Buying A House: How Student Loans Affect Your Mortgage

Table of Contents

Understanding the Impact of Student Loan Debt on Mortgage Approval

Your student loans significantly impact your mortgage application, influencing both approval and the terms you receive. Let's break down the key factors:

Credit Score and Student Loan Payments

Your credit score is paramount in securing a mortgage. Consistent, on-time student loan payments demonstrate financial responsibility and boost your credit score (whether FICO or VantageScore). Conversely, late or missed payments severely damage your credit, making mortgage approval more difficult and often resulting in higher interest rates – significantly impacting your monthly payments.

- Importance of credit score in mortgage applications: Lenders use your credit score to assess your risk. A higher score translates to better interest rates and a higher likelihood of approval.

- How student loan payment history affects credit scores: Your payment history accounts for a significant portion of your credit score. Even minor delinquencies can have a considerable negative impact.

- Resources to check credit reports and scores: Regularly check your credit reports from AnnualCreditReport.com and monitor your scores through services like Credit Karma or Experian. Addressing any errors promptly is crucial.

Debt-to-Income Ratio (DTI) and Student Loans

Your debt-to-income ratio (DTI) represents the percentage of your gross monthly income dedicated to debt payments. Student loan payments are a significant component of your DTI. A high DTI can hinder your mortgage approval or force you to settle for a smaller loan amount than desired.

- DTI calculation: Your DTI is calculated by dividing your total monthly debt payments (including student loans, credit cards, car payments, etc.) by your gross monthly income.

- Strategies to lower DTI: To improve your DTI, consider paying down high-interest debt, increasing your income, or exploring student loan repayment options that lower your monthly payments.

- Impact of different types of student loans (federal, private) on DTI: Both federal and private student loans are factored into your DTI calculation. However, some federal loan repayment plans may temporarily lower your monthly payments, improving your DTI.

Types of Mortgages for Borrowers with Student Loans

Several mortgage options cater to borrowers with student loan debt. Understanding these options is crucial for finding the best fit for your financial situation:

- FHA loans: These government-insured loans generally require lower down payments and credit scores than conventional loans, making them attractive to borrowers with student loan debt.

- USDA loans: These loans are designed for rural homebuyers and often have lenient credit requirements.

- Conventional loans: While potentially offering better interest rates, conventional loans usually demand higher credit scores and larger down payments. Comparing interest rates and down payment requirements across these options is vital to find the most affordable option.

Strategies for Managing Student Loan Debt Before Buying a House

Before embarking on the home-buying journey, proactively managing your student loan debt is paramount.

Creating a Realistic Budget and Financial Plan

Develop a comprehensive budget that accounts for all expenses, including student loan payments and anticipated mortgage costs. Prioritize saving for a down payment—a crucial step in securing a mortgage.

- Budgeting apps and tools: Use budgeting apps like Mint or YNAB (You Need A Budget) to track your spending and identify areas for savings.

- Saving strategies: Explore high-yield savings accounts and automate regular savings contributions to accelerate your down payment savings.

- Importance of emergency funds: Build an emergency fund to cover unexpected expenses and prevent setbacks that could jeopardize your home-buying plans.

- Setting realistic home-buying goals: Determine a realistic budget for your home purchase based on your income, DTI, and savings.

Exploring Student Loan Repayment Options

Several options can improve student loan affordability and potentially lower your DTI:

- Benefits and drawbacks of different repayment plans: Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Refinancing can lower your interest rate, but it might come with fees. Consolidation simplifies repayment but may not always reduce your interest rate.

- Eligibility requirements: Each repayment plan has specific eligibility criteria. Thoroughly research which plan best suits your circumstances.

- Finding a reputable refinancing lender: If refinancing, choose a reputable lender and compare offers carefully before making a decision.

Seeking Professional Financial Advice

Seeking professional guidance from a financial advisor or mortgage broker is invaluable.

- Importance of professional guidance: A financial advisor can help you create a comprehensive financial plan, optimize your student loan repayment strategy, and guide you toward achieving your homeownership goals.

- Questions to ask a financial advisor: Ask about strategies for improving your DTI, finding the right mortgage, and planning for long-term financial stability.

- Finding a reputable mortgage broker: A mortgage broker can help you navigate the mortgage process, compare loan offers from different lenders, and negotiate favorable terms.

Pre-Approval and the Home-Buying Process with Student Loan Debt

The pre-approval process is crucial for understanding your borrowing power and navigating the home-buying process effectively.

Getting Pre-Approved for a Mortgage

Pre-approval provides a realistic assessment of how much you can borrow. Lenders will analyze your income, debts (including student loans), credit score, and DTI to determine your eligibility.

- Steps to get pre-approved: Gather necessary documents (pay stubs, tax returns, etc.), complete a pre-approval application, and allow the lender to review your financial information.

- Documents required: Be prepared to provide comprehensive financial documentation to support your application.

- Comparing offers from different lenders: Shop around and compare offers from multiple lenders to find the best terms and interest rates.

Negotiating the Best Mortgage Terms

Once pre-approved, you're in a stronger position to negotiate favorable mortgage terms.

- Strategies for negotiating lower interest rates: Explore different lender options and leverage competitive offers to secure a better interest rate.

- Understanding mortgage closing costs: Be fully aware of all fees and charges associated with closing the mortgage.

Conclusion

Buying a house with student loan debt presents unique challenges, but it's entirely achievable with meticulous planning and informed decision-making. Understanding the impact of your student loans on your credit score and DTI, exploring various repayment options and mortgage types, and seeking professional financial advice are critical steps in this process. By proactively managing your debt, creating a realistic budget, and securing pre-approval, you can confidently navigate the mortgage maze and achieve your dream of homeownership. Start planning your financial future today and explore your options for securing a mortgage with student loans – achieving homeownership with student loan debt is within your reach! Learn more about managing student loan debt for home buying and securing a mortgage with student loans by exploring resources and consulting financial professionals.

Featured Posts

-

Mapping The Countrys Hottest New Business Hubs

May 17, 2025

Mapping The Countrys Hottest New Business Hubs

May 17, 2025 -

Eccles Foundation Funds Transformative U Of U Health Campus

May 17, 2025

Eccles Foundation Funds Transformative U Of U Health Campus

May 17, 2025 -

Severance Season 3 Renewal Status What We Know

May 17, 2025

Severance Season 3 Renewal Status What We Know

May 17, 2025 -

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025

Investing In Ubers Autonomous Vehicle Future An Etf Analysis

May 17, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Transport Now Available

May 17, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Transport Now Available

May 17, 2025

Latest Posts

-

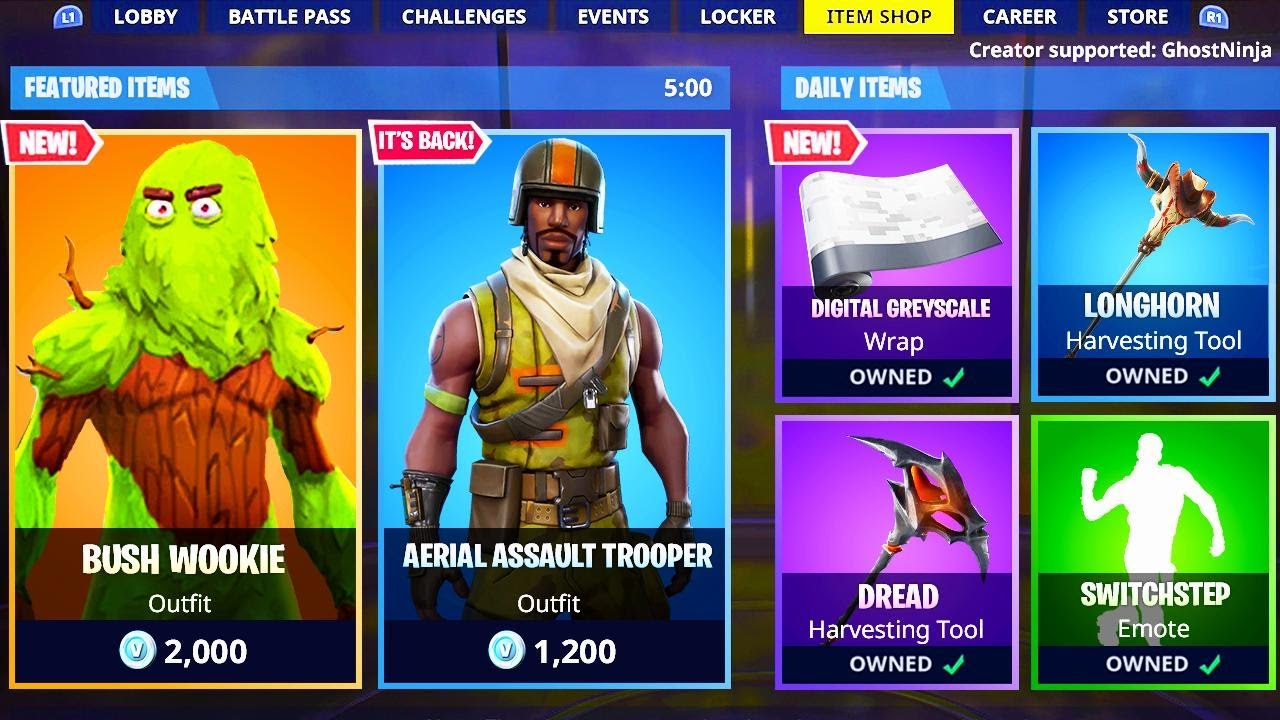

The Return Of Classic Fortnite Skins Item Shop Update

May 17, 2025

The Return Of Classic Fortnite Skins Item Shop Update

May 17, 2025 -

Fortnite Item Shop Restocks 1000 Day Old Skins Back

May 17, 2025

Fortnite Item Shop Restocks 1000 Day Old Skins Back

May 17, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Guide

May 17, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Guide

May 17, 2025 -

Highly Requested Fortnite Skins Return To Item Shop

May 17, 2025

Highly Requested Fortnite Skins Return To Item Shop

May 17, 2025 -

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025