Addressing Investor Concerns: BofA's View On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

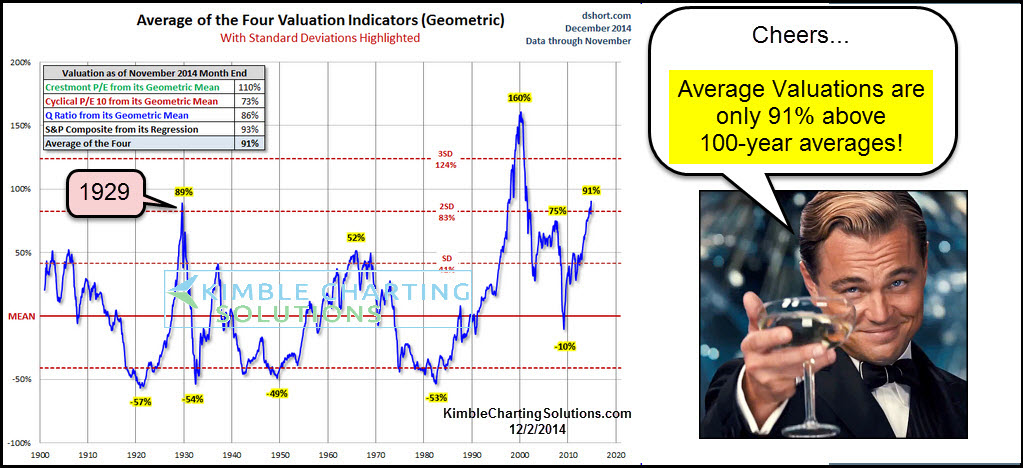

BofA's stance on current stock market valuations is nuanced. While acknowledging the high valuation multiples, they don't necessarily view them as solely indicative of an impending market crash. Their assessment considers a multitude of factors, painting a more complex picture than a simple "overvalued" or "undervalued" label. They believe a balanced perspective, incorporating various economic indicators, is crucial for informed investment decisions.

Earnings Growth Projections

BofA's analysis heavily relies on projected corporate earnings growth. Their economists and analysts scrutinize company financial reports, industry trends, and macroeconomic forecasts to predict future earnings. These predictions are then used to calculate key valuation metrics such as the Price-to-Earnings (P/E) ratio and other valuation multiples. While specific data points are subject to change and internal reports, BofA generally emphasizes the importance of sustainable earnings growth as a justification for current valuations. A strong earnings outlook can support higher stock prices, even at seemingly high P/E ratios. Conversely, sluggish earnings growth could signal overvaluation and increased risk.

- Focus on sustainable earnings growth: BofA prioritizes consistent, long-term earnings growth over short-term spikes.

- Industry-specific analysis: Their analysis considers variations in earnings growth across different sectors, helping investors make informed sector allocations.

- Impact of inflation on earnings: The impact of inflation on corporate profitability is a significant factor considered in their projections.

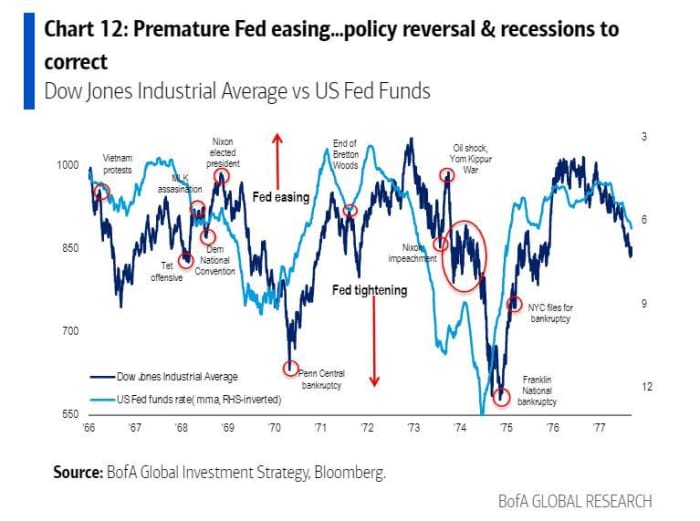

Interest Rate Environment

The interest rate environment significantly influences stock market valuations. BofA's analysts closely monitor monetary policy decisions by central banks, particularly the Federal Reserve. Higher interest rates typically increase the cost of borrowing, potentially slowing economic growth and reducing corporate profits. This can lead to lower stock valuations as investors demand higher returns to compensate for the increased risk. Conversely, lower interest rates can stimulate economic activity and boost corporate profits, supporting higher valuations.

- Impact of rate hikes: BofA's analysis incorporates potential impacts of future interest rate increases on stock valuations.

- Yield curve analysis: They analyze the yield curve (the relationship between short-term and long-term interest rates) to gauge economic expectations and potential market shifts.

- Bond yields as a benchmark: BofA compares stock valuations to bond yields to assess relative attractiveness and potential shifts in investor preference.

Geopolitical Risks

Geopolitical risks, such as inflation, war, and supply chain disruptions, are significant considerations in BofA's valuation analysis. These events can significantly impact corporate profits, economic growth, and investor sentiment. BofA incorporates various scenarios and risk assessments to understand the potential impact of geopolitical uncertainties on stock market valuations.

- Inflation's effect on consumer spending and corporate profits: BofA closely monitors inflation levels and their potential impact on both consumers and businesses.

- Supply chain disruptions and their impact on business operations: Their analysis considers the ongoing effect of global supply chain disruptions on corporate earnings.

- Geopolitical instability and its potential to increase market volatility: BofA analyzes the potential market impact of events like wars and political instability.

Addressing Key Investor Concerns

Many investors are understandably concerned about the elevated valuations. BofA addresses these concerns directly, offering a balanced perspective and practical recommendations.

Risk of a Market Correction

The possibility of a market correction is a major investor concern. BofA acknowledges the risk, but doesn't necessarily predict an imminent crash. Their analysis considers various factors, including valuation multiples, economic growth prospects, and investor sentiment, to assess the probability and potential severity of a correction. They emphasize the importance of diversification and risk management in mitigating potential losses during market downturns.

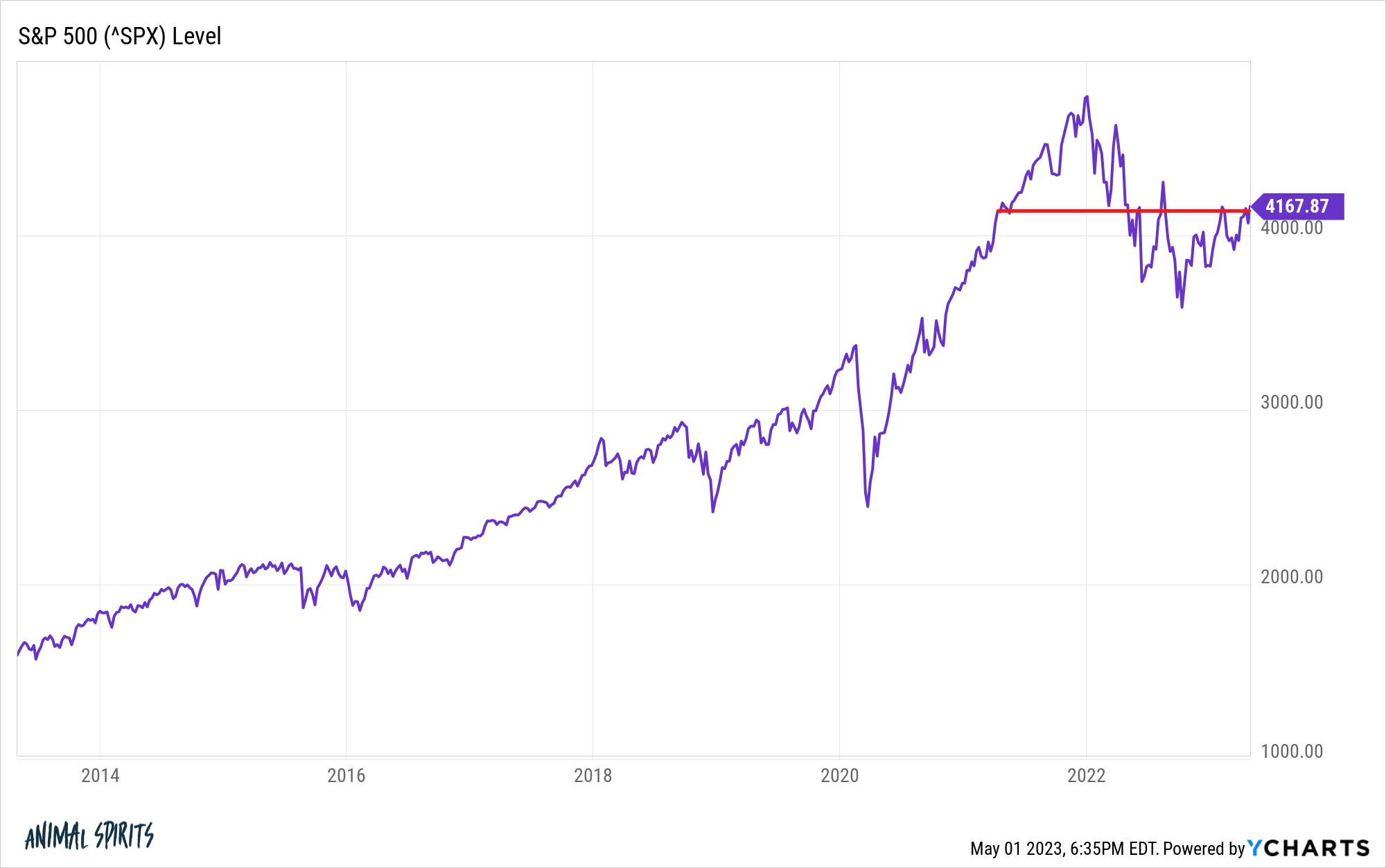

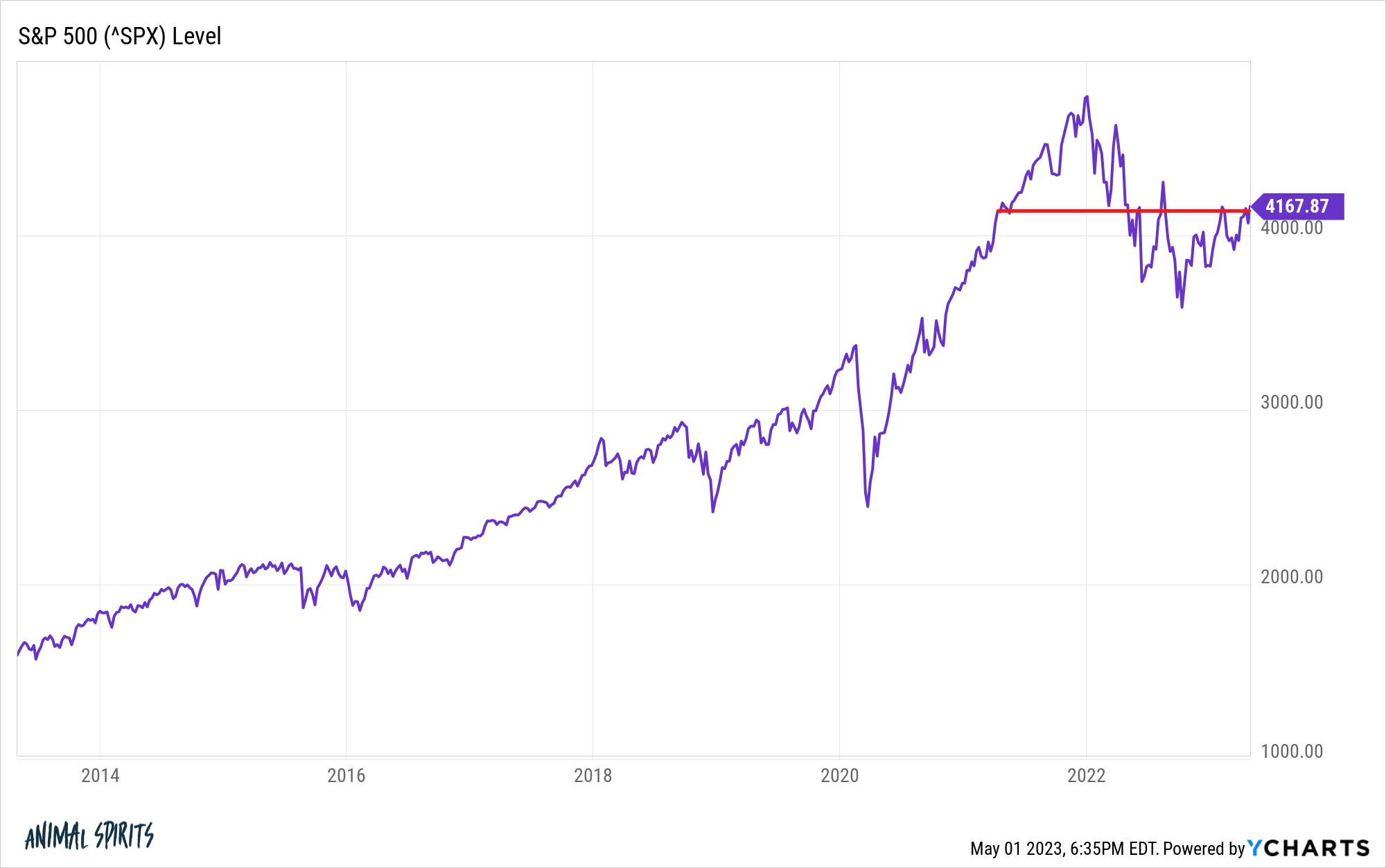

- Valuation multiples as indicators of potential risk: BofA uses valuation metrics to assess whether the market is vulnerable to a correction.

- Economic indicators to predict potential downturns: They examine key economic indicators to anticipate potential slowdowns.

- Investor sentiment analysis: BofA analyzes investor behavior to gauge market optimism or pessimism.

Investment Strategy Recommendations

Given the current valuation landscape, BofA suggests a diversified investment strategy. This includes spreading investments across different asset classes (stocks, bonds, real estate) and sectors to reduce overall portfolio risk. They may also recommend specific sector allocations based on their long-term growth projections.

- Diversification as a key risk management tool: They emphasize the importance of reducing concentration risk in portfolios.

- Sector allocation strategies: BofA provides insight into potentially outperforming sectors based on their analysis.

- Active versus passive management considerations: They weigh the advantages of active vs. passive investment strategies in the current market.

Long-Term Growth Potential

Despite the current high valuations, BofA maintains a positive outlook on the long-term growth potential of the stock market. They highlight secular trends like technological innovation, demographic shifts, and evolving consumer preferences that are expected to drive long-term growth, even if the path isn't always smooth.

- Technological innovation as a driver of long-term growth: BofA identifies key technological advancements and their potential for economic impact.

- Demographic shifts and their effect on consumer spending: They analyze demographic trends and their implications for various industries.

- Evolution of consumer preferences and their impact on market dynamics: BofA assesses changes in consumer behavior and their impact on business models.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Insights

BofA's analysis of elevated stock market valuations offers a balanced perspective. While acknowledging the inherent risks associated with high valuations, they emphasize the importance of considering various factors like earnings growth, interest rates, and geopolitical risks. Their recommendations focus on diversified investment strategies and a long-term perspective. Understanding BofA's insights on elevated stock market valuations is crucial for navigating the current market. Visit [link to BofA's research] to learn more and make informed investment choices based on their expert analysis of stock market valuation and related risk assessments. Remember, careful consideration of stock market valuation is key to successful long-term investing.

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For Technology And Politics

Apr 25, 2025

The Zuckerberg Trump Dynamic Implications For Technology And Politics

Apr 25, 2025 -

Is Apple Tv S Next Crime Thriller Its Masterpiece A Look At The Genres Ascent On The Platform

Apr 25, 2025

Is Apple Tv S Next Crime Thriller Its Masterpiece A Look At The Genres Ascent On The Platform

Apr 25, 2025 -

Basel Greenlights Funding For Eurovision Village In 2025

Apr 25, 2025

Basel Greenlights Funding For Eurovision Village In 2025

Apr 25, 2025 -

Bayern Munich Stunned By Late Union Berlin Equaliser

Apr 25, 2025

Bayern Munich Stunned By Late Union Berlin Equaliser

Apr 25, 2025 -

New York Jets 2025 Draft A Deep Dive Into Needs Picks And Potential Matches

Apr 25, 2025

New York Jets 2025 Draft A Deep Dive Into Needs Picks And Potential Matches

Apr 25, 2025

Latest Posts

-

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025 -

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025 -

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025