Dogecoin's Recent Decline: A Look At Elon Musk's Role And Tesla's Performance

Table of Contents

Dogecoin, the meme-based cryptocurrency, has experienced significant price fluctuations recently, leaving many investors wondering about the future of this volatile digital asset. This article delves into the reasons behind Dogecoin's recent decline, focusing on the influential role of Elon Musk and the performance of Tesla, a company intrinsically linked to the digital asset's trajectory. We will analyze the correlation between Musk's actions, Tesla's market performance, and the resulting impact on Dogecoin's value, providing a comprehensive understanding of the complex factors at play.

Elon Musk's Influence on Dogecoin's Price

Tweets and Market Sentiment

Elon Musk's pronouncements, particularly his tweets, have a demonstrably significant impact on Dogecoin's price. His enthusiastic endorsements have, in the past, propelled Dogecoin to impressive highs, while conversely, even a seemingly innocuous tweet can trigger a sharp decline. This influence stems from Musk's massive social media following and the considerable influence he wields over market sentiment.

- Example 1: Musk's tweets featuring Doge-related memes or positive comments have historically led to immediate surges in Dogecoin's price, attracting new investors and fueling speculative trading.

- Example 2: Conversely, tweets expressing doubt or even silence regarding Dogecoin have resulted in significant price drops, demonstrating the power of his words to sway market sentiment.

- Market Manipulation Concerns: The significant price swings triggered by Musk's tweets have raised concerns about potential market manipulation. Regulators are increasingly scrutinizing the influence of high-profile individuals on cryptocurrency markets.

- Investor Confidence: Musk's statements create a powerful psychological impact on investor confidence. Positive pronouncements instill confidence, driving up demand, whereas negative comments can trigger sell-offs and exacerbate market volatility.

Tesla's Acceptance of Dogecoin (Past and Present)

Tesla's previous acceptance of Dogecoin as a payment method for certain merchandise generated significant positive attention and boosted Dogecoin's adoption. However, the subsequent retraction of this policy highlighted the inherent volatility associated with such partnerships and impacted Dogecoin's perceived value and market stability.

- Timeline: Tesla initially accepted Dogecoin in late 2021, briefly boosting its price. The decision was later reversed, resulting in a price correction.

- Investor Sentiment: The initial acceptance fostered positive sentiment, attracting new investors and increasing trading volume. The subsequent retraction dampened this enthusiasm, leading to uncertainty among investors.

- Comparison to other Cryptocurrencies: The acceptance and subsequent rejection of Dogecoin by Tesla provided a case study on the risks and rewards of major companies adopting cryptocurrencies, highlighting the uncertainty involved in such partnerships.

Tesla's Financial Performance and its Correlation with Dogecoin

Stock Price Fluctuations and their Ripple Effect

Tesla's stock price performance exhibits a notable correlation with Dogecoin's price trajectory. Positive news regarding Tesla tends to have a positive spillover effect on Dogecoin, while negative news or declining stock performance can lead to a decrease in Dogecoin's value. This is partially due to the overlap in investor demographics and the general market sentiment surrounding Tesla and the broader technological sector.

- Correlation Analysis: Studies have shown a statistically significant correlation between Tesla's stock price and Dogecoin's price, indicating a degree of interdependence.

- Investor Behavior: Investors often view Tesla and Dogecoin as correlated assets, leading to similar buying and selling patterns during periods of high and low performance for both.

- Market Sentiment: Overall market sentiment significantly influences both Tesla's stock price and Dogecoin's value. Positive market conditions tend to benefit both assets, whereas negative sentiment can trigger sell-offs in both.

Tesla's Investments and Diversification Strategy

Tesla's broader financial strategies and investment decisions can indirectly influence its cryptocurrency holdings and its view of Dogecoin. Any significant shift in Tesla's investment portfolio could have implications for Dogecoin's market perception and future potential.

- Investment Portfolio: An analysis of Tesla's overall investment strategy reveals its approach to risk management and its appetite for speculative investments.

- Future Involvement with Cryptocurrencies: Tesla's future involvement with cryptocurrencies, beyond Bitcoin, could indirectly impact Dogecoin’s market position.

- Regulatory Changes: Regulatory changes impacting Tesla’s cryptocurrency holdings could inadvertently influence the value and perception of Dogecoin.

The Broader Cryptocurrency Market Context

Overall Market Trends and Their Impact on Dogecoin

Dogecoin's price is also influenced by broader trends within the cryptocurrency market, independent of Elon Musk or Tesla. Market-wide corrections, regulatory changes, and shifts in overall investor sentiment significantly impact Dogecoin's value.

- Bitcoin's Influence: Bitcoin, the largest cryptocurrency by market capitalization, significantly influences the altcoin market, including Dogecoin. Bitcoin's price movements often dictate the direction of the broader cryptocurrency market.

- Regulatory Announcements: Government regulations and announcements regarding cryptocurrencies impact investor confidence and trading activity, affecting Dogecoin's price.

- Investor Sentiment and Risk Appetite: Overall investor sentiment and risk appetite directly affect Dogecoin's price. Periods of high risk tolerance often lead to increased speculative investments in cryptocurrencies like Dogecoin.

Dogecoin's Fundamental Value and Long-Term Prospects

While Dogecoin's initial appeal was largely based on its meme-driven origins, evaluating its long-term viability requires considering its fundamental value proposition and technological aspects.

- Utility and Use Cases: Dogecoin's utility and real-world applications remain limited compared to other cryptocurrencies. Its use cases are largely based on community engagement and online tipping.

- Comparison to other Meme Coins and Established Cryptocurrencies: Dogecoin competes with other meme coins and established cryptocurrencies. Its position in the market depends on its community growth, development, and wider adoption.

- Technological Limitations: Dogecoin operates on a proof-of-work mechanism, which makes it less energy-efficient than some newer cryptocurrencies. This is a significant limitation that could affect its long-term sustainability.

Conclusion

Dogecoin's recent decline is a complex issue resulting from the interplay of various factors. Elon Musk's influence, Tesla's performance, and broader cryptocurrency market trends all contribute to Dogecoin's volatility. Understanding the interconnectedness of these factors is crucial for navigating the Dogecoin market. However, it is essential to remember that investing in Dogecoin carries significant risk. The price is highly susceptible to market sentiment and the actions of influential individuals.

Call to Action: While understanding the factors influencing Dogecoin's price is crucial, remember that investing in cryptocurrencies like Dogecoin carries significant risk. Conduct thorough research, diversify your portfolio, and only invest what you can afford to lose. Learn more about managing risk in Dogecoin investments and stay informed about the latest developments impacting the cryptocurrency market. Make informed decisions about your Dogecoin investment strategy.

Featured Posts

-

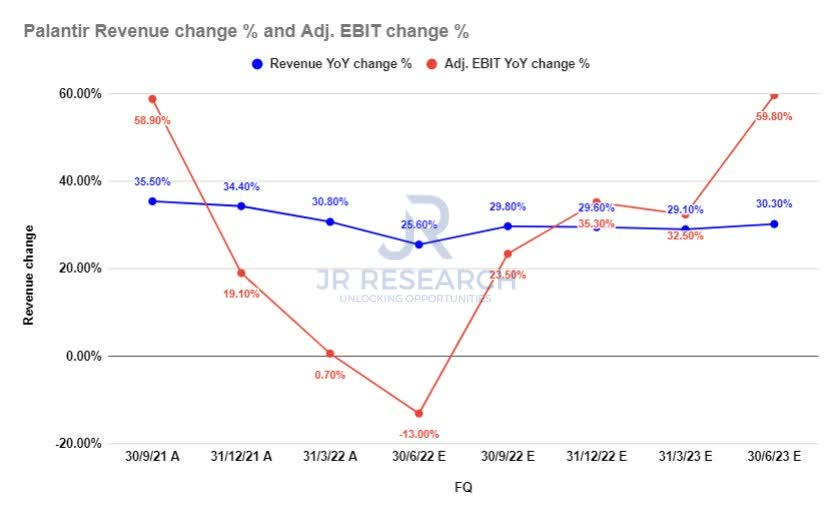

Should You Invest In Palantir Stock Before May 5th Risks And Rewards

May 10, 2025

Should You Invest In Palantir Stock Before May 5th Risks And Rewards

May 10, 2025 -

Elizabeth Hurleys Bikini Filled Maldives Holiday

May 10, 2025

Elizabeth Hurleys Bikini Filled Maldives Holiday

May 10, 2025 -

Manchester Castle Music Festival Olly Murs And More

May 10, 2025

Manchester Castle Music Festival Olly Murs And More

May 10, 2025 -

Jobs A Dijon Restaurants Et Rooftop Dauphine Postes A Pourvoir

May 10, 2025

Jobs A Dijon Restaurants Et Rooftop Dauphine Postes A Pourvoir

May 10, 2025 -

The Impact Of Trumps Executive Orders On Transgender People A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On Transgender People A Call For Stories

May 10, 2025