Causes Of Delayed Storm Damage Assessments In Kentucky

Table of Contents

Insufficient Adjuster Resources Following Major Storms

One of the primary reasons for delayed storm damage assessments in Kentucky is a simple matter of supply and demand: there aren't enough insurance adjusters to handle the massive influx of claims following widespread damage. The sheer volume of properties needing assessment overwhelms the available workforce.

- High demand exceeding supply of qualified adjusters: Kentucky, like many states, lacks a large pool of readily available, licensed insurance adjusters. After a major storm, this shortage becomes acutely apparent.

- Adjusters needing to travel from out of state, causing further delays: The lack of local adjusters necessitates bringing in professionals from other states, adding travel time and logistical challenges to the assessment process. This increases the overall time it takes to complete assessments.

- Increased workload leading to burnout and slower assessment processes: The intense pressure and long hours lead to adjuster burnout, impacting their efficiency and potentially leading to errors in assessments.

- Impact of independent vs. company adjusters on speed of assessment: The speed of assessment can also vary depending on whether an independent adjuster or a company adjuster is handling the claim. Independent adjusters may have more flexibility, but company adjusters often benefit from established processes and resources.

Navigating Complex Insurance Claims Processes in Kentucky

The process of filing and processing insurance claims in Kentucky, even under normal circumstances, can be complex and time-consuming. This complexity is significantly amplified after a major storm, contributing substantially to delayed storm damage assessments in Kentucky.

- Lengthy documentation requirements: Policyholders often face overwhelming paperwork demands, needing to meticulously document every aspect of the damage. This can be especially difficult for those already struggling with the aftermath of the storm.

- Multiple layers of review and approval: Insurance claims often go through multiple levels of review and approval within the insurance company, extending the overall processing time.

- Disputes over coverage and claim valuations: Disagreements frequently arise between policyholders and insurance companies regarding the extent of coverage and the valuation of the damage, causing delays while the dispute is resolved.

- Specific Kentucky state regulations impacting the claims process: Specific Kentucky state regulations and laws regarding insurance claims can further complicate and lengthen the assessment and processing times.

Access Issues and Infrastructure Damage Hindering Assessments

Following severe storms, damaged infrastructure significantly impedes access to affected properties, directly contributing to delayed storm damage assessments in Kentucky.

- Difficulty reaching remote or heavily damaged areas: Roads may become impassable due to flooding, debris, or downed power lines, preventing adjusters from reaching many affected properties.

- Safety concerns for adjusters in hazardous conditions: Dangerous conditions like downed power lines, unstable structures, and flooding pose significant safety risks to adjusters, delaying assessments until the environment is safer.

- Impact of downed power lines and communication disruptions: Lack of power and communication disruptions hinder adjusters' ability to contact policyholders, access necessary information, and file reports.

- The role of local government in facilitating access for adjusters: Efficient coordination between insurance companies, adjusters, and local government agencies is crucial to quickly and safely opening access to damaged areas.

Fraud and Verification Procedures Contributing to Delays

Insurance companies must take steps to prevent and detect fraudulent claims, a process that adds time to the assessment process and contributes to delayed storm damage assessments in Kentucky.

- Increased scrutiny of claims to prevent fraud: To mitigate the risk of fraudulent claims, insurance companies often implement stricter verification procedures, requiring more time for investigation.

- The use of technology (e.g., drone surveys) to verify damage: While technology can speed up some aspects, verifying damage using tools like drone surveys still requires time and expertise.

- The time-consuming process of investigating potentially fraudulent claims: Thorough investigations into potentially fraudulent claims can significantly delay the overall assessment process.

- The impact of thorough verification on overall assessment speed: While adding time, these verification processes ultimately protect both the insurance company and honest policyholders.

Lack of Communication and Transparency in the Claims Process

Poor communication between insurance companies, adjusters, and policyholders is a major source of frustration and contributes to the perception of delayed storm damage assessments in Kentucky.

- Lack of updates and timely communication from insurance companies: A lack of regular updates and timely communication from insurance companies adds to the stress and uncertainty faced by policyholders.

- Difficulty contacting adjusters and obtaining necessary information: Difficulty in contacting adjusters and obtaining crucial information exacerbates delays and uncertainty.

- The negative impact of poor communication on policyholder stress levels: The lack of communication contributes significantly to the stress and anxiety experienced by those already dealing with significant losses.

- The importance of clear and proactive communication strategies: Implementing clear and proactive communication strategies is essential to managing expectations and mitigating frustration.

Accelerating Storm Damage Assessments in Kentucky

Delayed storm damage assessments in Kentucky stem from a complex interplay of factors: adjuster shortages, intricate claims processes, access issues, fraud prevention, and communication breakdowns. By understanding these interconnected issues, we can work towards a more efficient and supportive system. To improve the speed and effectiveness of future storm damage assessments in Kentucky, we need proactive engagement. Contact your local representatives to voice your concerns about improving the efficiency of storm damage assessments in Kentucky and advocate for better resources and clearer communication protocols. Demand better from your insurance providers and work towards a system that prioritizes rapid and fair recovery for all affected by future storms.

Featured Posts

-

Update Ongoing Search For Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025

Update Ongoing Search For Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025 -

Social Media Misidentifies Pilot In Deadly D C Midair Collision

Apr 29, 2025

Social Media Misidentifies Pilot In Deadly D C Midair Collision

Apr 29, 2025 -

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 29, 2025

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 29, 2025 -

Why Current Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 29, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 29, 2025 -

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025

Willie Nelson Celebrates His Roadies Legacy In Upcoming Documentary

Apr 29, 2025

Latest Posts

-

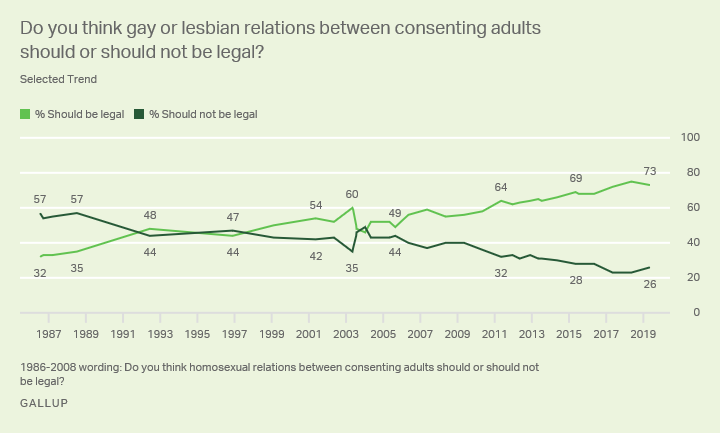

Gender Identity And The Supreme Court Trans Rights And Gender Critical Responses

Apr 29, 2025

Gender Identity And The Supreme Court Trans Rights And Gender Critical Responses

Apr 29, 2025 -

Public Sector Pension Reform Addressing The Growing Financial Risk

Apr 29, 2025

Public Sector Pension Reform Addressing The Growing Financial Risk

Apr 29, 2025 -

The Impact Of Lgbt Legal Figures On Modern Lgbtq Rights

Apr 29, 2025

The Impact Of Lgbt Legal Figures On Modern Lgbtq Rights

Apr 29, 2025 -

Are Public Sector Pensions Putting A Strain On Taxpayers

Apr 29, 2025

Are Public Sector Pensions Putting A Strain On Taxpayers

Apr 29, 2025 -

Supreme Court Ruling Trans Rights And Gender Critical Perspectives

Apr 29, 2025

Supreme Court Ruling Trans Rights And Gender Critical Perspectives

Apr 29, 2025