BofA's Take: Are High Stock Market Valuations Cause For Concern?

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook often reflects a nuanced perspective, neither purely bullish nor bearish, but rather a cautious optimism tempered by concerns about high stock market valuations. Their analysis typically incorporates a range of valuation metrics to gauge the market's overall health. These metrics are crucial for understanding whether current prices reflect intrinsic value or potential overvaluation.

Key valuation metrics BofA frequently utilizes include:

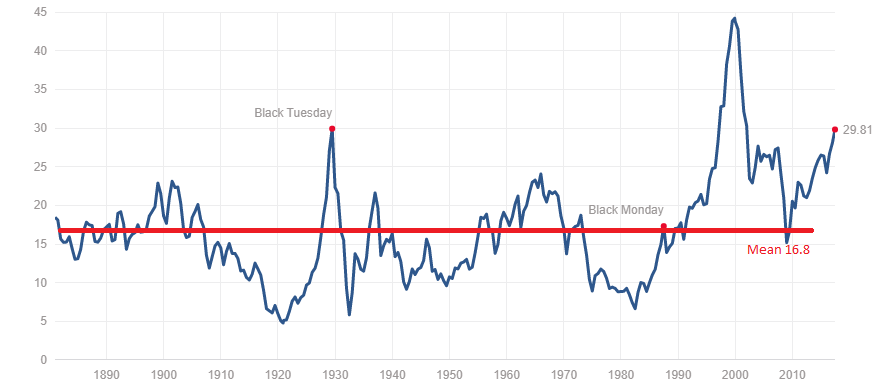

- Price-to-Earnings Ratio (P/E): BofA analyzes both trailing and forward P/E ratios across various sectors and the market as a whole. Recent reports might show elevated P/E ratios compared to historical averages, signaling potentially high valuations. For example, a recent BofA report may indicate a forward P/E ratio of 20 for the S&P 500, significantly higher than the historical average of 15.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out short-term earnings fluctuations, providing a longer-term perspective on valuations. High Shiller PEs can suggest overvaluation. BofA’s analysis might compare the current Shiller PE to its historical range to determine if current valuations are unusually high.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue, providing another perspective on valuation, particularly useful for companies with negative earnings. BofA may highlight sectors with particularly high P/S ratios as potentially overvalued.

Specific numbers and data from BofA's reports will vary depending on the publication date. It's essential to refer to the most recent BofA reports for the most up-to-date information on these valuation metrics and their comparisons to historical levels. BofA often points out specific sectors they consider overvalued (e.g., technology during certain periods) or undervalued (e.g., cyclical sectors after a downturn).

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current environment of high stock market valuations:

-

Low Interest Rates: Historically low interest rates decrease the discount rate used in discounted cash flow (DCF) valuations, leading to higher present values for future cash flows and thus higher stock prices. This makes stocks more attractive relative to bonds.

-

Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, increasing demand for assets like stocks and driving up prices.

-

Investor Sentiment: Positive investor sentiment, fueled by factors like technological advancements and expectations of future growth, can lead to increased demand and higher valuations, even in the absence of significant improvements in underlying fundamentals.

-

Impact of Low Interest Rates on Discounted Cash Flow Valuations: Lower discount rates directly increase the present value of future earnings, leading to higher valuations.

-

Influence of Technological Advancements and Growth Expectations: The promise of technological disruption and rapid growth in specific sectors can justify higher valuations, as investors anticipate significant future returns.

-

Analysis of Investor Behavior and Speculation: Periods of high investor optimism and speculation can inflate asset prices beyond what might be justified by fundamentals.

The Role of Corporate Earnings and Profitability

The relationship between high stock market valuations and corporate earnings is critical. BofA's analysis likely assesses whether current earnings justify these valuations or if a disconnect exists.

- Comparison of Earnings Growth to Valuation Growth: If valuations are rising much faster than earnings, it could signal overvaluation.

- Discussion of Potential Future Earnings Growth Projections: BofA might analyze analysts' forecasts for future earnings growth to assess whether high valuations are sustainable.

- Mention of any Concerns about Unsustainable Earnings Growth: Rapid growth isn't always sustainable. BofA might flag sectors where earnings growth appears unsustainable, indicating a potential risk to high valuations.

Potential Risks and Implications of High Stock Market Valuations

High stock market valuations inherently carry risks.

-

Market Corrections or Crashes: History shows that periods of high valuations are often followed by market corrections or even crashes.

-

Implications for Different Investor Types: Long-term investors might weather corrections better than short-term investors.

-

Historical Examples of Market Corrections Following Periods of High Valuations: BofA likely references historical data to highlight the risk of corrections following periods of high valuations. The dot-com bubble and the 2008 financial crisis serve as prime examples.

-

Analysis of Potential Triggers for a Market Correction: Rising interest rates, geopolitical instability, or unexpected economic downturns can trigger corrections.

-

Discussion of Risk Mitigation Strategies for Investors: BofA might suggest strategies like diversification, hedging, or reducing exposure to potentially overvalued assets.

BofA's Recommendations and Investment Strategies

BofA's recommendations likely emphasize a cautious approach given high stock market valuations.

- Specific Asset Allocation Recommendations: BofA might advise reducing equity exposure and increasing allocation to less volatile assets like bonds or cash.

- Suggestions for Diversification: Diversification across different asset classes and sectors is key to mitigate risk.

- Advice on Managing Risk in a Potentially Volatile Market: Strategies like hedging or using stop-loss orders could be recommended.

Conclusion: Navigating the Challenges of High Stock Market Valuations

BofA's analysis of high stock market valuations highlights both opportunities and risks. While growth potential remains in certain sectors, the elevated valuations warrant caution. Understanding BofA's perspective on high stock market valuations and their implications for potential corrections is crucial for informed investment decisions. Conduct thorough research and consult a financial professional to develop a strategy tailored to your risk tolerance and financial goals. Remember, understanding high stock market valuations is key to navigating the complexities of today's market.

Featured Posts

-

Nypd Investigating Harassment Of Woman By Pro Israel Group

Apr 30, 2025

Nypd Investigating Harassment Of Woman By Pro Israel Group

Apr 30, 2025 -

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025 -

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025 -

Nclh Stock Soars Strong Earnings And Upbeat Guidance

Apr 30, 2025

Nclh Stock Soars Strong Earnings And Upbeat Guidance

Apr 30, 2025 -

Cybercriminals Office365 Scheme Millions In Losses Reported By Federal Authorities

Apr 30, 2025

Cybercriminals Office365 Scheme Millions In Losses Reported By Federal Authorities

Apr 30, 2025

Latest Posts

-

Fialas Offense Powers Kings Past Stars In Thrilling Shootout

Apr 30, 2025

Fialas Offense Powers Kings Past Stars In Thrilling Shootout

Apr 30, 2025 -

Wayne Gretzky Fast Facts Records Awards And More

Apr 30, 2025

Wayne Gretzky Fast Facts Records Awards And More

Apr 30, 2025 -

The Ultimate Guide To Wayne Gretzky Fast Facts

Apr 30, 2025

The Ultimate Guide To Wayne Gretzky Fast Facts

Apr 30, 2025 -

Kevin Fialas Hot Streak Continues In Kings Shootout Victory Over Stars

Apr 30, 2025

Kevin Fialas Hot Streak Continues In Kings Shootout Victory Over Stars

Apr 30, 2025 -

Playoff Thriller Johnstons Historic Goal Leads Stars Past Avalanche

Apr 30, 2025

Playoff Thriller Johnstons Historic Goal Leads Stars Past Avalanche

Apr 30, 2025