Dangote And NNPC: A Joint Effort To Stabilize Petrol Prices In Nigeria?

Table of Contents

Dangote Refinery's Potential Impact on Petrol Prices

The Dangote refinery, touted as Africa's largest, holds immense potential for transforming Nigeria's fuel landscape. With a refining capacity of 650,000 barrels per day, it promises a significant increase in domestic refining capacity. This increased refining capacity Nigeria could drastically reduce the nation's reliance on imported fuel.

- Reduced Fuel Imports: Currently, Nigeria imports a substantial portion of its petrol needs, making it highly vulnerable to global price fluctuations and supply chain disruptions. The Dangote refinery could significantly decrease fuel import reduction, leading to greater control over domestic prices.

- Domestic Fuel Production: Increased domestic fuel production will strengthen Nigeria's energy security and lessen its dependence on foreign suppliers. This enhanced self-sufficiency is a cornerstone of petrol price control.

- Fuel Subsidy Implications: The substantial cost of fuel subsidies has long burdened the Nigerian government. Increased local refining could substantially reduce these costs, freeing up resources for other crucial sectors. A significant reduction in the need for imported fuel directly impacts the government's fuel subsidy expenditure.

NNPC's Role and Challenges

The NNPC currently plays a dominant role in petrol importation and distribution in Nigeria. However, the corporation faces numerous challenges in effectively managing fuel supply and maintaining price stability.

- NNPC Operations: The NNPC's operations are complex, often facing logistical hurdles, infrastructure limitations, and operational inefficiencies.

- Fuel Distribution Nigeria: Ensuring efficient and equitable fuel distribution across the country is a major undertaking, with challenges ranging from pipeline vandalism to inadequate storage facilities.

- Petroleum Sector Challenges Nigeria: The Nigerian petroleum sector is plagued by various issues, including corruption, regulatory inconsistencies, and a lack of transparency, all impacting the NNPC's ability to effectively manage fuel prices.

- Potential Collaboration Areas: A partnership with Dangote could leverage Dangote's refining capacity to address some of NNPC's distribution challenges and improve price control mechanisms. This NNPC Dangote partnership could lead to a more streamlined and efficient supply chain.

- Political and Economic Implications: Any collaboration between NNPC and Dangote carries significant political and economic implications, requiring careful consideration of government regulations and potential market impacts.

Potential Benefits of a Joint Venture

A joint venture between Dangote and NNPC offers significant potential benefits for Nigeria.

- Economic Benefits: The primary benefit would be increased price stability benefits, leading to more predictable fuel costs for businesses and consumers. This would also boost economic growth Nigeria by reducing uncertainty and fostering investment. Greater fuel security Nigeria through increased local production is another key economic advantage.

- Social Benefits: Stable and affordable petrol prices would alleviate hardship for ordinary Nigerians, freeing up household budgets and boosting overall economic activity.

- Challenges: Potential challenges include logistical hurdles in coordinating refining and distribution, navigating complex regulatory frameworks, and mitigating the risk of market manipulation. Establishing a strong public-private partnership Nigeria model is critical to overcoming these challenges.

Obstacles and Considerations

Despite the potential benefits, several obstacles must be addressed to ensure the success of a Dangote-NNPC joint venture.

- Regulatory Challenges Nigeria: Navigating Nigeria's regulatory environment, securing necessary permits, and ensuring compliance with all relevant laws and regulations will be crucial.

- Funding Requirements: Securing adequate funding for the project, potentially involving international investors and financial institutions, will be a key consideration.

- Conflicts of Interest: Mechanisms must be in place to address potential conflicts of interest between the two entities and ensure transparency in decision-making. A robust risk assessment is vital.

- Transparency in Governance: Establishing clear governance structures, promoting transparency, and ensuring accountability are crucial for building public trust and preventing corruption. Attracting international investment hinges on transparency in governance.

Conclusion

A joint venture between Dangote and NNPC holds significant potential for stabilizing petrol prices in Nigeria. While the benefits – including increased price stability benefits, improved fuel security Nigeria, and enhanced economic growth Nigeria – are considerable, challenges related to regulation, funding, and governance must be carefully addressed. A successful partnership would require strong collaboration, transparency, and a commitment to equitable outcomes. Further discussion and analysis on the potential of a Dangote-NNPC collaboration for petrol price stabilization in Nigeria are essential. Further research into the Dangote and NNPC partnership is crucial for understanding its long-term impact. The future of petrol pricing in Nigeria may very well depend on the success of such collaborations.

Featured Posts

-

Palantir Stock Investment Outlook And Buying Strategies

May 10, 2025

Palantir Stock Investment Outlook And Buying Strategies

May 10, 2025 -

Disneys Profit Outlook Improves Parks And Streaming Drive Growth

May 10, 2025

Disneys Profit Outlook Improves Parks And Streaming Drive Growth

May 10, 2025 -

Difficultes Economiques D Epicure A La Cite De La Gastronomie De Dijon

May 10, 2025

Difficultes Economiques D Epicure A La Cite De La Gastronomie De Dijon

May 10, 2025 -

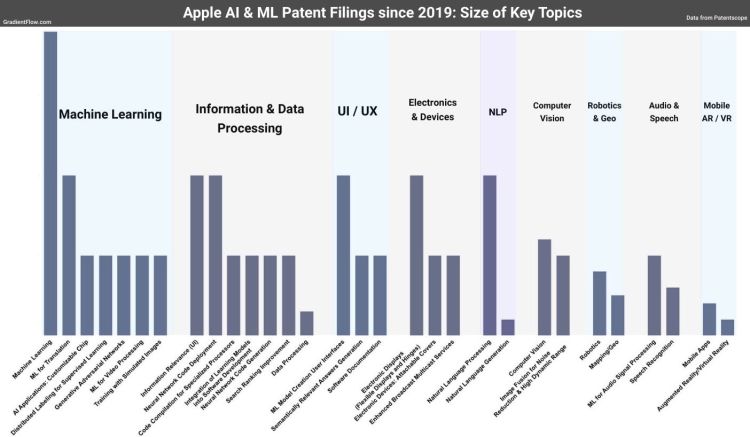

Is Apples Ai Strategy On The Right Path A Critical Analysis

May 10, 2025

Is Apples Ai Strategy On The Right Path A Critical Analysis

May 10, 2025 -

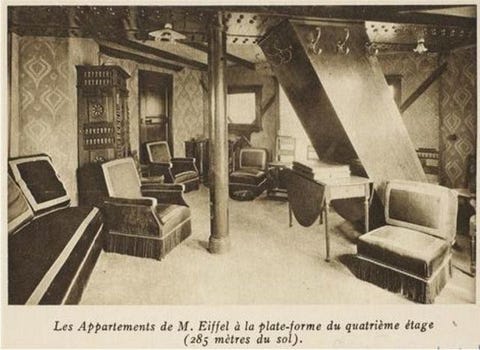

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 10, 2025

Dijon La Contribution Meconnue De Melanie Eiffel A La Tour Eiffel

May 10, 2025