China Weighs Trade Talks, Copper Prices React

Table of Contents

China's Role in the Global Copper Market

China's influence on the global copper market is undeniable. Its massive economy and voracious appetite for raw materials make it a key player, influencing price trends and market stability.

China as the Top Copper Consumer

China's massive construction industry and burgeoning manufacturing sector solidify its position as the world's largest copper consumer. Any change in its economic activity, whether expansion or contraction, directly impacts global copper demand.

- Increased infrastructure projects lead to higher copper demand: Ambitious infrastructure projects, such as high-speed rail lines, smart cities, and renewable energy initiatives, significantly boost copper consumption.

- Slowdown in construction activity reduces copper consumption: Conversely, a slowdown in these activities, potentially due to economic headwinds or government policy changes, directly reduces copper demand, impacting prices.

- China's manufacturing output is a key driver of copper prices: China's manufacturing sector, a powerhouse of global production, relies heavily on copper in electronics, appliances, and machinery, making its output a significant factor in global copper price determination.

Impact of Trade Policy on Copper Imports

Changes in China's trade policies, including tariffs, import quotas, and trade agreements, significantly influence the flow of copper into the country and, subsequently, global supply and prices.

- Increased tariffs on copper imports could raise prices for consumers: Higher tariffs increase the cost of imported copper, potentially leading to higher prices for consumers and impacting downstream industries.

- Relaxation of import restrictions could lead to lower prices: Conversely, easing import restrictions or establishing favorable trade agreements could increase copper availability and potentially lower prices.

- Trade agreements influence the price and availability of copper from various sources: Trade deals with copper-producing nations can impact pricing and supply chains, favoring certain sources over others and creating market fluctuations.

Analyzing the Correlation Between Trade Talks and Copper Prices

The correlation between China's trade talks and copper prices is demonstrably strong. Positive developments generally boost investor confidence and demand, while negative news can trigger a sell-off.

Positive Trade Outlook and Copper Prices

News of positive trade developments, such as reaching new agreements or de-escalation of trade tensions, typically boosts investor confidence. This leads to increased demand for copper, pushing prices higher.

- Investors view positive trade talks as a sign of economic stability: Positive trade news is often interpreted as a sign of stable global economic growth, encouraging investment in commodities like copper.

- Increased investor confidence leads to higher copper futures contracts: Futures contracts, reflecting future copper prices, increase as investors bet on higher demand and prices.

- Speculative buying can drive up copper prices during periods of optimism: Speculators might increase their copper holdings, further driving prices upward in anticipation of future gains.

Negative Trade Outlook and Copper Prices

Uncertainty or negative news concerning trade negotiations can have the opposite effect, causing investors to become risk-averse and reducing demand for copper.

- Trade disputes can create uncertainty and volatility in the market: Uncertainty surrounding trade policies creates volatility in the copper market as investors react to the changing landscape.

- Risk-averse investors may sell off copper holdings, driving prices down: Fear of economic downturn might prompt investors to liquidate copper assets, putting downward pressure on prices.

- Concerns about a global economic slowdown can negatively impact copper prices: Negative trade news can fuel concerns about a global economic slowdown, reducing demand for copper and leading to lower prices.

Other Factors Influencing Copper Prices

While China's trade talks play a significant role, other factors also influence copper prices. Understanding these elements is vital for a complete market analysis.

Global Economic Growth

Copper prices are highly sensitive to global economic growth. Strong growth typically leads to higher demand, while slower growth can dampen prices. Indicators like GDP growth and industrial production are closely monitored.

Supply-Side Factors

Mining production, geopolitical events affecting copper mines (strikes, political instability), and disruptions to supply chains (pandemics, natural disasters) can all significantly impact copper availability and price.

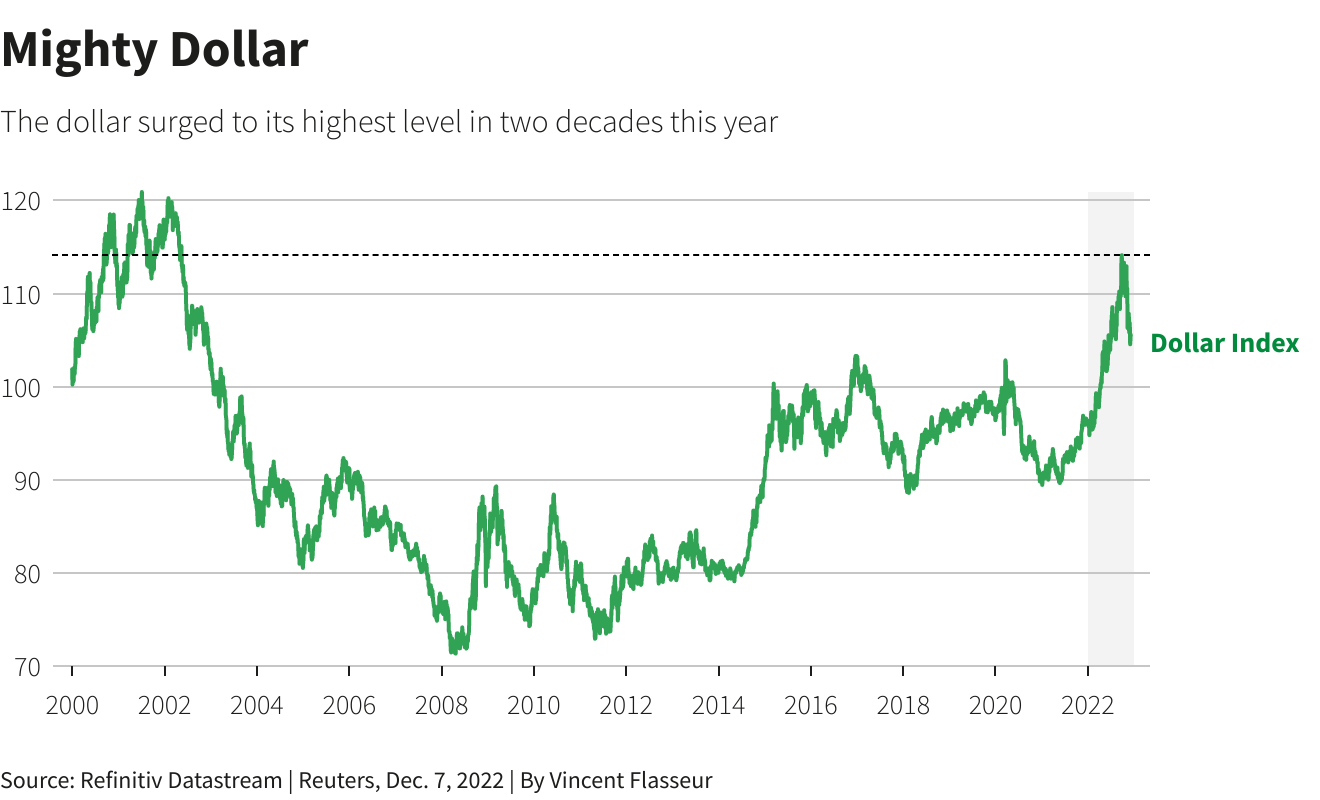

Dollar Strength

The strength of the US dollar against other currencies influences copper prices, as it’s traded internationally. A stronger dollar can make copper more expensive for buyers using other currencies, impacting global demand.

Conclusion

The interplay between China's ongoing trade talks and copper prices is complex and multifaceted. China's significant role as a copper consumer means that any shifts in its trade policy directly impact global supply and demand, creating price volatility. Understanding the correlation between these trade negotiations and the copper market is crucial for investors, businesses, and policymakers alike. To stay updated on the latest developments affecting the price of copper, continue monitoring news related to China weighs trade talks and their implications for global markets. Staying informed about these intricate relationships is key to navigating the complexities of the commodities market.

Featured Posts

-

Celtics Vs Heat Game Time And Viewing Options February 10 2024

May 06, 2025

Celtics Vs Heat Game Time And Viewing Options February 10 2024

May 06, 2025 -

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025

Mindy Kalings Slim Figure Stuns Fans At Series Premiere

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Maria Shriver Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Maria Shriver Weighs In

May 06, 2025 -

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025 -

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025

Latest Posts

-

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025 -

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025 -

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025 -

New Ddg Song Dont Take My Son Sparks Debate Is It Aimed At Halle Bailey

May 06, 2025

New Ddg Song Dont Take My Son Sparks Debate Is It Aimed At Halle Bailey

May 06, 2025