Don't Ignore This: Important HMRC Child Benefit Update

Table of Contents

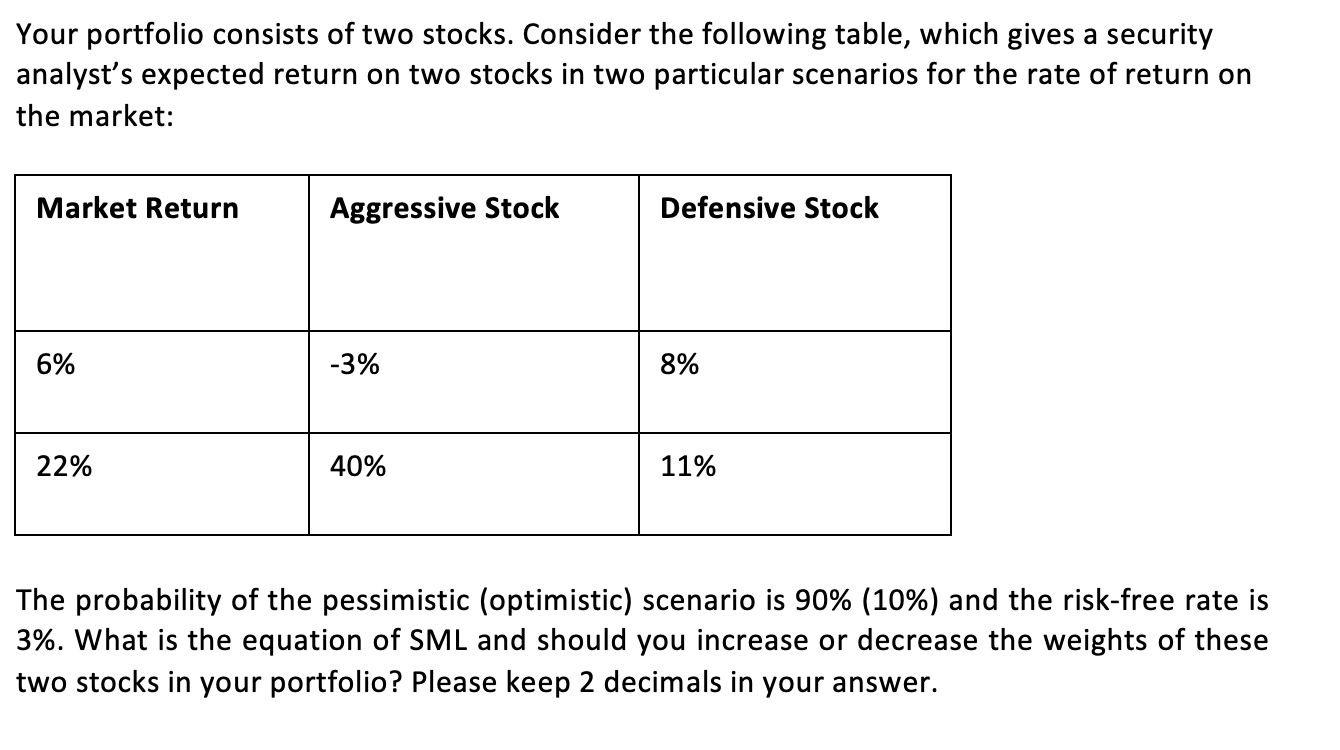

Understanding the High-Income Child Benefit Charge

The High-Income Child Benefit Charge affects families where one parent earns above a specified income threshold. This isn't a reduction in your Child Benefit payment itself; instead, it's a tax you may need to pay back. Understanding this charge is crucial to avoid unexpected tax bills.

Keywords: High Income Child Benefit Charge, High Earner Child Benefit, Income Threshold Child Benefit

-

The Current Income Threshold: For the tax year 2023-24, the income threshold for the High-Income Child Benefit Charge is £50,000. This means if one parent earns over £50,000, you may be liable for a charge. It's important to note that this is the combined income of both parents if they are both working.

-

Calculating the Charge: The charge isn't a fixed amount; it's calculated based on how much your income exceeds the threshold. For every £100 earned above £50,000, you'll pay back 1% of your Child Benefit. This means the more you earn above the threshold, the more you'll repay. The HMRC website provides detailed calculators and examples to help you estimate your potential charge.

-

Consequences of Non-Declaration: Failing to declare a high income can lead to significant penalties. HMRC may issue a demand for backdated payments along with substantial fines. It's crucial to be honest and accurate when declaring your income to avoid these repercussions.

-

Relevant HMRC Guidance: For comprehensive information and the latest updates, visit the official HMRC website: [Insert link to relevant HMRC page here].

Recent Changes to Child Benefit Eligibility

While the core principles of Child Benefit eligibility remain consistent, occasional refinements to the criteria occur. Staying updated on these changes is essential to ensure you continue receiving your entitlement.

Keywords: Child Benefit Eligibility, Child Benefit Claim, Eligibility Criteria Child Benefit, HMRC Child Benefit Claim

-

New Eligibility Criteria (if any): [Insert details of any recent changes to eligibility criteria here. If no changes, state this clearly: "There have been no significant changes to the core eligibility criteria for Child Benefit recently." ] This might include changes to residency requirements, or specific circumstances affecting eligibility for example, changes surrounding the definition of a 'child' for benefit purposes.

-

Situations Affecting Eligibility: Changes in family circumstances, such as a child turning 16, leaving full-time education or marriage significantly affect eligibility. It is crucial to inform HMRC of any changes to your circumstances promptly to prevent disruptions in payments.

-

Updating HMRC: If your circumstances change, immediately update your details through the HMRC online portal. Failing to do so could lead to overpayments or delays in receiving your payments.

How to Check Your Child Benefit Entitlement and Update Your Details

Regularly checking your Child Benefit entitlement and keeping your details up-to-date is crucial for maintaining a smooth and consistent payment flow.

Keywords: Check Child Benefit, Update Child Benefit Details, HMRC Online Account, Child Benefit Account, Manage Child Benefit

-

Accessing the HMRC Online Portal: Access your HMRC online account at [Insert link to HMRC online portal here]. You'll need your Government Gateway user ID and password. If you don't have an online account, you can create one on the HMRC website.

-

Updating Personal Details: Once logged in, you can easily update your personal details, including your address, bank account information, and contact details. Ensuring your details are current prevents delays and ensures payments reach you without issues.

-

Importance of Up-to-Date Information: Keeping your information current is paramount. Outdated details can lead to significant delays or even the suspension of your Child Benefit payments.

What to Do If You're Affected by the Changes

If the recent changes impact your Child Benefit payments, proactive steps are essential to address any concerns.

Keywords: Child Benefit Problems, HMRC Contact, Child Benefit Support, Appeal Child Benefit Decision

-

Contacting HMRC: If you have questions or concerns, contact HMRC directly through their helpline: [Insert HMRC helpline number here] or via their online webchat facility.

-

Appealing a Decision: If you disagree with a decision made regarding your Child Benefit entitlement, you can appeal the decision. The HMRC website provides detailed instructions on how to lodge an appeal.

-

Seeking Professional Advice: For complex situations or if you require further assistance, consider seeking professional advice from a tax advisor or benefits specialist.

Conclusion

Staying informed about HMRC Child Benefit updates is vital for all families receiving this crucial benefit. Understanding the High-Income Child Benefit Charge, eligibility criteria, and the importance of maintaining up-to-date information are key to ensuring you receive the correct payments without interruption. Don't ignore this important HMRC Child Benefit update. Check your eligibility and update your details today to ensure you receive the correct payments. Visit the HMRC website to learn more about the latest Child Benefit changes and manage your account effectively. Regularly reviewing your HMRC Child Benefit information is crucial for avoiding any unexpected financial consequences.

Featured Posts

-

Reddits Favorite Ai Stocks 12 To Consider For Your Portfolio

May 20, 2025

Reddits Favorite Ai Stocks 12 To Consider For Your Portfolio

May 20, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls I Apopsi Ton Eidikon

May 20, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls I Apopsi Ton Eidikon

May 20, 2025 -

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025 -

Kaellmanin Nousu Kenttien Ulkopuolella Tapahtunut Kasvu

May 20, 2025

Kaellmanin Nousu Kenttien Ulkopuolella Tapahtunut Kasvu

May 20, 2025 -

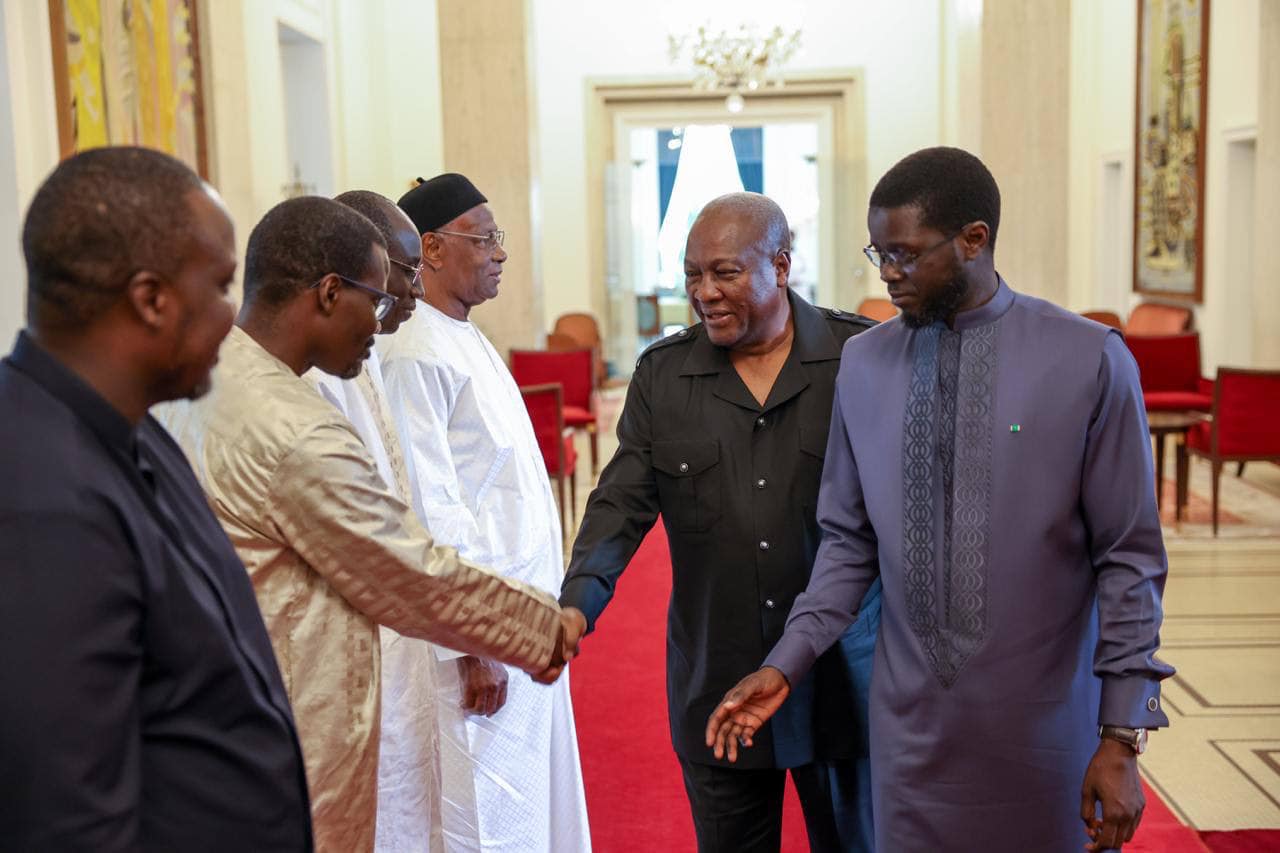

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025