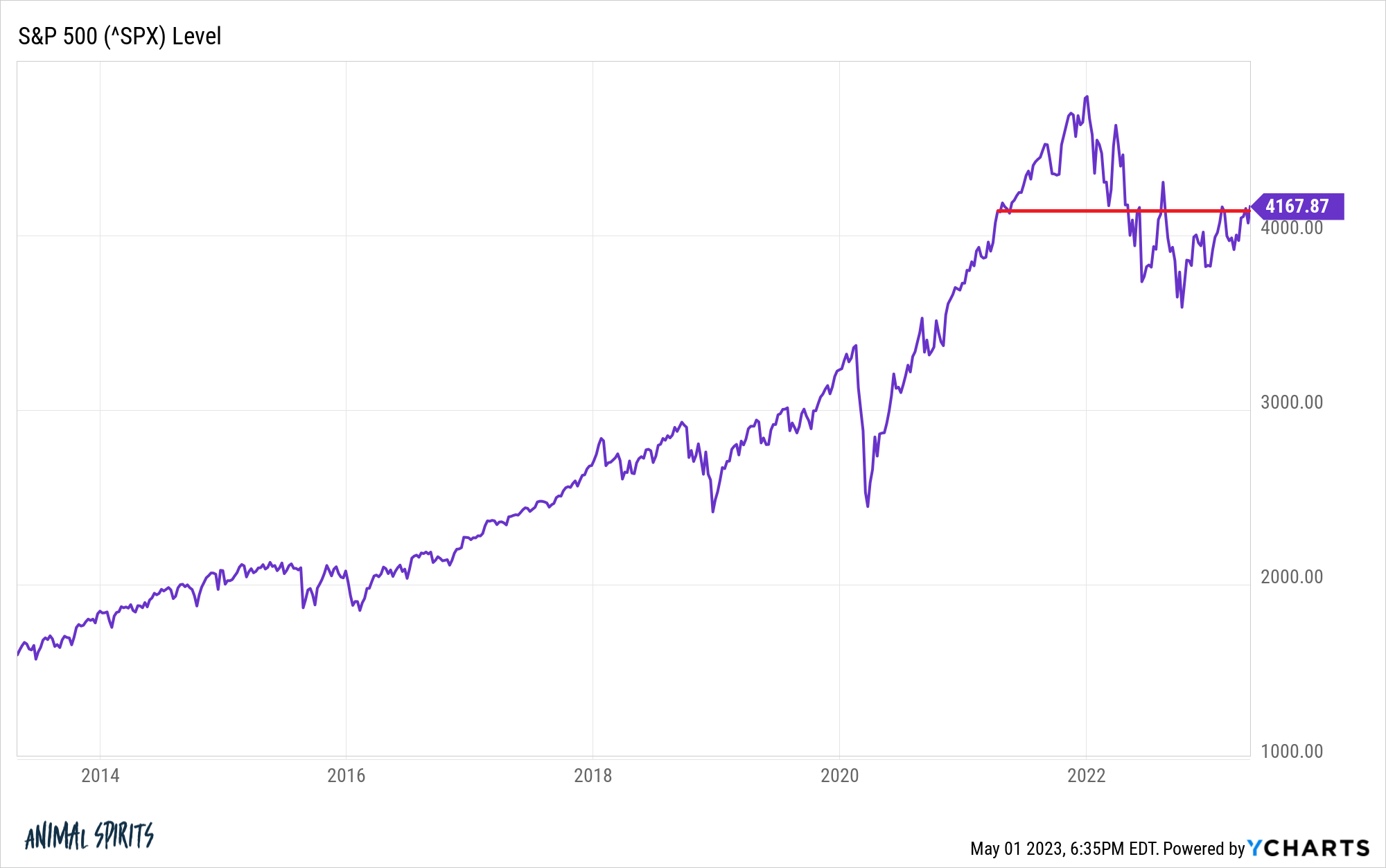

BofA's Current Assessment of Stock Market Valuations

BofA's recent reports suggest a nuanced view on current stock market valuations. While not declaring the market unequivocally overvalued or undervalued, their analysis points towards a cautious optimism. They acknowledge the presence of elevated valuations in certain sectors, but also highlight factors that support continued, albeit moderate, growth. This balanced perspective is crucial for investors seeking to navigate the complexities of the current market environment.

- Key Arguments: BofA's assessment considers factors beyond simple price-to-earnings ratios (P/E). Their models incorporate discounted cash flow analysis, taking into account projected earnings growth and interest rate environments. They emphasize the importance of considering long-term growth potential rather than solely focusing on short-term fluctuations.

- Metrics and Models: BofA employs a variety of sophisticated quantitative models, incorporating macroeconomic indicators and company-specific fundamentals to arrive at their valuation estimates. Their reports often detail the specific metrics and assumptions underlying their conclusions, providing transparency to their analysis.

- Caveats and Limitations: BofA consistently acknowledges the inherent uncertainties in market forecasting. Their reports highlight potential risks, such as unexpected inflationary pressures or geopolitical instability, that could impact their valuation assessments. This acknowledgement of limitations adds credibility to their analysis.

Sector-Specific Analysis from BofA

BofA's research provides a granular sector-specific analysis, enabling investors to make more targeted decisions. Their reports often highlight variations in valuations across different market segments.

- Overvalued and Undervalued Sectors: Recent reports may indicate that certain sectors, such as technology (particularly within specific sub-sectors like social media or cloud computing), might be considered relatively overvalued, while others, like energy or healthcare (depending on specific sub-segments and company performance), might present more attractive valuations.

- Reasoning Behind Sector Valuations: BofA justifies its sector-specific valuations by citing factors such as industry growth rates, competitive landscapes, and regulatory changes. For example, stricter environmental regulations might impact energy valuations, while advancements in medical technology could influence the healthcare sector.

- Examples of Specific Companies: BofA's reports often include examples of specific companies within each sector to illustrate their valuation arguments. This granular level of detail allows investors to understand the reasoning behind the broader sector assessments.

BofA's Long-Term Outlook and Implications for Investors

BofA's long-term outlook usually reflects a moderate growth scenario, acknowledging both the potential for upside and the risks of downside corrections. Their predictions are not simply about short-term gains but consider a longer time horizon.

- Long-Term Growth Projections: BofA's projections typically incorporate macroeconomic forecasts, along with estimates of corporate earnings growth. They consider factors such as technological innovation, demographic shifts, and global economic trends.

- Potential Risks and Opportunities: BofA's analysis carefully identifies potential risks, including inflation, interest rate hikes, and geopolitical uncertainties. At the same time, it highlights opportunities arising from technological advancements and emerging markets.

- Impact on Investment Strategies: BofA's long-term outlook directly informs its recommended investment strategies. This may involve suggesting a diversified portfolio, focusing on specific sectors, or adopting a cautious approach to risk management.

Factors Contributing to BofA's Confidence (or Caution)

BofA's confidence (or caution) in its stock market valuation assessments is shaped by several key macroeconomic and market factors.

- Interest Rates, Inflation, and Geopolitical Events: These factors play a significant role in shaping BofA's perspective. Rising interest rates can dampen market valuations, while high inflation can erode purchasing power and impact corporate profitability. Geopolitical instability introduces significant uncertainty.

- Corporate Earnings and Economic Growth Forecasts: BofA carefully analyzes corporate earnings reports and economic growth forecasts to inform their valuation assessments. Strong earnings growth usually supports higher valuations, while weak economic forecasts can exert downward pressure.

- Other Relevant Factors: Other factors influencing BofA's perspective might include regulatory changes, technological disruptions, and shifts in consumer behavior. These dynamic factors contribute to the complexity of market valuation analysis.

Conclusion

BofA's analysis of stock market valuations provides a crucial perspective for investors. While acknowledging the inherent uncertainties, their research offers a nuanced and comprehensive view, considering various macroeconomic factors and sector-specific dynamics. Their balanced approach, incorporating both potential risks and opportunities, is invaluable for developing informed investment strategies. To fully understand BofA's stock market valuation analysis and gain valuable insights for your investment decisions, we encourage you to review their latest reports and consult with a financial advisor. Stay informed on BofA's stock market valuation insights to make the most of your investment opportunities. Understanding BofA's stock market valuation analysis is key to navigating the complexities of the market and making sound investment decisions.

Featured Posts

-

Are Businesses Using Tik Tok To Evade Tariffs A Closer Look

Apr 22, 2025

Are Businesses Using Tik Tok To Evade Tariffs A Closer Look

Apr 22, 2025 -

Conclave 2023 Evaluating Pope Franciss Papacy

Apr 22, 2025

Conclave 2023 Evaluating Pope Franciss Papacy

Apr 22, 2025 -

Why Robots Still Cant Replace Human Labor In Nike Sneaker Manufacturing

Apr 22, 2025

Why Robots Still Cant Replace Human Labor In Nike Sneaker Manufacturing

Apr 22, 2025 -

The End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 22, 2025

The End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 22, 2025 -

Evaluating The Economic Impact Of Trumps Presidency

Apr 22, 2025

Evaluating The Economic Impact Of Trumps Presidency

Apr 22, 2025