D-Wave Quantum (QBTS) Stock Price Drop: Impact Of Kerrisdale Capital's Report

Table of Contents

Kerrisdale Capital's Report: Key Allegations and Evidence

Kerrisdale Capital, a well-known short-selling firm, published a scathing report detailing numerous concerns about D-Wave Quantum's business practices and technological claims. The report alleges significant discrepancies between D-Wave's public pronouncements and its actual technological capabilities and financial performance. The evidence presented included a detailed analysis of D-Wave's financial statements, highlighting what Kerrisdale deemed misleading projections and questionable accounting practices. Technological limitations were also heavily scrutinized.

Key criticisms leveled against D-Wave Quantum in the Kerrisdale Capital report include:

- Overstated technological capabilities: The report challenged D-Wave's claims regarding the power and applicability of its quantum annealing technology.

- Misleading financial projections: Kerrisdale argued that D-Wave's financial projections were overly optimistic and lacked a solid foundation.

- Questionable business model: The report questioned the long-term viability of D-Wave's business model and its ability to generate sustainable revenue.

- Concerns about market competition: The report highlighted the increasing competition in the quantum computing space, suggesting D-Wave may struggle to maintain its market position.

You can find the original Kerrisdale Capital report . This report is crucial reading for anyone interested in a deeper understanding of the allegations.

Market Reaction and Impact on QBTS Stock Price

The release of the Kerrisdale Capital report triggered an immediate and dramatic negative reaction in the market. The QBTS stock price experienced a sharp decline, reflecting investor concerns about the validity of D-Wave's claims and the long-term prospects of the company.

Key observations regarding the market reaction include:

- Percentage drop in QBTS stock price: [Insert percentage drop here - needs to be researched and updated].

- Changes in trading volume: Trading volume significantly increased following the report's release, indicating heightened investor activity and uncertainty.

- Investor responses: Many investors reacted by selling their QBTS shares, leading to a further decrease in the stock price. Others chose to hold, while a smaller number may have viewed the dip as a buying opportunity.

- Impact on market capitalization: The stock price decline resulted in a substantial decrease in D-Wave Quantum's market capitalization.

This substantial market reaction underscores the significance of the Kerrisdale Capital report and its impact on investor sentiment towards D-Wave Quantum. The negative sentiment quickly spread throughout the quantum computing investment community.

D-Wave Quantum's Response and Counterarguments

D-Wave Quantum responded to Kerrisdale Capital's report with an official press release [insert link here - replace with actual link], attempting to refute the allegations and defend its technological capabilities and business model. The company's counterarguments primarily focused on challenging the accuracy of Kerrisdale's analysis and highlighting the ongoing progress in its technology development and commercialization efforts.

However, the effectiveness of D-Wave's rebuttal remains a matter of ongoing debate among investors and analysts. Some viewed the response as insufficient to address the key concerns raised in the Kerrisdale report, while others considered it a reasonable defense against what they perceived as overly critical analysis. The strength and credibility of D-Wave's response will ultimately influence the long-term trajectory of the QBTS stock price.

Long-Term Implications for D-Wave Quantum and the Quantum Computing Industry

The long-term implications of the Kerrisdale Capital report extend beyond the immediate impact on D-Wave Quantum's stock price. The report's revelations could significantly impact the company's ability to secure future funding rounds and forge strategic partnerships. Furthermore, the controversy could erode investor confidence not only in D-Wave Quantum but also in the broader quantum computing industry, potentially hindering the sector's overall growth and development. The credibility of quantum computing companies, in general, may be affected, causing potential investors to increase their due diligence processes.

Conclusion: Navigating the Uncertainty of QBTS After the Kerrisdale Report

The Kerrisdale Capital report has significantly impacted D-Wave Quantum (QBTS), causing a substantial drop in its stock price and raising concerns about the company's future prospects. While D-Wave has offered counterarguments, the long-term consequences remain uncertain. The event highlights the inherent risks associated with investing in the still-developing quantum computing sector.

Before making any investment decisions related to D-Wave Quantum (QBTS) or other quantum computing stocks, thorough due diligence is crucial. We encourage readers to conduct independent research and carefully consider the risks involved. Further reading on quantum computing investments and risk assessment is highly recommended to help inform your investment strategy. Understanding the complexities of the quantum computing market and the inherent volatility of its stocks is paramount for making informed investment decisions about D-Wave Quantum (QBTS) and other similar companies.

Featured Posts

-

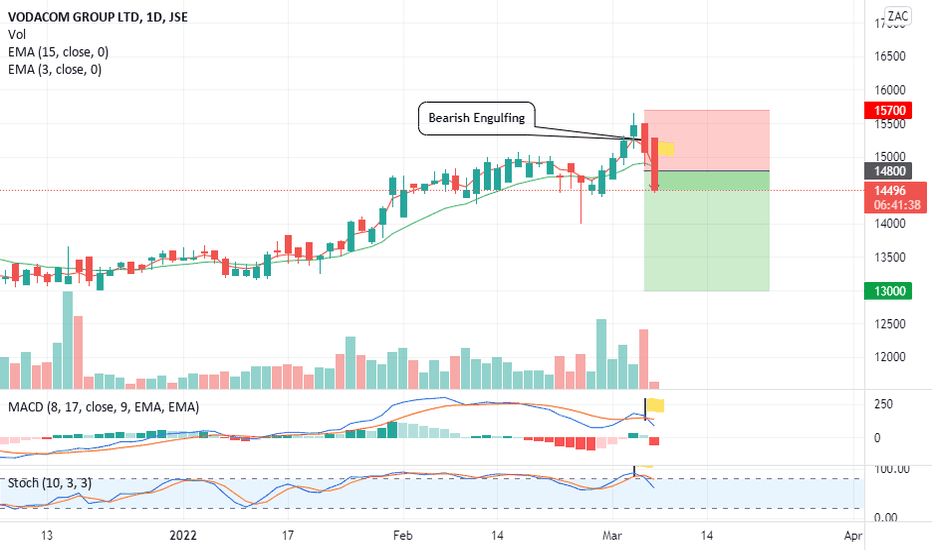

Vodacom Vod Reports Better Than Anticipated Earnings And Payout

May 20, 2025

Vodacom Vod Reports Better Than Anticipated Earnings And Payout

May 20, 2025 -

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

Leverkusens Win Delays Bayern Munichs Bundesliga Celebrations Kane Out

May 20, 2025

Leverkusens Win Delays Bayern Munichs Bundesliga Celebrations Kane Out

May 20, 2025 -

Germanys Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germanys Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Todays Nyt Mini Crossword Answers April 13

May 20, 2025

Todays Nyt Mini Crossword Answers April 13

May 20, 2025