Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

Understanding Different Types of Finance Loans

Before you start your loan application, it's crucial to understand the various types of finance loans available. Choosing the right loan depends heavily on your specific needs and financial situation.

Personal Loans: Your Flexible Financing Option

Personal loans are unsecured or secured loans designed for a wide range of personal expenses.

- Uses: Debt consolidation, home improvement, medical expenses, major purchases, wedding expenses.

- Interest Rates: Typically range from 6% to 36%, significantly influenced by your credit score, loan amount, and repayment term. A higher credit score usually translates to a lower interest rate.

- Advantages: Flexible use of funds, fixed monthly payments, and potentially faster approval compared to secured loans.

- Disadvantages: Higher interest rates compared to secured loans (if unsecured), and potential for higher total interest paid over the loan term.

Secured Loans: Leveraging Collateral for Lower Rates

Secured loans require collateral – an asset you pledge as security for the loan. If you default, the lender can seize the collateral.

- Examples: Mortgage loans (using your home as collateral), auto loans (using your vehicle).

- Risks: Repossession of the collateral if you fail to repay the loan. This can have serious financial consequences.

- Benefits: Generally lower interest rates than unsecured loans due to the reduced risk for the lender.

Unsecured Loans: No Collateral Required

Unsecured loans don't require collateral. However, this higher risk for the lender often translates to higher interest rates.

- Examples: Credit cards, personal loans without collateral.

- Interest Rates: Usually higher than secured loans due to the increased risk for the lender.

- Suitability: Best suited for borrowers with excellent credit history who can demonstrate a strong ability to repay the loan.

Business Loans: Fueling Your Entrepreneurial Dreams

Securing funding for your business requires understanding various loan options tailored to business needs.

- Small Business Loans: SBA loans (backed by the Small Business Administration), term loans (with fixed repayment schedules), and lines of credit (allowing for borrowing and repayment as needed).

- Factors Considered by Lenders: A comprehensive business plan, strong credit history, sufficient revenue projections, and collateral (in some cases).

Preparing Your Loan Application: Essential Steps

A well-prepared loan application significantly increases your chances of approval.

Checking Your Credit Score: The Foundation of Your Application

Your credit score is a crucial factor in loan approval and interest rates.

- Obtaining a Credit Report: You can obtain your credit report from major credit bureaus (e.g., Experian, Equifax, TransUnion).

- Improving Your Credit Score: Pay bills on time, keep credit utilization low, and avoid opening too many new accounts.

- Impact on Loan Approval: A higher credit score improves your chances of approval and can secure you a lower interest rate.

Gathering Necessary Documentation: Be Prepared

Ensure you have all necessary documents readily available to expedite the loan application process.

- Essential Documents: Income statements (pay stubs, W-2s), tax returns, proof of address (utility bills, driver's license), bank statements, and any other supporting documentation requested by the lender.

Comparing Loan Offers: Shop Around for the Best Deal

Don't settle for the first loan offer you receive. Compare offers from multiple lenders to find the best terms.

- Factors to Compare: Interest rates (APR), fees (origination fees, late payment fees), repayment terms (loan duration), and any other conditions.

- Online Comparison Tools: Use online comparison tools to quickly compare loan offers from different lenders.

- Understanding APR: The Annual Percentage Rate (APR) reflects the total cost of the loan, including interest and fees.

The Loan Application Process: A Step-by-Step Guide

The loan application process can vary slightly depending on the lender and loan type, but the general steps remain consistent.

Completing the Application Form: Accuracy is Key

Accurate and complete information is paramount.

- Avoiding Common Mistakes: Double-check all information for accuracy before submitting the application. Inconsistent or inaccurate information can delay processing or lead to denial.

- Providing Accurate Information: Provide truthful and complete answers to all questions on the application form.

- Verifying Details: Review the completed application carefully before submission.

Providing Supporting Documentation: Complete and Organized

Submit all required documents in a well-organized manner.

- Organizing Documents: Organize documents chronologically or by type for efficient processing.

- Secure Submission: Use secure methods to submit sensitive documents (e.g., encrypted email, secure online portals).

- Following Up: If you haven't heard back within the expected timeframe, follow up with the lender.

Understanding Loan Approval and Disbursement: What to Expect

The loan approval process can take several days or weeks.

- Factors Affecting Processing Time: The complexity of the loan, the completeness of your application, and the lender's processing speed all play a role.

- Notification of Approval/Denial: You will typically receive notification from the lender once a decision has been made.

- Loan Disbursement: Once approved, the funds are usually disbursed to your account within a few business days.

Managing Your Finance Loans Responsibly

Responsible loan management is crucial for maintaining a healthy financial standing.

Budgeting and Repayment: Plan for Success

Creating a realistic budget is essential for timely repayment.

- Tracking Expenses: Track your income and expenses to identify areas where you can save.

- Creating a Repayment Plan: Develop a realistic repayment plan that aligns with your budget.

- Automatic Payments: Set up automatic payments to avoid missed payments.

Avoiding Late Payments: Protect Your Credit

Late payments can severely damage your credit score.

- Impact on Credit Score: Late payments negatively impact your credit score, making it harder to obtain future loans at favorable rates.

- Late Payment Fees: You'll incur additional fees for late payments.

- Strategies for Avoiding Late Payments: Set reminders, automate payments, and communicate with your lender if you anticipate difficulty making a payment.

Seeking Help When Needed: Don't Hesitate to Ask

If you're facing financial difficulties, don't hesitate to seek help.

- Contacting Lenders: Contact your lenders to explore options like loan modifications or repayment plans.

- Debt Consolidation: Consider debt consolidation to simplify your payments and potentially lower your interest rates.

- Professional Financial Advice: Seek guidance from a financial advisor to create a plan to manage your debt.

Conclusion: Make Informed Decisions with Finance Loans

This guide has equipped you with the knowledge to navigate the world of finance loans successfully. From understanding different loan types and preparing your application to managing your loans responsibly, you're now better prepared to make informed decisions. Remember, securing a loan is a significant financial commitment. By carefully considering the factors discussed above and approaching the process with diligence, you can increase your chances of securing the best loan for your needs. Now that you have a solid understanding of finance loans and the application process, take the next step towards achieving your financial goals. Start exploring available finance loan options and apply today! Secure a loan that works for you and start building a brighter financial future.

Featured Posts

-

Jennifer Lopez Your Host For The 2025 American Music Awards On Cbs

May 28, 2025

Jennifer Lopez Your Host For The 2025 American Music Awards On Cbs

May 28, 2025 -

Psv Amankan Gelar Liga Belanda Setelah Taklukkan Sparta Rotterdam

May 28, 2025

Psv Amankan Gelar Liga Belanda Setelah Taklukkan Sparta Rotterdam

May 28, 2025 -

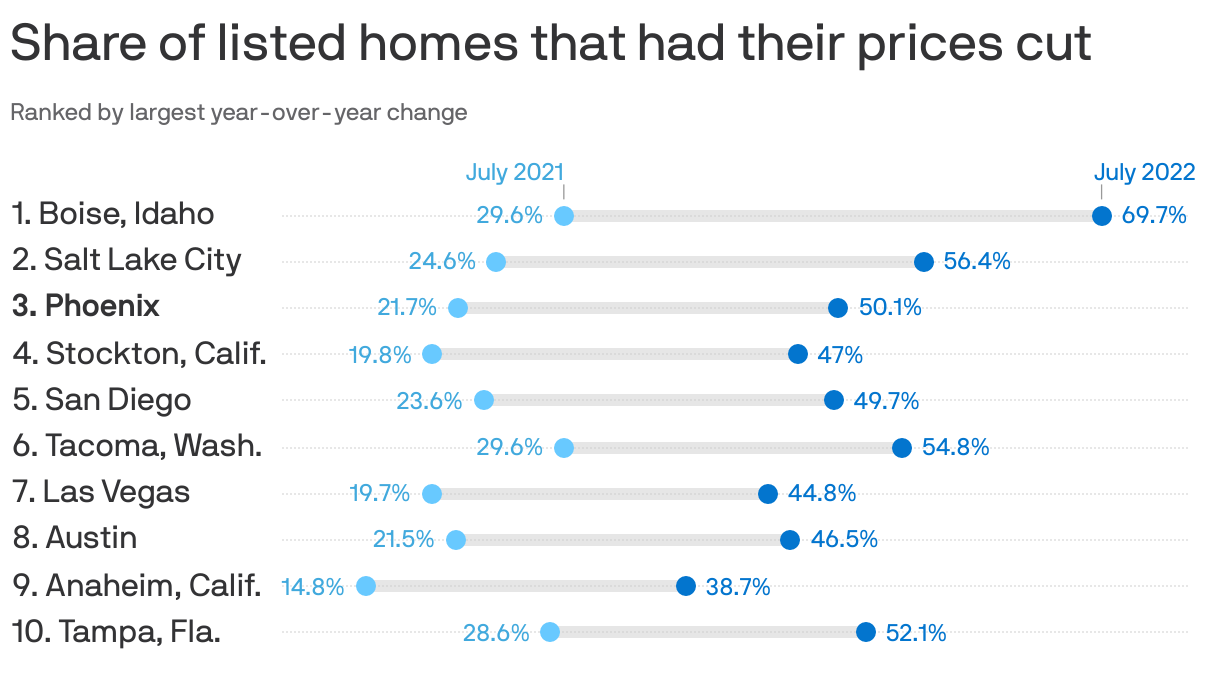

The Housing Market Cools A Deep Dive Into Permit Numbers

May 28, 2025

The Housing Market Cools A Deep Dive Into Permit Numbers

May 28, 2025 -

Building The World Of The Phoenician Scheme Bts Featurette

May 28, 2025

Building The World Of The Phoenician Scheme Bts Featurette

May 28, 2025 -

Analysis Of Attack Mailers In Bethlehems Mayoral And Councilwoman Elections

May 28, 2025

Analysis Of Attack Mailers In Bethlehems Mayoral And Councilwoman Elections

May 28, 2025

Latest Posts

-

Elevated Uncertainty The Growing Risks Of Inflation And Job Losses

May 30, 2025

Elevated Uncertainty The Growing Risks Of Inflation And Job Losses

May 30, 2025 -

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025 -

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semifinal

May 30, 2025

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semifinal

May 30, 2025 -

Tsitsipas Addresses Ivanisevic Coaching Reports The Truth

May 30, 2025

Tsitsipas Addresses Ivanisevic Coaching Reports The Truth

May 30, 2025 -

Monte Carlo Masters Alcaraz Beats Davidovich Fokina Reaches Final

May 30, 2025

Monte Carlo Masters Alcaraz Beats Davidovich Fokina Reaches Final

May 30, 2025