Buy XRP (Ripple) Now? A Look At The Current Market Under $3

Table of Contents

Ripple's Ongoing Legal Battle with the SEC: A Major Factor Influencing XRP Price

The SEC lawsuit against Ripple Labs remains a dominant factor influencing XRP's price. Understanding this legal battle is crucial for any potential investor.

Understanding the SEC Lawsuit and its Potential Outcomes

- The Allegation: The SEC alleges that Ripple sold XRP as an unregistered security.

- Ripple's Defense: Ripple argues that XRP is a currency and not a security.

- Potential Outcomes: A favorable ruling could significantly boost XRP's price, while an unfavorable outcome could lead to further price declines. The uncertainty surrounding the legal proceedings creates significant regulatory risk.

- Impact on Investor Confidence: The lawsuit has undoubtedly impacted investor confidence, leading to market volatility. A clear resolution, regardless of the outcome, could bring much-needed clarity and potentially stabilize the market. Keywords: SEC lawsuit, Ripple vs SEC, legal uncertainty, regulatory risk, XRP price prediction.

Ripple's Technology and Partnerships: Examining the Underlying Value of XRP

Despite the legal challenges, Ripple's underlying technology and its growing adoption within the financial industry offer a counterpoint to the negative sentiment.

RippleNet and its Growing Adoption

- Cross-border Payments: RippleNet facilitates faster and cheaper cross-border payments for financial institutions.

- Adoption by Banks and Payment Providers: Several major financial institutions have adopted RippleNet, showcasing its practical applications. This adoption demonstrates the real-world utility of XRP and its potential for future growth.

- Partnerships and Integrations: Strategic partnerships with banks and payment processors continue to expand, strengthening Ripple's position in the global financial landscape. These partnerships often contribute to increased XRP demand and potential price appreciation. Keywords: RippleNet, cross-border payments, blockchain technology, financial institutions, partnerships, XRP utility.

Market Sentiment and Technical Analysis: Assessing the Current XRP Market Conditions

Understanding the current market sentiment and conducting a technical analysis are essential for evaluating XRP's potential.

Analyzing Current Market Trends

- Market Capitalization and Trading Volume: Monitoring XRP's market capitalization and trading volume provides insights into its overall market strength and liquidity.

- Price Movements and Patterns: Analyzing past price movements can help identify potential trends and predict future price action, though it's crucial to remember that past performance is not indicative of future results.

- Technical Indicators: Utilizing technical indicators such as moving averages, relative strength index (RSI), and MACD can help assess the current market momentum and identify potential support and resistance levels. However, these indicators should be used in conjunction with fundamental analysis. Keywords: market analysis, technical analysis, XRP chart, trading volume, market capitalization, price trends.

Risk Assessment: Understanding the Volatility of the Cryptocurrency Market

Investing in cryptocurrencies, including XRP, carries significant risk. It's crucial to understand this volatility before committing any capital.

The Inherent Risks of Investing in Cryptocurrencies

- High Volatility: The cryptocurrency market is notoriously volatile, and XRP's price can experience significant swings in short periods.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving and remains uncertain in many jurisdictions. This uncertainty can impact prices.

- Security Risks: Cryptocurrency exchanges and wallets are vulnerable to hacking and theft, posing risks to investors' funds.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, particularly in less regulated markets. Keywords: Cryptocurrency risk, volatility, risk management, diversification, investment strategy.

Conclusion: Making Informed Decisions About Buying XRP (Ripple)

The decision of whether to buy XRP now is complex, influenced by the ongoing legal battle, Ripple's technological advancements, current market conditions, and the inherent risks of cryptocurrency investment. A thorough understanding of these factors is essential before investing. The potential rewards are significant, but so are the risks. A favorable resolution to the SEC lawsuit could propel XRP's price upward, while a negative outcome could lead to further declines. The growth of RippleNet and its partnerships point towards a strong underlying technology, but the market's volatility remains a considerable factor.

Weigh the factors discussed above and decide if buying XRP now aligns with your investment strategy. Remember to conduct your own thorough research and only invest what you can afford to lose. Keywords: Buy XRP, Ripple investment, XRP price, cryptocurrency investment, informed decision.

Featured Posts

-

Should You Invest In Xrp Ripple Below 3 A Comprehensive Guide

May 02, 2025

Should You Invest In Xrp Ripple Below 3 A Comprehensive Guide

May 02, 2025 -

Airbus Passes Us Airline Tariffs

May 02, 2025

Airbus Passes Us Airline Tariffs

May 02, 2025 -

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025 -

Addressing High Stock Market Valuations A Bof A Analysis For Investors

May 02, 2025

Addressing High Stock Market Valuations A Bof A Analysis For Investors

May 02, 2025 -

Can Xrp Make You A Millionaire Analyzing Ripples Rise To Fourth Largest Cryptocurrency

May 02, 2025

Can Xrp Make You A Millionaire Analyzing Ripples Rise To Fourth Largest Cryptocurrency

May 02, 2025

Latest Posts

-

Fortnite Cowboy Bebop Crossover Event Freebies Available Now

May 02, 2025

Fortnite Cowboy Bebop Crossover Event Freebies Available Now

May 02, 2025 -

Free Fortnite Cowboy Bebop Skins And Cosmetics A Limited Time Event

May 02, 2025

Free Fortnite Cowboy Bebop Skins And Cosmetics A Limited Time Event

May 02, 2025 -

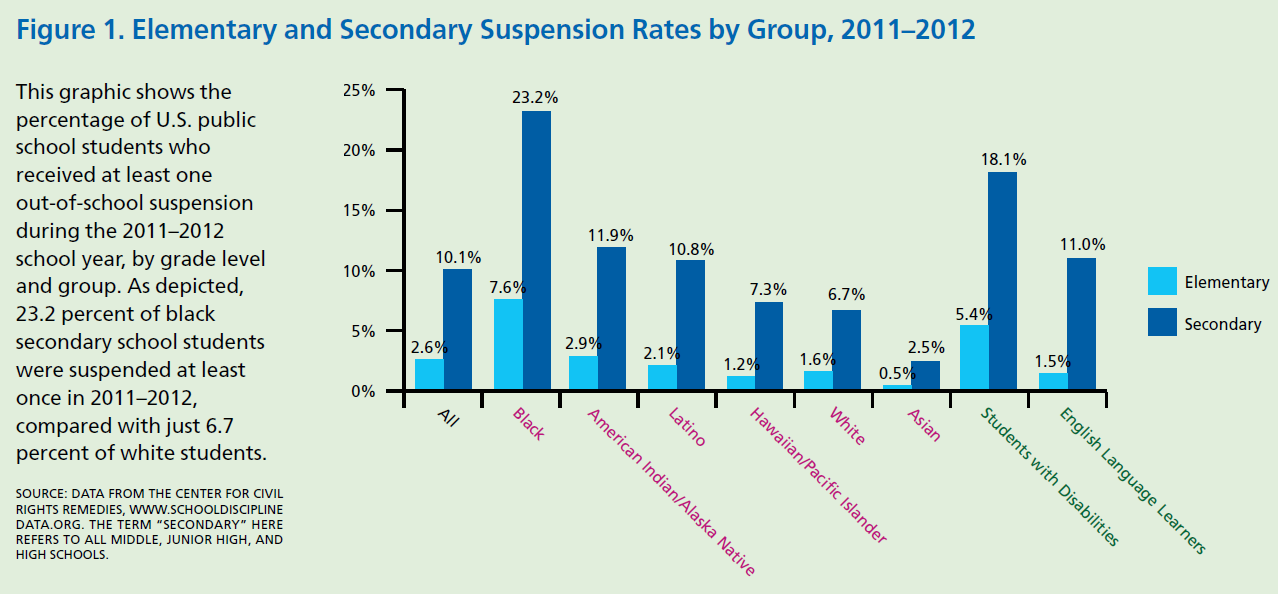

The Harmful Effects Of School Suspension A Critical Look

May 02, 2025

The Harmful Effects Of School Suspension A Critical Look

May 02, 2025 -

Fortnite Cowboy Bebop Collaboration How To Get The Free Items

May 02, 2025

Fortnite Cowboy Bebop Collaboration How To Get The Free Items

May 02, 2025 -

Why School Suspensions Are Detrimental To Students

May 02, 2025

Why School Suspensions Are Detrimental To Students

May 02, 2025