Canadian Dollar's Complex Performance: A Detailed Analysis

Table of Contents

Key Factors Influencing the Canadian Dollar's Value

Several interconnected factors significantly influence the Canadian dollar's value. Understanding these dynamics is key to predicting and managing CAD-related risks.

Commodity Prices and the CAD

The Canadian economy is heavily reliant on commodity exports, particularly energy (oil and natural gas) and lumber. This creates a strong correlation between commodity prices and the CAD's value.

- Impact of fluctuating oil prices: As a major oil producer, Canada's economy is sensitive to global oil price fluctuations. Higher oil prices generally strengthen the CAD, while lower prices weaken it.

- The role of global demand: Global demand for Canadian commodities directly impacts export revenue and, consequently, the CAD's exchange rate. Increased global demand boosts the CAD, and vice versa.

- The influence of Canadian energy exports on the CAD: The volume and value of Canadian energy exports are paramount. A surge in exports strengthens the CAD, while a decline weakens it. Diversification of the Canadian economy away from sole reliance on commodities is a key factor impacting future CAD performance.

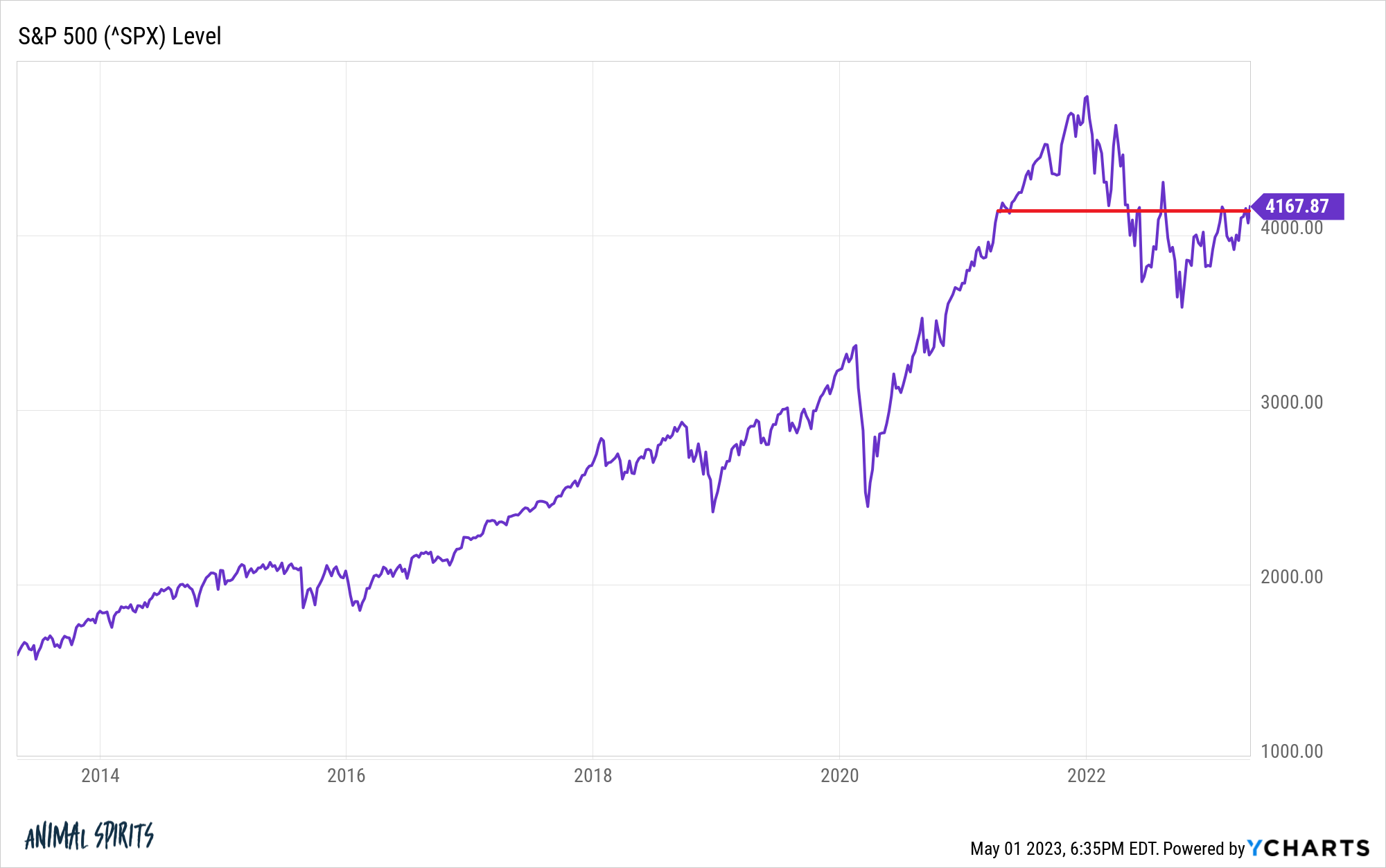

[Insert chart showing correlation between oil prices and CAD value]

Interest Rate Differentials and Monetary Policy

The Bank of Canada's monetary policy plays a pivotal role in influencing the CAD. Interest rate adjustments affect capital flows and investor sentiment.

- Comparison of Canadian interest rates with other major economies: Higher interest rates in Canada relative to other countries attract foreign investment, increasing demand for the CAD and strengthening its value.

- The effect of interest rate hikes or cuts on the CAD's value: Interest rate hikes typically strengthen the CAD, while cuts weaken it. The market anticipates these moves, often causing fluctuations before the official announcements.

- Investor sentiment and capital flows: Positive economic outlook and confidence in the Canadian economy attract foreign investment, boosting the CAD. Conversely, negative sentiment leads to capital flight and a weaker CAD. Upcoming policy decisions from the Bank of Canada are closely watched by investors.

Geopolitical Events and Global Uncertainty

Global events significantly impact the CAD, often affecting investor confidence and market sentiment.

- Examples of past events and their impact: Trade wars, political instability in major economies, and global crises have historically impacted the CAD's value. For example, the 2008 financial crisis and the recent COVID-19 pandemic both caused significant CAD volatility.

- Current geopolitical risks and their potential effect on the Canadian dollar: Ongoing trade tensions, geopolitical conflicts, and global economic uncertainties all pose potential risks to the CAD's stability.

- Safe-haven status of the CAD during times of uncertainty: During periods of global uncertainty, investors may seek the relative safety of the CAD, leading to increased demand and strengthening its value. However, this effect is not always consistent.

Analyzing Recent Performance of the Canadian Dollar

Understanding both short-term fluctuations and long-term trends is vital for informed decision-making regarding the CAD.

Short-Term Trends and Fluctuations

The CAD has recently shown [describe recent trends – e.g., appreciation against the USD but depreciation against the EUR].

- Highlight significant price movements: [Cite specific examples of recent significant price movements against major currencies like the USD, EUR, and GBP, citing dates and percentage changes].

- Analyze the reasons behind these changes: [Explain the causes of these movements, connecting them to factors discussed above, such as commodity price changes, interest rate announcements, or significant news events].

[Insert chart showing CAD performance against major currencies over the past [e.g., 6 months, 1 year]]

Long-Term Outlook and Predictions

Predicting the long-term performance of the CAD is challenging, given the numerous influencing factors.

- Consider factors influencing long-term trends: Long-term trends will be shaped by factors such as sustained commodity prices, the Bank of Canada's long-term monetary policy strategy, and the overall global economic outlook. Economic diversification in Canada will play a key role.

- Potential risks and opportunities: Potential risks include further commodity price volatility, global economic slowdowns, and geopolitical instability. Opportunities lie in a strong Canadian economy and potential increases in global demand for Canadian exports.

- Expert opinions and forecasts: While forecasts vary, many experts [cite sources and their predictions] foresee [summarize the consensus]. It is crucial to remember that these are predictions and subject to change.

Strategies for Navigating the Canadian Dollar's Volatility

Businesses and investors can employ several strategies to manage the risks associated with CAD fluctuations.

Hedging Strategies for Businesses

Businesses engaged in international trade can significantly reduce their exposure to CAD volatility.

- Discuss hedging techniques like forward contracts, options, and currency swaps: These financial instruments allow businesses to lock in exchange rates for future transactions, mitigating the impact of unexpected fluctuations. The choice of hedging strategy depends on the business's specific risk profile and financial goals.

Investment Strategies for Investors

For investors, diversification and a thoughtful approach to risk management are key to navigating CAD volatility.

- Diversification strategies: Diversifying investments across different asset classes and currencies can reduce overall portfolio risk.

- Asset allocation: Investors should consider their risk tolerance and adjust their asset allocation accordingly. A more conservative approach may involve fewer investments directly exposed to CAD fluctuations.

Conclusion

The Canadian dollar's performance is a complex interplay of commodity prices, monetary policy, and global events. Recent trends highlight the need for careful analysis and strategic planning. Understanding these factors is crucial for making informed decisions. Short-term fluctuations are influenced by immediate economic news and market sentiment, while long-term trends depend on broader economic conditions and policy. Businesses can hedge against risk through financial instruments like forward contracts and options, while investors can diversify their portfolios to manage exposure. Staying updated on the latest developments impacting the Canadian dollar and seeking professional financial advice is essential for navigating this dynamic market. Stay informed about the latest developments impacting the Canadian dollar by regularly checking our analysis and forecasts to make the most informed decisions about your investments and business strategies involving the Canadian dollar.

Featured Posts

-

Addressing Investor Concerns Bof As View On Elevated Stock Market Valuations

Apr 25, 2025

Addressing Investor Concerns Bof As View On Elevated Stock Market Valuations

Apr 25, 2025 -

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 25, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 25, 2025 -

Enis Reduced Cash Flow Impact On Share Buyback And Future Outlook

Apr 25, 2025

Enis Reduced Cash Flow Impact On Share Buyback And Future Outlook

Apr 25, 2025 -

Nfl Draft A Cowboys Insiders Surprising Top Targets

Apr 25, 2025

Nfl Draft A Cowboys Insiders Surprising Top Targets

Apr 25, 2025 -

Sadie Sinks Age What It Means For Mcu Casting And Spider Man 4

Apr 25, 2025

Sadie Sinks Age What It Means For Mcu Casting And Spider Man 4

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025