Common Questions About Proxy Statements (Form DEF 14A) Answered

Table of Contents

What Information is Contained in a Proxy Statement?

A proxy statement (Form DEF 14A) is a crucial document filed with the Securities and Exchange Commission (SEC) by publicly traded companies. It provides shareholders with the information they need to make informed decisions on matters to be voted on at the annual meeting or a special meeting. The SEC mandates its use to ensure transparency and fairness in shareholder voting. The information within a DEF 14A is extensive and typically includes:

- Executive Compensation: A detailed breakdown of salaries, bonuses, stock options, retirement benefits, and other compensation paid to the company's top executives. This section often includes comparisons to previous years and industry peers.

- Shareholder Proposals: Descriptions of any proposals submitted by shareholders for a vote at the upcoming meeting. These proposals can cover a wide range of topics, from environmental sustainability to executive compensation policies.

- Director Nominations: Information about the individuals nominated to serve on the company's board of directors, including their biographies, qualifications, and any potential conflicts of interest.

- Mergers and Acquisitions: Details on any proposed mergers, acquisitions, or other significant corporate transactions. This section will outline the terms of the deal and its potential impact on shareholders.

- Auditor Information: Information regarding the company's independent auditor, including their fees and any changes in auditors.

- Other Important Matters: This section can cover various topics depending on the company's specific circumstances, such as amendments to the company's bylaws or other important corporate governance matters.

How to Read and Understand a Proxy Statement Effectively

Proxy statements can be lengthy and complex, filled with legal jargon. However, with a strategic approach, you can effectively navigate them and extract the key information. Here’s how:

- Start with the Summary: Begin by reading the summary or highlights section. This provides a concise overview of the key issues being presented to shareholders.

- Focus on Key Sections: Depending on your interests, prioritize certain sections. If you are concerned about executive compensation, focus on that section. If shareholder proposals are important to you, read those carefully.

- Utilize Online Tools: Several online tools and resources can help you analyze the data in a proxy statement more efficiently and compare it to industry standards.

- Don't Be Afraid to Ask for Clarification: If anything is unclear, don't hesitate to contact the company's investor relations department for clarification.

- Compare to Previous Years: Analyze trends and changes over time by comparing the current proxy statement to previous years' filings. This can reveal important patterns and potential issues.

Who Needs to Understand Proxy Statements?

Understanding proxy statements is beneficial for a wide range of stakeholders:

- Individual Investors: Proxy statements empower you to make informed voting decisions on issues that directly impact your investment. By understanding executive compensation, you can assess management’s performance and alignment with shareholder interests. Understanding shareholder proposals allows you to support or oppose initiatives that align with your values.

- Institutional Investors: Institutional investors, such as mutual funds and pension funds, use proxy statements to evaluate corporate governance practices, engage with management, and vote on behalf of their clients.

- Corporate Governance Professionals: Corporate governance professionals rely on proxy statements to analyze corporate governance structures, identify potential risks, and advise boards of directors on best practices.

What are my rights as a shareholder regarding the proxy statement?

As a shareholder, you have the right to:

- Vote on matters presented in the proxy statement: This includes electing directors, approving executive compensation, and voting on shareholder proposals.

- Submit your own shareholder proposals: While there are specific rules and regulations governing the submission of shareholder proposals, you have the right to advocate for changes within the company.

- Seek legal assistance: If you believe the proxy statement contains inaccurate or misleading information, or if your shareholder rights have been violated, you can seek legal counsel.

Conclusion: Mastering Proxy Statements for Informed Decision-Making

Mastering the art of understanding and analyzing proxy statements is essential for every informed investor. This guide has highlighted the critical information contained within Form DEF 14A, from executive compensation and shareholder proposals to director nominations and corporate transactions. By effectively utilizing the information provided, you can make informed decisions, hold corporate management accountable, and actively participate in the governance of your investments. Actively engage with proxy statements, utilize the resources available, and become a more informed and influential investor. For additional resources and information on proxy statements and Form DEF 14A, please visit the .

Featured Posts

-

Liverpool Transfer News The Angelo Stiller Pursuit

May 17, 2025

Liverpool Transfer News The Angelo Stiller Pursuit

May 17, 2025 -

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem Thiet Ke Moi

May 17, 2025

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem Thiet Ke Moi

May 17, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Transport Now Available

May 17, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Transport Now Available

May 17, 2025 -

Car Dealerships Step Up Opposition To Mandatory Ev Sales

May 17, 2025

Car Dealerships Step Up Opposition To Mandatory Ev Sales

May 17, 2025 -

Could Eminem Become A Wnba Team Owner The Latest News

May 17, 2025

Could Eminem Become A Wnba Team Owner The Latest News

May 17, 2025

Latest Posts

-

Chat Gpt Plus Ai Coding Agent Now Available

May 18, 2025

Chat Gpt Plus Ai Coding Agent Now Available

May 18, 2025 -

Rome Trip Paid For By Regulated Companies Ethics Concerns For State Officials

May 18, 2025

Rome Trip Paid For By Regulated Companies Ethics Concerns For State Officials

May 18, 2025 -

Chat Gpts New Ai Coding Agent Revolutionizing Software Development

May 18, 2025

Chat Gpts New Ai Coding Agent Revolutionizing Software Development

May 18, 2025 -

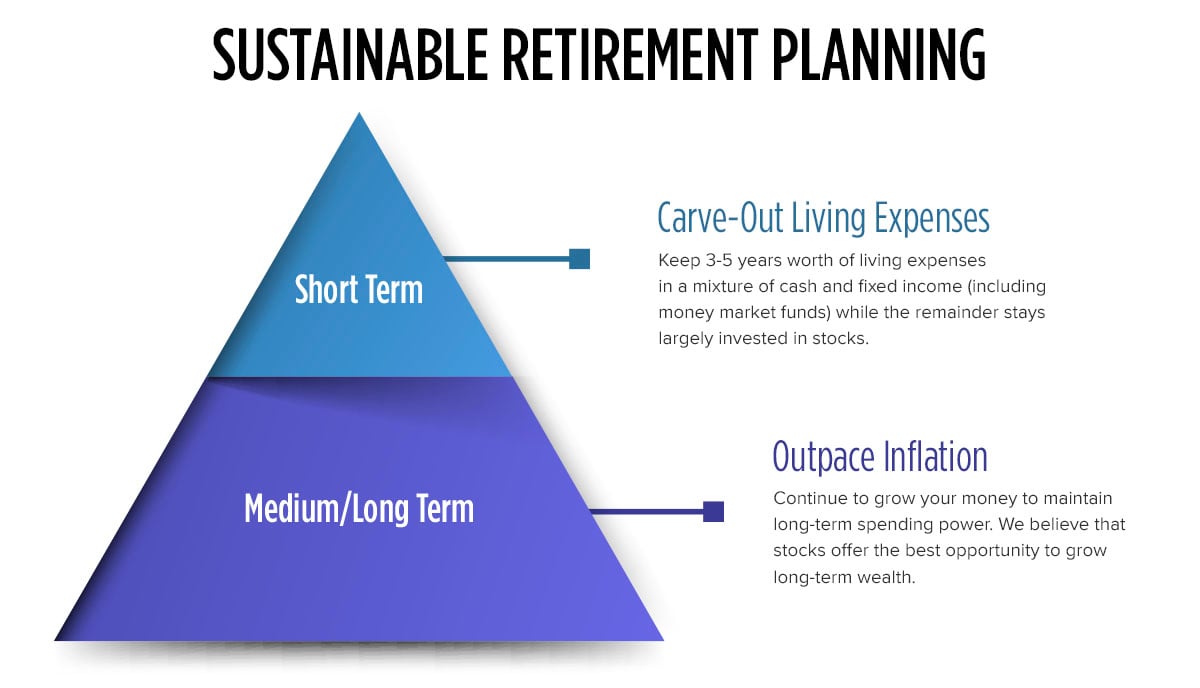

Retirement Investment Strategy Is This New Idea A Good Or Bad Choice

May 18, 2025

Retirement Investment Strategy Is This New Idea A Good Or Bad Choice

May 18, 2025 -

The End Of Ryujinx Nintendo Intervention And Emulator Shutdown

May 18, 2025

The End Of Ryujinx Nintendo Intervention And Emulator Shutdown

May 18, 2025