Broadcom's VMware Acquisition: AT&T Exposes A Potential 1,050% Cost Increase

Table of Contents

Understanding the Broadcom-VMware Merger and its Implications

Broadcom, a leading semiconductor and infrastructure software company, successfully acquired VMware, a virtualization and cloud computing giant, in a deal finalized in late 2023. This merger combines two industry behemoths, significantly altering the landscape of enterprise software and cloud computing.

- The Deal: Broadcom's acquisition of VMware represents a monumental shift in the tech industry, consolidating significant market power under a single entity. The $61 billion price tag underscores the strategic value of VMware's virtualization technology and its broad customer base.

- Combined Market Power: This merger creates a powerhouse in the enterprise software market, impacting everything from server virtualization to networking and cloud infrastructure. Broadcom gains access to VMware's extensive customer base, while VMware benefits from Broadcom's existing infrastructure solutions.

- Potential Benefits (and Concerns): Proponents suggest that the merger could lead to increased innovation through the integration of Broadcom's and VMware's technologies. However, concerns about reduced competition and potential price hikes are paramount, particularly for existing VMware customers. The potential for market consolidation within the enterprise software market is a significant factor influencing industry response. The combined entity's control over cloud infrastructure and virtualization technology raises questions about future pricing strategies.

AT&T's Reliance on VMware and the Potential Cost Impact

AT&T is a major user of VMware products and services, relying heavily on its virtualization technology for its vast network infrastructure and data centers. The Broadcom acquisition raises serious concerns about the future cost of these services.

- AT&T's VMware Dependence: AT&T's infrastructure is deeply intertwined with VMware's solutions. This dependence makes them particularly vulnerable to any price increases following the merger.

- Potential Price Increases: The acquisition could lead to significant increases in VMware licensing fees and support contracts. The claimed 1,050% cost increase for AT&T is based on extrapolated projections considering Broadcom's historical pricing strategies and VMware's market dominance. While precise figures aren't publicly available, analysts suggest a substantial upward trend is highly probable. This analysis involved comparing Broadcom's past acquisitions and subsequent price changes for acquired software solutions.

- Consequences for AT&T: A 1,050% increase in VMware costs would represent a massive financial burden for AT&T, potentially impacting its budget, requiring cost optimization strategies, and possibly leading to service disruptions or reduced features. It may force cloud migration to alternative platforms. The impact extends beyond just financial constraints; operational efficiency and budget impact are key concerns.

Broader Industry Concerns: Ripple Effects Beyond AT&T

The Broadcom-VMware merger's implications extend far beyond AT&T. Many other companies heavily rely on VMware's products, and they too face the prospect of higher prices.

- Industry-Wide Price Increases: The acquisition raises concerns about a potential domino effect, leading to increased VMware pricing across the board. This could significantly impact businesses of all sizes that depend on VMware for cloud infrastructure and virtualization technology.

- Antitrust Scrutiny: The merger is likely to face scrutiny from antitrust authorities concerned about reduced competition and potential anti-competitive practices. The extent of regulatory intervention will play a significant role in shaping the future of VMware pricing and the competitive landscape.

- Mitigation Strategies: Companies can proactively mitigate the risk of rising VMware costs by negotiating favorable contract terms, exploring alternative cloud alternatives, and implementing robust cost management strategies. This might involve switching to open-source virtualization solutions or diversifying their cloud infrastructure providers.

Conclusion: Navigating the Post-Acquisition Landscape of Broadcom and VMware

The Broadcom VMware acquisition presents significant challenges for businesses relying on VMware technologies. The potential for substantial cost increases, as highlighted by the potential 1,050% spike for AT&T, necessitates careful planning and proactive strategies. Understanding the implications of this merger is crucial for informed decision-making. Businesses must thoroughly assess their VMware dependencies, explore alternative solutions, and negotiate favorable contracts to minimize potential financial impacts. Develop a comprehensive Broadcom VMware acquisition strategy to ensure continued operational efficiency and minimize financial risk. Don't wait; start evaluating your options today.

Featured Posts

-

Brookfields Us Manufacturing Investment The Tariff Conundrum

May 02, 2025

Brookfields Us Manufacturing Investment The Tariff Conundrum

May 02, 2025 -

Norfolk Mp And Nhs Clash In Supreme Court Over Gender Identity Rights

May 02, 2025

Norfolk Mp And Nhs Clash In Supreme Court Over Gender Identity Rights

May 02, 2025 -

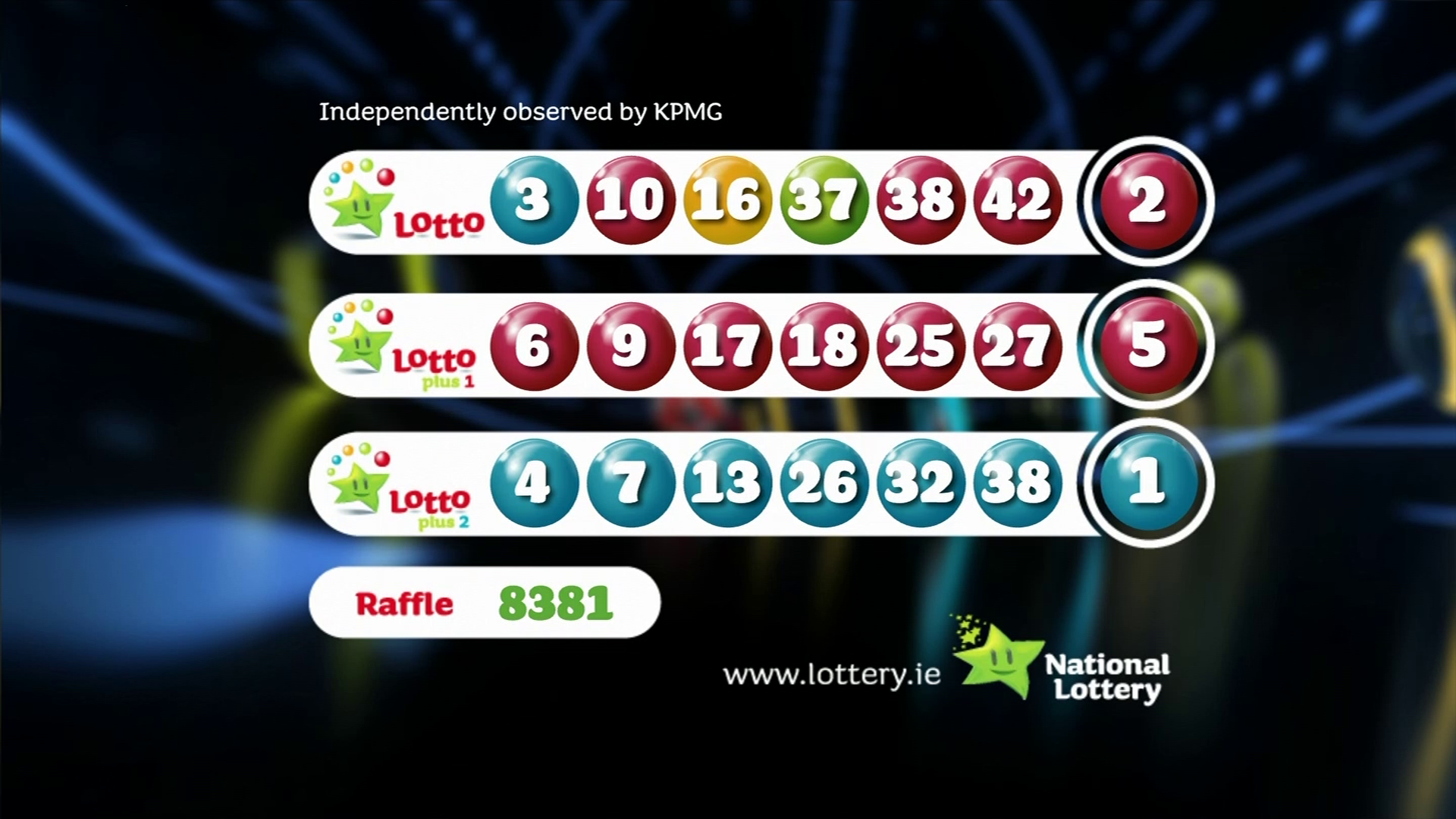

Check The Latest Lotto Results Lotto Plus 1 And Lotto Plus 2 Included

May 02, 2025

Check The Latest Lotto Results Lotto Plus 1 And Lotto Plus 2 Included

May 02, 2025 -

Wednesday April 9th Lotto Jackpot Winning Numbers Revealed

May 02, 2025

Wednesday April 9th Lotto Jackpot Winning Numbers Revealed

May 02, 2025 -

Smart Rings And Fidelity Would You Wear One

May 02, 2025

Smart Rings And Fidelity Would You Wear One

May 02, 2025

Latest Posts

-

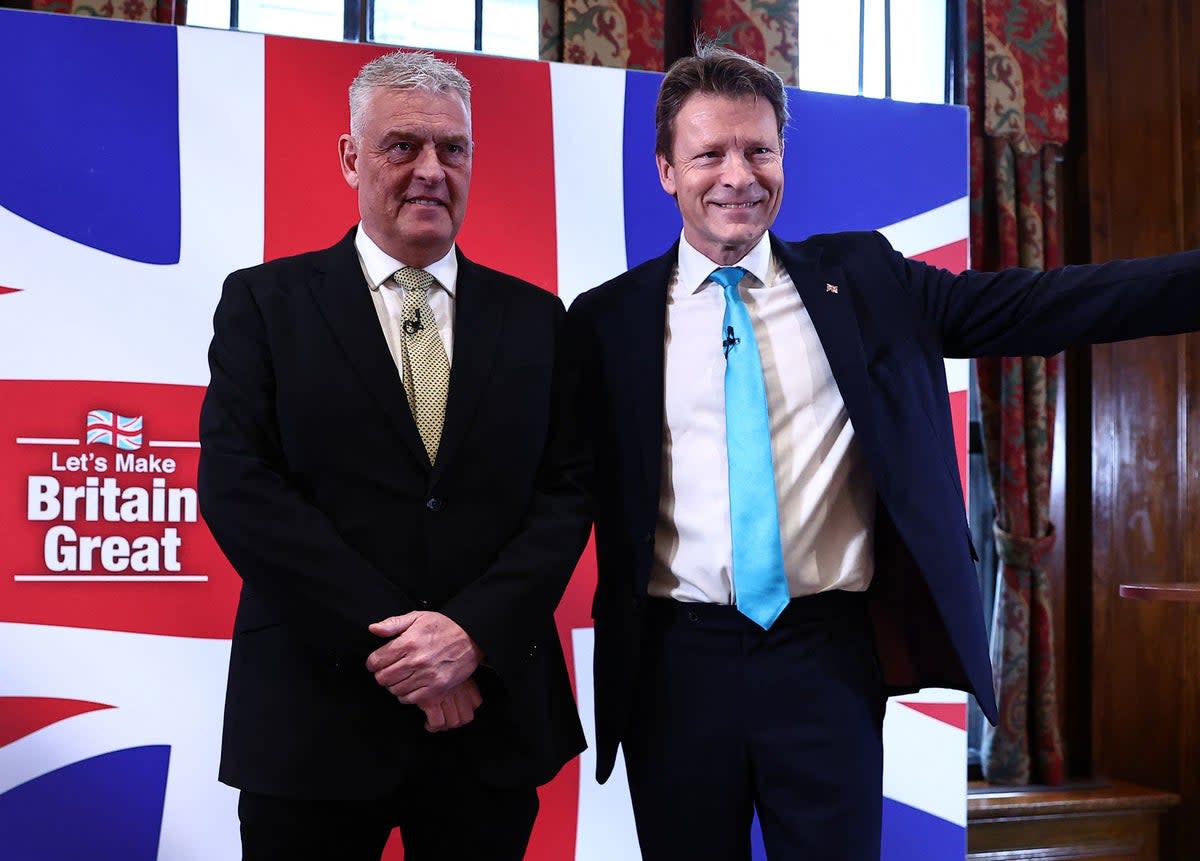

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025 -

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025 -

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025