Palantir Stock: Investment Outlook And Buying Strategies

Table of Contents

Understanding Palantir Technologies and its Business Model

Palantir Technologies is a data analytics company specializing in providing software platforms for large-scale data integration and analysis. Its success hinges on two core offerings:

Data Analytics and Government Contracts

Palantir's foundation is built upon its government contracts. These contracts generate significant revenue and provide a degree of stability. The company's platforms, Gotham and Foundry, are instrumental in this success:

- Gotham: Primarily serves government agencies, assisting in national security, intelligence gathering, and counter-terrorism efforts. These long-term contracts offer predictable revenue streams.

- Foundry: Targets commercial clients across various sectors, offering a platform for data integration and analysis to improve operational efficiency and decision-making.

While the reliance on government contracts provides stability, it also presents potential risks:

- Government budget fluctuations: Changes in government spending could impact future contract awards.

- Regulatory hurdles: Navigating government regulations and security clearances can be complex and time-consuming.

However, Palantir is actively diversifying its revenue streams by focusing on expanding its commercial client base.

Commercial Market Expansion

Palantir's push into the commercial sector is crucial for long-term growth. The company is targeting various industries:

- Healthcare: Improving operational efficiency, streamlining research, and enhancing patient care.

- Finance: Strengthening fraud detection, risk management, and regulatory compliance.

- Energy: Optimizing operations, predicting asset failures, and improving resource allocation.

Successful commercial partnerships are vital to Palantir’s future. Challenges remain in penetrating established commercial markets and competing with other analytics companies. However, the potential rewards are substantial.

Palantir Stock: Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is crucial for any potential investor.

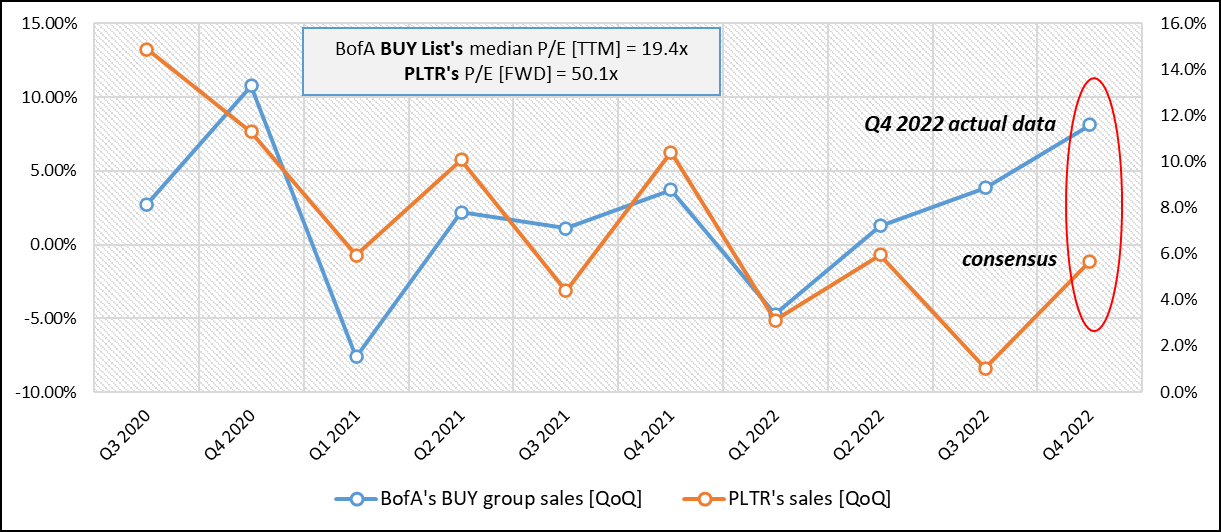

Revenue Growth and Profitability

Palantir has shown consistent revenue growth in recent years. However, profitability remains a key focus for the company:

- Revenue Growth: Examine yearly revenue figures to track the growth trajectory. Look for consistent upward trends.

- Earnings Per Share (EPS): This metric reflects the company's profitability on a per-share basis. Positive EPS signals improved profitability.

- Cash Flow: Strong cash flow indicates the company's ability to generate cash from its operations. This is crucial for sustainability and future investments.

Palantir's path to profitability is a key factor to consider when evaluating Palantir stock.

Stock Valuation and Price-to-Sales Ratio

Evaluating Palantir's stock valuation requires a comprehensive approach. The price-to-sales (P/S) ratio is a common metric used:

- Price-to-Sales Ratio (P/S): This ratio compares the company's market capitalization to its revenue. A lower P/S ratio may suggest the stock is undervalued.

- Competitor Comparison: Compare Palantir's P/S ratio to its competitors to gauge its relative valuation.

- Future Growth Expectations: The market often prices stocks based on future growth expectations. High growth expectations can justify a higher P/S ratio.

Investment Outlook and Risks

Investing in Palantir stock presents significant opportunities but also carries inherent risks.

Growth Potential and Future Projections

Palantir's growth potential is tied to several factors:

- Market Expansion: Continued penetration into the commercial market will be a crucial driver of growth.

- Technological Advancements: Innovation in data analytics and artificial intelligence will be vital for maintaining a competitive edge.

- Strategic Acquisitions: Acquiring complementary companies could accelerate Palantir's growth.

Analyst projections should be considered but should not be the sole basis for investment decisions.

Risk Assessment and Mitigation

Investing in Palantir stock comes with several risks:

- Competition: The data analytics market is highly competitive, with established players and new entrants.

- Regulatory Changes: Government regulations could impact Palantir's ability to operate effectively.

- Economic Downturns: Economic instability could reduce demand for Palantir's services.

Mitigation strategies include diversification (spreading investments across different asset classes) and dollar-cost averaging (investing a fixed amount at regular intervals).

Palantir Stock: Buying Strategies

Timing the market and proper portfolio allocation are crucial for success when investing in Palantir stock.

Timing the Market

Determining the optimal time to buy Palantir stock requires a combination of approaches:

- Fundamental Analysis: Focus on the company's financial performance, business model, and competitive landscape.

- Technical Analysis: Examine chart patterns, trading volume, and other technical indicators.

- Market Sentiment: Gauge investor sentiment towards Palantir stock and the broader market.

Dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, can help mitigate risk. Long-term investing is generally recommended for stocks like Palantir.

Portfolio Allocation and Diversification

Diversification is critical to managing risk:

- Risk Tolerance: Only invest an amount that aligns with your individual risk tolerance.

- Asset Allocation: Spread investments across various asset classes, not just Palantir stock.

- Diversification Benefits: Reduces overall portfolio volatility and protects against significant losses.

Conclusion

Investing in Palantir stock presents both exciting opportunities and considerable risks. By carefully analyzing the company's financial performance, understanding its business model, and employing smart buying strategies, investors can make informed decisions. Remember to diversify your portfolio and consider your risk tolerance before investing in Palantir or any other stock. Thorough research and a long-term perspective are crucial for success in navigating the complexities of the Palantir stock market. Start your research today and learn more about how to effectively invest in Palantir stock. Consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

Investing In Palantir Before May 5th A Data Driven Analysis

May 10, 2025

Investing In Palantir Before May 5th A Data Driven Analysis

May 10, 2025 -

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025 -

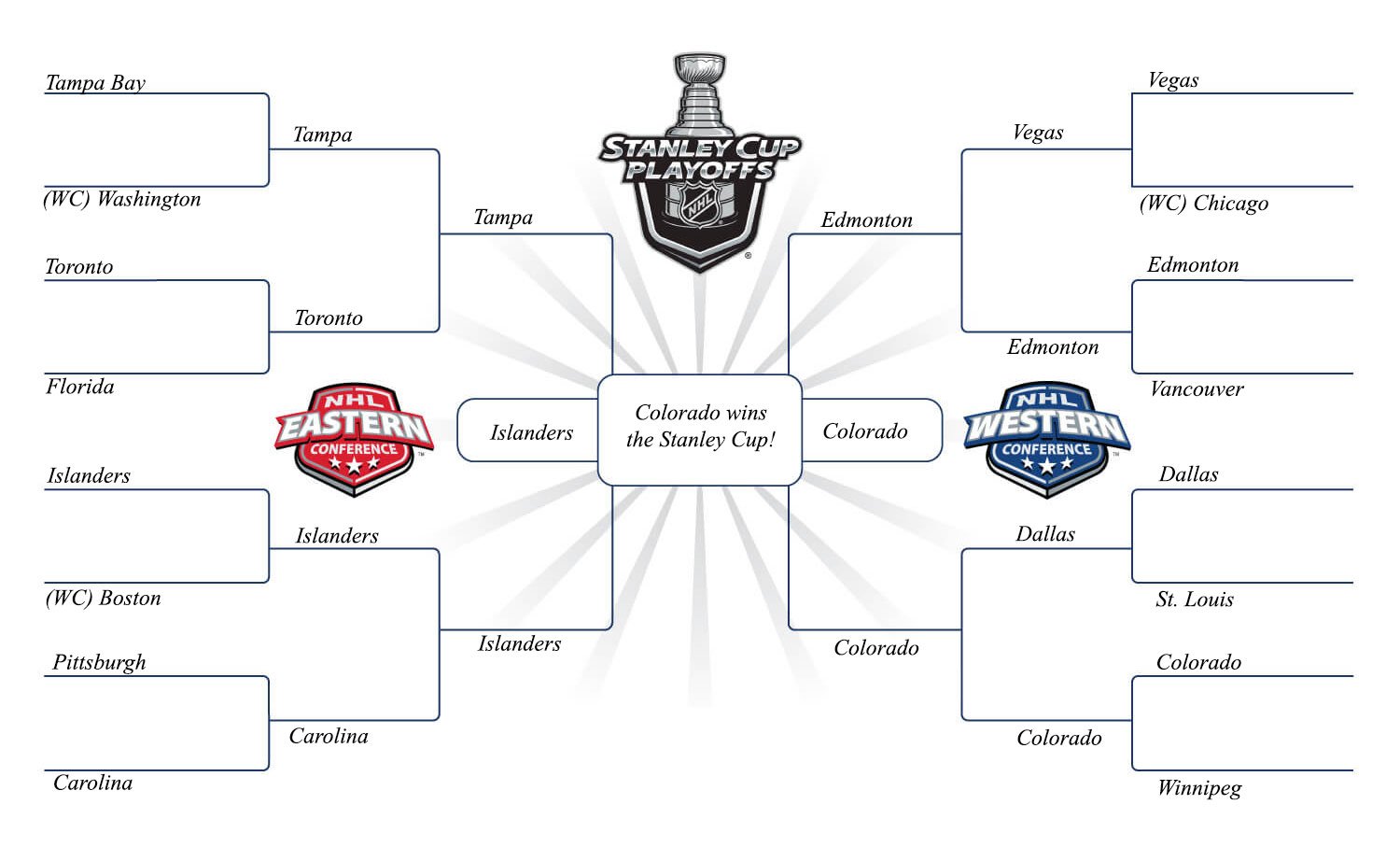

Post 2025 Nhl Season Playoff Predictions Based On Trade Deadline Moves

May 10, 2025

Post 2025 Nhl Season Playoff Predictions Based On Trade Deadline Moves

May 10, 2025 -

Novi Zayavi Stivena Kinga Pro Politiku Tramp Ta Mask U Fokusi

May 10, 2025

Novi Zayavi Stivena Kinga Pro Politiku Tramp Ta Mask U Fokusi

May 10, 2025 -

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 10, 2025

Uk Citys Transformation Caravan Dwellers And Growing Concerns

May 10, 2025