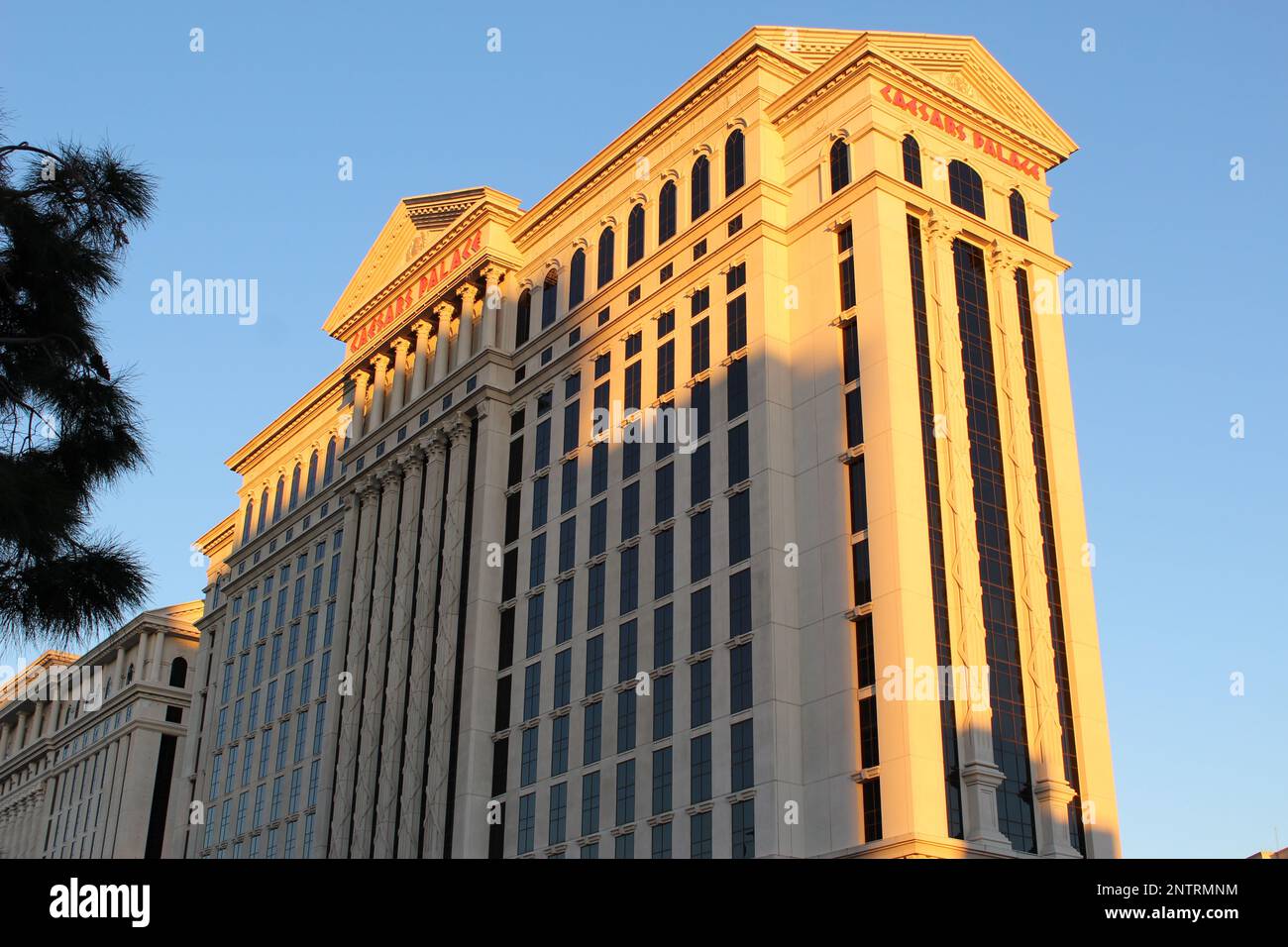

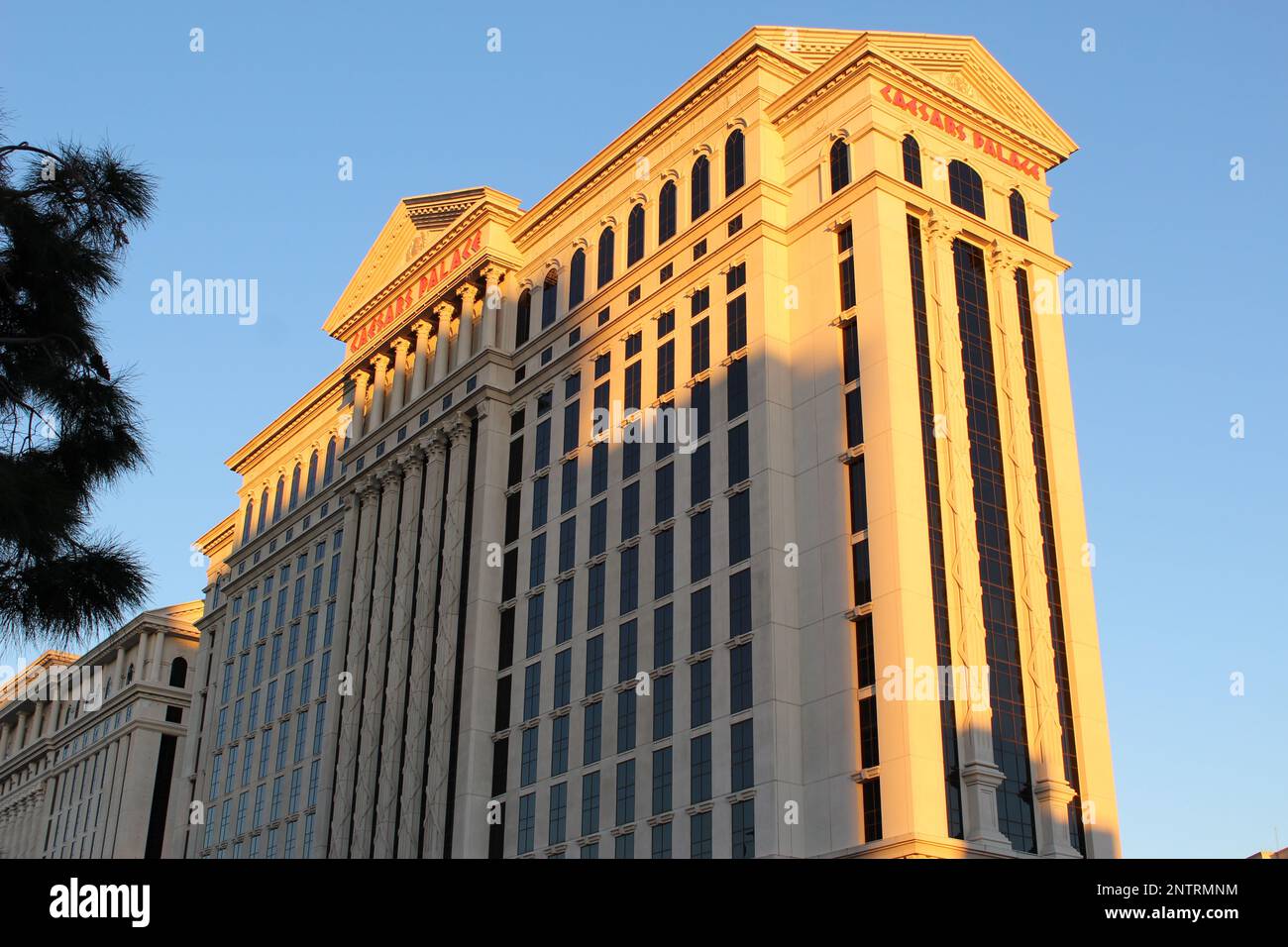

Caesar's Las Vegas Strip Properties Show Minor Value Decline

Table of Contents

Factors Contributing to the Value Decline

Several interconnected factors have contributed to the minor value decline observed in Caesar's Las Vegas Strip properties. Understanding these factors is crucial to assessing the long-term prospects of these prominent resorts.

Impact of the Pandemic's Lingering Effects

The COVID-19 pandemic dealt a significant blow to the global tourism industry, and Las Vegas was no exception. The lingering effects continue to impact Caesar's properties.

- Reduced tourism: International and domestic travel restrictions significantly reduced visitor numbers for a considerable period.

- Slower recovery than anticipated: The recovery of the Las Vegas tourism market has been slower than initially projected, affecting occupancy rates and revenue generation.

- Lingering concerns about travel and large gatherings: Some potential visitors remain hesitant about large gatherings and air travel, impacting demand.

The impact of the pandemic on casino revenue is undeniable. Compared to pre-pandemic levels, occupancy rates at Caesar's properties remained significantly lower for an extended period, leading to a decrease in overall revenue. The slow recovery of Las Vegas tourism recovery, coupled with post-pandemic travel anxieties, contributed to the subdued performance. Analyzing the casino revenue figures alongside occupancy rates paints a clear picture of the pandemic's lingering impact on the valuation of these properties.

Increased Competition in the Las Vegas Market

The Las Vegas Strip is a highly competitive market, and the value of Caesar's properties is influenced by the actions of its competitors.

- New resort openings: The opening of new resorts and hotels introduces additional competition for customers and market share.

- Renovations and expansions by competitors: Existing casinos are constantly upgrading and expanding their offerings, creating a more competitive landscape.

- Evolving entertainment options: The entertainment landscape is constantly evolving, requiring casinos to innovate and adapt to maintain their appeal.

The Las Vegas casino competition is fierce. The rise of new resorts and significant renovations by established competitors like MGM Resorts and Wynn Resorts has put pressure on Caesar's market share. New resort development, often featuring innovative amenities and entertainment options, draws visitors away from established properties, impacting their revenue potential and, consequently, their valuation.

Economic Headwinds and Inflationary Pressures

Macroeconomic factors also play a significant role in the valuation of real estate, including casino properties.

- Rising interest rates: Higher interest rates increase borrowing costs for businesses, affecting investment decisions and potentially slowing growth.

- Inflation affecting consumer spending: Inflation reduces consumer purchasing power, impacting discretionary spending on entertainment and travel.

- Potential recessionary concerns: Economic uncertainty can dampen consumer confidence, leading to decreased spending on leisure activities.

The impact of inflation on casinos is substantial. Rising prices for goods and services increase the cost of operating large resorts, while simultaneously reducing consumer spending on non-essential activities like gambling and entertainment. Interest rates and real estate values are inversely correlated; rising interest rates make borrowing more expensive, negatively affecting investment in property development and potentially lowering valuations. The economic outlook Las Vegas depends heavily on the broader macroeconomic environment.

Analyzing Caesar's Response to the Value Decline

Caesar's Entertainment is actively working to mitigate the impact of the value decline and position its properties for future growth.

Strategic Investments and Renovations

Caesar's is undertaking several strategic initiatives to enhance its properties' appeal and attract more visitors.

- Ongoing renovations at existing properties: Caesar's is investing in renovations to modernize its facilities and enhance the guest experience.

- Plans for new amenities and attractions: The company is developing plans to introduce new amenities and attractions to diversify its offerings.

- Investments in technology and guest experiences: Caesar's is investing in technology to improve operational efficiency and enhance the guest experience through personalized services.

Casino renovations are a common strategy to attract visitors and maintain competitiveness. By investing in upgraded facilities, new amenities, and technological advancements, Caesar's aims to enhance the guest experience and attract a broader range of clientele. These technology investments, focusing on personalized service and streamlined operations, are crucial for maintaining a competitive edge.

Marketing and Promotional Strategies

Effective marketing is key to attracting visitors in a competitive market.

- Targeted marketing campaigns: Caesar's is employing targeted marketing campaigns to reach specific customer segments.

- Loyalty programs: Robust loyalty programs are crucial for customer retention and repeat business.

- Partnerships with other businesses: Strategic partnerships can expand reach and access to new customer bases.

Casino marketing strategies are essential for driving occupancy and revenue. Through targeted campaigns, loyalty programs, and partnerships, Caesar's aims to increase customer engagement and boost revenue streams. These customer retention strategies are critical for long-term success in a highly competitive environment.

Future Outlook for Caesar's Las Vegas Strip Properties

Despite the recent minor value decline, the long-term prospects for Caesar's Las Vegas Strip properties remain positive.

Potential for Growth and Recovery

Several factors suggest a positive outlook for Caesar's properties.

- Long-term prospects for Las Vegas tourism: Las Vegas remains a major global tourism destination with strong long-term growth potential.

- Potential for increased investment: Further investment in renovations and new developments can enhance the appeal of Caesar's properties.

- Adaptability to changing market demands: Caesar's ability to adapt to changing market conditions is crucial for future success.

The Las Vegas tourism forecast remains optimistic, suggesting a robust recovery in the coming years. The potential for increased investment, coupled with Caesar's adaptability to evolving market demands, positions the company for future growth and success. The future of casinos in Las Vegas hinges on their ability to innovate, adapt, and offer unique and compelling experiences to visitors. Investment opportunities abound for companies that can capitalize on this evolving market.

Conclusion

While Caesar's Las Vegas Strip properties have experienced a minor value decline, several factors contribute to this temporary setback, including the lingering effects of the pandemic and increased competition. However, Caesar's proactive response, including strategic investments and innovative marketing, positions the company for future growth and recovery. The long-term prospects for these iconic properties remain positive, and the company's adaptability ensures their continued success in the dynamic Las Vegas market. Interested in learning more about the evolving landscape of Caesar's Las Vegas Strip properties? Stay informed on the latest market trends and analysis.

Featured Posts

-

Amanda Bynes Only Fans Debut Strict Rules And New Chapter

May 18, 2025

Amanda Bynes Only Fans Debut Strict Rules And New Chapter

May 18, 2025 -

Reliable Bitcoin And Crypto Casinos Your 2025 Selection Guide

May 18, 2025

Reliable Bitcoin And Crypto Casinos Your 2025 Selection Guide

May 18, 2025 -

Gridlock On Capitol Hill Gop Tax Bill Snagged By Conservative Demands

May 18, 2025

Gridlock On Capitol Hill Gop Tax Bill Snagged By Conservative Demands

May 18, 2025 -

Tigers Riley Greene Makes Mlb History With Two Ninth Inning Home Runs

May 18, 2025

Tigers Riley Greene Makes Mlb History With Two Ninth Inning Home Runs

May 18, 2025 -

Poker Stars Casino How To Participate In The St Patricks Day Spin Of The Day

May 18, 2025

Poker Stars Casino How To Participate In The St Patricks Day Spin Of The Day

May 18, 2025

Latest Posts

-

O Kasselakis Milaei Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025

O Kasselakis Milaei Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025 -

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025 -

Naytilia Kai Nisiotiki Politiki I Omilia Toy Kasselaki

May 18, 2025

Naytilia Kai Nisiotiki Politiki I Omilia Toy Kasselaki

May 18, 2025 -

Disekatommyrioyxoi Ellinikis Katagogis I Lista Toy Forbes Kai Oi Epixeirimatikes Toys Epityxies

May 18, 2025

Disekatommyrioyxoi Ellinikis Katagogis I Lista Toy Forbes Kai Oi Epixeirimatikes Toys Epityxies

May 18, 2025 -

Kasselakis Naytilia Kai Nisiotiki Politiki Kentriko Simeio Tis Omilias Toy

May 18, 2025

Kasselakis Naytilia Kai Nisiotiki Politiki Kentriko Simeio Tis Omilias Toy

May 18, 2025