XRP Rising: The Potential Connection To President Trump

Table of Contents

Trump's Stance on Financial Regulation and its Potential Impact on XRP

President Trump's administration adopted a generally deregulatory approach, potentially creating a more favorable environment for cryptocurrency adoption. This less restrictive regulatory landscape could have positively impacted investor sentiment towards cryptocurrencies like XRP.

Deregulation Efforts and Increased Crypto Adoption

- Examples of deregulation attempts: While no specific legislation directly targeted cryptocurrencies, the overall reduction in financial regulation fostered a climate of reduced scrutiny, potentially boosting investor confidence. This contrasts with more stringent approaches seen in other jurisdictions.

- Potential positive effects on crypto market sentiment: A less regulatory environment can lead to increased participation from institutional investors, who might have been hesitant under stricter rules.

- Increased investor confidence leading to higher XRP prices: Increased investor confidence translates directly into higher trading volumes and, potentially, higher prices. The perception of reduced risk often fuels market growth.

- Details: Specific policies like those promoting financial deregulation could be analyzed for their possible indirect influence on the broader crypto market and specifically on the XRP price. It's crucial to note this is an indirect influence and not a direct causal link.

"America First" Policies and the Rise of Domestic Crypto Innovation

The "America First" policy, with its emphasis on domestic economic growth, might have indirectly benefited US-based cryptocurrency companies like Ripple and its XRP token.

- Explain how a focus on domestic innovation might have made investors more interested in US-based crypto projects: A focus on domestic businesses might have created a sense of national pride and preference for investments within the United States.

- Details: This effect is indirect and complex. It requires careful consideration of other market forces influencing investment decisions. Any specific initiatives supporting this claim require careful examination and supporting data.

The Role of Geopolitical Uncertainty and XRP's Safe-Haven Potential

Geopolitical uncertainty often leads investors to seek alternative assets, potentially boosting demand for cryptocurrencies perceived as having safe-haven characteristics. XRP, with its established use cases, may have benefited from this trend.

Uncertainty Creates Demand for Alternative Assets

- Examples of geopolitical events that might have influenced XRP’s price: Global events causing market instability, such as trade wars or political tensions, might drive investors towards cryptocurrencies as a hedge against risk. The concept of “flight to safety” is relevant here, with investors seeking assets perceived as less vulnerable to political upheaval.

- Details: Data showing correlation, not necessarily causation, between geopolitical events and XRP price movements would strengthen this argument. This necessitates detailed analysis of price movements against a backdrop of specific global events.

XRP's Position in a Changing Global Financial Landscape

XRP's potential as a faster and more cost-effective alternative to traditional cross-border payment systems might benefit from periods of increased global trade tensions.

- Outline the advantages of XRP for international payments: Ripple’s technology aims to expedite and reduce the cost of international transactions, making it an attractive option in a world of increasing trade complexities.

- Details: Ripple's partnerships with financial institutions and the actual use cases of XRP in cross-border transactions need to be highlighted to support this claim.

Speculation and Market Sentiment

The cryptocurrency market is highly susceptible to speculation and market sentiment, amplified by social media and news cycles. Any potential links between Trump-related news and XRP price movements must be carefully considered.

The Influence of Social Media and News Cycles

- Examples of social media trends impacting XRP price: Positive or negative sentiment expressed on social media platforms regarding XRP can dramatically affect its price, sometimes irrespective of fundamental value.

- Mention any significant news stories: Specific news items linking XRP to Trump's policies or broader political events could be analyzed for their impact on market sentiment.

- Details: Acknowledge the speculative nature of the crypto market and the potential for misinformation to drive price volatility.

Addressing the Correlation vs. Causation Issue

It's crucial to distinguish between correlation and causation. While there might be a correlation between certain events and XRP's price, this doesn't necessarily imply a direct causal relationship.

- Explain the difference between correlation and causation: A correlation merely indicates a relationship between two variables, whereas causation establishes that one variable directly influences the other.

- Details: Financial experts' opinions are needed to provide context and avoid oversimplifying the complex interplay of factors driving cryptocurrency price fluctuations.

Conclusion

The potential link between XRP's price movements and President Trump's policies is a complex issue. While a direct causal relationship remains unproven, the analysis highlights how broader political and regulatory landscapes can indirectly influence cryptocurrency markets. The interplay of deregulation efforts, geopolitical uncertainty, market sentiment, and speculation all contribute to the volatility of the cryptocurrency market and, consequently, the price of XRP. While correlation doesn't equal causation, understanding these intricate connections is key to navigating the cryptocurrency landscape.

Call to Action: While the connection between XRP rising and President Trump's policies remains a subject of ongoing debate, stay informed about the latest developments in XRP and the ever-evolving cryptocurrency investment landscape. Continue researching the regulatory environment and its impact on cryptocurrency markets, focusing on XRP's unique position. Thorough analysis and continuous monitoring are essential for informed decision-making in this dynamic sector.

Featured Posts

-

Implementing Directives To Expedite Crime Control Best Practices And Challenges

May 08, 2025

Implementing Directives To Expedite Crime Control Best Practices And Challenges

May 08, 2025 -

Nathan Fillions Unforgettable 3 Minute Role In Saving Private Ryan

May 08, 2025

Nathan Fillions Unforgettable 3 Minute Role In Saving Private Ryan

May 08, 2025 -

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 08, 2025

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 08, 2025 -

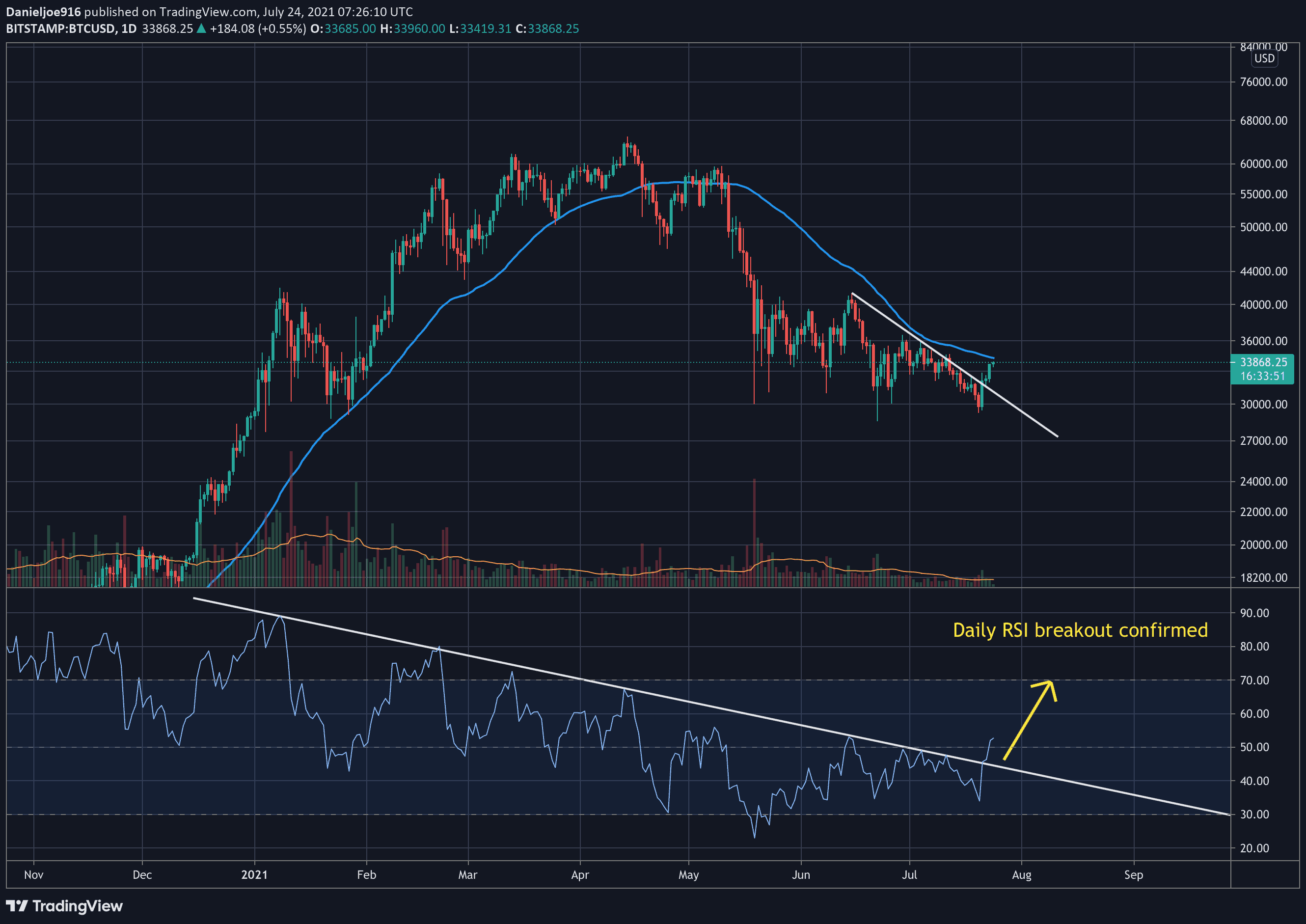

Is A Bitcoin Price Rally Imminent Analysts Chart Suggests So May 6

May 08, 2025

Is A Bitcoin Price Rally Imminent Analysts Chart Suggests So May 6

May 08, 2025 -

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025