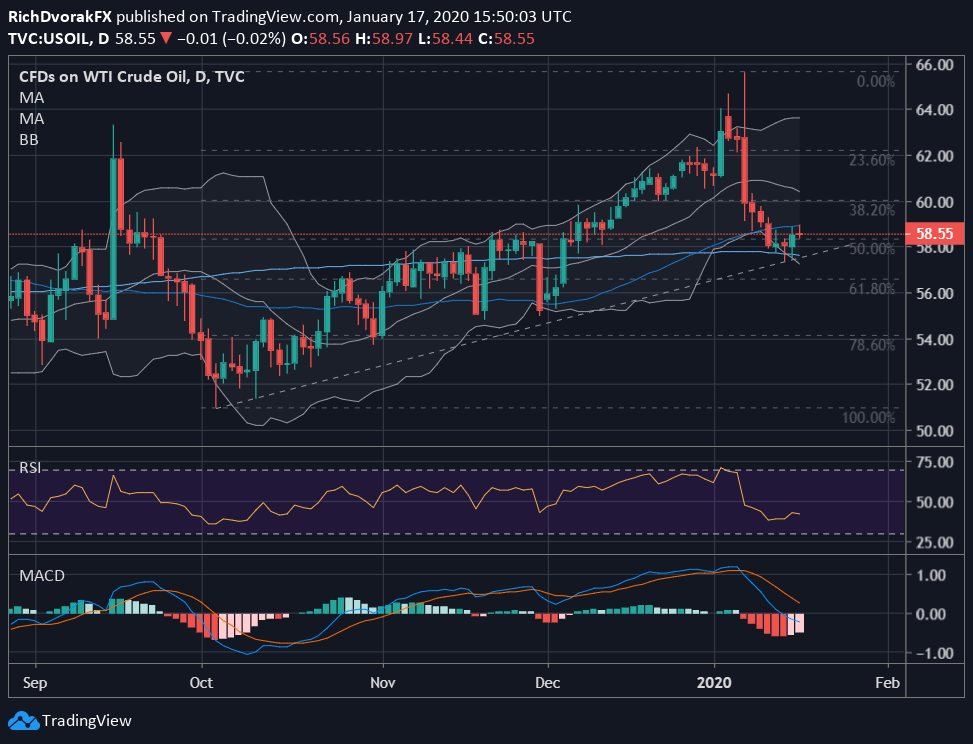

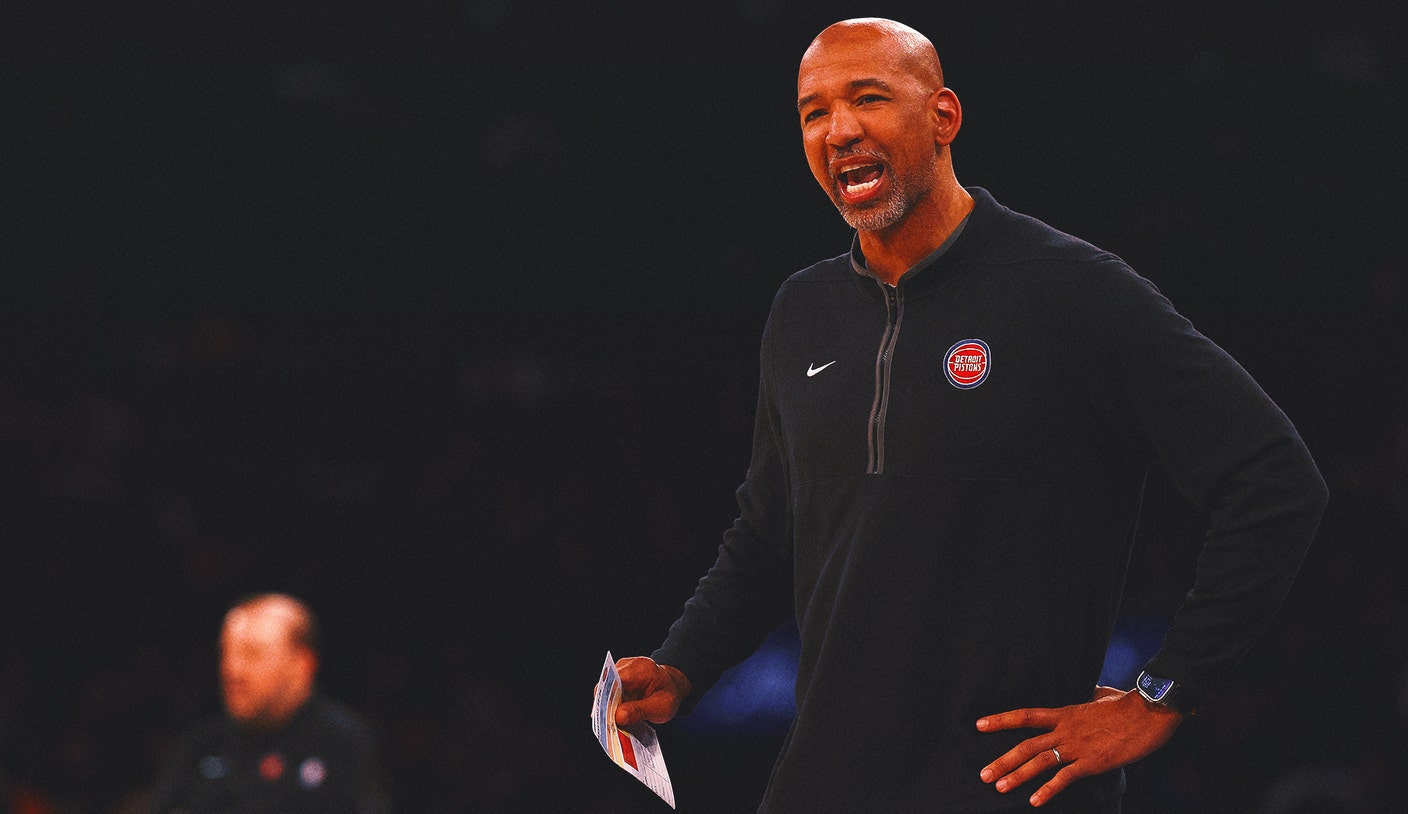

Crude Oil Price Analysis: Market News For May 16

Table of Contents

Global Supply and Demand Dynamics

OPEC+ Production Cuts

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have significantly impacted crude oil prices through their production decisions. Recent OPEC+ meetings have seen agreements to adjust production quotas, aiming to stabilize the market and influence crude oil prices. However, the effectiveness of these cuts depends on several factors.

-

Adherence to Production Quotas: Monitoring member countries' adherence to agreed-upon production levels is crucial. Variations in production, whether due to technical issues or deliberate overproduction, directly affect the global supply of crude oil and consequently, the crude oil price.

-

Unexpected Disruptions: Unforeseen events such as political instability in producing regions, natural disasters, or refinery outages can disrupt supply chains and lead to price spikes. These unforeseen circumstances highlight the inherent volatility of the crude oil market.

-

Geopolitical Instability and Sanctions: Geopolitical tensions and international sanctions significantly impact crude oil supply. The ongoing conflict in Ukraine, for example, has created substantial uncertainty and disruptions in global energy markets, pushing crude oil prices higher. Sanctions imposed on certain oil-producing nations further restrict supply, influencing the crude oil price.

Global Demand Outlook

Global oil demand is a complex interplay of economic growth, seasonal variations, and the increasing adoption of alternative energy sources. A robust global economy generally translates to higher demand for oil, while economic slowdowns decrease demand.

-

Rising Interest Rates and Economic Growth: Rising interest rates, aimed at controlling inflation, can curb economic growth, reducing demand for energy and impacting crude oil prices. The relationship between interest rates, economic growth, and crude oil price is a key factor to consider.

-

Seasonal Demand Fluctuations: Seasonal factors like the summer driving season in the northern hemisphere usually increase demand for gasoline, thus affecting crude oil prices. These seasonal patterns add another layer of complexity to predicting crude oil price movements.

-

Impact of Renewable Energy: The growing adoption of renewable energy sources like solar and wind power gradually reduces the reliance on fossil fuels, putting downward pressure on long-term crude oil demand and its price. This long-term trend is a crucial factor to consider when analyzing the future of the crude oil market. The transition to cleaner energy sources will undoubtedly impact the crude oil price in the years to come.

Geopolitical Factors and Market Uncertainty

Geopolitical Tensions

Geopolitical events are major drivers of crude oil price volatility. Instability in oil-producing regions or conflicts affecting major shipping lanes can significantly disrupt supply, leading to price surges.

-

The War in Ukraine: The ongoing conflict in Ukraine has significantly impacted global energy markets, causing major disruptions in crude oil supply and pushing prices to record highs. The war underscores the significant impact of geopolitical factors on the crude oil price.

-

Supply Disruptions from Volatile Regions: Instability in the Middle East or other oil-rich regions can quickly lead to supply disruptions and price increases. Investors and traders need to monitor geopolitical developments closely to assess their potential impact on crude oil prices.

-

Sanctions and International Relations: International sanctions and diplomatic relations between oil-producing nations and consuming countries significantly affect oil supply and, consequently, its price. Changes in these dynamics can lead to substantial market fluctuations.

Market Sentiment and Speculation

Market sentiment plays a crucial role in crude oil price volatility. News events, analyst predictions, and investor behavior all contribute to price fluctuations.

-

Trading Activity and Volume: High trading volumes and significant price swings can indicate strong market sentiment, either bullish or bearish, which in turn impacts the crude oil price. Analyzing trading activity provides valuable insights into market sentiment.

-

Influence of Financial News and Analyst Predictions: Major news announcements regarding geopolitical events, production cuts, or economic data can significantly influence investor sentiment and lead to rapid price changes in the crude oil market. Analyst predictions also play a significant role.

-

Speculation and Hedging Strategies: Speculation and hedging strategies employed by investors and traders can amplify price swings, leading to increased volatility in the crude oil market. Understanding these strategies is crucial for comprehending price movements.

Economic Indicators and their Influence

Inflation and Interest Rates

Inflation and interest rates are key macroeconomic indicators affecting crude oil prices. High inflation generally leads to increased commodity prices, including crude oil.

-

Impact of Rising Interest Rates on Oil Demand: Rising interest rates can cool down economic growth, thus reducing demand for oil and potentially lowering crude oil prices. The interplay between interest rates and crude oil demand is a significant factor in price determination.

-

Inflation's Influence on Commodity Prices: Inflation increases the cost of goods and services, including crude oil, as producers pass on higher input costs to consumers. This relationship between inflation and crude oil prices is important to consider.

Dollar Strength

The US dollar's strength has an inverse relationship with crude oil prices. A stronger dollar makes oil more expensive for buyers using other currencies, potentially reducing demand and lowering prices.

-

Impact of a Strong Dollar: A strong US dollar makes it more expensive for countries using other currencies to buy oil, potentially lowering global demand and impacting crude oil prices.

-

Currency Fluctuations and Oil-Producing Nations' Revenues: Fluctuations in the value of the US dollar directly influence the revenues of oil-producing nations, impacting their production decisions and the supply of crude oil in the market.

Conclusion

The analysis of crude oil prices for May 16th reveals a complex interplay of global supply and demand, geopolitical factors, and macroeconomic indicators. Understanding the dynamics of OPEC+ production cuts, global demand forecasts, geopolitical instability, and the impact of economic indicators such as inflation and the US dollar is crucial for navigating this volatile market. Staying informed about these factors is vital for making informed decisions. To stay updated on the latest crude oil price movements and analysis, continue to monitor our daily reports and subscribe to our newsletter for in-depth market insights. Regularly review your investment strategies and adjust accordingly based on ongoing crude oil price analysis to effectively manage risk and capitalize on market opportunities.

Featured Posts

-

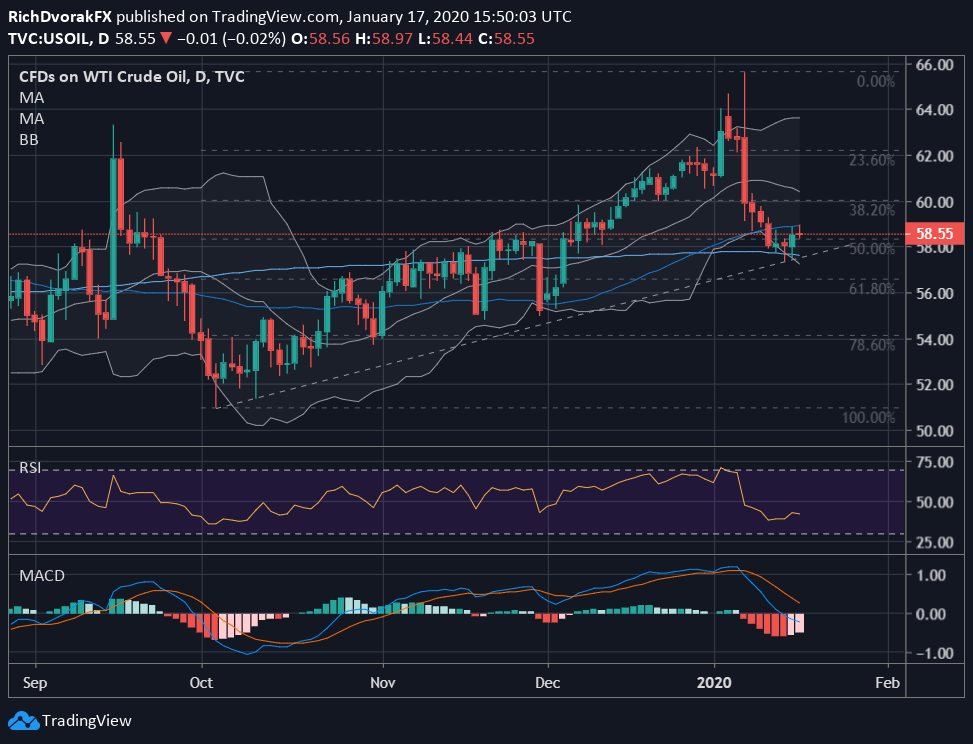

Missed Call Controversy Officials Address Late Game Decision In Knicks Pistons Matchup

May 17, 2025

Missed Call Controversy Officials Address Late Game Decision In Knicks Pistons Matchup

May 17, 2025 -

Todays Mlb Game Yankees Vs Mariners Prediction Betting Odds And Picks

May 17, 2025

Todays Mlb Game Yankees Vs Mariners Prediction Betting Odds And Picks

May 17, 2025 -

Iowa Basketball Mc Collums Coaching Experience A Major Addition

May 17, 2025

Iowa Basketball Mc Collums Coaching Experience A Major Addition

May 17, 2025 -

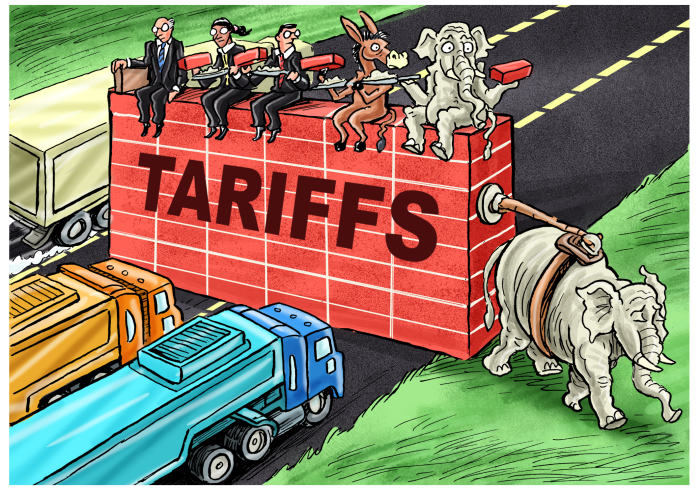

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025 -

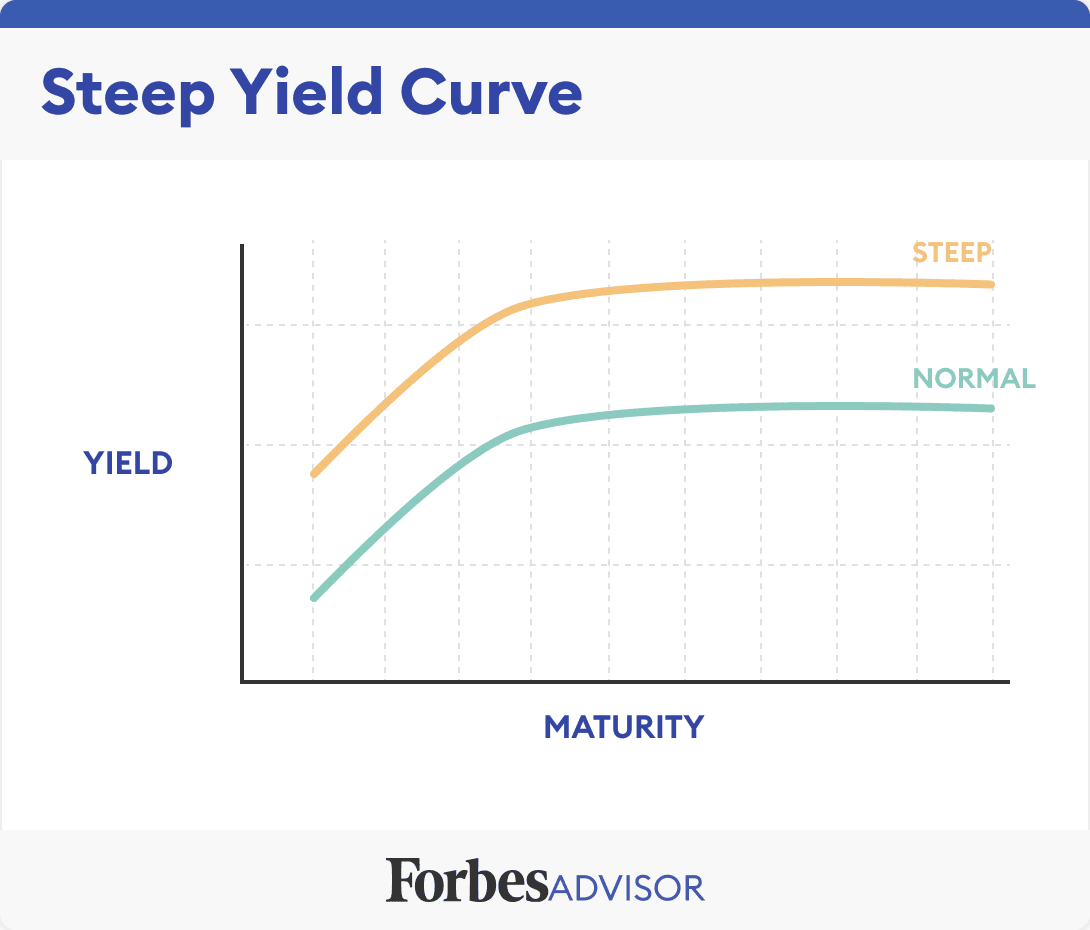

Steepening Japanese Bond Curve Investor Divisions And Economic Implications

May 17, 2025

Steepening Japanese Bond Curve Investor Divisions And Economic Implications

May 17, 2025

Latest Posts

-

Last Chance Get 3 Months Of Apple Tv For Only 3

May 17, 2025

Last Chance Get 3 Months Of Apple Tv For Only 3

May 17, 2025 -

Apple Tv Discount 3 Months For 3 Limited Time Offer

May 17, 2025

Apple Tv Discount 3 Months For 3 Limited Time Offer

May 17, 2025 -

Free Severance Streaming Watch Every Episode Online

May 17, 2025

Free Severance Streaming Watch Every Episode Online

May 17, 2025 -

Stream Severance For Free A Complete Episode Guide

May 17, 2025

Stream Severance For Free A Complete Episode Guide

May 17, 2025 -

How To Watch Severance A Free On Demand Guide

May 17, 2025

How To Watch Severance A Free On Demand Guide

May 17, 2025