CoreWeave, Inc. (CRWV): Exploring The Factors Behind Recent Stock Growth

Table of Contents

The Booming Demand for AI Infrastructure

The AI market is experiencing explosive growth, fueled by advancements in machine learning, deep learning, and the increasing adoption of AI across various industries. This explosive growth translates into an insatiable demand for high-performance computing resources capable of handling the immense computational demands of AI model training and deployment. CoreWeave specializes in providing this critical infrastructure, leveraging its cutting-edge data center capabilities and extensive GPU resources. This strategic focus positions the company perfectly to capitalize on this booming market.

- Increased demand for GPUs for AI workloads: The training of sophisticated AI models requires massive parallel processing power, primarily delivered through Graphics Processing Units (GPUs). CoreWeave’s vast GPU infrastructure directly addresses this crucial need.

- CoreWeave's strategic partnerships with GPU manufacturers: Collaborations with leading GPU manufacturers ensure CoreWeave has access to the latest hardware, maintaining a competitive edge in terms of performance and efficiency.

- Growth in the adoption of cloud-based AI solutions: Businesses are increasingly migrating their AI workloads to the cloud, driven by scalability, cost-effectiveness, and accessibility. CoreWeave's cloud-based infrastructure perfectly aligns with this trend.

CoreWeave's Competitive Advantages

CoreWeave differentiates itself from other cloud providers through a combination of superior performance, cost-effectiveness, and a commitment to sustainable infrastructure. This competitive advantage is a key driver of its stock growth. Its focus on providing a specifically tailored GPU cloud computing service, optimized for AI, sets it apart.

- Superior GPU performance and efficiency: CoreWeave’s infrastructure is engineered for optimal GPU utilization, ensuring faster training times and reduced costs for its clients.

- Flexible and scalable cloud infrastructure: Clients can easily scale their computing resources up or down based on their needs, offering flexibility and cost optimization.

- Competitive pricing strategies: CoreWeave offers competitive pricing models, making its services accessible to a broader range of AI developers and businesses.

- Commitment to sustainability and environmentally friendly practices: CoreWeave’s focus on sustainable infrastructure resonates with environmentally conscious clients and investors, enhancing its brand image and attracting socially responsible investments.

Strategic Partnerships and Investments

CoreWeave's strategic partnerships and successful funding rounds have significantly contributed to its market position and growth trajectory. These collaborations and investments provide the capital and resources necessary for expansion and market penetration.

- Details about key partnerships: [Insert details about specific partnerships with software companies, hardware manufacturers, or other relevant entities. Include links if possible.]

- Impact of successful funding rounds on expansion and market penetration: [Mention specific funding rounds and their impact on infrastructure development and market reach. Include details about the investors involved.]

- Mention any notable investors and their influence: [Highlight the influence of prominent investors on CoreWeave’s growth strategy and market credibility.]

Strong Financial Performance and Future Outlook

CoreWeave’s recent financial results demonstrate strong revenue growth and increasing profitability. Analyst predictions suggest a positive future outlook, further fueling investor confidence and contributing to the CRWV stock growth.

- Key financial metrics (revenue, earnings, etc.): [Insert relevant financial data. Cite sources.]

- Growth projections based on market analysis: [Summarize market analysis and growth projections for CoreWeave and the AI cloud computing sector.]

- Analyst ratings and target prices: [Include information on analyst ratings and target prices for CRWV stock. Cite sources.]

- Potential risks and challenges for future growth: [Acknowledge potential risks, such as competition, technological advancements, or economic downturns. A balanced perspective is crucial for transparency.]

Conclusion: Investing in CoreWeave's (CRWV) Future

CoreWeave's recent stock growth is a direct result of its strategic positioning within the booming AI infrastructure market. Its competitive advantages, strategic partnerships, strong financial performance, and positive future outlook make it an attractive investment opportunity. While potential risks exist, the company's strong position in this rapidly expanding sector suggests significant long-term growth potential. Learn more about CoreWeave (CRWV), investigate CoreWeave's stock, and assess CoreWeave's investment potential. The future of AI is bright, and CoreWeave is well-positioned to lead the way.

Featured Posts

-

Core Weaves Ipo 40 Listing Price Falls Short Of Initial Estimates

May 22, 2025

Core Weaves Ipo 40 Listing Price Falls Short Of Initial Estimates

May 22, 2025 -

Air Traffic Control System Failures Causes Consequences And Prevention Strategies

May 22, 2025

Air Traffic Control System Failures Causes Consequences And Prevention Strategies

May 22, 2025 -

Alles Over Tikkie Betalen In Nederland

May 22, 2025

Alles Over Tikkie Betalen In Nederland

May 22, 2025 -

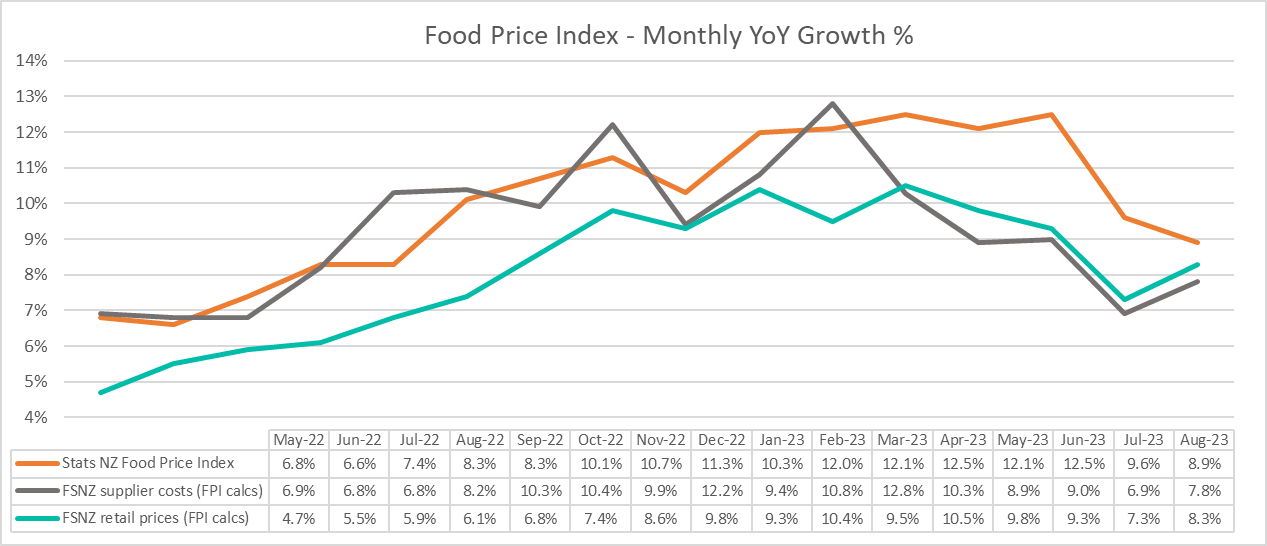

Grocery Bills Surge Inflationary Pressures On Food Costs Persist

May 22, 2025

Grocery Bills Surge Inflationary Pressures On Food Costs Persist

May 22, 2025 -

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025

Latest Posts

-

Understanding The Succession Phenomenon On Sky Atlantic Hd

May 23, 2025

Understanding The Succession Phenomenon On Sky Atlantic Hd

May 23, 2025 -

Sky Atlantic Hds Succession Power Family And Intrigue

May 23, 2025

Sky Atlantic Hds Succession Power Family And Intrigue

May 23, 2025 -

Succession On Sky Atlantic Hd Review Characters And More

May 23, 2025

Succession On Sky Atlantic Hd Review Characters And More

May 23, 2025 -

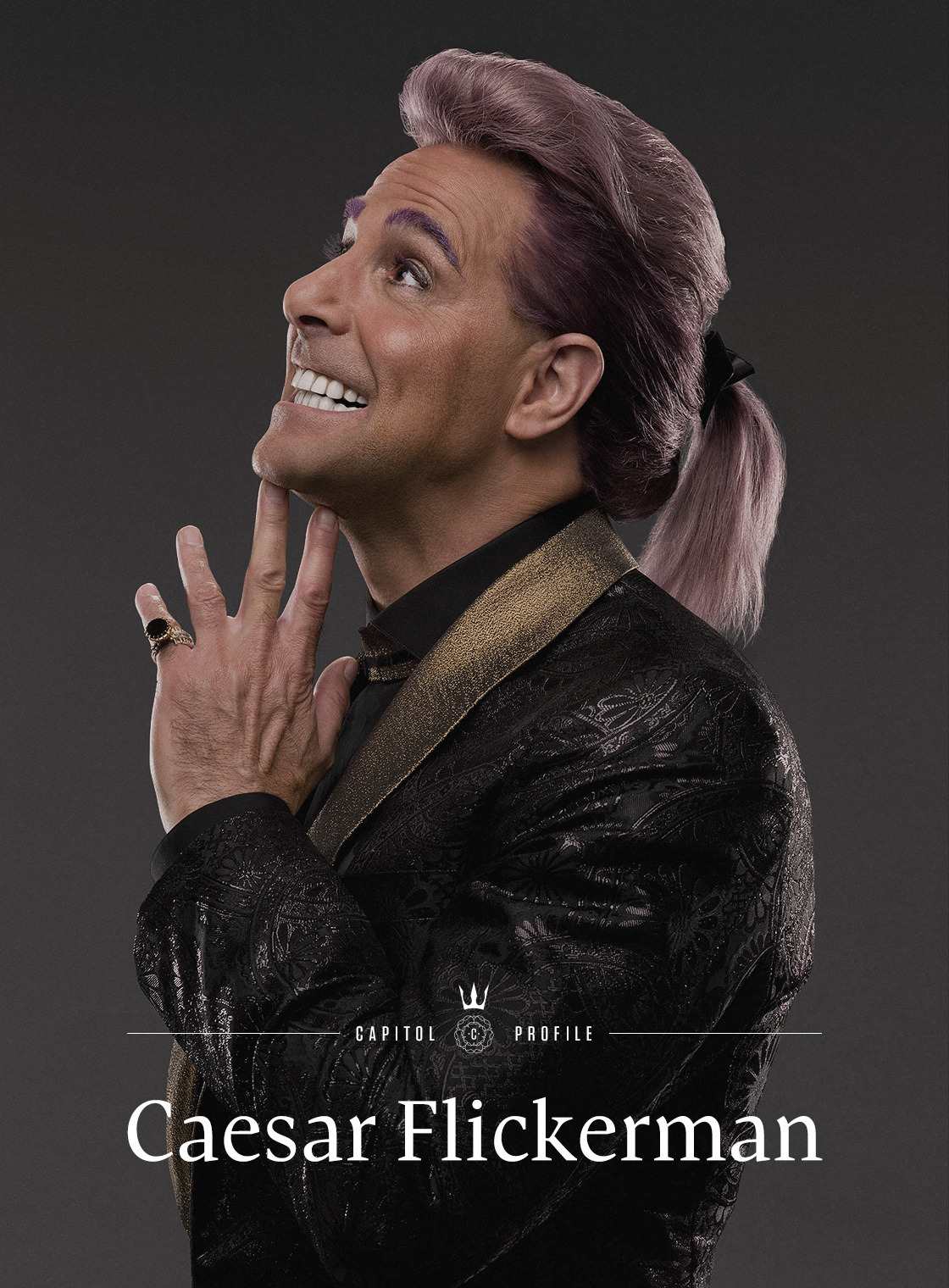

Casting News Kieran Culkin Joins The Hunger Games Prequel As Caesar Flickerman

May 23, 2025

Casting News Kieran Culkin Joins The Hunger Games Prequel As Caesar Flickerman

May 23, 2025 -

Confirmed Kieran Culkin To Play Caesar Flickerman In The Hunger Games Sunrise On The Reaping

May 23, 2025

Confirmed Kieran Culkin To Play Caesar Flickerman In The Hunger Games Sunrise On The Reaping

May 23, 2025