Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Increase

Table of Contents

AT&T's Public Statements and Concerns Regarding Increased Costs

AT&T, a major telecommunications company heavily reliant on VMware's virtualization solutions for its network infrastructure, has publicly voiced concerns regarding the substantial price increases following the Broadcom acquisition. The increased costs represent a significant challenge to AT&T's operational budget and strategic planning.

-

Direct quotes from AT&T executives expressing worry about VMware pricing post-acquisition: While specific quotes may not be publicly available due to confidential business discussions, industry analysts have reported concerns expressed by AT&T leadership regarding the unexpected price increases and their potential impact on profitability. Further research into financial reports and analyst briefings may reveal more precise statements.

-

Specific examples of price increases experienced by AT&T (percentage increases where possible): Although exact figures are generally kept confidential, reports suggest significant double-digit percentage increases across various VMware products utilized by AT&T. These increases are impacting licensing fees, support contracts, and other related services.

-

Analysis of the impact on AT&T's operational budget and potential cost-cutting measures: The Broadcom VMware acquisition price increase necessitates AT&T to explore cost-cutting measures across its operations. This could lead to reduced investment in other crucial areas, potential job cuts, or a reassessment of its long-term technology strategy.

-

Mention any public statements regarding potential impacts on AT&T's services or customers: While AT&T has not publicly announced service reductions directly resulting from these increased costs, the potential for indirect consequences, such as slower innovation or reduced customer support resources, remains a concern.

Impact on AT&T's Network Infrastructure

AT&T utilizes VMware's vSphere, NSX, and vRealize products extensively to manage and virtualize its vast network infrastructure. The price hikes for these core technologies directly affect AT&T’s operational expenses. The cost impact is further exacerbated by the scale of AT&T's network, making even small percentage increases translate into substantial financial burdens.

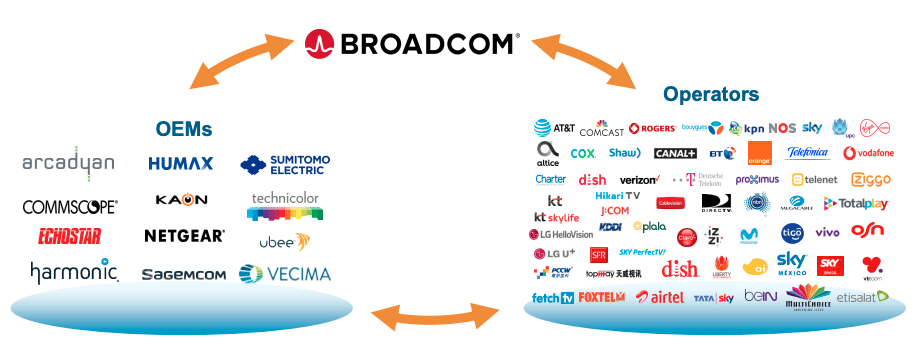

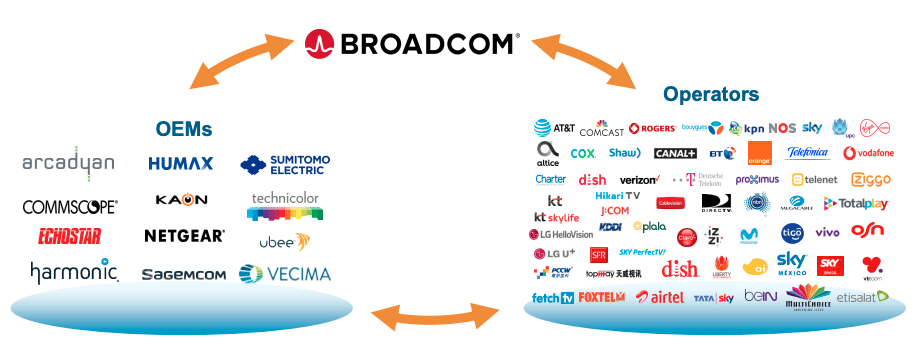

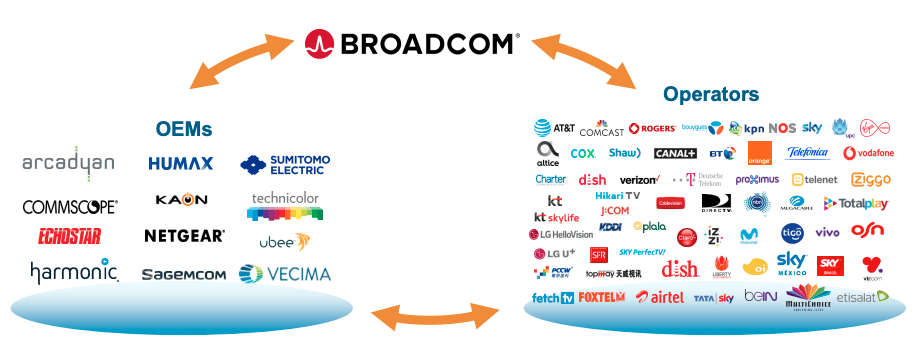

Competitive Landscape and Market Domination

The Broadcom-VMware merger raises concerns about the competitive landscape. Broadcom's control over both VMware's virtualization technologies and its own networking hardware creates potential for increased market dominance and reduced competition, ultimately leading to higher prices for consumers and businesses. This consolidated power could limit choices and stifle innovation within the industry.

Broadcom's Rationale and Strategies Following the Acquisition

Broadcom's acquisition of VMware was driven by its strategic goals to expand its presence in the enterprise software market and integrate VMware's virtualization technologies with its existing networking solutions.

-

Discuss Broadcom's stated goals for the VMware acquisition: Broadcom has publicly stated intentions to leverage the combined strength of both companies to offer a comprehensive suite of networking and infrastructure solutions, enhancing its market position and customer offerings.

-

Analyze Broadcom's pricing strategies and their potential impact on the market: Broadcom’s pricing strategy post-acquisition appears focused on maximizing profitability through significant price increases. This aggressive approach has sparked concern regarding potential monopolistic practices and has drawn scrutiny from regulatory bodies.

-

Examine any statements from Broadcom regarding their pricing policies post-acquisition: While Broadcom might justify the price increases by citing improved features, enhanced security, and greater efficiency, these justifications need to be weighed against the magnitude of the increase and its impact on customers.

-

Explore any potential antitrust concerns or regulatory investigations related to the acquisition: The substantial Broadcom VMware acquisition price increase has triggered antitrust concerns, prompting regulatory bodies to investigate whether the merger leads to anti-competitive practices and harms consumer interests.

The Broader Implications of the Broadcom VMware Acquisition for the Tech Industry

The impact of the Broadcom-VMware merger extends far beyond AT&T. Numerous other telecom companies, cloud providers, and enterprises rely on VMware's virtualization technologies, making them susceptible to similar price increases.

-

Discuss the potential impact on other telecom companies facing similar price increases: The price increases are likely to affect other telecommunication companies, potentially causing them to cut costs, reduce services, or raise their prices to consumers.

-

Analyze the effects on cloud computing costs and the broader digital economy: Higher virtualization costs can cascade through the entire cloud ecosystem, increasing the overall cost of cloud services and potentially hindering innovation and growth in the broader digital economy.

-

Explore potential innovation disruptions due to increased barriers to entry for smaller companies: The increased cost of VMware technologies might create a higher barrier to entry for smaller companies and startups, potentially stifling competition and innovation.

-

Mention the perspectives of industry analysts on the long-term effects of this merger: Industry analysts are closely monitoring the situation, offering diverse perspectives ranging from concerns over monopolistic practices and diminished competition to predictions about how the market will adapt to these significant changes.

Conclusion

The Broadcom acquisition of VMware has undeniably led to substantial Broadcom VMware acquisition price increases for companies like AT&T, raising significant concerns about market competition, innovation, and the overall cost of cloud computing. The impact extends beyond AT&T, influencing the broader tech landscape and impacting numerous organizations reliant on VMware technologies. The long-term effects of this merger remain to be seen, but it is clear that the landscape of enterprise software pricing has undergone a dramatic shift.

Call to Action: Stay informed about the ongoing implications of the Broadcom VMware acquisition price increase. Follow industry news and analysis to understand the evolving dynamics of the market and adapt to the changing landscape of enterprise software pricing. Understanding the long-term consequences of this merger is crucial for all businesses relying on virtualization and networking technologies.

Featured Posts

-

Did Trumps Tariffs Help Or Hurt Us Manufacturers

May 06, 2025

Did Trumps Tariffs Help Or Hurt Us Manufacturers

May 06, 2025 -

Option Traders Favor Aussie Over Kiwi Amidst Waning Trade Concerns

May 06, 2025

Option Traders Favor Aussie Over Kiwi Amidst Waning Trade Concerns

May 06, 2025 -

Mindy Kaling Honored With Hollywood Walk Of Fame Star

May 06, 2025

Mindy Kaling Honored With Hollywood Walk Of Fame Star

May 06, 2025 -

Westpac Wbc Earnings Report A Deep Dive Into Margin Challenges

May 06, 2025

Westpac Wbc Earnings Report A Deep Dive Into Margin Challenges

May 06, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

May 06, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

May 06, 2025

Latest Posts

-

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025 -

New Ddg Song Dont Take My Son Sparks Debate Is It Aimed At Halle Bailey

May 06, 2025

New Ddg Song Dont Take My Son Sparks Debate Is It Aimed At Halle Bailey

May 06, 2025 -

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey Explored

May 06, 2025

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey Explored

May 06, 2025 -

The Lyrics And Meaning Behind Ddgs Dont Take My Son Diss Track

May 06, 2025

The Lyrics And Meaning Behind Ddgs Dont Take My Son Diss Track

May 06, 2025