Dow Jones Gains Momentum: PMI Beat Fuels Steady Ascent

Table of Contents

Positive PMI Report Signals Economic Strength

The recently released PMI data significantly exceeded analyst expectations, painting a picture of a much healthier manufacturing and services sector than previously predicted. This positive news reflects increased economic activity and a surge in consumer confidence, boosting investor sentiment and fueling the Dow Jones's upward trajectory.

- Manufacturing PMI: Rose to 53.0, surpassing the projected 52.5. This indicates expansion in the manufacturing sector, with businesses reporting increased production and new orders.

- Services PMI: Reached a robust 56.0, signifying strong growth in the services sector. This points to a healthy consumer spending environment and a thriving job market.

The PMI's strong performance directly correlates with stock market performance. A higher PMI often translates to increased investor confidence, leading to higher stock valuations and a stronger Dow Jones. This positive feedback loop is evident in the current market dynamics.

Dow Jones Performance Analysis

The Dow Jones has exhibited impressive performance in recent weeks, showcasing significant gains and percentage increases. This upward trend is not isolated, but rather reflects a broader market sentiment shift.

- Growth Trajectory: Between [Start Date] and [End Date], the Dow Jones experienced a [Percentage]% increase, outperforming many analysts' predictions.

- Key Contributing Sectors: The technology and financial sectors have been particularly instrumental in driving these gains, with companies like [Example Tech Company] and [Example Financial Company] reporting strong performance.

- Index Comparison: Compared to other major indices like the S&P 500 and Nasdaq, the Dow Jones has shown relatively stronger performance during this period, indicating a unique strength within its constituent companies.

While the short-term outlook appears positive, long-term Dow Jones investors should consider potential market corrections and geopolitical factors that may influence future performance.

Investor Sentiment and Market Volatility

The positive PMI report has undeniably boosted investor confidence, leading to increased trading activity and a generally bullish market sentiment. However, this doesn't negate the possibility of market volatility.

- Shift in Sentiment: A clear shift from cautious optimism to more pronounced bullishness is observable in investor behavior.

- Trading Volume: Trading volumes have increased significantly, reflecting heightened investor interest and engagement.

- Potential Risks: Geopolitical uncertainties, inflation concerns, and potential interest rate hikes remain potential risks that could dampen the Dow Jones's upward momentum. Investors need to maintain a watchful eye on these factors.

Factors Beyond the PMI Report

While the PMI report played a pivotal role, other contributing factors have further fueled the Dow Jones's ascent.

- Strong Corporate Earnings: Several major companies have reported better-than-expected earnings, reinforcing the positive economic narrative and bolstering investor confidence. For example, [Company A] exceeded expectations by [Percentage]%, while [Company B] announced record profits.

- Supportive Government Policies: Government initiatives aimed at stimulating economic growth, such as [Specific Policy Example], have also played a role in fostering a positive investment climate.

- Global Economic Trends: Favorable global economic trends, including [Specific Global Trend Example], have also contributed positively to the overall market sentiment and, in turn, to the Dow Jones performance.

The interplay between these factors and the positive PMI data creates a synergistic effect, pushing the Dow Jones upward.

Conclusion

The Dow Jones's recent surge is primarily attributed to a robust PMI report, indicative of a strong economic recovery and boosted investor confidence. However, positive corporate earnings, supportive government policies, and favorable global economic trends have also played crucial roles. Understanding these interconnected factors is vital for navigating the complexities of the Dow Jones and making informed investment decisions.

Call to Action: Stay informed about the latest news and analysis impacting the Dow Jones, and utilize reliable resources to make informed investment decisions. Monitoring key economic indicators like the PMI and understanding the interplay of various market forces is key to managing your Dow Jones investments effectively and achieving your financial goals. Learn more about effective Dow Jones investment strategies today and stay ahead of the curve.

Featured Posts

-

Porsche 956 Tavan Sergilemesinin Teknik Ve Estetik Yoenleri

May 25, 2025

Porsche 956 Tavan Sergilemesinin Teknik Ve Estetik Yoenleri

May 25, 2025 -

The Underappreciated Value Of News Corp A Financial Analysis

May 25, 2025

The Underappreciated Value Of News Corp A Financial Analysis

May 25, 2025 -

A Successful Escape To The Country Tips And Considerations

May 25, 2025

A Successful Escape To The Country Tips And Considerations

May 25, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025 -

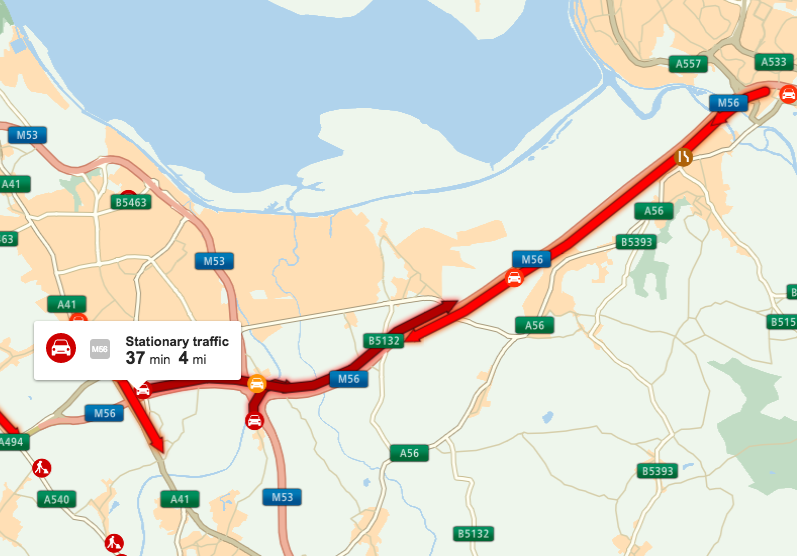

M56 Collision Delays On Cheshire Deeside Border

May 25, 2025

M56 Collision Delays On Cheshire Deeside Border

May 25, 2025

Latest Posts

-

Technologies De Pointe Au Ces Unveiled Europe A Amsterdam

May 25, 2025

Technologies De Pointe Au Ces Unveiled Europe A Amsterdam

May 25, 2025 -

Ces Unveiled Revient A Amsterdam Ce Qu Il Faut Attendre De L Edition Europe

May 25, 2025

Ces Unveiled Revient A Amsterdam Ce Qu Il Faut Attendre De L Edition Europe

May 25, 2025 -

Alexandria International Airport And England Airpark Ae Xplore Global Campaign Takes Off

May 25, 2025

Alexandria International Airport And England Airpark Ae Xplore Global Campaign Takes Off

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 25, 2025 -

Fly Local Explore Global England Airpark And Alexandria International Airport Launch New Campaign

May 25, 2025

Fly Local Explore Global England Airpark And Alexandria International Airport Launch New Campaign

May 25, 2025