Canada's Economy: Navigating The Challenges Of A Strong Loonie

Table of Contents

Impact on Canadian Exports

A strong loonie makes Canadian goods and services more expensive for foreign buyers, thus significantly reducing export competitiveness. This impacts various sectors and necessitates strategic adjustments to maintain market share and profitability.

Reduced Demand for Exports

Higher prices resulting from a strong loonie lead to lower international demand, hitting industries heavily reliant on exports particularly hard.

- Reduced sales for resource-based industries: Mining, forestry, and energy sectors are particularly vulnerable, as their products often face intense global competition. A strong loonie exacerbates this, making Canadian resources less price-competitive.

- Decreased manufacturing exports: Canadian manufacturers also struggle, as their products become more expensive for international buyers, leading to lost sales and potential market share erosion.

- Potential job losses in export-oriented sectors: As demand falls, companies in export-oriented sectors may be forced to reduce production, leading to layoffs and potential economic hardship in affected communities.

The Canadian government often implements support measures, such as export financing programs and trade missions, to help mitigate the negative effects of a strong loonie on exporters. However, these measures can only offer limited relief. For instance, the recent decline in lumber exports to the US, partially attributed to a strong loonie, highlights the industry's vulnerability.

Increased Competition from Cheaper Imports

Conversely, a strong Canadian dollar makes imports cheaper, putting immense pressure on domestic producers who struggle to compete on price. This leads to increased import penetration in various sectors, squeezing profit margins and threatening job security.

- Increased import penetration in various sectors: Consumers are more likely to choose cheaper imported goods, reducing demand for domestically produced alternatives. This is particularly true for consumer goods with readily available cheaper imports from countries with weaker currencies.

- Pressure on domestic manufacturers' profit margins: Domestic producers face a double whammy: reduced demand due to higher export prices and increased competition from cheaper imports. This shrinks profit margins and forces them to cut costs or even close down.

- Potential for increased unemployment in import-competing industries: As domestic industries struggle, job losses in import-competing sectors become a serious concern, necessitating proactive strategies to reskill and retrain affected workers. The textile and clothing industries, for example, have historically faced significant challenges from cheaper imports.

Effects on Inflation and Consumer Spending

While a strong loonie can reduce the cost of imported goods, leading to lower inflation, its effect on consumer spending is more nuanced. The overall impact is a complex interplay of positive and negative factors.

Lower Import Prices

A strong loonie can suppress inflation by making imports cheaper, benefiting consumers through lower prices for goods and services.

- Lower prices for imported consumer goods: Consumers see lower prices on a wide range of goods, from electronics to clothing, increasing their purchasing power for imported items.

- Reduced inflation rate: The lower cost of imports translates into a lower Consumer Price Index (CPI), indicating a reduction in the overall price level of goods and services in the economy.

- Increased consumer purchasing power for imported items: Consumers have more disposable income to spend on imported goods, potentially stimulating consumption and boosting economic activity in related sectors (retail, transportation, etc.).

Impact on Domestic Industries

However, the decreased demand for Canadian exports due to the strong loonie can negatively affect domestic jobs and economic growth, potentially offsetting the positive impact on consumers.

- Potential for reduced investment and job creation in domestic industries: As export-oriented industries struggle, investment in these sectors may decline, leading to fewer job creation opportunities.

- Decreased wages in export-oriented sectors: Reduced profitability and job losses in export-oriented industries can lead to lower wages for workers in those sectors.

- Slowing overall economic growth: The combined effect of reduced exports, decreased investment, and job losses can negatively impact overall economic growth, even if consumer spending is temporarily boosted by lower import prices.

The relationship between export performance and overall economic growth is significant. A healthy export sector is crucial for sustained economic expansion, making the challenges posed by a strong loonie particularly concerning.

The Role of the Bank of Canada

The Bank of Canada plays a critical role in managing the value of the Canadian dollar and mitigating the negative effects of a strong loonie. This involves a careful balancing act between various economic objectives.

Monetary Policy Tools

The Bank of Canada utilizes various monetary policy tools to influence the exchange rate and maintain price stability. The effectiveness of these tools depends on various economic factors and global market conditions.

- Interest rate adjustments: Raising interest rates can attract foreign investment, increasing demand for the Canadian dollar and strengthening its value. Conversely, lowering interest rates can weaken the loonie.

- Quantitative easing: This involves injecting liquidity into the financial system, which can indirectly influence the exchange rate by affecting the overall demand for the currency.

- Foreign exchange interventions (less common): In exceptional circumstances, the Bank of Canada may intervene directly in the foreign exchange market to influence the loonie's value, but this is typically a last resort.

The choice of which tool to use, and to what degree, requires careful consideration of its potential effects across various sectors of the economy.

Balancing Act

The Bank faces the challenge of balancing price stability with economic growth, making decisions that consider the complex interplay between the loonie's strength and the overall health of the Canadian economy.

- The need to consider employment rates alongside inflation: The Bank must consider not just inflation but also its impact on employment and economic growth when setting monetary policy. A strong loonie that controls inflation but leads to significant job losses might be considered undesirable.

- The difficulty of predicting the long-term impact of monetary policy decisions: The effects of monetary policy can be complex and unpredictable, making it challenging for the Bank to fine-tune the economy to its desired state.

- The potential for unintended consequences: Any monetary policy decision carries the risk of unintended consequences, requiring the Bank to carefully assess the potential risks and benefits of each action.

The Bank's success in navigating these challenges is crucial for maintaining a healthy and stable Canadian economy. The decisions made impact businesses, consumers, and the overall economic well-being of the country.

Conclusion

A strong Canadian loonie presents a double-edged sword for Canada's economy. While it offers benefits such as lower import prices and suppressed inflation, it also poses significant challenges to export-oriented industries, potentially hindering economic growth and job creation. Understanding the complex interplay between the loonie's value and the various sectors of the Canadian economy is crucial for businesses, investors, and policymakers alike. To navigate this complex landscape effectively, continuous monitoring of the loonie's strength and proactive adaptation to its impact are essential. Stay informed about the fluctuations of the Canadian dollar and its impact on the Canadian economy by regularly reviewing economic reports and analyses related to the strong loonie and its implications. Understanding the nuances of a strong Canadian dollar is vital for navigating the complexities of the Canadian economic landscape.

Featured Posts

-

6 Million Awarded In Soulja Boy Sexual Assault Lawsuit

May 08, 2025

6 Million Awarded In Soulja Boy Sexual Assault Lawsuit

May 08, 2025 -

Xrp Rising The Potential Connection To President Trump

May 08, 2025

Xrp Rising The Potential Connection To President Trump

May 08, 2025 -

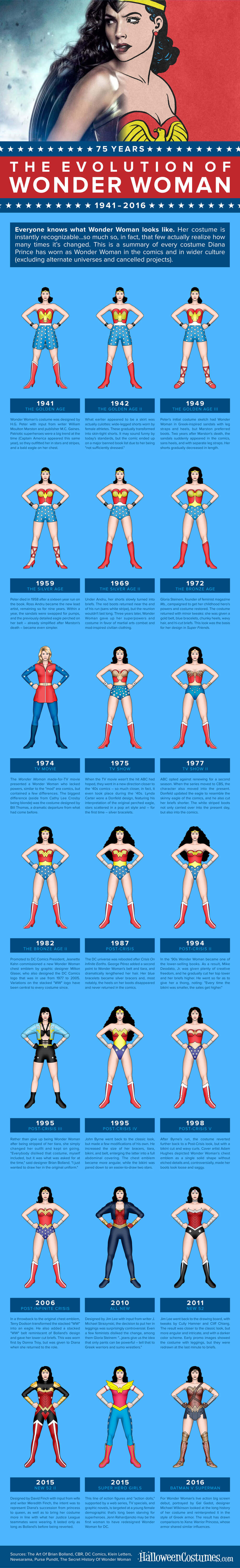

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

Inter Milan Midfielder Piotr Zielinski Could Miss Weeks Due To Calf Problem

May 08, 2025

Inter Milan Midfielder Piotr Zielinski Could Miss Weeks Due To Calf Problem

May 08, 2025 -

Les Corneilles Et Leur Incroyable Capacite Geometrique Surclassant Meme Les Babouins

May 08, 2025

Les Corneilles Et Leur Incroyable Capacite Geometrique Surclassant Meme Les Babouins

May 08, 2025