China-US Trade Soars: Exporters Rush To Beat Trade Truce Deadline

Table of Contents

<p>The clock is ticking for exporters hoping to capitalize on the current trade truce between the US and China. With a looming deadline for certain trade agreements, a dramatic surge in bilateral trade is underway. This article examines the factors driving this rapid increase in China-US trade and analyzes its potential implications for businesses and the global economy. The current dynamic in US-China trade relations is creating both opportunities and significant challenges for businesses worldwide.</p>

<h2>The Impending Trade Truce Deadline Fuels Export Rush</h2>

<p>The uncertainty surrounding future US-China trade relations is a key driver of the current export rush. Businesses are eager to finalize shipments before potential new tariffs or trade restrictions are implemented, leading to a significant increase in bilateral trade. While the exact date of the deadline for specific trade agreements isn't publicly released in a single announcement, various deadlines exist across different categories of goods and agreements, creating a sense of urgency for exporters.</p>

<ul> <li>While precise dates for all relevant deadlines remain fluid and dependent on ongoing negotiations, many exporters are operating under a sense of urgency related to previously agreed-upon phases and anticipated future policy changes.</li> <li>Goods experiencing the largest export surges include electronics, agricultural products, and textiles. These are sectors particularly sensitive to tariffs and trade restrictions.</li> <li>Exporters face significant challenges, including increased logistical constraints due to higher demand, port congestion, and strained shipping capacity, leading to rising transportation costs.</li> <li>This pre-deadline surge has a noticeable economic impact, boosting short-term economic activity in both countries but also potentially exacerbating existing supply chain vulnerabilities.</li> </ul>

<h2>Increased Demand and Supply Chain Adjustments</h2>

<p>The surge in China-US trade isn't solely driven by the looming deadline; increased demand from US consumers and businesses for Chinese goods plays a significant role. This increased demand is forcing Chinese manufacturers and exporters to make substantial adjustments to their supply chains. This includes everything from ramping up production to navigating logistical hurdles.</p>

<ul> <li>Specific examples of increased demand include consumer electronics, apparel, and certain industrial components, many of which are integral to the US manufacturing sector.</li> <li>While many Chinese manufacturers are increasing capacity, there are limitations, resulting in potential bottlenecks and delays in fulfilling orders. This has resulted in some price increases for certain products.</li> <li>Logistical challenges, such as port congestion in both China and the US, as well as increased shipping costs (fuel surcharges, container shortages), are adding complexity and cost to the process.</li> <li>Companies are employing various strategies to manage supply chain disruptions, including diversifying sourcing, investing in more efficient logistics, and building greater inventory buffers.</li> </ul>

<h2>The Geopolitical Implications of the China-US Trade Dynamic</h2>

<p>The current trade dynamic between the US and China is deeply intertwined with broader geopolitical considerations. The ongoing strategic competition between these two superpowers casts a long shadow over trade negotiations and the overall global economic landscape. This surge in trade, therefore, has significant geopolitical implications.</p>

<ul> <li>The long-term implications of the trade truce remain uncertain, with the potential for future trade disputes and escalating tensions between the two countries.</li> <li>The risk of further trade wars or protectionist policies remains a significant concern for businesses and the global economy.</li> <li>This trade dynamic significantly impacts other global economies, as countries are forced to adapt to changing trade relationships and potential shifts in supply chains.</li> <li>International organizations play a crucial, albeit often limited, role in attempting to manage trade relations between the US and China and promote a more stable global trading system.</li> </ul>

<h3>Potential Impacts on Specific Sectors</h3>

<p>The impact of the China-US trade surge and the impending deadline varies significantly across different sectors. The technology sector, for example, faces unique challenges related to intellectual property and technological dominance. Similarly, the agricultural sector is vulnerable to tariff changes and fluctuations in demand. A nuanced understanding of these sector-specific impacts is crucial for effective business planning and risk mitigation.</p>

<h2>Conclusion</h2>

<p>The current surge in China-US trade, driven by the impending trade truce deadline, highlights the complex and dynamic relationship between these two economic giants. Exporters are scrambling to capitalize on the current situation, facing both opportunities and challenges related to logistics, tariffs, and geopolitical uncertainty. The longer-term consequences of this trade dynamic remain to be seen, impacting various sectors and the global economy. The ongoing adjustments to supply chains and the potential for future policy changes will continue to shape the landscape of China-US trade for years to come.</p>

<p><strong>Call to Action:</strong> Stay informed about the evolving China-US trade relations to make informed business decisions and navigate the complexities of this crucial bilateral trade relationship. Follow our updates on the latest developments impacting China-US trade for insights and analysis to help your business thrive in this dynamic environment.</p>

Featured Posts

-

Core Weave Crwv And Open Ai Jim Cramers Analysis

May 22, 2025

Core Weave Crwv And Open Ai Jim Cramers Analysis

May 22, 2025 -

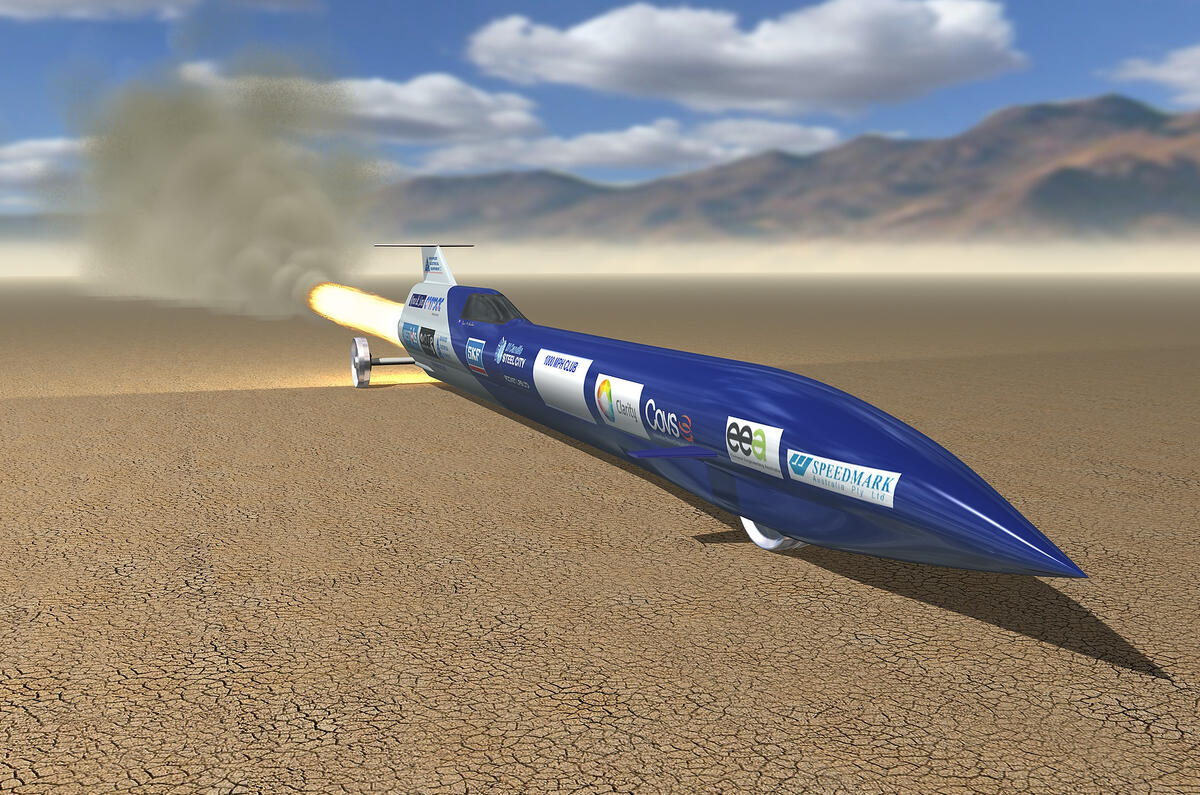

British Ultrarunner Attempts Australian Speed Record

May 22, 2025

British Ultrarunner Attempts Australian Speed Record

May 22, 2025 -

Peppa Pigs Family Celebrates A Gender Reveal Party For Their New Arrival

May 22, 2025

Peppa Pigs Family Celebrates A Gender Reveal Party For Their New Arrival

May 22, 2025 -

President Bidens Health Details On His 2014 Prostate Cancer Screening

May 22, 2025

President Bidens Health Details On His 2014 Prostate Cancer Screening

May 22, 2025 -

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisara

May 22, 2025

Latest Posts

-

Core Weave Ipo Lower Than Expected Listing Price At 40

May 22, 2025

Core Weave Ipo Lower Than Expected Listing Price At 40

May 22, 2025 -

Core Weave Crwv And Open Ai Jim Cramers Analysis

May 22, 2025

Core Weave Crwv And Open Ai Jim Cramers Analysis

May 22, 2025 -

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025 -

Blake Lively Separating Fact From Fiction In Recent Reports

May 22, 2025

Blake Lively Separating Fact From Fiction In Recent Reports

May 22, 2025 -

The Blake Lively Allegations Fact Checking And Analysis

May 22, 2025

The Blake Lively Allegations Fact Checking And Analysis

May 22, 2025