Canadian Private Investment: A Key Focus For CAAT Pension Plan

Table of Contents

Why Canadian Private Investment is Attractive for CAAT

CAAT, recognizing the inherent benefits, has made Canadian private investment a cornerstone of its portfolio diversification strategy. This strategic choice is driven by several compelling factors:

Diversification and Risk Mitigation

Investing in Canadian private markets offers significant diversification benefits for CAAT, mitigating the risks associated with traditional public market investments.

- Lower Correlation with Public Markets: Private investments often exhibit lower correlation with public market fluctuations, reducing overall portfolio volatility and enhancing risk-adjusted returns.

- Access to Unique Investment Opportunities: The private market provides access to unique investment opportunities unavailable to public market investors, offering potential for higher returns and alpha generation.

- Potential for Higher Returns: Historically, private investments have demonstrated the potential for higher long-term returns compared to publicly traded assets, although with a higher level of illiquidity.

Strong Domestic Growth Potential

Canada's economy offers compelling growth prospects across various sectors, making it an attractive destination for private investment.

- Strong Resource Sector: Canada's abundant natural resources, including energy, mining, and forestry, continue to be significant drivers of economic growth.

- Technological Innovation: A growing tech sector, particularly in areas like artificial intelligence and clean technology, presents significant opportunities for venture capital and private equity investments.

- Growing Middle Class: A steadily expanding middle class fuels demand in sectors like consumer goods and services, creating fertile ground for private investment.

- Government Support for Infrastructure Projects: Government initiatives focusing on infrastructure development provide further impetus to private investment in this crucial area.

Alignment with CAAT's Investment Mandate

CAAT's commitment to long-term value creation and responsible investing aligns seamlessly with the characteristics of Canadian private investment.

- Focus on Long-Term Value Creation: Private investments often require a long-term horizon, aligning perfectly with CAAT's own long-term investment strategy.

- ESG Considerations: CAAT integrates environmental, social, and governance (ESG) factors into its investment decisions, seeking investments that contribute positively to society and the environment.

- Alignment with Canadian Economic Growth: Investing in Canadian private markets supports the growth of the domestic economy, creating jobs and generating wealth for Canadians.

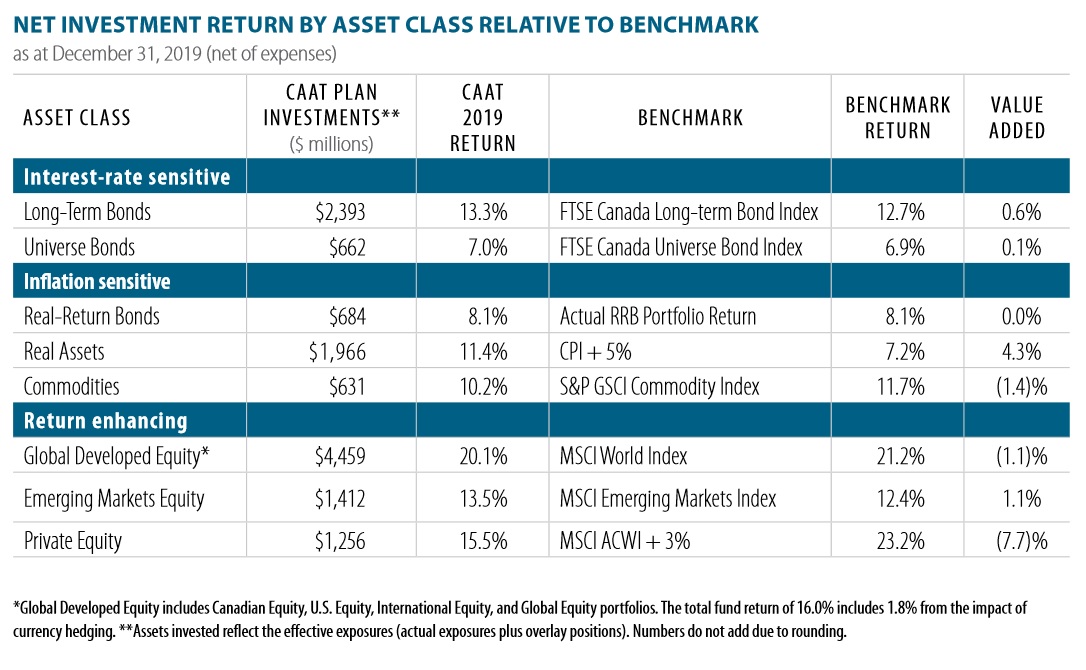

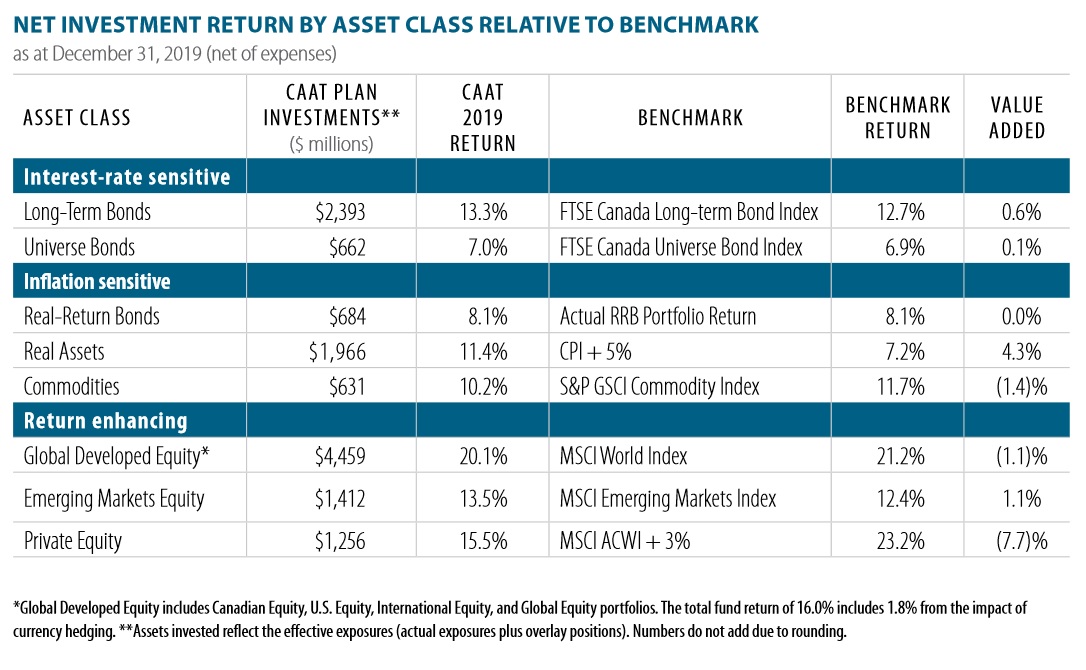

Types of Canadian Private Investments Pursued by CAAT

CAAT's Canadian private investment strategy is diversified across several asset classes:

Private Equity

CAAT invests in Canadian private equity funds and makes direct investments in promising private companies across various sectors.

- Examples of Sectors: Technology, healthcare, renewable energy, and consumer goods represent key areas of focus for CAAT's private equity investments.

- Benefits of Leveraged Returns: Private equity investments often leverage debt to amplify returns, although this comes with increased financial risk.

- Due Diligence Process: CAAT employs a rigorous due diligence process to thoroughly assess the management teams, business models, and financial projections of potential investments.

Venture Capital

CAAT participates in venture capital funds, focusing on early-stage companies with high-growth potential.

- High-Growth Potential: Venture capital investments offer the potential for significant returns, albeit with higher risk, due to the inherent uncertainties associated with early-stage businesses.

- Higher Risk Tolerance: Venture capital investments require a higher risk tolerance, reflecting the possibility of both substantial gains and total losses.

- Focus on Innovation and Technological Disruption: CAAT targets companies driving innovation and technological disruption, aiming to capitalize on transformative trends.

Real Estate and Infrastructure

CAAT invests in both Canadian real estate and infrastructure projects, benefiting from stable income streams and potential for value appreciation.

- Long-Term Asset Class: Real estate and infrastructure are considered long-term asset classes, offering relatively stable returns over extended periods.

- Stable Income Streams: These assets often generate predictable income streams through rent or tolls, providing a degree of stability to the portfolio.

- Potential for Value Appreciation: Both real estate and infrastructure assets have the potential to appreciate in value over time, generating capital gains for investors.

CAAT's Approach to Canadian Private Investment

CAAT's success in Canadian private investment is driven by its disciplined and responsible approach:

Due Diligence and Risk Management

CAAT employs a rigorous due diligence process to assess and mitigate risks in its private investments.

- Thorough Research: A comprehensive research process is conducted to assess the investment opportunity, including financial modeling, market analysis, and competitive landscape review.

- Independent Valuations: Independent valuations are obtained to ensure that the investment is priced appropriately and fairly.

- Risk Mitigation Strategies: CAAT employs various risk mitigation strategies, including diversification, hedging, and stress testing, to minimize potential losses.

ESG Integration

Environmental, social, and governance (ESG) factors are central to CAAT's investment decision-making process.

- Alignment with UN Sustainable Development Goals: CAAT seeks investments that align with the UN Sustainable Development Goals, contributing to a more sustainable future.

- Responsible Sourcing: CAAT prioritizes investments in companies with strong ethical sourcing and supply chain management practices.

- Community Engagement: CAAT encourages portfolio companies to engage actively with the communities in which they operate.

Long-Term Partnership Approach

CAAT cultivates long-term partnerships with portfolio companies and managers.

- Active Portfolio Management: CAAT actively monitors its investments and provides support to portfolio companies to optimize their performance.

- Value-Added Support to Portfolio Companies: CAAT provides expertise and resources to help portfolio companies grow and achieve their strategic objectives.

- Fostering Growth and Sustainability: CAAT's goal is to foster the long-term growth and sustainability of its portfolio companies, contributing to both financial returns and societal benefit.

Conclusion

Canadian private investment represents a strategic priority for the CAAT Pension Plan, offering crucial diversification, substantial growth potential, and alignment with its responsible investing mandate. Through its diversified investments in private equity, venture capital, real estate, and infrastructure, coupled with its rigorous due diligence, robust risk management framework, and unwavering commitment to ESG principles, CAAT is securing the long-term financial health of its members. The diverse opportunities within the Canadian private investment landscape are substantial, and CAAT's strategic approach serves as a model for other pension funds seeking to enhance their portfolio performance and resilience. Learn more about CAAT's commitment to Canadian private investment and its role in securing the long-term financial health of its members. Explore the potential of Canadian private investment for your own portfolio.

Featured Posts

-

Milwaukee Brewers Win Walk Off Thriller Thanks To Brice Turang

Apr 23, 2025

Milwaukee Brewers Win Walk Off Thriller Thanks To Brice Turang

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs 3 By Aaron Judge In 2025 Season Opener

Apr 23, 2025

Yankees Historic Night 9 Home Runs 3 By Aaron Judge In 2025 Season Opener

Apr 23, 2025 -

Brewers Offensive Explosion Nine Stolen Bases Spark Blowout Victory

Apr 23, 2025

Brewers Offensive Explosion Nine Stolen Bases Spark Blowout Victory

Apr 23, 2025 -

Attracting Canadian Private Investment Caat Pension Plans Strategy

Apr 23, 2025

Attracting Canadian Private Investment Caat Pension Plans Strategy

Apr 23, 2025 -

Understanding The Urgent Need To Sell Florida Condo Market Trends

Apr 23, 2025

Understanding The Urgent Need To Sell Florida Condo Market Trends

Apr 23, 2025