The Underappreciated Value Of News Corp: A Financial Analysis

Table of Contents

H2: News Corp's Diversified Portfolio: A Key Strength

News Corp's success stems from its remarkably diversified portfolio, a key factor mitigating risk and ensuring consistent revenue streams. This diversification across various media segments offers significant advantages compared to companies focused on a single sector.

H3: Robust Revenue Streams from Multiple Segments:

News Corp operates across several key business segments:

-

News & Information Services: This segment includes prominent brands like The Wall Street Journal, The Times and The Sunday Times, and New York Post. Recent performance data shows this segment remains a significant revenue contributor, despite challenges in the print media landscape. News Corp is actively adapting to the digital age, transitioning to digital subscriptions and expanding its online presence.

-

Book Publishing: HarperCollins Publishers, a major player in the publishing industry, contributes substantially to News Corp's overall revenue. This segment benefits from the enduring popularity of physical books and the growing e-book market. Recent bestsellers and strategic acquisitions have fueled growth in this area.

-

Digital Real Estate Services: Realtor.com, a leading online real estate platform, provides another robust revenue stream. The growth of the digital real estate market presents significant opportunities for future expansion and market share growth.

The diversification across these segments ensures that News Corp is not overly reliant on any single market, providing resilience against economic downturns or sector-specific challenges. This is a key strength of News Corp's business model.

H3: Strategic Acquisitions and Growth Initiatives:

News Corp's history demonstrates a strategic approach to acquisitions and investments. By strategically acquiring complementary businesses, News Corp has expanded its reach and strengthened its market position. These acquisitions often bring valuable assets, technologies, and talent, fueling further organic growth. Ongoing investments in digital infrastructure and technological advancements further enhance News Corp's competitive edge.

H2: Undervalued Assets and Potential for Future Growth:

Despite its inherent strengths, News Corp's stock often trades below its intrinsic value, representing a compelling investment opportunity.

H3: Strong Balance Sheet and Cash Flow:

News Corp boasts a strong balance sheet and consistent cash flow generation. Key financial ratios, such as a healthy Debt-to-Equity ratio and a robust Current Ratio, demonstrate its financial stability. This consistent cash flow allows for strategic investments, acquisitions, and shareholder returns.

H3: Growth Opportunities in Digital Media and Subscription Models:

News Corp is actively pursuing growth opportunities in digital media and subscription models. While the transition from print to digital has presented challenges, News Corp has successfully leveraged digital platforms to expand its reach and attract new subscribers. The effectiveness of their subscription models is evident in the growing number of digital subscribers across their various properties. Furthermore, the potential for growth in targeted digital advertising remains substantial.

H2: Addressing Investor Concerns and Risks:

While the outlook for News Corp is positive, it's essential to acknowledge potential challenges.

H3: Challenges in the Media Industry:

The media industry faces significant challenges, including intense competition, the decline of print media, and concerns regarding misinformation. News Corp is actively addressing these issues through diversification, investments in digital platforms, and a commitment to journalistic integrity.

H3: Potential Market Volatility and Economic Factors:

External factors like economic downturns and political changes can impact News Corp's performance. However, News Corp's diversified revenue streams and strong financial foundation provide a level of resilience against such external shocks. Historically, News Corp has shown the ability to weather economic storms.

3. Conclusion:

News Corp’s diversified portfolio, strong financial health, and proactive approach to navigating industry challenges strongly suggest its stock is undervalued. The company's consistent cash flow, coupled with its strategic acquisitions and digital transformation initiatives, positions it for significant future growth. News Corp's successful adaptation to the digital landscape, coupled with its substantial presence in various media segments, indicates a compelling investment opportunity.

With its diversified portfolio, strong financial performance, and significant growth potential, News Corp deserves a closer look from investors seeking undervalued opportunities. Conduct thorough due diligence and consider adding News Corp to your investment strategy today. Investing in News Corp stock offers exposure to a robust and diversified media conglomerate with significant growth potential.

Featured Posts

-

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025 -

Burys Missing Link Exploring The Lost M62 Relief Road Project

May 25, 2025

Burys Missing Link Exploring The Lost M62 Relief Road Project

May 25, 2025 -

Southamptons Kyle Walker Peters A Leeds United Target

May 25, 2025

Southamptons Kyle Walker Peters A Leeds United Target

May 25, 2025 -

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025 -

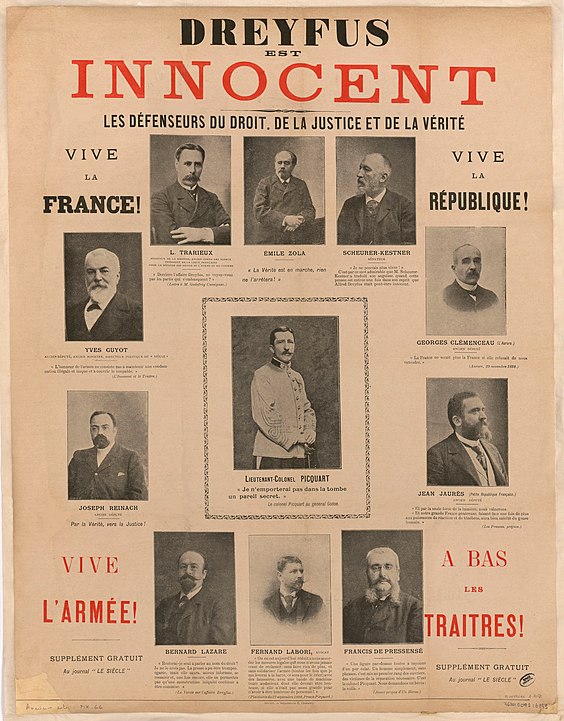

130 Years After The Dreyfus Affair A Push For Recognition

May 25, 2025

130 Years After The Dreyfus Affair A Push For Recognition

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025