Businessman Defies Dragon Den Investors, Accepts Unconventional Offer

Table of Contents

In a shocking turn of events on the popular entrepreneurial show, Dragon Den, a businessman, Mark Olsen, founder of innovative sustainable packaging company "EcoPack Solutions," rejected lucrative offers from several seasoned investors. Instead, he opted for an unconventional offer that left the Dragons speechless. This bold decision challenges the conventional wisdom often presented on the show and offers valuable lessons for aspiring entrepreneurs seeking funding. This article explores Mark's journey, highlighting his unconventional path and the strategic thinking behind his rejection of traditional investment terms.

The Dragon Den Pitch – What Went Wrong (or Right)?

Mark Olsen entered the Dragon Den with a confident pitch for EcoPack Solutions, presenting his eco-friendly, biodegradable packaging solutions to a panel of notoriously discerning investors. His presentation showcased impressive market research, highlighting the growing demand for sustainable alternatives in the packaging industry. He projected significant growth and profitability within the next five years.

- Investor Feedback: The Dragons were initially impressed by Mark's passion and the potential of his product. However, their proposed investment terms focused heavily on equity, demanding a significant stake in the company in exchange for funding. They emphasized the need for rapid scaling and immediate returns on investment.

- Conventional Wisdom: The investors' feedback reflected the conventional wisdom prevalent in venture capital: high-growth, quick returns, and a substantial equity stake. They valued immediate market penetration above other considerations.

- Business Valuation: The Dragons’ valuation of EcoPack Solutions, while generous, was based on conventional metrics that didn't fully reflect the long-term value proposition of sustainable practices and brand loyalty.

The Unconventional Offer – A Deeper Dive

The unconventional offer came from a surprising source: a strategic partnership with "GreenGrowth Initiatives," a non-profit organization dedicated to promoting sustainable businesses. This partnership didn't involve a direct financial investment in the traditional sense but offered invaluable resources:

-

Unconventional Investment: GreenGrowth Initiatives offered marketing support, access to their extensive network of environmentally conscious retailers, and crucial industry certifications. This strategic alliance allowed Mark to focus on product development and market penetration without giving up a large share of his company.

-

Strategic Partnership: This wasn't about capital injection but about synergistic growth. The partnership aimed to leverage both organizations’ strengths for mutual benefit.

-

Alternative Funding: This demonstrates that alternative funding sources, beyond traditional venture capital, can be extremely effective for businesses with a strong ethical and social mission.

-

Pros & Cons:

- Pros: Brand enhancement, market access, reduced financial risk, alignment with company values.

- Cons: Slower initial growth compared to venture capital-fueled expansion, potential reliance on the partnership for success.

The Businessman's Rationale – Why He Said No to the Dragons

Mark's decision to reject the Dragons' offers stemmed from a long-term vision that extended beyond immediate profits:

-

Strategic Decision-Making: Mark prioritized long-term sustainability and ethical business practices, a vision that wasn't fully embraced by the Dragons' focus on short-term returns.

-

Long-Term Vision: He believed the GreenGrowth partnership better aligned with his company's mission and values, fostering sustainable growth and brand loyalty in the long run.

-

Risk Management: While the Dragons’ offer presented a faster route to growth, it also meant relinquishing a significant portion of his company's ownership and potentially compromising his long-term vision.

-

Key Reasons:

- Maintaining majority ownership and control over EcoPack Solutions

- Aligning the business with a partner sharing the same ethical and environmental goals

- Focusing on sustainable, long-term growth rather than rapid, potentially unsustainable expansion

The Aftermath – Lessons Learned and Future Implications

Mark's decision has sparked considerable debate within the entrepreneurial community. While some criticize his rejection of readily available capital, many applaud his commitment to his values and long-term vision.

-

Business Success: The early signs indicate that Mark's choice might prove successful. EcoPack Solutions has secured several major contracts thanks to GreenGrowth's network, and its brand is gaining significant traction in the environmentally conscious market segment.

-

Entrepreneurial Lessons: This story emphasizes the importance of aligning funding sources with your business's core values and long-term goals. Not all businesses are suited for the high-growth, venture capital model.

-

Investment Strategy: Entrepreneurs should explore various funding options beyond conventional venture capital, considering strategic partnerships, grants, and crowdfunding.

-

Key Lessons for Entrepreneurs:

- Evaluate funding options based on long-term vision, not just short-term gains.

- Consider strategic partnerships that align with your business values.

- Don't be afraid to explore unconventional funding routes.

Conclusion: Defying the Odds – Learning from the Businessman's Unconventional Success

Mark Olsen's unconventional choice on Dragon Den serves as a powerful example of how prioritizing long-term vision and aligning with the right partners can lead to sustainable business success. His rejection of the Dragons' offers demonstrates the importance of considering alternative funding strategies. His story proves that sometimes, defying conventional wisdom and pursuing an unconventional offer can be the key to building a thriving, ethical, and impactful business. Learn from this businessman's bold move and explore unconventional options for your own business. Are you ready to defy the odds and seek your own unconventional offer?

Featured Posts

-

Beloved Actress Priscilla Pointer Dies Remembering Her Legacy In Dallas And The Carrie Diaries

May 01, 2025

Beloved Actress Priscilla Pointer Dies Remembering Her Legacy In Dallas And The Carrie Diaries

May 01, 2025 -

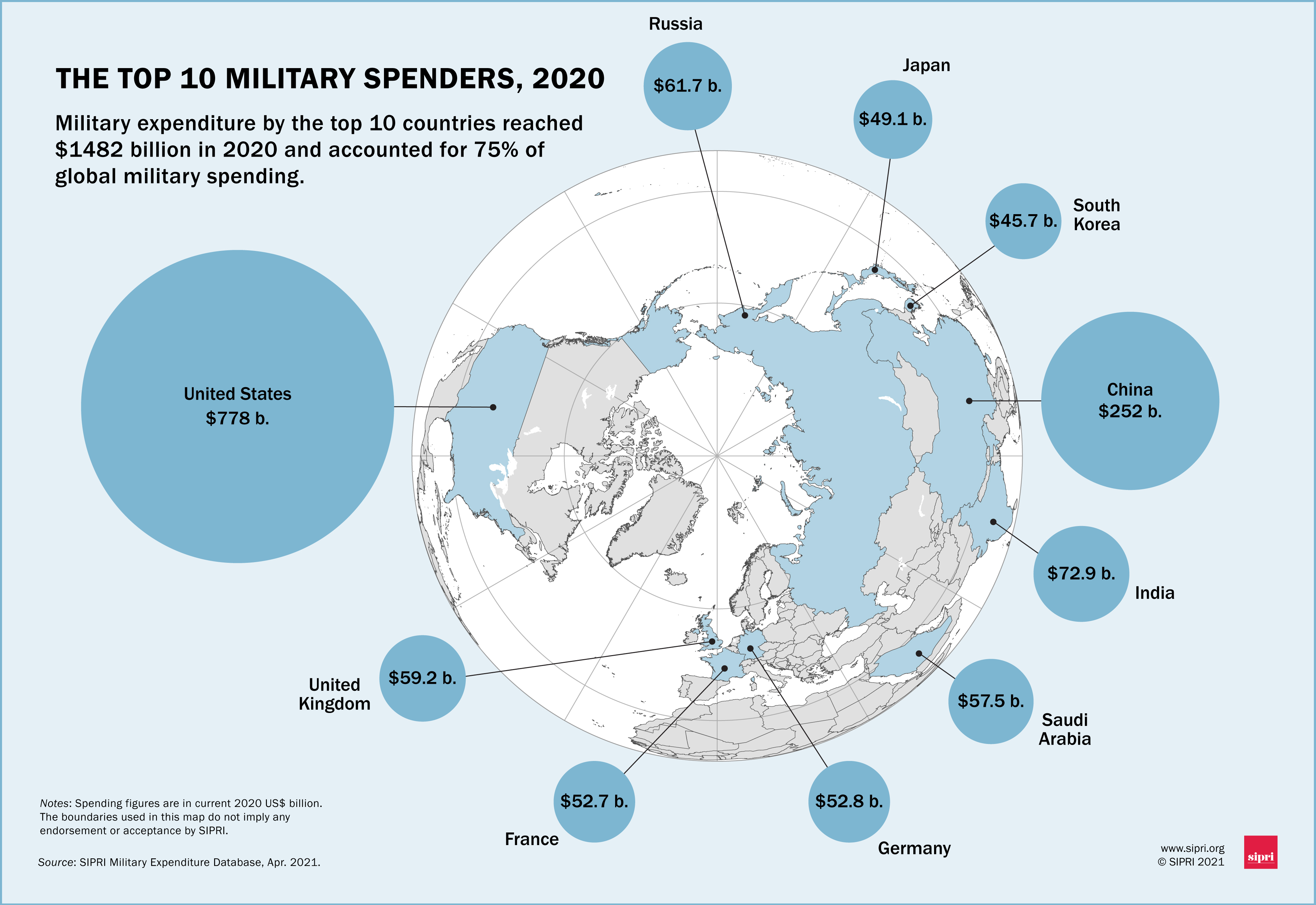

Global Military Spending Surge Europes Response To The Russian Threat

May 01, 2025

Global Military Spending Surge Europes Response To The Russian Threat

May 01, 2025 -

White House Eagles And Controversy Jalen Hurts Absence And Trumps Comments

May 01, 2025

White House Eagles And Controversy Jalen Hurts Absence And Trumps Comments

May 01, 2025 -

Dragon Den Shock Businessman Rejects Top Investors Accepts Risky Deal

May 01, 2025

Dragon Den Shock Businessman Rejects Top Investors Accepts Risky Deal

May 01, 2025 -

The Biggest And Best Cruise Ships Launching In 2025

May 01, 2025

The Biggest And Best Cruise Ships Launching In 2025

May 01, 2025

Latest Posts

-

Souness On Arsenal Champions League Contenders Poised For A Difficult Challenge

May 03, 2025

Souness On Arsenal Champions League Contenders Poised For A Difficult Challenge

May 03, 2025 -

Barrow Afc Fans Participate In Sky Bet Every Minute Matters Relay Cycle

May 03, 2025

Barrow Afc Fans Participate In Sky Bet Every Minute Matters Relay Cycle

May 03, 2025 -

Arsenals Champions League Threat Souness Highlights Unbeatable Opposition

May 03, 2025

Arsenals Champions League Threat Souness Highlights Unbeatable Opposition

May 03, 2025 -

Barrow Afc Supporters Sky Bet Every Minute Matters Cycle Relay

May 03, 2025

Barrow Afc Supporters Sky Bet Every Minute Matters Cycle Relay

May 03, 2025 -

Mn Hm Akthr Laeby Krt Alqdm Mkrwht Qaymt Mwqe Bkra Lakthr 30 Shkhsyt

May 03, 2025

Mn Hm Akthr Laeby Krt Alqdm Mkrwht Qaymt Mwqe Bkra Lakthr 30 Shkhsyt

May 03, 2025