Copper Prices Surge Amidst China-U.S. Trade Talk Speculation

Table of Contents

China's Role in the Copper Price Surge

China's enormous consumption of copper significantly impacts global demand and, consequently, copper prices. As the world's largest copper consumer, any shift in Chinese policy or economic activity sends ripples throughout the international copper market. Trade tensions and the threat of tariffs between China and the U.S. directly affect Chinese copper imports, creating uncertainty and influencing market sentiment.

- Massive Infrastructure Spending: China's ambitious infrastructure spending plans, including its Belt and Road Initiative, fuel immense demand for copper, a key component in construction and power infrastructure projects. This increased demand directly pushes copper prices upward.

- Policy Changes and Import Tariffs: Recent policy changes in China, even subtle adjustments to import tariffs or regulations affecting the manufacturing sector, can significantly impact copper imports and, subsequently, global copper prices. Any perceived tightening of trade restrictions often leads to price increases.

- Trade Deal Impacts: The outcome of trade negotiations between China and the U.S. heavily influences market sentiment. A positive trade agreement could ease concerns and potentially stabilize copper prices. Conversely, escalating trade wars or new sanctions can lead to further price volatility.

US Economic Indicators and Their Influence

American economic indicators play a crucial role in shaping copper prices. Data like the manufacturing Purchasing Managers' Index (PMI) and construction spending figures directly reflect the health of sectors heavily reliant on copper. Positive economic data generally boosts confidence and increases copper demand, driving prices higher. Conversely, negative data can dampen investor enthusiasm, leading to price drops.

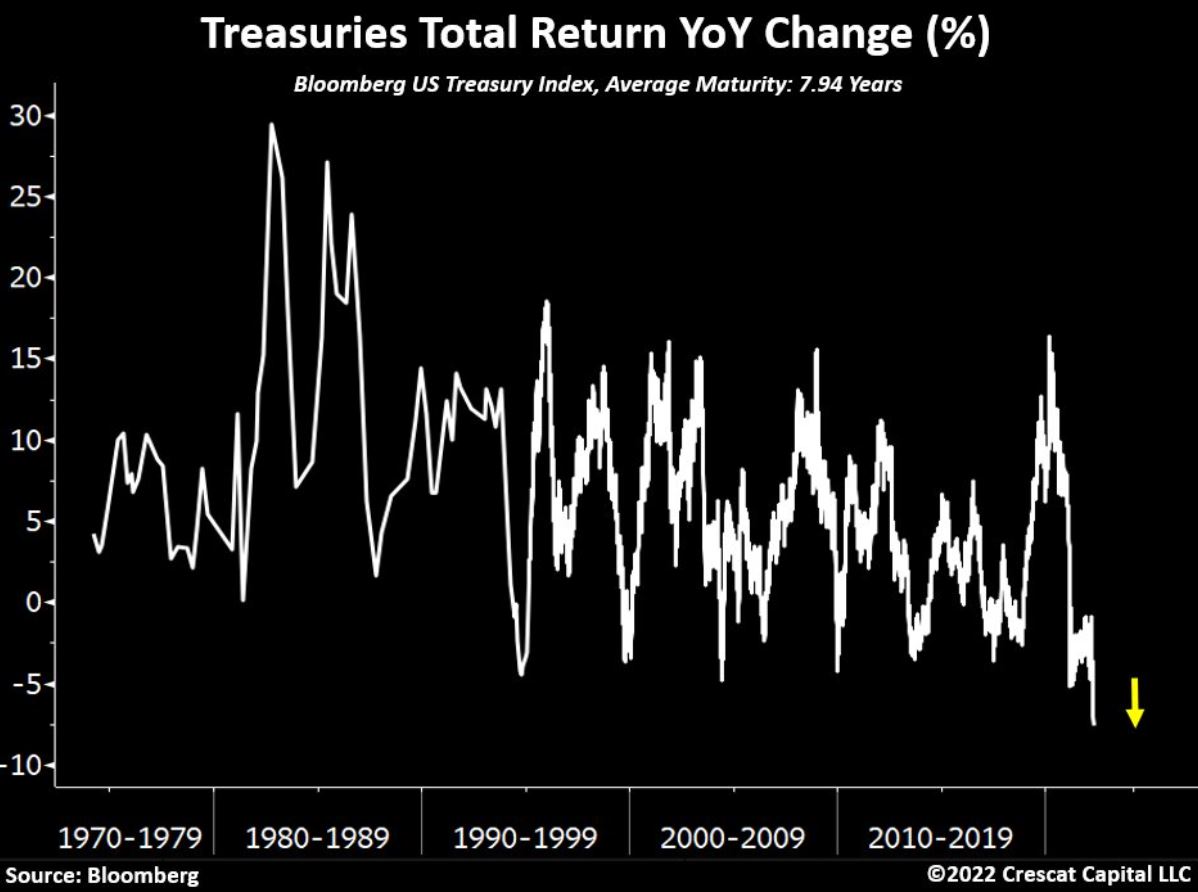

- US Dollar's Impact: The inverse relationship between the US dollar and copper prices is well-established. A strengthening dollar makes copper more expensive for buyers using other currencies, thereby reducing demand and potentially lowering prices.

- Interest Rate Hikes: Potential interest rate hikes by the Federal Reserve can impact copper demand by affecting borrowing costs for businesses engaged in construction and manufacturing. Higher interest rates can curb investment and reduce demand, potentially leading to lower copper prices.

- Economic News and Data: Market reactions to important economic news releases and data from the U.S. – such as employment figures or inflation data – can significantly influence investor sentiment and directly impact copper price movements.

Global Supply Chain Disruptions and Their Impact

Global supply chain disruptions, ranging from mine closures due to environmental concerns or labor disputes to logistical bottlenecks caused by geopolitical instability, significantly affect copper availability. These disruptions can drive up prices even when demand remains relatively stable. The scarcity created by supply chain issues creates upward pressure on copper prices.

- Mine Closures and Production Issues: Recent examples of mine closures due to operational difficulties, environmental regulations, or labor disputes illustrate the fragility of the copper supply chain. These disruptions reduce the overall supply, leading to higher prices.

- ESG Factors and Mining: Growing awareness of Environmental, Social, and Governance (ESG) factors is influencing copper mining practices. Companies are facing increasing scrutiny regarding their environmental impact and social responsibility, which can lead to increased costs and potentially tighter supply.

- Alternative Copper Sources: The exploration and development of alternative copper sources, such as recycled copper or new mining operations, can play a role in mitigating supply chain issues. However, the impact of these alternatives often lags behind immediate market pressures.

Speculation and Investor Sentiment

Speculation and investor sentiment play a significant role in copper price volatility. Futures markets and options trading allow investors to bet on future price movements, creating a dynamic environment susceptible to rapid price swings driven by market psychology rather than purely fundamental factors.

- Investor Sentiment Shifts: Changes in investor sentiment towards copper, driven by news, analysis, or economic forecasts, can trigger rapid price increases or decreases. Optimism leads to buying, driving up prices; pessimism leads to selling, depressing prices.

- Hedge Fund Activity: Significant investment by hedge funds and other large financial institutions can exacerbate price volatility, amplifying both upward and downward trends in copper prices.

- Media Influence: News media coverage and market analysis can significantly influence investor behavior and contribute to the volatility of copper prices. Positive or negative narratives can significantly impact sentiment and drive price movements.

Conclusion: Understanding the Future of Copper Prices

The recent surge in copper prices reflects a complex interplay of factors, including China-U.S. trade relations, fluctuations in key U.S. economic indicators, and disruptions within the global copper supply chain. While China's immense copper consumption and its vulnerability to trade tensions remain primary drivers, other factors, such as investor speculation and supply chain vulnerabilities, contribute significantly to the overall price volatility. Predicting future copper price movements remains challenging due to the inherent uncertainties in global markets and the complexity of geopolitical influences. However, by staying informed about developments in China-U.S. trade relations, closely monitoring key global economic indicators, and understanding the dynamics of the copper market, individuals and businesses can navigate this volatile landscape more effectively. To stay updated on the latest developments affecting copper prices and receive expert insights into future copper price forecasts, sign up for our newsletter today! Understanding the copper market and the impact of copper price fluctuations is crucial for informed decision-making in various sectors.

Featured Posts

-

Toxic Chemicals From Ohio Train Derailment Lingering Contamination In Buildings

May 06, 2025

Toxic Chemicals From Ohio Train Derailment Lingering Contamination In Buildings

May 06, 2025 -

Patrik Shvartsenegger I Ebbi Chempion Novye Podrobnosti O Fotosessii Dlya Kim Kardashyan

May 06, 2025

Patrik Shvartsenegger I Ebbi Chempion Novye Podrobnosti O Fotosessii Dlya Kim Kardashyan

May 06, 2025 -

Fortnite Season 8 Sabrina Carpenter Confirmed As Headliner

May 06, 2025

Fortnite Season 8 Sabrina Carpenter Confirmed As Headliner

May 06, 2025 -

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025 -

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Latest Posts

-

I Dont Know Why I Just Do Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras Unexpected Hit

May 06, 2025

I Dont Know Why I Just Do Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras Unexpected Hit

May 06, 2025 -

Sabrina Carpenters Fun Size Reunion On Snl A Surprise Performance

May 06, 2025

Sabrina Carpenters Fun Size Reunion On Snl A Surprise Performance

May 06, 2025 -

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

May 06, 2025

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

May 06, 2025 -

Unexpected Snl Appearance Sabrina Carpenter And A Fun Size Friend

May 06, 2025

Unexpected Snl Appearance Sabrina Carpenter And A Fun Size Friend

May 06, 2025 -

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025