BSE Shares Get A Lift: Earnings Drive Rally In Indian Bourse

Table of Contents

Strong Corporate Earnings Fuel BSE Share Price Surge

The correlation between robust Q[Insert Quarter] earnings reports and the subsequent positive market reaction is undeniable. Many companies exceeded expectations, delivering a positive earnings surprise that sent ripples across various sectors. This surge in corporate profits directly translates to increased investor confidence and higher share prices.

- Specific Examples: [Company A] in the IT sector saw its share price jump by [Percentage]% following its Q[Insert Quarter] results, which showcased impressive revenue growth and increased EPS. Similarly, [Company B] in the banking sector reported strong profit margins, leading to a [Percentage]% increase in its share price. [Company C], a prominent player in the FMCG sector, also contributed to the positive sentiment with its robust earnings announcement.

Impact of Key Sectors on BSE Performance

The BSE rally isn't solely driven by one sector; rather, it's a collective effort from several key players.

- IT Sector: The IT sector has been a major contributor, with several companies exceeding revenue growth targets and demonstrating strong profit margins. Increased global demand for IT services played a crucial role.

- Banking Sector: The banking sector also showcased impressive performance, driven by increased lending activity and improved asset quality.

- Pharmaceutical Sector: The pharmaceutical sector contributed positively, fueled by strong domestic and international demand for medicines.

Here’s a snapshot of key performance indicators (KPIs) from some leading companies:

- Company X (IT): Revenue growth of 15%, EPS growth of 20%

- Company Y (Banking): Profit margin increase of 5%, strong loan disbursement growth

- Company Z (Pharma): Increased export orders, strong domestic sales

Investor Sentiment and Market Confidence

The strong Q[Insert Quarter] earnings have significantly bolstered investor sentiment and market confidence. Investors are increasingly optimistic about the future prospects of Indian companies and the overall economic outlook.

- FII Activity: Foreign Institutional Investors (FIIs) have been net buyers in the recent period, further fueling the rally. This influx of foreign capital signals a strong vote of confidence in the Indian market.

- Global Market Trends: While global market trends can influence the BSE, the strength of the current earnings season has largely insulated the Indian Bourse from negative external factors. The bullish sentiment remains strong.

Technical Analysis and Future Outlook for BSE Shares

From a technical perspective, the BSE indices are currently trading above key support levels, suggesting further upside potential. However, resistance levels might present short-term challenges.

- Potential Risks: While the outlook is positive, it's crucial to acknowledge potential risks, including global economic slowdown and inflationary pressures. Market volatility is always a possibility.

Despite these potential challenges, the current positive trend, driven by strong corporate earnings and positive investor sentiment, suggests continued growth in the coming months. The BSE market outlook remains cautiously optimistic.

BSE Shares and the Road Ahead

The recent BSE share price rally is primarily attributed to the strong performance of Indian companies during the Q[Insert Quarter] earnings season. The positive earnings surprises have significantly boosted investor confidence and attracted substantial FII investment. While potential global risks exist, the robust underlying fundamentals of the Indian economy and the positive market sentiment suggest further growth potential for BSE shares.

To stay informed about the BSE market outlook and make wise investment decisions, it’s crucial to track BSE share prices regularly. Consider diversifying your portfolio and monitor BSE performance closely. To access real-time data and analysis, visit [Link to a reputable financial news website or brokerage]. Invest in BSE shares wisely and be a part of India's growth story.

Featured Posts

-

Need To Know 2025 Nhl Draft Lottery And The Utah Hockey Club

May 07, 2025

Need To Know 2025 Nhl Draft Lottery And The Utah Hockey Club

May 07, 2025 -

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025 -

Goaltender Recalls Ovechkins First Nhl Goal Seeking Autographed Jersey

May 07, 2025

Goaltender Recalls Ovechkins First Nhl Goal Seeking Autographed Jersey

May 07, 2025 -

Is Zendayas Sister Skipping Her Wedding To Tom Holland The Story Behind The Rumor

May 07, 2025

Is Zendayas Sister Skipping Her Wedding To Tom Holland The Story Behind The Rumor

May 07, 2025 -

Ovechkins Take Why He Might Skip The 4 Nations Face Off Without Russia

May 07, 2025

Ovechkins Take Why He Might Skip The 4 Nations Face Off Without Russia

May 07, 2025

Latest Posts

-

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025 -

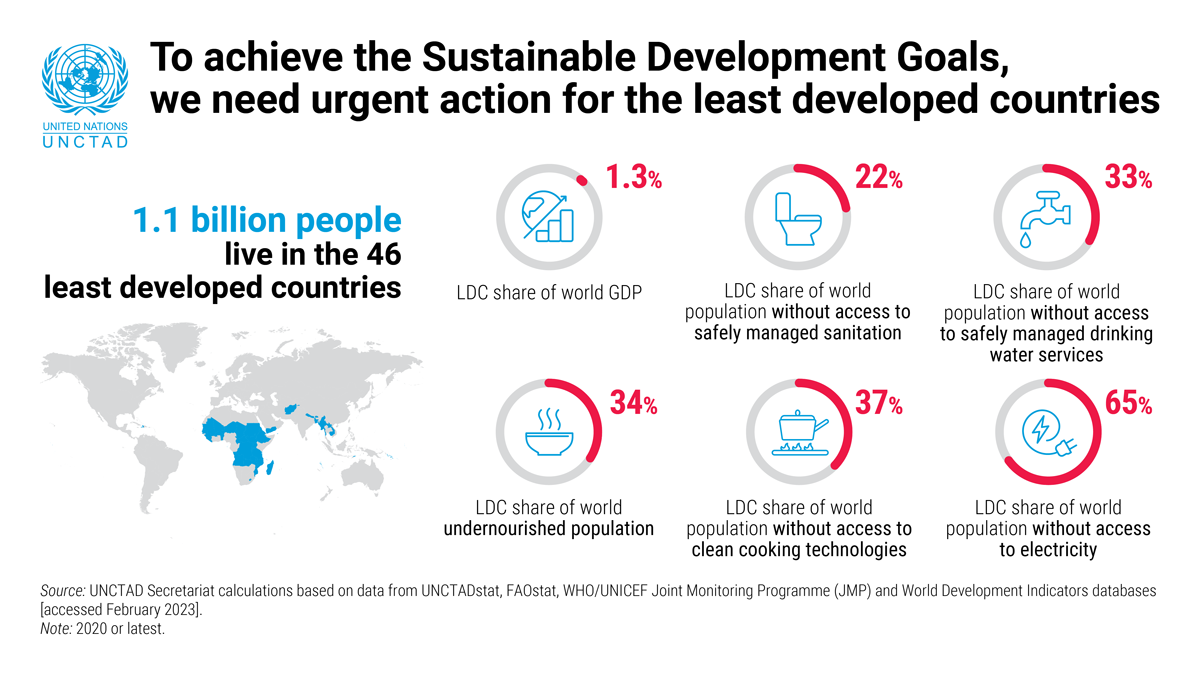

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025 -

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025 -

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025 -

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025