Trump's 30% Tariffs On China: An Extended Forecast Through 2025

Table of Contents

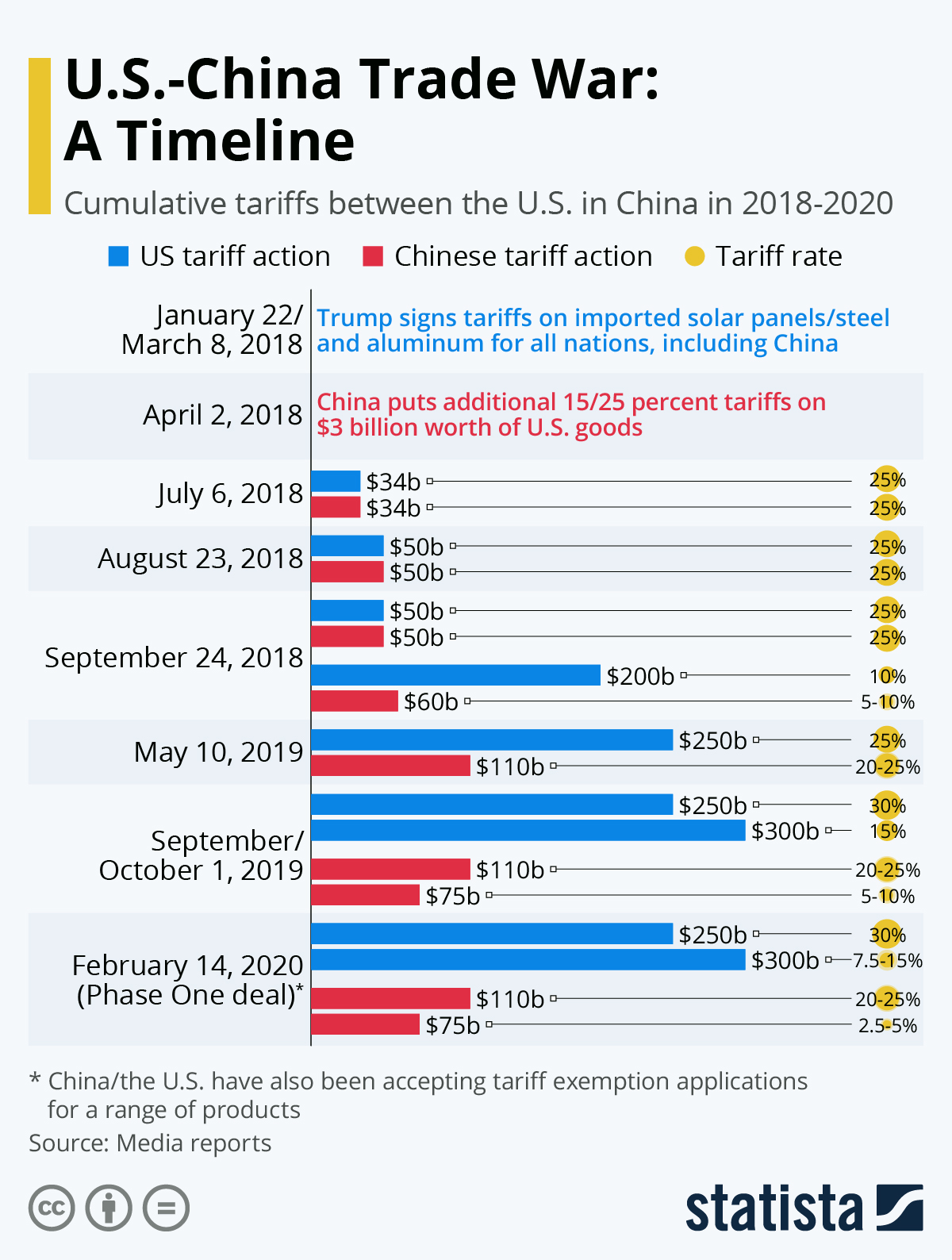

Initial Impact and Short-Term Effects (2018-2020)

Increased Prices for Consumers

The immediate consequence of Trump's 30% tariffs on Chinese goods was a noticeable rise in prices for consumers. This increase affected a wide range of products, impacting household budgets across the board.

- Examples of specific products: Steel, aluminum, furniture, electronics, and clothing experienced significant price hikes.

- Statistical data on price increases: The Consumer Price Index (CPI) showed a clear correlation between the tariff implementation and increased inflation, particularly in sectors heavily reliant on Chinese imports. Specific data points from relevant periods would be included here, citing reputable sources like the Bureau of Labor Statistics.

- Consumer sentiment surveys: Surveys conducted during this period revealed widespread consumer dissatisfaction with rising prices, impacting purchasing power and consumer confidence.

Keywords: Consumer price index, inflation, import costs, retail prices, cost of living

Retaliatory Tariffs from China

China responded swiftly to the Trump administration's tariffs with its own retaliatory measures. This escalated the situation, leading to a full-blown trade war with significant consequences for both economies.

- Examples of Chinese retaliatory tariffs: China targeted US agricultural products, impacting soybean farmers and other agricultural exporters. They also levied tariffs on various manufactured goods.

- Impact on specific US industries: Industries like agriculture, manufacturing, and technology were significantly impacted by reduced exports to China and increased import costs.

- Trade volume changes: Bilateral trade volume between the US and China decreased sharply during this period, reflecting the negative impact of the trade war.

Keywords: Trade war, retaliatory tariffs, bilateral trade, trade deficit, US-China trade relations

Impact on US Businesses and Employment

The trade war resulting from Trump's 30% tariffs had a mixed impact on US businesses and employment. While some sectors experienced job losses, others saw opportunities for growth.

- Data on job losses/gains in specific industries: Some manufacturing sectors reliant on Chinese imports experienced job losses due to reduced competitiveness. However, other industries, particularly those focusing on domestic production, potentially saw increased job creation. Specific data would be required here, sourced from reliable economic reports.

- Business relocation trends: Some US companies considered relocating production facilities outside of China to avoid tariffs, impacting employment in different regions.

- Government support programs: The government implemented various support programs aimed at mitigating the negative impact of the tariffs on businesses and workers, though their effectiveness remains a subject of debate.

Keywords: US manufacturing, job creation, unemployment, business investment, economic impact

Mid-Term Adjustments and Shifting Global Dynamics (2021-2023)

Phase One Trade Deal and Tariff Reductions

The "Phase One" trade deal between the US and China in 2020 brought some relief, resulting in tariff reductions on certain goods. This phase aimed to de-escalate trade tensions, though it didn't eliminate them entirely.

- Details of tariff reductions: Specific details on which tariffs were reduced and the extent of the reduction would be outlined here.

- Impact on trade volumes: The tariff reductions led to a modest increase in trade volumes between the two countries, signaling a tentative step towards de-escalation.

- Changes in business strategies: Businesses began adjusting their strategies in response to the changing tariff landscape, including reassessing sourcing and production locations.

Keywords: Phase One Trade Deal, tariff reductions, trade negotiations, economic recovery

The COVID-19 Pandemic's Influence

The COVID-19 pandemic profoundly disrupted global supply chains, adding another layer of complexity to the ongoing trade tensions.

- Supply chain disruptions: Lockdowns and logistical challenges significantly impacted global supply chains, creating shortages and further increasing prices.

- Increased reliance on domestic production: The pandemic highlighted the vulnerability of relying heavily on a single source for goods, leading some businesses to explore options for domestic production or nearshoring.

- Changes in consumer demand: Consumer demand shifted during the pandemic, impacting various sectors and creating new challenges for businesses navigating both the pandemic and trade tensions.

Keywords: COVID-19, supply chain disruptions, global trade, economic slowdown, pandemic impact

Restructuring of Global Supply Chains

The combined impact of the tariffs and the pandemic accelerated the restructuring of global supply chains.

- Examples of companies diversifying supply chains: Many companies diversified their supply chains to reduce reliance on a single country or region, reducing vulnerability to future disruptions.

- “Reshoring” and “nearshoring” trends: The trends of bringing manufacturing back to the home country ("reshoring") or moving it to nearby countries ("nearshoring") gained momentum as businesses sought to enhance supply chain resilience.

- Impact on developing economies: The shift in supply chains has implications for developing economies that previously relied heavily on exports to the US and China.

Keywords: Reshoring, nearshoring, supply chain diversification, global manufacturing, supply chain resilience

Long-Term Consequences and Forecast Through 2025

Continued Trade Tensions and Geopolitical Implications

Despite the Phase One deal, trade tensions between the US and China are likely to persist through 2025.

- Predictions on future trade negotiations: Further negotiations and potential adjustments to trade policies are expected. The outcome will depend on the geopolitical climate and the priorities of both governments.

- Potential for further tariffs or trade disputes: The risk of new tariffs or trade disputes remains, depending on future developments in the relationship between the two countries.

- Geopolitical risks: Geopolitical factors, such as the ongoing competition for technological dominance, will continue to influence the trajectory of US-China trade relations.

Keywords: Geopolitical risks, US-China relations, trade policy, long-term economic outlook, trade agreements

Technological Competition and Decoupling

The competition between the US and China in technology is intensifying, potentially leading to a decoupling of the two economies.

- Examples of technological competition: Competition is evident in areas such as 5G technology, artificial intelligence, and semiconductors.

- Impact on innovation: This competition may both stimulate and hinder innovation, depending on the approach taken by both governments.

- Potential for economic separation: A complete decoupling of the US and Chinese economies is a significant risk, with potentially far-reaching global implications.

Keywords: Technological competition, decoupling, technological independence, innovation, technological advancement

Economic Projections and Investment Strategies

Predicting the precise economic impact of Trump's 30% tariffs through 2025 is challenging.

- Economic growth forecasts: Economic growth forecasts for both the US and China will need to account for the ongoing impacts of the trade war and related geopolitical factors.

- Sector-specific predictions: Specific sectors will experience different outcomes; some may benefit from reshoring and diversification, while others might continue to face challenges.

- Investment opportunities and risks: Investors need to carefully assess the risks and opportunities presented by the evolving trade landscape, adapting their strategies accordingly.

Keywords: Economic forecast, investment strategies, risk assessment, market analysis, economic growth

Conclusion

Trump's 30% tariffs on Chinese goods have had profound and lasting effects on the global economy, with impacts extending far beyond the initial imposition. While some tariffs have been reduced, the ripple effects continue to influence trade relations, supply chains, and global economic growth. Understanding the long-term consequences, as outlined in this forecast through 2025, is crucial for businesses, investors, and policymakers alike. By carefully analyzing the evolving geopolitical landscape and adapting strategies accordingly, stakeholders can navigate the complexities of this ongoing trade dynamic. To stay informed on the latest developments related to Trump's 30% tariffs on China and their continuing impact, continue following our analysis and updates.

Featured Posts

-

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025 -

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025 -

Oil Market News And Analysis May 16 2024 Update

May 17, 2025

Oil Market News And Analysis May 16 2024 Update

May 17, 2025 -

What Is Creatine And How Does It Work

May 17, 2025

What Is Creatine And How Does It Work

May 17, 2025 -

Pga Championship Upset In Round One As Unexpected Leader Emerges

May 17, 2025

Pga Championship Upset In Round One As Unexpected Leader Emerges

May 17, 2025

Latest Posts

-

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025 -

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025 -

What Is Creatine And How Does It Work

May 17, 2025

What Is Creatine And How Does It Work

May 17, 2025 -

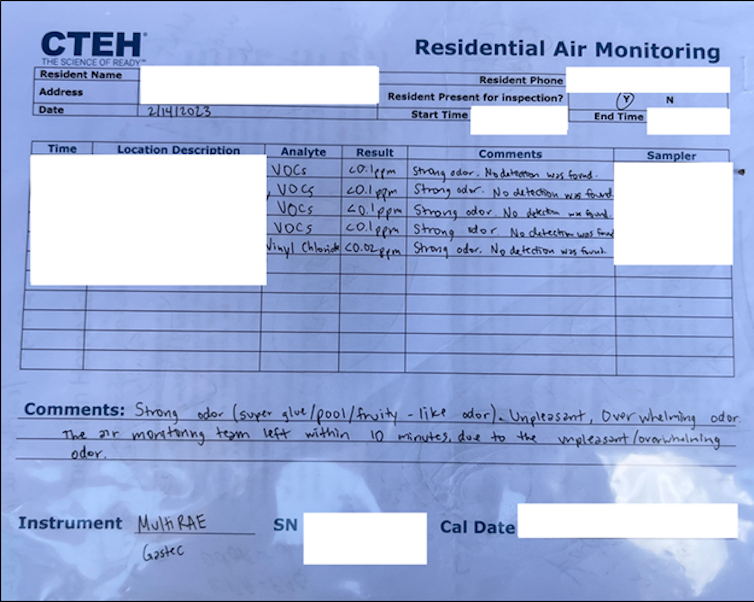

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025 -

Creatine For Beginners A Simple Explanation

May 17, 2025

Creatine For Beginners A Simple Explanation

May 17, 2025