Building Wealth The Stealthy Way: Practical Strategies For Quiet Accumulation

Table of Contents

Mastering the Art of Frugal Living

The foundation of stealth wealth building lies in mindful spending and financial discipline. It's not about deprivation; it's about prioritizing needs over wants and making conscious choices that align with your long-term financial goals.

Budgeting and Debt Reduction

Creating a detailed budget is the first step towards financial freedom. This involves tracking your income and expenses meticulously, identifying areas where you can cut back, and developing a plan to eliminate high-interest debt.

- Track your spending: Use budgeting apps like Mint or YNAB (You Need A Budget) to monitor your expenses.

- Identify areas for savings: Analyze your spending patterns to find unnecessary expenses, such as subscriptions you rarely use or eating out too often.

- Eliminate high-interest debt: Prioritize paying off high-interest debt like credit cards and payday loans to reduce interest payments and free up cash flow.

- The 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Mindful Spending and Avoiding Lifestyle Inflation

The difference between needs and wants is crucial for quiet wealth accumulation. Resisting impulse purchases and avoiding lifestyle inflation—the tendency to increase spending as your income rises—are key to long-term success.

- Delay gratification: Before making a significant purchase, wait 24-48 hours to assess its necessity.

- Prioritize experiences: Focus on experiences and memories rather than accumulating material possessions.

- Find affordable alternatives: Look for cheaper alternatives to expensive goods and services.

Strategic Investing for Long-Term Growth

Investing wisely is essential for building wealth the stealthy way. A long-term perspective and a diversified portfolio are crucial to mitigate risk and maximize returns.

Diversification and Risk Management

Diversification is key to reducing investment risk. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of any single investment's underperformance.

- Assess your risk tolerance: Understand your comfort level with risk before choosing investments.

- Consider different investment vehicles: Explore index funds, ETFs (exchange-traded funds), and mutual funds for diversified exposure.

- Balanced portfolio: A balanced portfolio typically includes a mix of stocks and bonds, adjusted based on your risk tolerance and investment goals.

Dollar-Cost Averaging and Reinvesting Dividends

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the risk of investing a lump sum at a market peak. Reinvesting dividends compounds your returns over time.

- Dollar-cost averaging mitigates risk: By investing regularly, you buy more shares when prices are low and fewer shares when prices are high.

- Compounding returns: Reinvesting dividends allows your earnings to generate further earnings, accelerating your wealth accumulation.

- Long-term perspective: Investing for the long term allows your investments to weather market downturns and benefit from the power of compounding.

Generating Passive Income Streams

Passive income streams significantly accelerate stealth wealth building. These income sources generate money with minimal ongoing effort, allowing you to focus on other aspects of your financial plan.

Real Estate Investing (Rental Properties)

Rental properties offer a reliable stream of passive income. However, thorough research and careful planning are essential to minimize risk and maximize returns.

- Due diligence: Thoroughly research the property market before investing in rental properties.

- Risk mitigation strategies: Develop strategies to deal with vacancies and property maintenance.

- Tax advantages: Utilize tax advantages associated with real estate investment.

Building Online Businesses and Other Passive Income Sources

The internet provides numerous opportunities for generating passive income. Affiliate marketing, blogging, and creating and selling online courses are just a few examples.

- Market research: Identify a profitable niche with significant demand.

- Diversify passive income: Don't put all your eggs in one basket. Explore diverse passive income streams.

- Dividend stocks: Invest in dividend-paying stocks to generate a regular stream of passive income.

Protecting and Growing Your Wealth Discreetly

Protecting your accumulated wealth and planning for the future are critical components of building wealth the stealthy way.

Tax Optimization Strategies

Minimizing your tax liability is essential for maximizing your investment returns. Consult with a financial advisor and tax professional to explore legal tax optimization strategies.

- Tax-advantaged accounts: Utilize retirement accounts like 401(k)s and IRAs to reduce your taxable income.

- Tax planning: Develop a comprehensive tax plan to minimize your tax burden legally.

Estate Planning and Asset Protection

Estate planning protects your assets and ensures they are distributed according to your wishes. Having a comprehensive plan can safeguard your wealth from creditors and unforeseen circumstances.

- Will and trust: Develop a will and consider establishing a trust to manage the distribution of your assets.

- Asset protection strategies: Explore strategies to protect your assets from lawsuits and creditors.

Securing Your Financial Future Through Stealth Wealth Building

Building wealth the stealthy way involves a holistic approach, combining frugal living, strategic investing, passive income generation, and robust wealth protection strategies. By prioritizing long-term financial security over immediate gratification, you can steadily accumulate wealth without drawing unnecessary attention. Start implementing these strategies today, and embark on your journey towards quiet wealth accumulation. Consider consulting a financial advisor to develop a personalized plan tailored to your specific circumstances and goals. Remember, consistent effort and smart decision-making are the keys to successfully building wealth the stealthy way.

Featured Posts

-

Sygkritiki Timon Kaysimon Stin Kypro Paratiriseis And Statistika

May 19, 2025

Sygkritiki Timon Kaysimon Stin Kypro Paratiriseis And Statistika

May 19, 2025 -

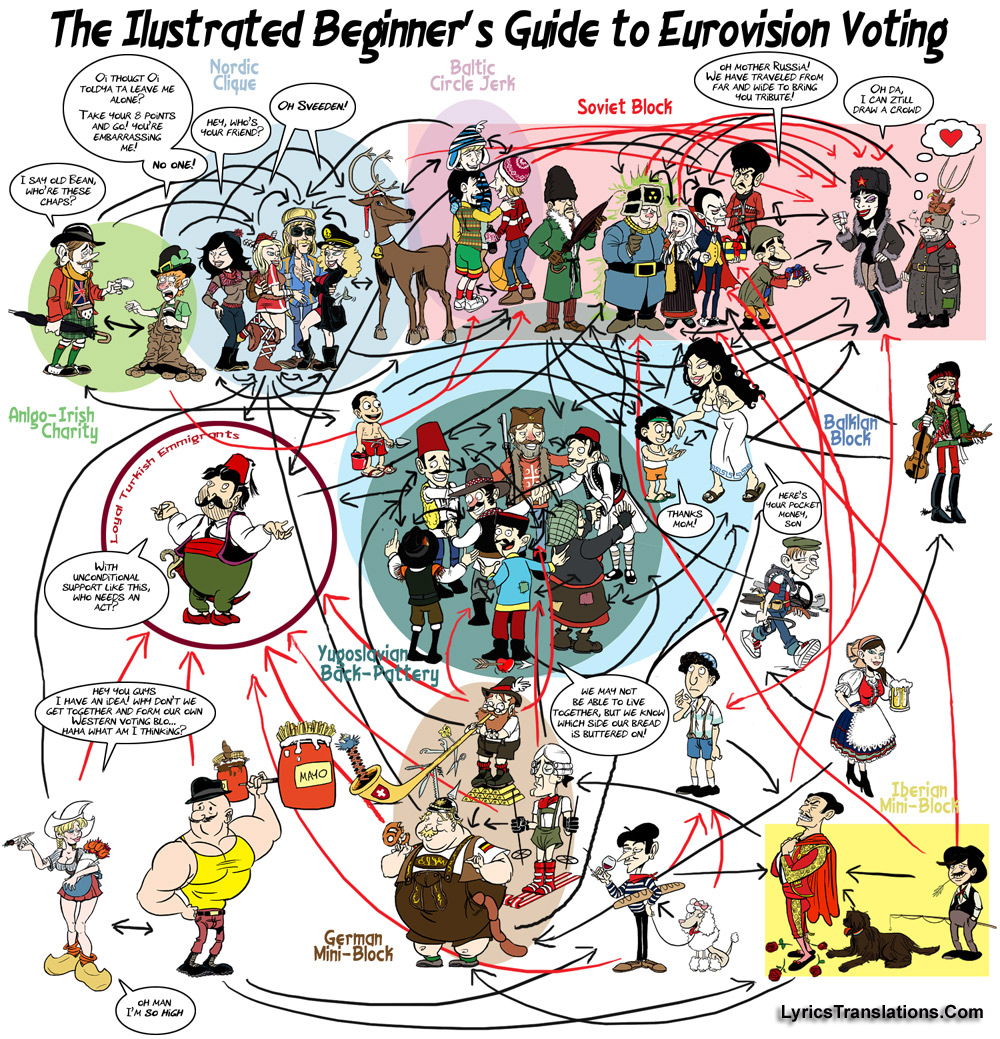

How Eurovision Voting Works A Complete Guide

May 19, 2025

How Eurovision Voting Works A Complete Guide

May 19, 2025 -

Orlando Citys Home Opener Ends In Defeat Against Philadelphia Union

May 19, 2025

Orlando Citys Home Opener Ends In Defeat Against Philadelphia Union

May 19, 2025 -

Building Wealth The Stealthy Way Practical Strategies For Quiet Accumulation

May 19, 2025

Building Wealth The Stealthy Way Practical Strategies For Quiet Accumulation

May 19, 2025 -

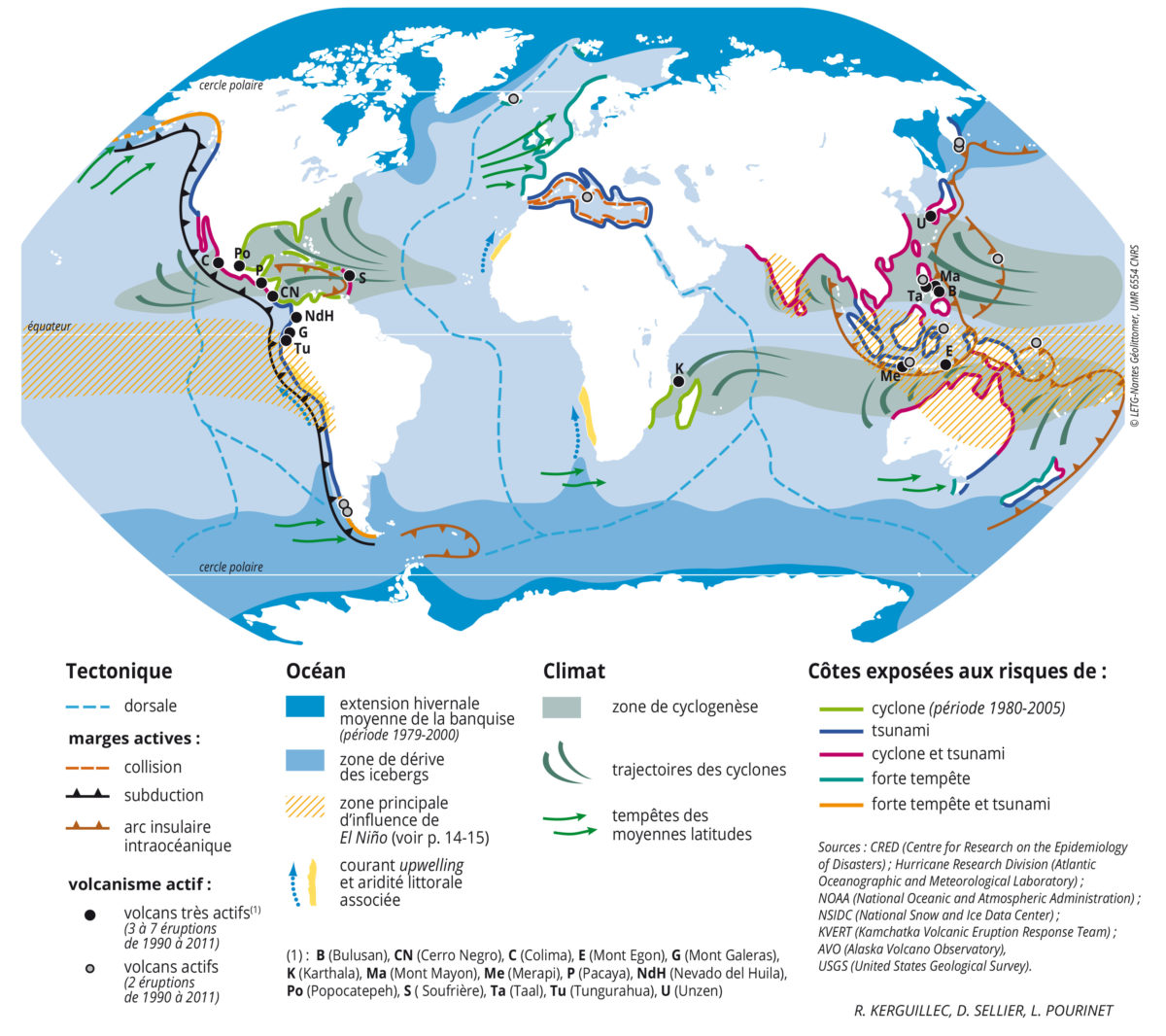

Credit Mutuel Am Et Les Risques Geopolitiques Pour L Environnement Maritime

May 19, 2025

Credit Mutuel Am Et Les Risques Geopolitiques Pour L Environnement Maritime

May 19, 2025

Latest Posts

-

De Soto County Votes The Southaven Mayoral Election 2024

May 19, 2025

De Soto County Votes The Southaven Mayoral Election 2024

May 19, 2025 -

Collier County Mom Fights For Better School Bus Safety After Childrens Wrong Stop Incident

May 19, 2025

Collier County Mom Fights For Better School Bus Safety After Childrens Wrong Stop Incident

May 19, 2025 -

De Soto County Setting The Standard With 100 Broadband

May 19, 2025

De Soto County Setting The Standard With 100 Broadband

May 19, 2025 -

First In The State De Soto Countys 100 Broadband Connection

May 19, 2025

First In The State De Soto Countys 100 Broadband Connection

May 19, 2025 -

Hillsborough County Celebrates De Soto Elementary Principals Achievement

May 19, 2025

Hillsborough County Celebrates De Soto Elementary Principals Achievement

May 19, 2025