Should You Invest In Palantir Stock Before May 5th? Risks And Rewards

Table of Contents

Palantir Technologies (PLTR), a prominent player in the big data and analytics market, has seen its stock price fluctuate significantly. With a potentially pivotal date approaching – May 5th – many investors are wondering whether now is the right time to buy Palantir stock. This analysis aims to provide a balanced perspective on the risks and rewards of a Palantir stock investment before May 5th, considering factors such as recent financial performance, the competitive landscape, and potential market volatility. We'll delve into Palantir's financials, growth prospects, and the overall investment climate to help you make an informed decision. Keywords: Palantir stock, Palantir investment, Palantir stock price, May 5th, stock market, investment risk, investment reward.

H2: Understanding Palantir's Current Market Position

H3: Recent Financial Performance and Growth Prospects:

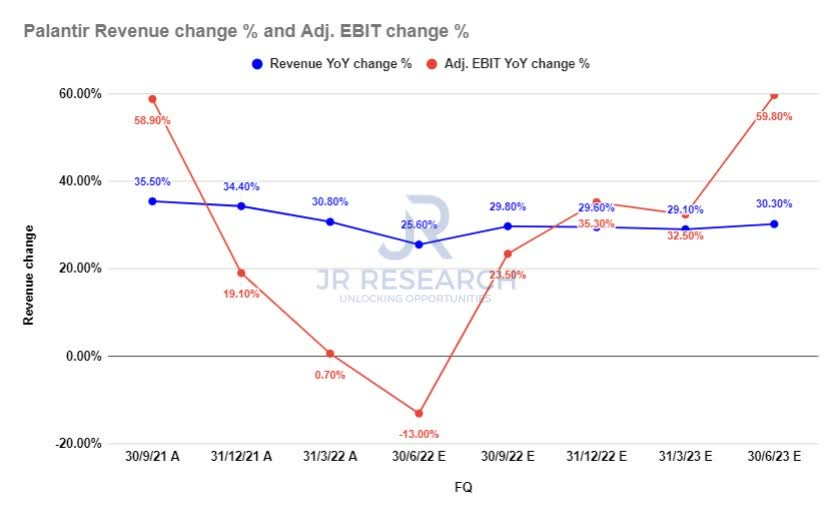

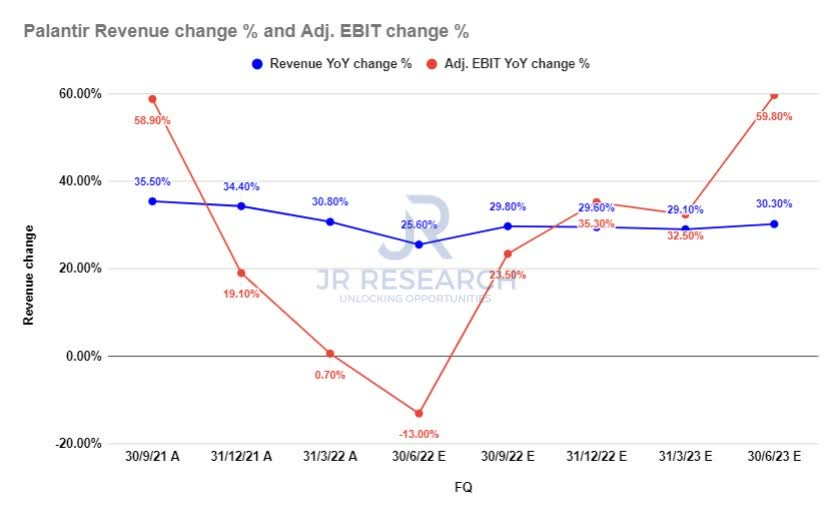

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Examining Palantir financials requires a thorough look at revenue streams, operating expenses, and net income. Analyzing Palantir revenue growth year-over-year and comparing it to competitors is crucial for assessing its performance within the data analytics market.

- Bullet points:

- Revenue growth rate comparison with competitors like Databricks and Snowflake shows a competitive, though not always leading, position.

- Profitability analysis reveals improving margins but still significant net losses in some quarters, indicating a need for continued growth and cost management.

- Key performance indicators (KPIs) such as customer acquisition cost and customer churn rate offer insights into the sustainability of Palantir's growth. Keywords: Palantir financials, Palantir revenue, Palantir earnings, Palantir growth.

H3: Competitive Landscape and Market Share:

Palantir operates in a rapidly evolving big data and analytics market. Its position is defined by its unique platform, government contracts, and its competition with established players and emerging startups. The company faces stiff competition from cloud-based solutions and other data analytics providers.

- Bullet points:

- Comparison with leading competitors (e.g., Databricks, Snowflake) highlights Palantir's strengths in specialized government and enterprise solutions, but also points to weaknesses in broader market penetration.

- Analysis of Palantir's unique selling propositions (USPs), such as its focus on complex data integration and its strong government relationships, are vital in understanding its competitive edge.

- Evaluation of market penetration and potential for expansion reveals significant opportunities but also emphasizes the challenges of securing and maintaining market share against more established, and often more broadly appealing, competitors. Keywords: Big data analytics, data analytics market, Palantir competitors, market share.

H2: Assessing the Risks of Investing in Palantir Stock Before May 5th

H3: Market Volatility and External Factors:

The stock market is inherently volatile, and Palantir stock is no exception. Macroeconomic factors such as inflation and interest rate hikes can significantly impact Palantir's stock price and the overall market sentiment. Geopolitical events also contribute to uncertainty.

- Bullet points:

- Potential impact of geopolitical events, such as international conflicts or trade disputes, can cause widespread market fluctuations, negatively impacting Palantir's stock price.

- Sensitivity of Palantir's stock to economic downturns is significant, as investors often reduce risk during economic uncertainty, leading to selling pressure on growth stocks.

- Analysis of investor sentiment and market trends shows a considerable degree of uncertainty surrounding Palantir's long-term prospects, reflected in the stock price volatility. Keywords: Stock market volatility, macroeconomic factors, inflation, interest rates, Palantir stock price volatility.

H3: Company-Specific Risks:

Investing in Palantir also involves company-specific risks. These include reliance on government contracts, intense competition, and the inherent challenges of executing its ambitious growth plans.

- Bullet points:

- Dependence on government contracts exposes Palantir to potential changes in government spending and regulatory hurdles.

- Competition from established players and new entrants poses a constant threat to market share and revenue growth.

- Execution risks related to product development, deployment, and customer acquisition could hinder Palantir's progress and affect its stock price. Keywords: Palantir business model, Palantir operations, Palantir management, investment risks.

H2: Evaluating the Potential Rewards of a Palantir Investment

H3: Long-Term Growth Potential:

Despite the risks, Palantir boasts significant long-term growth potential. Its innovative platform and strategic initiatives position it for expansion into new markets and industries, driving future revenue and profitability.

- Bullet points:

- Expansion into new markets and industries beyond its current government and commercial client base will be crucial for long-term success.

- Development of innovative products and services, leveraging AI and machine learning, has the potential to significantly enhance its offerings and attract new customers.

- Potential for strategic acquisitions and partnerships will allow Palantir to further strengthen its market position and accelerate growth. Keywords: Palantir long-term growth, investment return, Palantir future prospects.

H3: Potential for Stock Price Appreciation:

Positive news or events, such as exceeding earnings expectations or securing significant new contracts, could lead to a substantial rise in Palantir's stock price. A thorough valuation analysis, comparing Palantir to industry peers, is needed to assess the potential for stock appreciation.

- Bullet points:

- Analysis of historical stock price performance indicates substantial volatility, but also shows periods of significant growth.

- Potential catalysts for stock price appreciation include exceeding earnings expectations, securing major new contracts, and successful product launches.

- Valuation analysis and comparison with industry peers will help in determining whether the current Palantir stock price is undervalued or overvalued. Keywords: Palantir stock price appreciation, stock market gains.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Investing in Palantir stock before May 5th presents both significant risks and potential rewards. The company's growth prospects are promising, but market volatility and company-specific risks cannot be ignored. Thorough due diligence is crucial before making any investment decisions. Consider Palantir's financial performance, competitive landscape, and the overall market conditions. Weigh the potential for substantial gains against the inherent risks involved. This analysis is not investment advice. Before investing in Palantir stock or any other stock, conduct your own thorough research and consult a qualified financial advisor to determine if it aligns with your investment strategy and risk tolerance. Remember, the information presented here is for educational purposes only. Make informed decisions regarding your Palantir stock investments.

Featured Posts

-

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025 -

Projet Viticole Aux Valendons Dijon 2500 M De Plantation

May 10, 2025

Projet Viticole Aux Valendons Dijon 2500 M De Plantation

May 10, 2025 -

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025 -

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vzglyad Iz Berlina

May 10, 2025

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vzglyad Iz Berlina

May 10, 2025 -

Nyt Strands Game 403 Hints And Solutions For April 10th

May 10, 2025

Nyt Strands Game 403 Hints And Solutions For April 10th

May 10, 2025