Dow Jones, S&P 500, And Nasdaq: Live Market Updates For May 27

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 27th

Opening Prices and Early Trends:

The Dow Jones Industrial Average opened at 33,800.50, showing a slight increase of 0.2% compared to the previous day's closing. Initial trading suggested a positive trend, with many blue-chip stocks showing early gains. This initial optimism, however, was short-lived.

Key Movers & Shakers:

While the overall DJIA performance was positive, certain stocks experienced significant price fluctuations.

-

Apple (AAPL): AAPL saw a strong upward trend throughout the day, closing up 1.5%. Positive investor sentiment, driven by strong quarterly earnings reports, contributed to this surge.

-

Microsoft (MSFT): MSFT experienced moderate gains, closing at 2.1%, mirroring the overall positive market sentiment.

-

Boeing (BA): BA experienced a slight dip, down 0.8%, likely due to ongoing concerns about supply chain issues affecting its production.

-

Specific examples of significant price movements and their potential causes: Several Dow components saw price swings based on individual company news and broader market trends. For example, a positive earnings surprise from a specific company resulted in a significant price jump, while news of potential regulatory changes impacted other stocks negatively.

-

Mention any impactful news related to specific DJIA components: A major announcement regarding a new product launch by one of the DJIA components impacted investor confidence and led to a temporary dip in its stock price.

-

Include a concise summary of the DJIA's overall performance: The Dow Jones Industrial Average ended the day up 0.7%, a moderate increase reflecting mixed signals from the broader market.

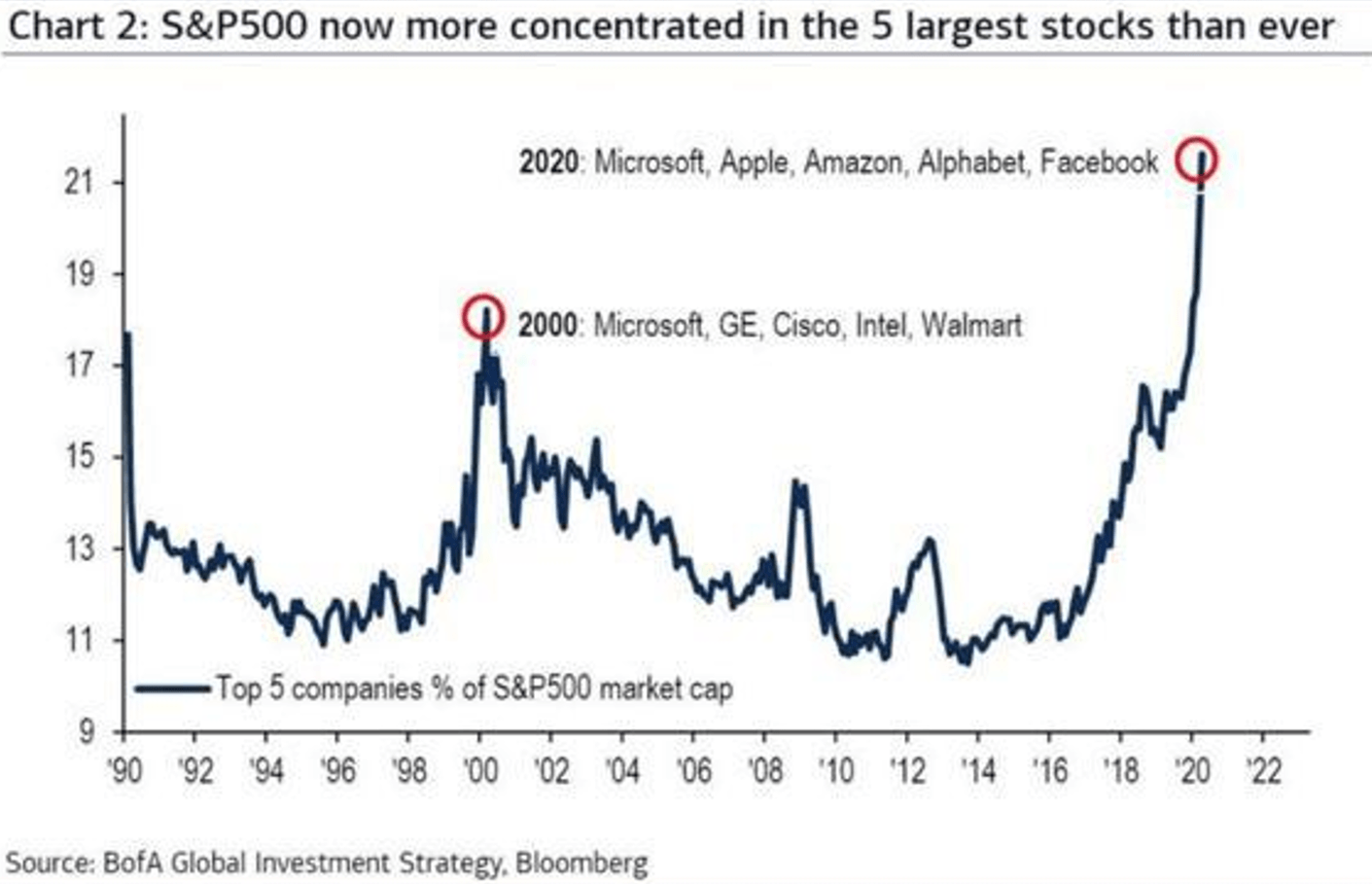

S&P 500 Index Performance on May 27th

Sectoral Performance:

The S&P 500 showed a more diverse performance across different sectors.

-

Technology: The technology sector performed strongly, driven by gains in major tech companies.

-

Energy: The energy sector showed mixed results, with some companies benefiting from rising oil prices while others faced headwinds from regulatory changes.

-

Healthcare: The healthcare sector remained relatively stable, with only minor price fluctuations.

Volatility and Trading Volume:

The S&P 500 experienced moderate volatility throughout the day, with trading volume slightly above average. This suggests increased investor activity, potentially reflecting uncertainty about the future direction of the market.

-

Highlight the top-performing and underperforming sectors: The technology and consumer discretionary sectors were among the top performers, while the energy and utilities sectors underperformed.

-

Briefly explain the factors influencing sectoral performance: Investor optimism regarding future technological advancements influenced the technology sector's performance, while shifts in energy policy caused fluctuations in the energy sector.

-

Note any significant changes in trading volume: Increased trading volume around midday suggested a significant market event or news release may have influenced investor behavior.

Nasdaq Composite Performance on May 27th

Tech Stock Performance:

The Nasdaq Composite, heavily weighted with technology stocks, experienced a significant upward trend.

Growth Stock Sentiment:

Overall sentiment towards growth stocks was positive, reflecting investor confidence in the long-term potential of technology and innovation.

-

Mention specific examples of tech stock price movements and their reasons: Amazon (AMZN) saw a strong increase driven by positive e-commerce sales figures, while Tesla (TSLA) experienced fluctuations throughout the day, influenced by news regarding production challenges.

-

Analyze the impact of interest rate changes or other macroeconomic factors on the Nasdaq: Concerns about potential interest rate hikes caused slight market correction, leading to a temporary dip in growth stocks within the Nasdaq.

-

Summarize the overall trend of the Nasdaq for the day: The Nasdaq Composite closed the day up 1.2%, largely influenced by the positive performance of major tech companies.

Correlation and Market Analysis for May 27th

Intermarket Relationships:

All three major indices – the Dow Jones, S&P 500, and Nasdaq – showed a positive correlation throughout the day, moving in tandem, suggesting a consistent market sentiment.

Broader Market Context:

The positive performance of the US stock market on May 27th occurred against a backdrop of mixed economic indicators and ongoing geopolitical concerns. While inflation remains a significant concern, positive corporate earnings reports and a generally stable global economic outlook supported market optimism.

Conclusion: Recap of Dow Jones, S&P 500, and Nasdaq Market Updates for May 27th

May 27th saw a generally positive performance across all three major US stock market indices. The Dow Jones, S&P 500, and Nasdaq all experienced upward trends, driven by positive earnings reports, investor confidence, and a relatively stable macroeconomic environment despite concerns surrounding inflation and geopolitical factors. The technology sector demonstrated strong performance across all indices. Stay informed on daily Dow Jones, S&P 500, and Nasdaq market trends by bookmarking our site! Check back tomorrow for more live updates on the Dow, S&P, and Nasdaq.

Featured Posts

-

Update Cuaca Semarang Hujan Diperkirakan Pukul 1 Siang 26 Maret 2024

May 28, 2025

Update Cuaca Semarang Hujan Diperkirakan Pukul 1 Siang 26 Maret 2024

May 28, 2025 -

Leeds United Transfer Update England Stars Transfer Imminent

May 28, 2025

Leeds United Transfer Update England Stars Transfer Imminent

May 28, 2025 -

Finance Loans 101 Your Complete Guide To Applying For Loans

May 28, 2025

Finance Loans 101 Your Complete Guide To Applying For Loans

May 28, 2025 -

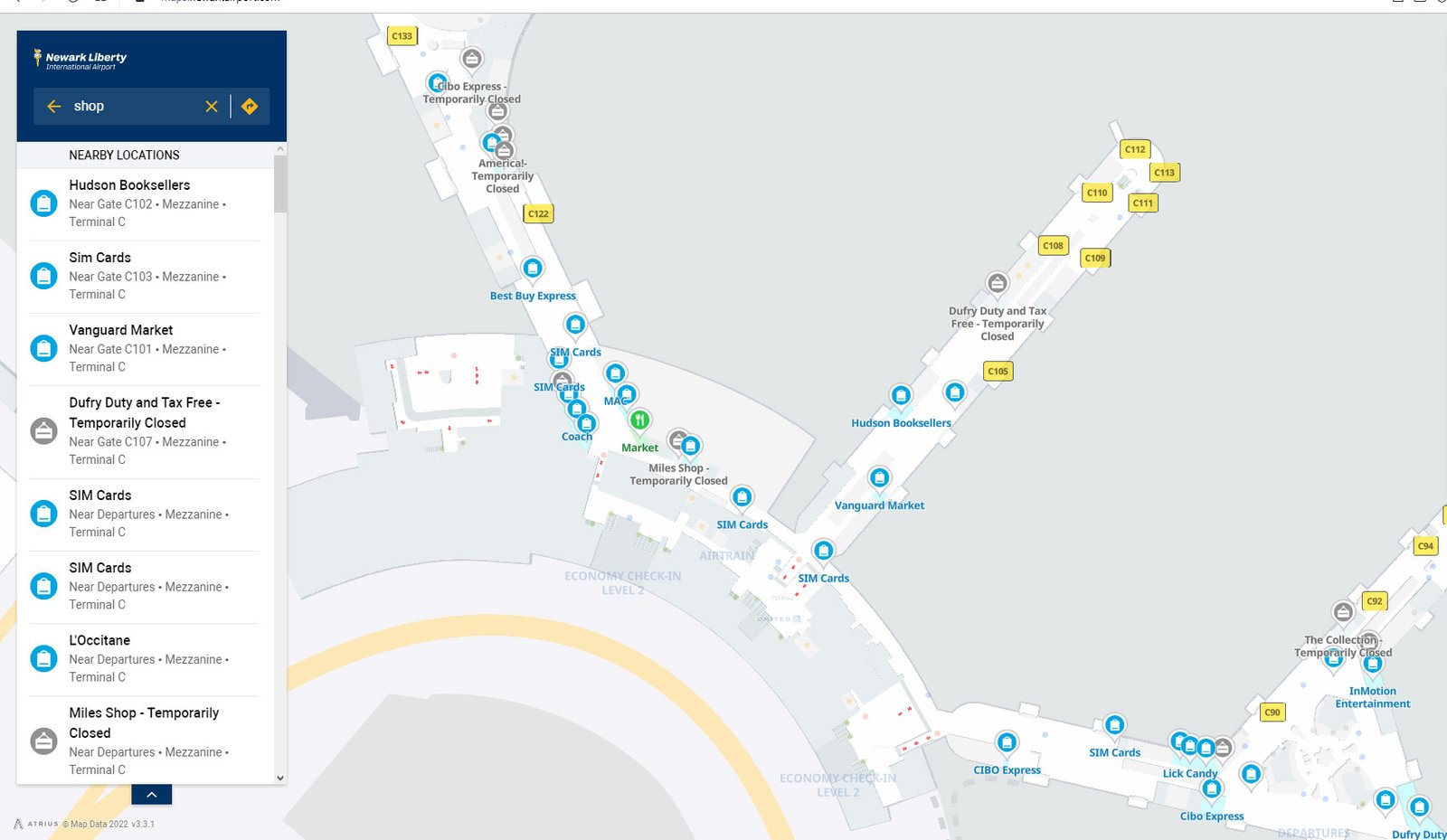

Newark Airport Crisis A Looming National Problem

May 28, 2025

Newark Airport Crisis A Looming National Problem

May 28, 2025 -

Mundial De Atletismo Nanjing 2023 La Seleccion Espanola Confirmada

May 28, 2025

Mundial De Atletismo Nanjing 2023 La Seleccion Espanola Confirmada

May 28, 2025

Latest Posts

-

Alastqlal Qst Ndal Mstmr

May 30, 2025

Alastqlal Qst Ndal Mstmr

May 30, 2025 -

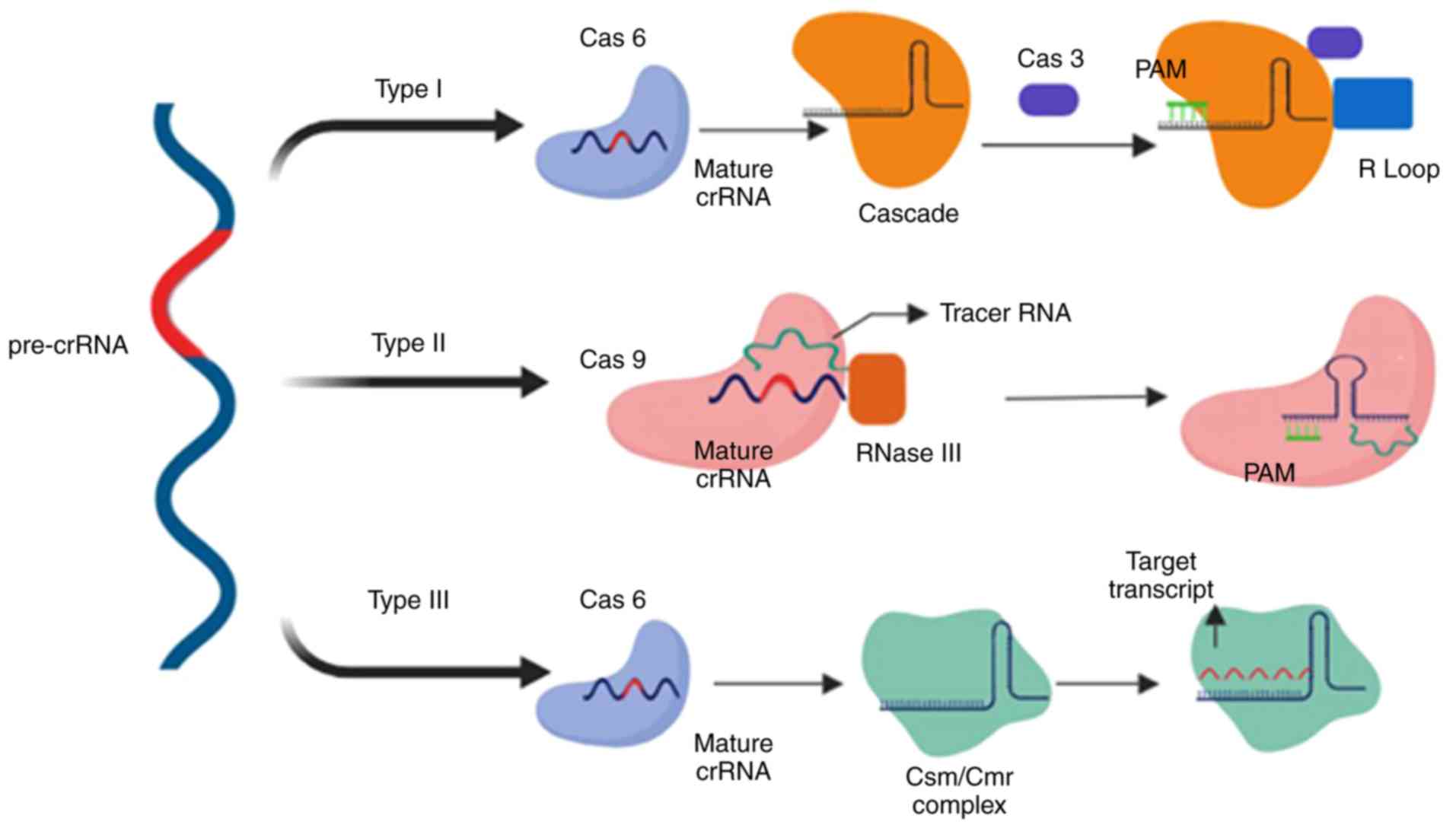

Advanced Crispr System For Whole Gene Integration In Human Cells

May 30, 2025

Advanced Crispr System For Whole Gene Integration In Human Cells

May 30, 2025 -

Tamlat Fy Alastqlal Drws Webr

May 30, 2025

Tamlat Fy Alastqlal Drws Webr

May 30, 2025 -

Alastqlal Irth Yubna Elyh Mstqbl Zahr

May 30, 2025

Alastqlal Irth Yubna Elyh Mstqbl Zahr

May 30, 2025 -

Abead Alastqlal Alaqtsadyt Walajtmaeyt Walsyasyt

May 30, 2025

Abead Alastqlal Alaqtsadyt Walajtmaeyt Walsyasyt

May 30, 2025