Cryptocurrency's Future Despite Geopolitical Uncertainty

Table of Contents

Cryptocurrency as a Hedge Against Geopolitical Risk

The decentralized nature of cryptocurrencies offers a potential hedge against the risks associated with geopolitical instability. Unlike fiat currencies controlled by governments, cryptocurrencies operate independently, making them less susceptible to inflation, sanctions, and government manipulation. This inherent resilience positions crypto as a potential safe haven asset during times of crisis.

-

Examples of past geopolitical events and their impact on crypto markets: The Russian invasion of Ukraine in 2022, for instance, saw a surge in cryptocurrency adoption in both countries as citizens sought to protect their assets from economic sanctions and currency devaluation. Similarly, periods of political unrest in various regions have historically seen increases in Bitcoin and other cryptocurrency trading volumes.

-

Comparison of crypto's performance against traditional assets during periods of uncertainty: Studies have shown that, in certain instances, cryptocurrencies have outperformed traditional assets like stocks and bonds during times of geopolitical turmoil, showcasing their potential as a diversifying investment. However, it's crucial to note that cryptocurrency markets are still relatively young and volatile, and past performance doesn't guarantee future results.

-

Mention specific cryptocurrencies often seen as safe havens (e.g., Bitcoin): Bitcoin, often referred to as "digital gold," is frequently cited as a safe-haven asset due to its scarcity and established market position. However, other cryptocurrencies with strong fundamentals and established communities may also demonstrate similar resilience during periods of uncertainty.

Regulatory Landscape and its Influence on Cryptocurrency Adoption

The regulatory landscape surrounding cryptocurrencies varies significantly across nations. This regulatory disparity directly impacts the growth and adoption of cryptocurrencies globally. Clear and consistent regulations can foster investor confidence and market stability, while ambiguous or restrictive laws can stifle innovation and hinder broader adoption.

-

Examples of countries with favorable crypto regulations and their effects: Countries like El Salvador, which has adopted Bitcoin as legal tender, are demonstrating a proactive approach to crypto regulation. This has, to some extent, boosted both Bitcoin adoption and foreign investment.

-

Examples of countries with restrictive regulations and their consequences: Conversely, countries with strict bans or overly cautious regulatory frameworks often see reduced cryptocurrency activity and capital flight to jurisdictions with more lenient policies.

-

Discussion on the potential for future global crypto regulation: The future likely holds a shift towards greater international cooperation in regulating the cryptocurrency space, balancing the need for consumer protection with the promotion of innovation. International regulatory frameworks could bring increased stability and attract more mainstream investment.

Technological Advancements Shaping Cryptocurrency's Resilience

Significant technological advancements within the cryptocurrency ecosystem are enhancing its resilience to geopolitical shocks. These advancements are bolstering scalability, privacy, and overall security.

-

Examples of specific technological advancements and their benefits: Layer-2 scaling solutions like Lightning Network for Bitcoin and Polygon for Ethereum dramatically improve transaction speeds and reduce fees, making crypto more accessible and practical for everyday use, even during periods of network congestion caused by geopolitical events.

-

Discussion on the role of blockchain technology in ensuring transparency and security: The inherent transparency and security of blockchain technology remain crucial in maintaining trust and confidence in cryptocurrencies, even amidst uncertainty. The immutable nature of blockchain records strengthens the integrity of transactions.

-

Mention the potential for cross-border payments and reduced reliance on traditional financial systems: Cryptocurrencies facilitate cross-border payments with greater speed and efficiency, potentially bypassing traditional financial systems susceptible to geopolitical manipulation or sanctions. This decentralized approach to finance is a key component of its resilience.

The Role of Institutional Investment in Crypto's Long-Term Stability

The growing involvement of institutional investors—large financial institutions, hedge funds, and corporations—in the cryptocurrency market is a significant factor contributing to its long-term stability. This influx of capital brings increased liquidity and reduces volatility compared to a market driven primarily by retail investors.

-

Examples of large institutional investors entering the crypto space: Several major financial institutions now hold significant cryptocurrency assets, signaling a growing acceptance of crypto as an asset class worthy of inclusion in diversified portfolios.

-

Discussion on the impact of institutional investment on price stability: Institutional investors typically employ more sophisticated risk management strategies, potentially leading to more stable price action and a reduction in extreme volatility.

-

Mention the potential for increased market maturity and reduced speculation: Increased institutional participation tends to foster more mature market dynamics, moving away from speculative bubbles and towards a more sustainable, long-term growth trajectory.

Securing Cryptocurrency's Future in a Turbulent World

In conclusion, while the future of cryptocurrency's future despite geopolitical uncertainty remains somewhat unpredictable, several factors point towards its potential for resilience. The decentralized nature of cryptocurrencies, combined with technological advancements, evolving regulatory frameworks, and increasing institutional adoption, all contribute to a more stable and robust ecosystem. By understanding these factors and engaging in careful research, individuals can navigate the complexities of the crypto market and consider the potential benefits of incorporating cryptocurrencies into their investment strategies. Continue learning about cryptocurrency's future despite geopolitical uncertainty and research different cryptocurrencies and investment strategies thoughtfully to make informed decisions. [Link to further resources (if applicable)]

Featured Posts

-

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 09, 2025

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 09, 2025 -

Investigacao Avanca Mulher Que Afirma Ser Madeleine Mc Cann Presa No Reino Unido

May 09, 2025

Investigacao Avanca Mulher Que Afirma Ser Madeleine Mc Cann Presa No Reino Unido

May 09, 2025 -

India En Brekelmans De Toekomst Van Een Partnerschap

May 09, 2025

India En Brekelmans De Toekomst Van Een Partnerschap

May 09, 2025 -

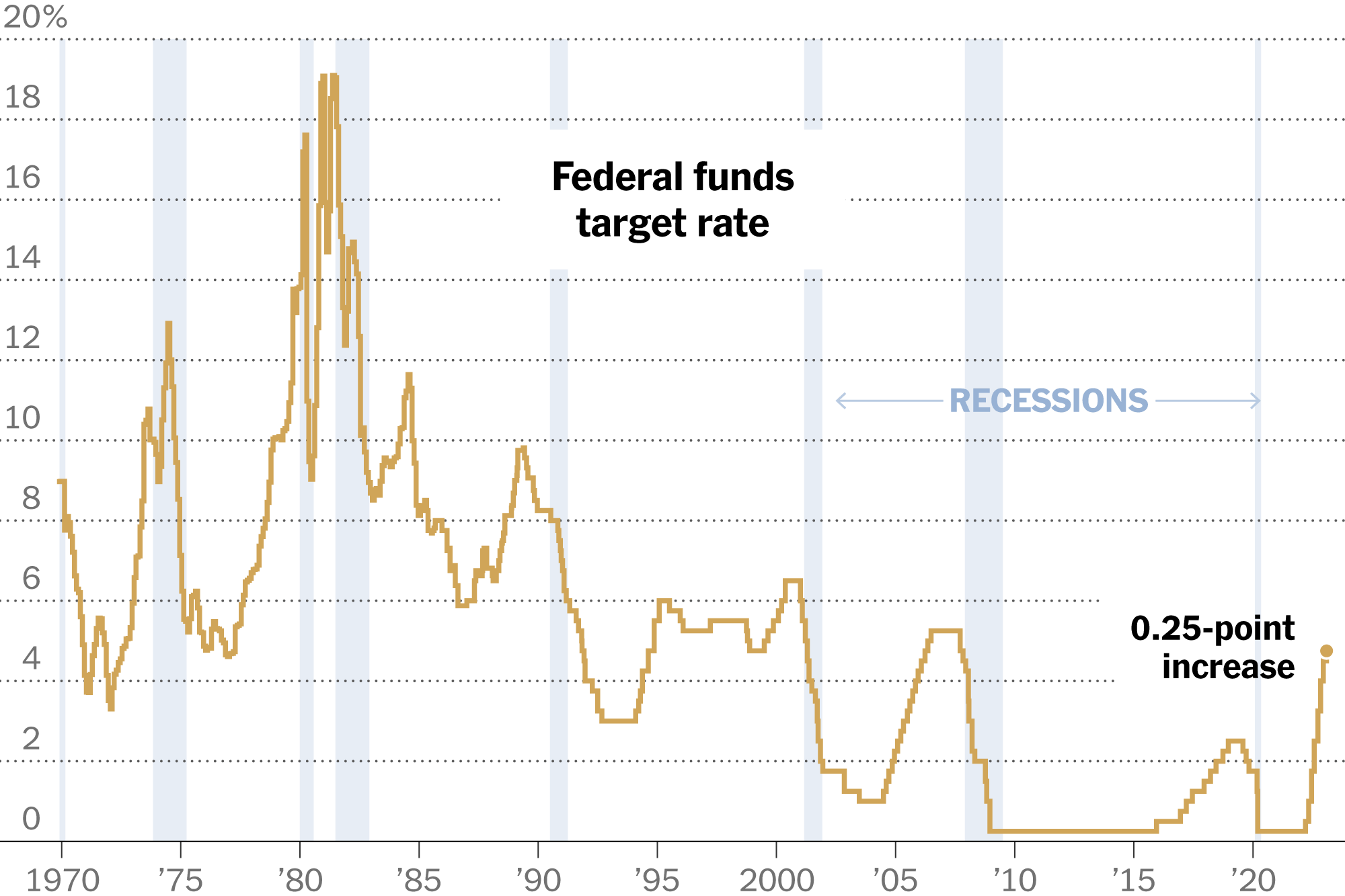

Assessing The Federal Reserves Next Move Inflation And Rate Hikes

May 09, 2025

Assessing The Federal Reserves Next Move Inflation And Rate Hikes

May 09, 2025 -

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025