Dollar Depreciation: Analyzing Its Impact On Asian Currency Markets

Table of Contents

The Mechanics of Dollar Depreciation and its Ripple Effect on Asia

Dollar depreciation, simply put, refers to a decrease in the value of the US dollar relative to other currencies. Several factors contribute to this phenomenon, including US monetary policy (e.g., interest rate adjustments by the Federal Reserve), inflation levels within the US, and broader global economic trends such as shifting trade balances and geopolitical events. These factors influence investor confidence and capital flows, directly impacting the dollar's exchange rate.

The effects of dollar depreciation on Asian currencies are transmitted through various channels. Changes in the dollar's value affect international trade, capital flows, and investor sentiment, creating a ripple effect across the region.

- Increased demand for Asian exports: A weaker dollar makes Asian goods cheaper for US and other international buyers, potentially boosting export volumes and economic growth in exporting Asian nations.

- Potential capital inflows into Asian markets: Investors may seek higher returns in Asian markets when the dollar depreciates, leading to increased investment and strengthening of some Asian currencies.

- Impact on Asian importers: Conversely, a weaker dollar makes dollar-denominated imports more expensive for Asian businesses, potentially increasing input costs and impacting inflation.

- Increased volatility in Asian foreign exchange markets: The fluctuating value of the dollar creates uncertainty and increased risk in Asian foreign exchange markets, requiring careful management by businesses and investors.

Winners and Losers: How Different Asian Currencies Respond to Dollar Weakness

Asian currencies react differently to dollar depreciation due to variations in their economic fundamentals, trade balances, and political stability. A country with a strong export-oriented economy might see its currency appreciate as demand for its goods increases, while a nation heavily reliant on imports might experience currency depreciation.

- Case study: Impact on Japanese Yen: The Yen's relationship with the dollar is complex and often inversely correlated. Dollar depreciation can lead to Yen appreciation, particularly if Japanese exports benefit significantly. However, other factors such as global economic uncertainty can influence this relationship.

- Case study: Impact on Chinese Yuan: China's managed exchange rate regime means the Yuan's response to dollar depreciation is less straightforward. The People's Bank of China (PBOC) intervenes in the foreign exchange market to manage volatility and maintain stability.

- Case study: Impact on emerging Asian currencies: Emerging Asian currencies are often more vulnerable to capital flight during periods of dollar depreciation. Investors might pull funds from these markets seeking safer havens, leading to currency devaluation.

Implications for Businesses and Investors in Asia

Dollar depreciation presents both opportunities and risks for businesses and investors in Asia. Export-oriented firms may benefit from increased demand, while import-dependent industries face rising costs. Investors must carefully assess the potential impact of currency fluctuations on their portfolios.

- Hedging strategies: Businesses can use hedging strategies, such as forward contracts or options, to mitigate currency risks associated with dollar depreciation.

- Investment opportunities: Dollar depreciation can create investment opportunities in Asian markets as some assets become more affordable for international investors.

- Risks associated with currency volatility: Currency volatility can lead to significant losses for investors who are not adequately hedged against currency risk.

- Foreign exchange derivatives: Foreign exchange derivatives can be used to manage currency risk and speculate on exchange rate movements.

Policy Responses to Dollar Depreciation in Asian Economies

Asian central banks employ various policy tools to manage the impact of dollar depreciation on their economies. These policies aim to stabilize exchange rates, control inflation, and maintain financial stability. However, these interventions can have unintended consequences.

- Intervention in foreign exchange markets: Central banks may buy or sell their own currencies to influence exchange rates.

- Monetary policy adjustments: Interest rate changes can affect capital flows and influence the exchange rate. Higher interest rates generally attract foreign investment, potentially strengthening the currency.

- Capital controls: Some governments may impose restrictions on capital flows to limit volatility and protect their currencies.

- Challenges faced by policymakers: Navigating currency volatility is challenging, requiring careful balancing of competing economic objectives. Policymakers must consider the impact of their actions on trade, inflation, and economic growth.

Conclusion: Understanding Dollar Depreciation's Impact on Asian Currency Markets

Dollar depreciation significantly impacts Asian currency markets, creating both winners and losers. Export-oriented economies may benefit, while import-dependent ones might face challenges. Investors must carefully consider currency risk and utilize appropriate hedging strategies. Policymakers face the complex task of managing currency volatility while promoting economic stability.

Stay ahead of the curve by continuously monitoring dollar depreciation and its impact on your investments in Asian markets. Consult with financial experts to develop strategies for mitigating currency risk and capitalizing on opportunities presented by fluctuating exchange rates. Understanding the dynamics of dollar depreciation is critical for navigating the complexities of Asian currency markets and achieving long-term financial success.

Featured Posts

-

House Democrats Internal Feud A Public Dispute Over Senior Leadership

May 06, 2025

House Democrats Internal Feud A Public Dispute Over Senior Leadership

May 06, 2025 -

Decoding Recession Signals What Social Media Trends Reveal About The Economy

May 06, 2025

Decoding Recession Signals What Social Media Trends Reveal About The Economy

May 06, 2025 -

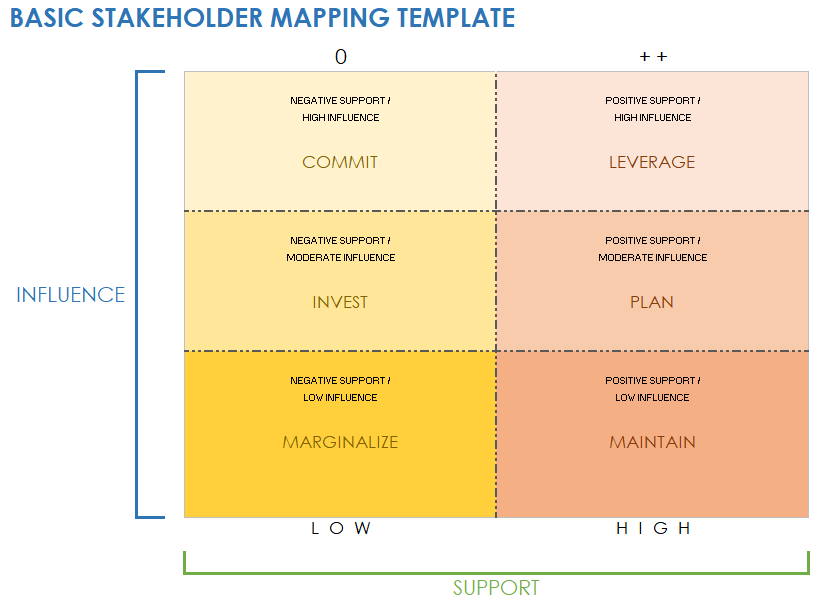

Where To Invest Mapping The Countrys Top Business Destinations

May 06, 2025

Where To Invest Mapping The Countrys Top Business Destinations

May 06, 2025 -

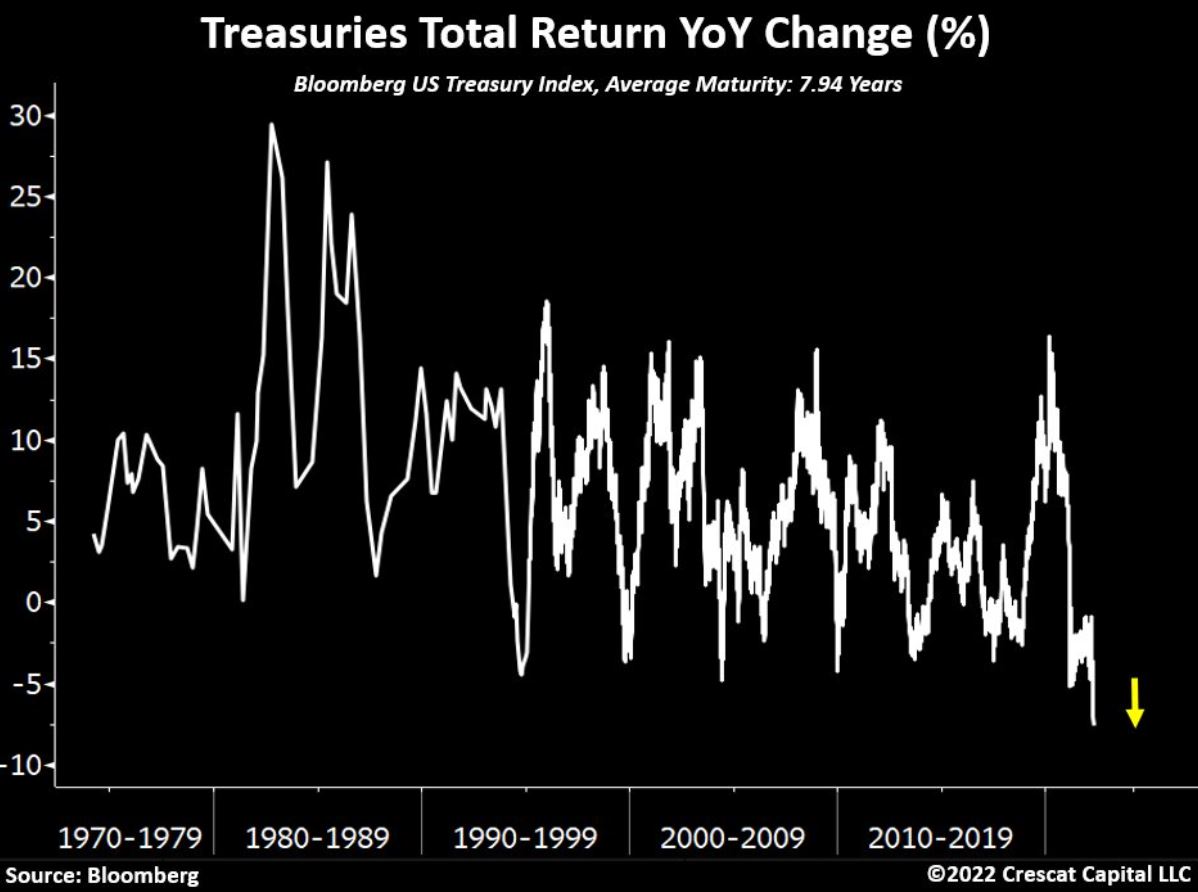

Katos Stance No Us Treasury Sales In Trade Talks

May 06, 2025

Katos Stance No Us Treasury Sales In Trade Talks

May 06, 2025 -

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Latest Posts

-

Celtics Vs Knicks Prediction Playoff Game 1 Betting Analysis And Picks

May 06, 2025

Celtics Vs Knicks Prediction Playoff Game 1 Betting Analysis And Picks

May 06, 2025 -

February 10th Celtics Heat Game Time Tv Channel And Live Stream Info

May 06, 2025

February 10th Celtics Heat Game Time Tv Channel And Live Stream Info

May 06, 2025 -

Nba Playoffs Knicks Vs Celtics Predictions Picks And Best Bets For Game 1

May 06, 2025

Nba Playoffs Knicks Vs Celtics Predictions Picks And Best Bets For Game 1

May 06, 2025 -

Celtics Vs Heat Game On February 10th Where To Watch

May 06, 2025

Celtics Vs Heat Game On February 10th Where To Watch

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025