Cenovus CEO Rules Out MEG Bid, Prioritizing Organic Expansion

Table of Contents

Cenovus CEO's Statement and Reasoning

Alex Pourbaix's statement regarding the decision to forgo the MEG Energy acquisition was clear and concise. He emphasized a focus on Cenovus's existing assets and operational efficiency, citing several key reasons for prioritizing organic growth over an inorganic strategy through mergers and acquisitions (M&A). His rationale centers around:

-

Financial Prudence: Cenovus currently has a significant debt load. Pourbaix highlighted the substantial financial implications of acquiring MEG, including the high acquisition cost and the potential strain on the company's balance sheet. Debt reduction and maintaining a strong financial position are key priorities.

-

Focus on Internal Growth: Cenovus believes its existing assets offer significant opportunities for growth through increased production and operational efficiencies. Pourbaix emphasized the potential returns from investing in these established operations.

-

Maximizing Shareholder Value: The CEO stated that the best way to maximize shareholder returns is through focused investment in existing projects and technological advancements, leading to increased production and improved profitability, rather than diverting resources to a potentially risky acquisition.

-

Minimizing Risk and Integration Challenges: A large acquisition like MEG would present significant integration challenges, potentially disrupting ongoing operations and incurring unforeseen costs. Pourbaix clearly prioritized the reduced risk associated with organic expansion.

Cenovus's Strategy for Organic Expansion

Cenovus's strategy for organic growth is multi-faceted and involves strategic investments across its operations. The company's plans include:

-

Increased Investment in Oil Sands Operations: Cenovus will continue to invest heavily in its existing oil sands operations, focusing on improving production efficiency and optimizing resource recovery. This includes technological upgrades and operational improvements to extract maximum value from existing reserves.

-

Technological Advancements: Cenovus is committed to leveraging technology to improve operational efficiency, reduce costs, and enhance environmental sustainability. This includes investments in automation, data analytics, and advanced reservoir management techniques.

-

Exploration and Development of New Reserves: While the primary focus is on existing assets, Cenovus will continue to explore and develop new reserves to ensure long-term production growth. This will be done strategically, balancing exploration with the efficient management of existing assets.

-

Potential Expansion into Sustainable Energy: Cenovus is exploring opportunities in renewable energy sources, recognizing the evolving energy landscape and the growing demand for sustainable solutions. This diversification strategy aligns with environmental, social, and governance (ESG) considerations.

-

Specific Projects and Timelines: Although specific details of upcoming projects and precise timelines are subject to change, Cenovus has committed to regularly updating investors and the public on its progress towards its organic growth targets.

Comparison of Organic vs. Inorganic Growth Strategies

The choice between organic and inorganic growth is a crucial strategic decision for any company, especially in the volatile energy sector. Cenovus's decision highlights the key differences:

-

Risk Assessment: Organic growth generally carries lower risk than inorganic growth through acquisitions. Internal expansion offers more control and allows for a gradual, more predictable growth trajectory. Acquisitions, conversely, involve significant upfront costs, integration challenges, and potential for unforeseen issues.

-

Return on Investment (ROI): While acquisitions can offer faster growth potential, organic growth can generate a more consistent and predictable ROI over the long term. The timing and magnitude of returns from acquisitions can be less certain.

-

Integration and Control: Organic growth allows for better integration of new projects and resources into the existing corporate structure. Acquisitions often require significant efforts to integrate different company cultures, systems, and operational practices.

-

Synergies and Market Share: While organic growth focuses on internal improvements, acquisitions can lead to synergies and increased market share if done successfully. However, these potential benefits must be carefully weighed against the increased risks and potential costs of integration.

Conclusion

Cenovus Energy's decision to prioritize organic expansion over a bid for MEG Energy reflects a strategic focus on financial prudence, operational efficiency, and the maximization of shareholder value. By investing in its existing assets, leveraging technological advancements, and exploring opportunities in sustainable energy, Cenovus aims to achieve sustainable long-term growth. The reduced risk associated with organic growth, compared to the potential complexities and financial burdens of a major acquisition, represents a cautious yet potentially rewarding approach. Stay informed about Cenovus's commitment to organic growth and its impact on the future of the Canadian energy sector. Learn more about Cenovus's long-term strategy for organic growth in the Canadian oil sands and beyond on their investor relations website.

Featured Posts

-

Maccabi Tel Avivs Dominance In The Israeli Football Championship

May 26, 2025

Maccabi Tel Avivs Dominance In The Israeli Football Championship

May 26, 2025 -

F1 Drivers Press Conference Insights And Analysis

May 26, 2025

F1 Drivers Press Conference Insights And Analysis

May 26, 2025 -

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 26, 2025

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 26, 2025 -

Tl Abyb Tshhd Tzahrat Mtwaslt Llmtalbt Bitlaq Srah Alasra

May 26, 2025

Tl Abyb Tshhd Tzahrat Mtwaslt Llmtalbt Bitlaq Srah Alasra

May 26, 2025 -

Georgia Cold Case Solved Man Charged After 19 Year Flight With Nanny Following Wifes Death

May 26, 2025

Georgia Cold Case Solved Man Charged After 19 Year Flight With Nanny Following Wifes Death

May 26, 2025

Latest Posts

-

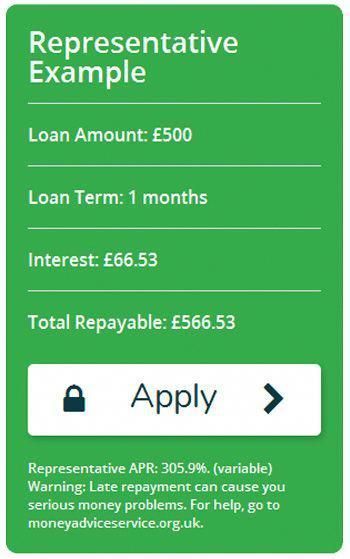

Personal Loans For Bad Credit Direct Lender Comparison

May 28, 2025

Personal Loans For Bad Credit Direct Lender Comparison

May 28, 2025 -

Meilleur Prix Samsung Galaxy S25 128 Go Comparatif Et Offres

May 28, 2025

Meilleur Prix Samsung Galaxy S25 128 Go Comparatif Et Offres

May 28, 2025 -

Secure A Personal Loan With Bad Credit Up To 5000

May 28, 2025

Secure A Personal Loan With Bad Credit Up To 5000

May 28, 2025 -

Find The Best Personal Loan For Bad Credit Direct Lender Options

May 28, 2025

Find The Best Personal Loan For Bad Credit Direct Lender Options

May 28, 2025 -

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025