BofA: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Long-Term Outlook for the Stock Market

BofA maintains a surprisingly optimistic long-term forecast for the stock market, despite current valuation anxieties. Their positive market outlook is underpinned by several key factors. BofA's analysts point to robust corporate earnings growth as a primary driver. Many companies are exceeding expectations, demonstrating resilience and adaptability in the face of economic challenges.

This strong corporate performance is further supported by continued economic expansion. While specific economic indicators fluctuate, BofA's analysis suggests a sustained period of growth, particularly in key sectors. Technological innovation plays a crucial role in this forecast, with disruptive technologies driving productivity gains and creating new avenues for growth across various industries. Furthermore, factors like (relatively) low interest rates, while subject to change, currently contribute to a favorable environment for stock market investment.

- Key Projections from BofA Reports: While specific numerical projections change, BofA consistently highlights substantial long-term growth potential. Their reports often emphasize the outperformance of equities compared to other asset classes over extended periods.

- Sectors Poised for Growth: BofA analysts often highlight technology, healthcare, and sustainable energy as sectors poised for significant growth in the coming years. This is driven by technological advancements, aging populations, and increasing global focus on environmental sustainability.

- Potential Risks Acknowledged by BofA: It's important to note that BofA isn't blind to potential risks. Their reports typically acknowledge the potential for market corrections, inflation, and geopolitical uncertainties. However, these are considered manageable within the context of their long-term positive outlook.

Understanding the Context of "Stretched" Valuations

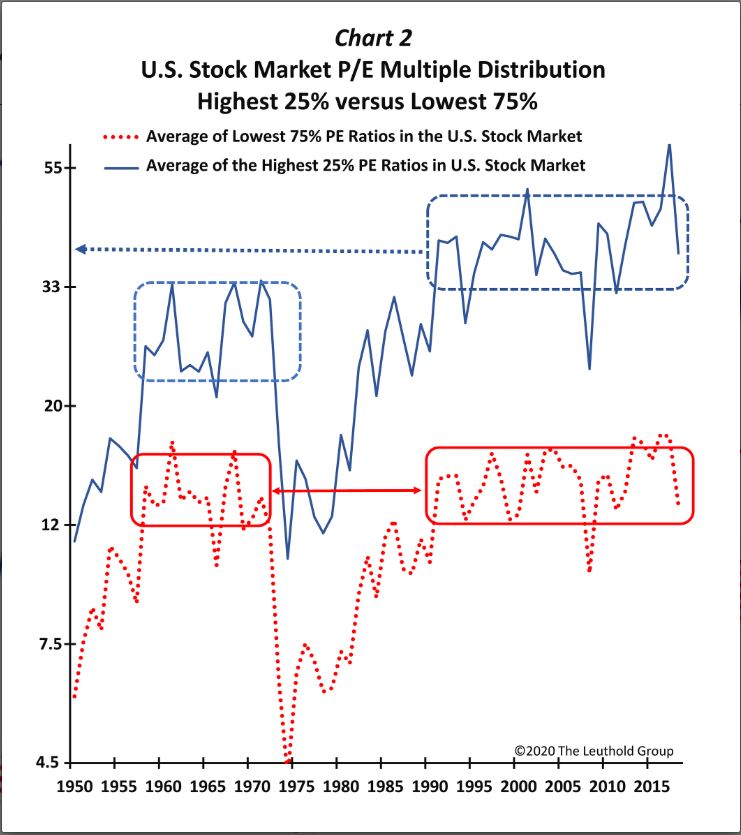

The term "stretched valuations" often sparks fear, but understanding the context is crucial. Market valuation metrics like the Price-to-Earnings ratio (P/E ratio) and price-to-sales ratio are frequently used to assess whether the market is overvalued. However, high valuations aren't inherently negative, especially when considered within a broader perspective.

Low interest rates significantly influence bond yields, making equities a more attractive investment for many. When compared to historical market cycles, current valuations, while high, aren't unprecedented. Furthermore, specific sectors or even individual companies can significantly skew overall market valuation metrics. A handful of high-growth, high-valuation companies can disproportionately affect the overall picture.

- Key Valuation Metrics: The P/E ratio compares a company's stock price to its earnings per share, while the price-to-sales ratio compares its stock price to its revenue per share. Understanding these and other metrics is essential for a nuanced view of market valuations.

- Historical Context: Comparing current valuation multiples to those seen during previous market cycles provides crucial perspective. While current valuations might be elevated, they may not be as extreme relative to history as some headlines suggest.

- Influence of Economic Factors: Inflation, interest rate changes, and economic growth directly impact valuation multiples. Understanding these influences helps to contextualize seemingly high valuations.

The Role of Innovation and Technological Disruption

Technological disruption is a key factor justifying higher valuations in certain sectors. Companies pioneering breakthroughs in areas like artificial intelligence, sustainable energy, and biotechnology often command higher valuations due to their immense growth potential. These valuations aren't simply speculative; they reflect the potential for these companies to reshape entire industries and generate substantial long-term returns. While some investors might view these valuations as "stretched," they are often forward-looking, reflecting the anticipated future impact of these disruptive technologies.

Strategies for Navigating a Potentially Volatile Market

Even with a positive long-term outlook, navigating a potentially volatile market requires a well-defined investment strategy. Risk management is paramount.

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps to mitigate risk. Diversification within the stock market itself is also important – don't put all your eggs in one basket (or one sector).

-

Long-Term Investing: Focusing on long-term investment goals rather than reacting to short-term market fluctuations is crucial. Market volatility is normal; long-term investors should ride out the ups and downs.

-

Strategic Asset Allocation: Develop an asset allocation strategy that aligns with your risk tolerance and time horizon. This involves determining the optimal mix of different asset classes in your portfolio.

-

Regular Rebalancing: Periodically rebalancing your portfolio to maintain your desired asset allocation helps to manage risk and capitalize on market opportunities.

-

Specific Diversification Examples: A diversified portfolio might include a mix of large-cap and small-cap stocks, international stocks, bonds, and potentially alternative investments.

-

Tips for Long-Term Investing: Avoid emotional decision-making, stay disciplined with your investment plan, and regularly review your progress.

-

Evaluating Individual Stocks: In a high-valuation market, thorough due diligence on individual stocks is crucial. Focus on companies with strong fundamentals, sustainable competitive advantages, and clear growth prospects.

Conclusion

BofA's positive long-term stock market outlook, while acknowledging potential short-term volatility, suggests that stretched stock market valuations shouldn't necessarily deter investors with a long-term perspective. The potential for sustained economic growth, robust corporate earnings, and technological innovation outweighs the concerns about current valuation levels for many investors. Remember the importance of context when evaluating valuations, consider the role of innovation in driving future growth, and utilize effective risk management techniques such as diversification and long-term investing. Don't let concerns about stretched stock market valuations deter you from achieving your long-term financial goals. Contact a financial advisor today to discuss your investment strategy.

Featured Posts

-

Dame Laura Kenny Reflecting On Olympic Triumphs And Shaping The Future

May 07, 2025

Dame Laura Kenny Reflecting On Olympic Triumphs And Shaping The Future

May 07, 2025 -

Should The Wolves Trade For Julius Randle A Detailed Analysis

May 07, 2025

Should The Wolves Trade For Julius Randle A Detailed Analysis

May 07, 2025 -

Warren Buffetts Leadership Lessons Humility And Avoiding Mistakes

May 07, 2025

Warren Buffetts Leadership Lessons Humility And Avoiding Mistakes

May 07, 2025 -

Rihannas Show Stopping Engagement Ring And Chic Red Heels

May 07, 2025

Rihannas Show Stopping Engagement Ring And Chic Red Heels

May 07, 2025 -

Josh Jacobs To Green Bay Analyzing A Potential Packers Steelers Trade

May 07, 2025

Josh Jacobs To Green Bay Analyzing A Potential Packers Steelers Trade

May 07, 2025

Latest Posts

-

Jenna Ortega Past Marvel Role No Future Plans

May 07, 2025

Jenna Ortega Past Marvel Role No Future Plans

May 07, 2025 -

Ortega Remains Unsure About Future Marvel Projects

May 07, 2025

Ortega Remains Unsure About Future Marvel Projects

May 07, 2025 -

Jenna Ortega And Glen Powells Fantasy Film A London Summer Production

May 07, 2025

Jenna Ortega And Glen Powells Fantasy Film A London Summer Production

May 07, 2025 -

Jenna Ortegas Hesitancy To Reprise Her Marvel Role

May 07, 2025

Jenna Ortegas Hesitancy To Reprise Her Marvel Role

May 07, 2025 -

London Bound Jenna Ortega And Glen Powell Star In Upcoming Fantasy Film

May 07, 2025

London Bound Jenna Ortega And Glen Powell Star In Upcoming Fantasy Film

May 07, 2025