Steepening Japanese Bond Curve: Investor Divisions And Economic Implications

Table of Contents

Factors Contributing to the Steepening Japanese Bond Curve

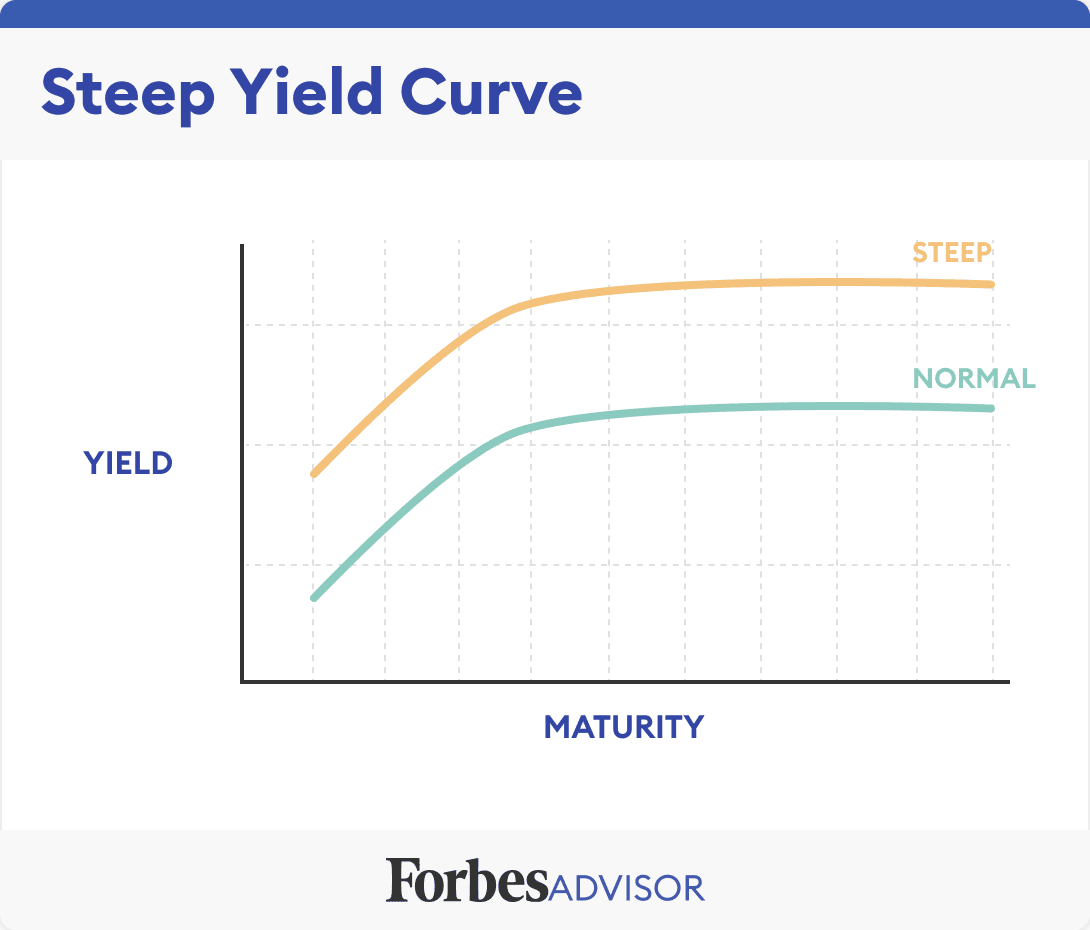

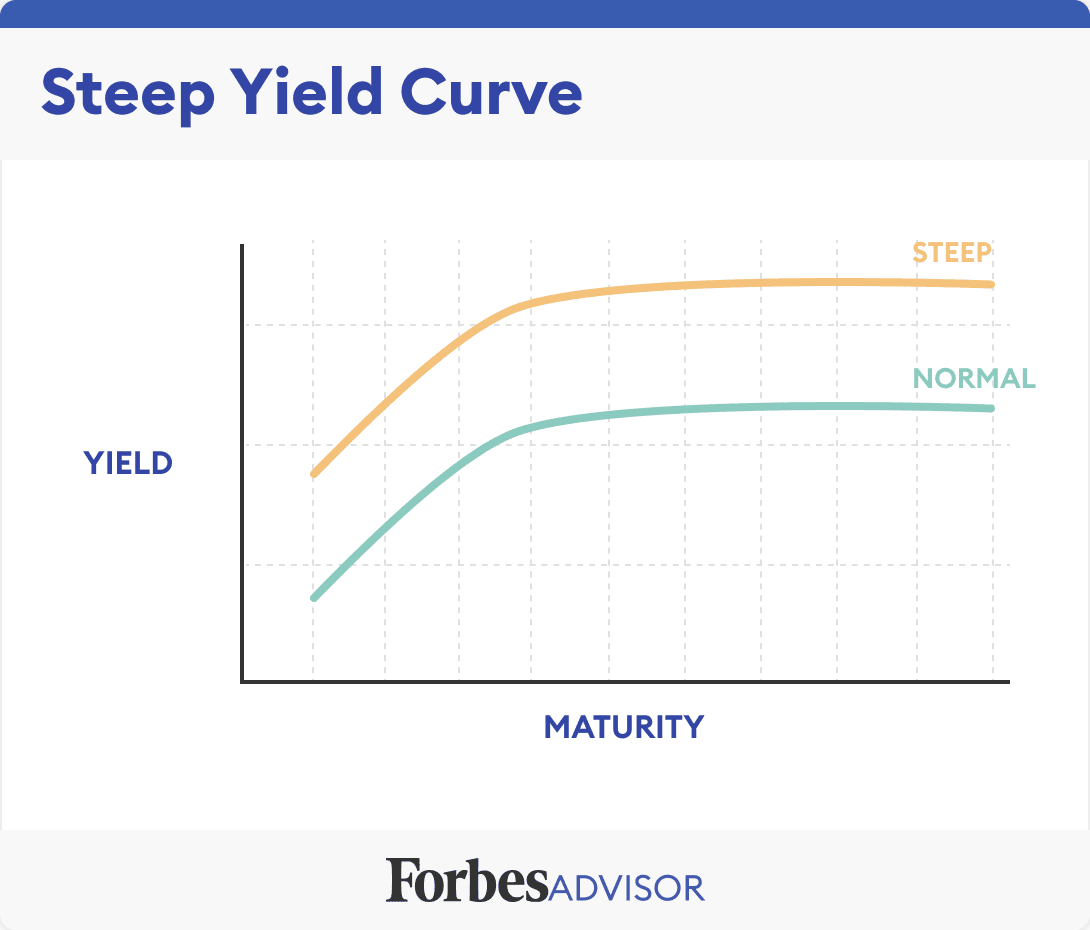

The steepening Japanese bond curve is a complex phenomenon driven by several intertwined factors. Keywords related to this section include: Yield curve control (YCC), inflation expectations, global interest rates, US Treasury yields, market speculation, and BOJ policy adjustments.

-

The Unwinding of Yield Curve Control (YCC): The BOJ's gradual unwinding of its Yield Curve Control (YCC) policy is arguably the most significant catalyst. YCC, implemented to keep long-term interest rates low, has been a cornerstone of the BOJ's monetary policy for years. However, persistent inflationary pressures are forcing a reevaluation of this strategy. The shift away from rigid YCC allows market forces to exert more influence on long-term Japanese Government Bond (JGB) yields, leading to a steeper curve.

-

Rising Inflation Expectations: Both domestic and global inflationary pressures are contributing to higher bond yields. Increased inflation erodes the purchasing power of future bond payments, pushing investors to demand higher yields as compensation for the reduced real return. This effect is amplified by global inflation, impacting investor sentiment across international bond markets.

-

Influence of US Treasury Yields: The interconnected nature of global financial markets means that movements in US Treasury yields exert significant upward pressure on JGB yields. Higher US yields make US bonds more attractive to international investors, potentially diverting funds away from JGBs unless Japanese yields rise to compensate. This correlation highlights the global nature of financial markets and the inherent vulnerability of even seemingly isolated economies to external factors.

-

Market Speculation and BOJ Policy Adjustments: Anticipation of further BOJ policy adjustments, including potential interest rate hikes, fuels market speculation and contributes to volatility. Investors are actively trying to anticipate the BOJ's next move, influencing trading activity and contributing to the steepening curve. This uncertainty further complicates the market, potentially leading to sharp price fluctuations.

-

Shifting Investor Preferences: Increased demand for longer-term bonds, potentially driven by factors such as pension fund liabilities and hedging strategies, can also contribute to the steepening of the yield curve. This increased demand bids up the price of longer-term bonds and consequently lowers their yields relative to shorter-term bonds.

Diverging Investor Sentiments on the Steepening Curve

The steepening Japanese bond curve has created a stark divide among investors, with bullish and bearish perspectives clashing. Keywords here include: Bullish investors, bearish investors, risk appetite, bond yield forecasts, and macroeconomic outlook.

-

Bullish Investors: These investors view the steepening curve as a positive sign, suggesting improved economic prospects and potentially higher returns on longer-term investments. They believe that the BOJ's policy adjustments reflect a growing confidence in the economy’s ability to handle higher interest rates, ultimately leading to stronger economic growth.

-

Bearish Investors: Conversely, bearish investors are deeply concerned. They worry that the steepening curve is a warning sign of overheating and a potential trigger for sharper interest rate hikes by the BOJ. This, they argue, could lead to slower economic growth, potentially even a recession, as higher borrowing costs stifle business investment and consumer spending. They believe the current economic strength is unsustainable given the global economic slowdown.

The divergence in opinions highlights the inherent uncertainty and risk associated with the current market conditions. The degree of risk appetite among investors significantly influences their interpretation of the steepening curve and their consequent investment strategies.

The Role of the Bank of Japan (BOJ)

The BOJ's actions and policy decisions are central to understanding the steepening Japanese bond curve. Keywords in this section include: Monetary policy, quantitative easing (QE), interest rate adjustments, inflation targeting, and BOJ intervention.

The BOJ's current monetary policy stance, characterized by a gradual shift away from YCC and quantitative easing (QE), significantly influences the bond market. The Bank faces a challenging balancing act: controlling inflation without triggering a sharp economic downturn. The potential for future interest rate adjustments, however small, is enough to create considerable market uncertainty. The BOJ's past interventions in the bond market, although less frequent now, remain a key factor influencing investor expectations and market behavior. The BOJ's communication strategy and transparency in explaining its policy decisions are crucial to managing investor expectations and preventing undue volatility.

Economic Implications of a Steepening Japanese Bond Curve

The steepening Japanese bond curve has profound implications for the Japanese economy. Keywords here include: Economic growth, inflation, government borrowing costs, corporate investment, and consumer spending.

-

Government Borrowing Costs: A steeper curve increases the cost of government borrowing, potentially impacting fiscal policy. Higher interest rates on government bonds could lead to tighter fiscal constraints, forcing the government to either reduce spending or raise taxes.

-

Corporate Investment: Higher interest rates can dampen corporate investment as borrowing becomes more expensive. This could lead to reduced capital expenditures and slower economic growth.

-

Consumer Spending: Higher interest rates can also reduce consumer spending, as borrowing for purchases like houses and cars becomes more costly. This can create a ripple effect throughout the economy, potentially slowing overall economic activity.

-

Currency Fluctuations: Changes in interest rates can lead to fluctuations in the value of the Japanese yen. A steepening curve might attract foreign investment, potentially strengthening the yen, but this effect is not guaranteed and depends on other global macroeconomic factors.

Conclusion:

The steepening Japanese bond curve represents a pivotal moment for the Japanese economy. Several intertwined factors, including the unwinding of YCC, rising inflation, global interest rate increases, and investor speculation, contribute to this phenomenon. The resulting divergence in investor sentiment highlights the uncertainty surrounding the future economic outlook. The BOJ's response and the wider economic consequences remain to be seen, but understanding the dynamics of this evolving market is crucial for investors and policymakers alike. Further analysis and close monitoring of the Japanese bond market are necessary to navigate this complex situation. Stay informed about developments in the Japanese bond market and consider consulting with financial professionals for informed investment decisions. Closely following the Japanese government bond (JGB) yield curve provides invaluable insights into the evolving state of the Japanese economy.

Featured Posts

-

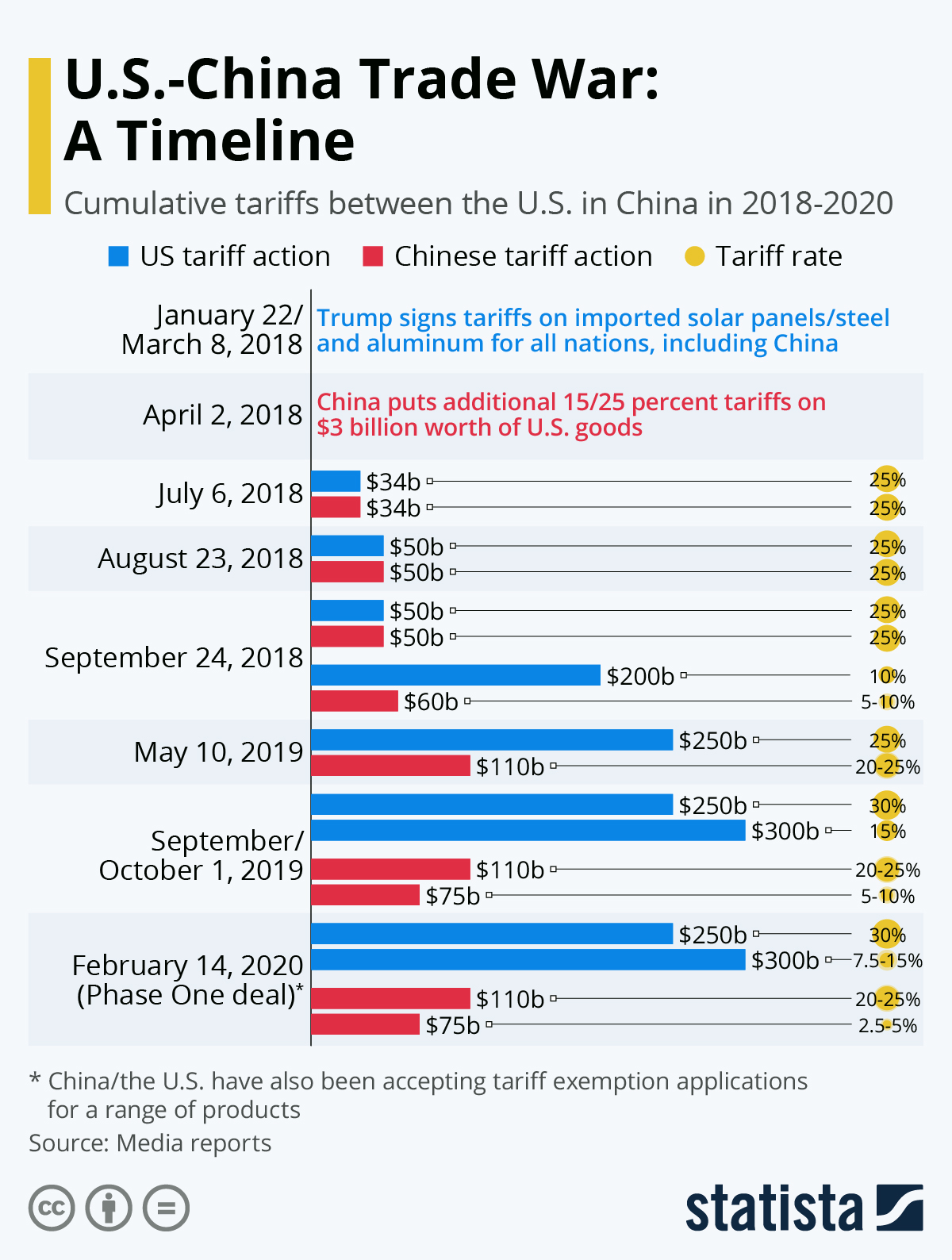

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025 -

Impact Of Trumps Student Loan Decision On Black Borrowers

May 17, 2025

Impact Of Trumps Student Loan Decision On Black Borrowers

May 17, 2025 -

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025 -

Tom Thibodeaus Pope Joke Unraveling The Knicks Connection

May 17, 2025

Tom Thibodeaus Pope Joke Unraveling The Knicks Connection

May 17, 2025 -

Tom Thibodeaus High Praise For St Johns Success A New York Knicks Perspective

May 17, 2025

Tom Thibodeaus High Praise For St Johns Success A New York Knicks Perspective

May 17, 2025

Latest Posts

-

Acidente Com Onibus Universitario Ao Menos Mortos E Feridos

May 17, 2025

Acidente Com Onibus Universitario Ao Menos Mortos E Feridos

May 17, 2025 -

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025 -

Trumps Student Loan Order Diverse Reactions From Black Americans

May 17, 2025

Trumps Student Loan Order Diverse Reactions From Black Americans

May 17, 2025 -

Local Science Educator Honored Sheyenne Highs Eagleson Receives Prestigious Award

May 17, 2025

Local Science Educator Honored Sheyenne Highs Eagleson Receives Prestigious Award

May 17, 2025 -

Former Springfield City Councilman Joins Missouri State Board Of Education

May 17, 2025

Former Springfield City Councilman Joins Missouri State Board Of Education

May 17, 2025