Dutch Stock Market Suffers Further Losses In US Trade Dispute

Table of Contents

Impact on Major Dutch Sectors

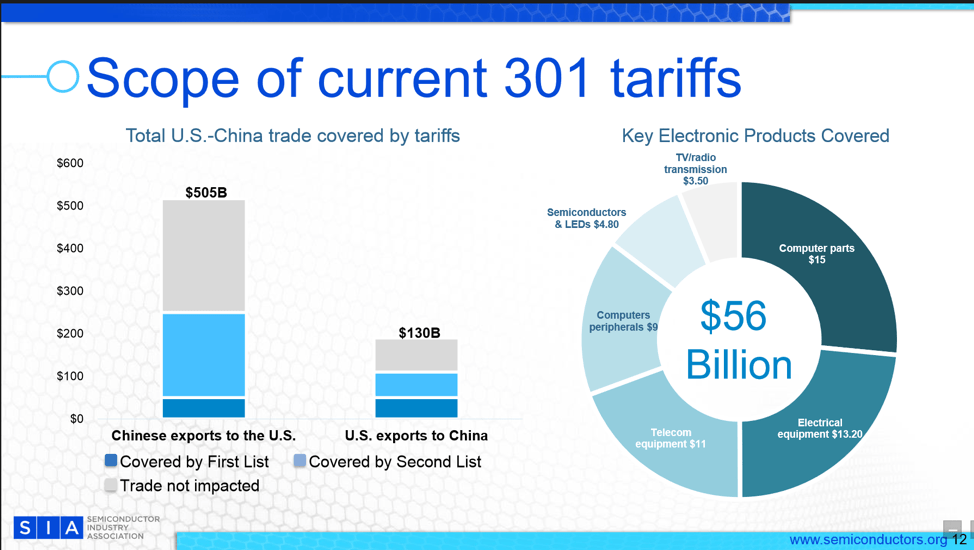

The US trade dispute is significantly impacting several key sectors of the Dutch economy. Companies heavily reliant on exports to the US are facing the brunt of the consequences, experiencing decreased sales and reduced profit margins. The introduction of trade tariffs and import restrictions has further exacerbated the situation.

-

Agriculture: The Dutch agricultural sector, a major exporter of products like dairy and horticultural goods, is facing significant challenges due to increased tariffs imposed by the US. This has led to a decline in export volumes and a subsequent decrease in the market capitalization of several agricultural companies listed on the AEX index. For example, [Insert example of an agricultural company and its losses].

-

Technology: The Dutch technology sector, while less directly affected than agriculture, is still feeling the ripple effects of the trade dispute through reduced consumer confidence and supply chain disruptions. The uncertainty surrounding future trade relations is hindering investment and impacting the growth prospects of several tech startups.

-

Manufacturing: Dutch manufacturing companies, particularly those involved in exporting machinery and industrial goods, are experiencing decreased demand from the US market. This has led to production cuts, job losses, and a decline in the share prices of several manufacturing firms listed on the AMX index.

These trade tariffs and import restrictions are impacting Dutch export capabilities, significantly affecting the overall economic health and the performance of the Dutch stock market. The effects of these economic sanctions are far-reaching and require careful consideration.

Investor Sentiment and Market Volatility

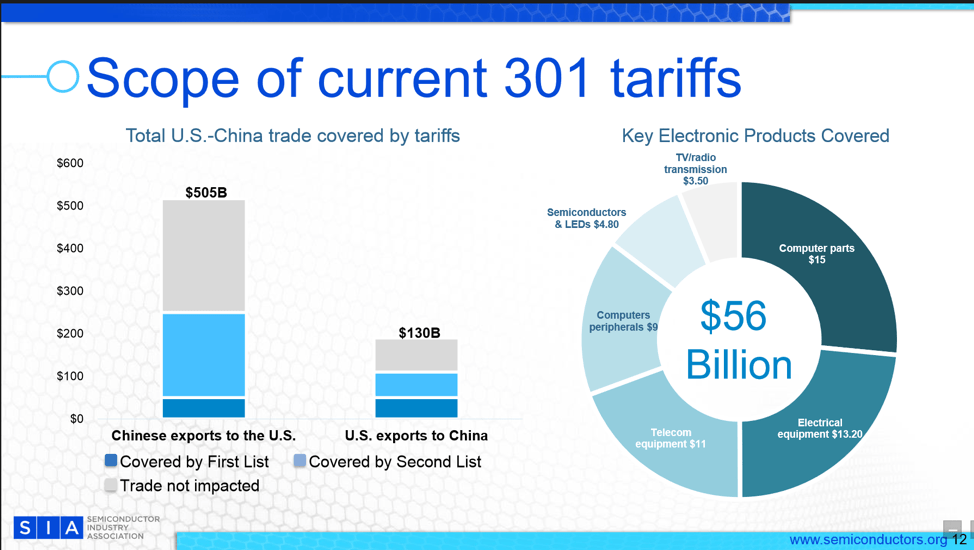

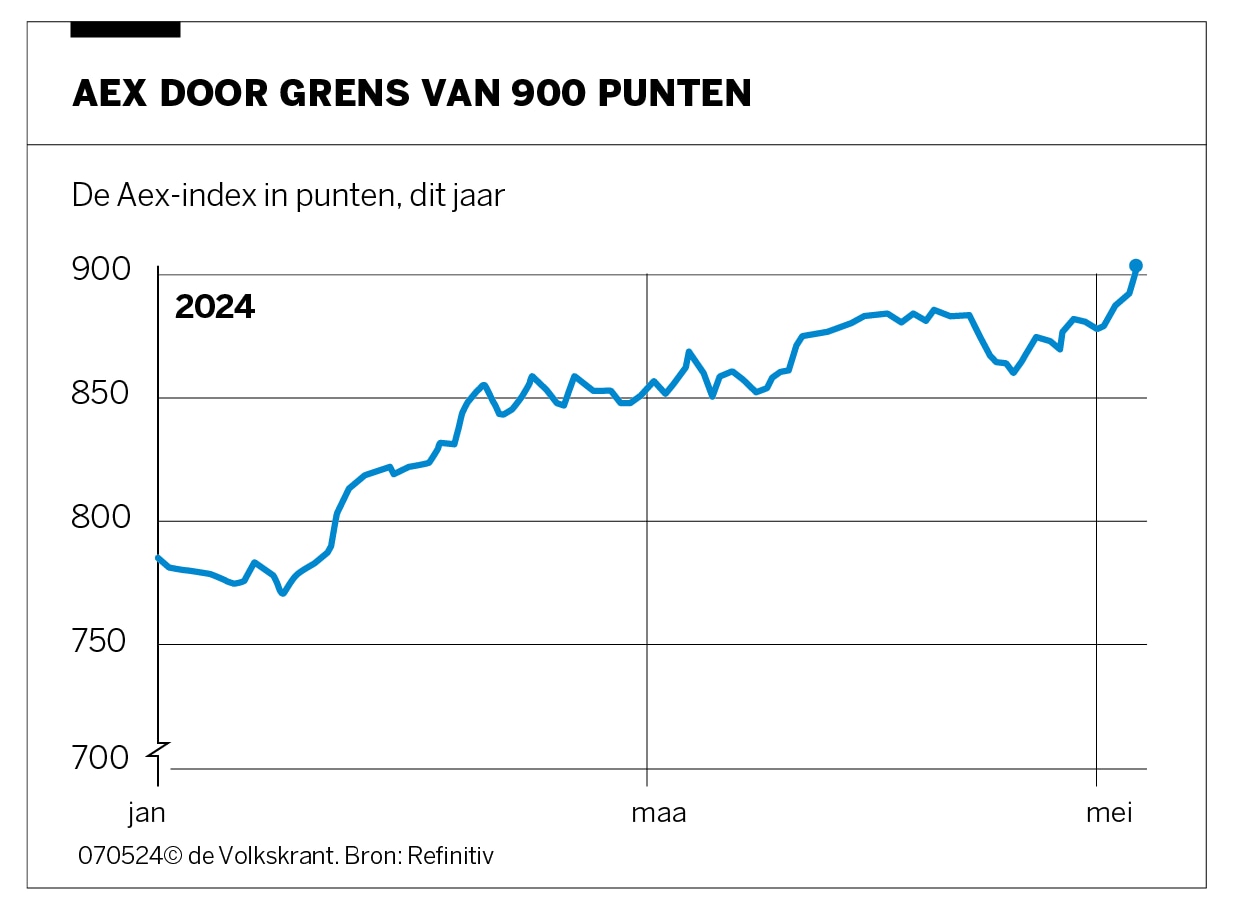

The escalating US trade dispute has significantly eroded investor confidence in the Dutch stock market. The uncertainty surrounding future trade relations has led to increased market volatility, with the AEX index experiencing substantial fluctuations in recent weeks.

-

Declining Trading Volume: Lower trading volumes reflect a hesitancy among investors to commit capital in the face of uncertainty.

-

Increased Market Volatility: The AEX and AMX indices have shown heightened volatility, characterized by sharp price swings, reflecting the nervousness in the market.

-

Flight to Safety: Investors are increasingly moving towards safer assets, such as government bonds, further contributing to the decline in stock market performance.

The resulting stock market crash fears are palpable, leading to a negative feedback loop where decreased confidence further fuels market volatility.

Government Response and Potential Mitigation Strategies

The Dutch government is actively monitoring the situation and exploring various options to mitigate the impact of the US trade dispute on the Dutch economy. While immediate solutions are limited, the government is considering several strategies.

-

Trade Negotiations: The government is actively engaged in diplomatic efforts to negotiate a mutually beneficial trade agreement with the US.

-

Economic Stimulus: The government may consider implementing an economic stimulus package to boost domestic demand and support affected businesses. This might include tax cuts or increased government spending on infrastructure projects.

-

Support for Affected Businesses: Financial aid and other support measures are being explored to help businesses in affected sectors cope with the economic fallout.

The efficacy of these government interventions and fiscal policies will be crucial in determining the long-term recovery of the Dutch stock market.

Long-Term Outlook and Predictions for the Dutch Stock Market

The long-term outlook for the Dutch stock market hinges largely on the resolution of the US trade dispute. Several scenarios are possible:

-

Scenario 1 (Optimistic): A swift resolution to the trade dispute leads to a quick recovery, with investor confidence returning and the AEX index rebounding.

-

Scenario 2 (Neutral): A prolonged but ultimately resolved trade dispute results in a slower recovery, with some lingering negative effects on certain sectors.

-

Scenario 3 (Pessimistic): An escalation of the trade dispute leads to a more protracted downturn, with significant and long-lasting consequences for the Dutch economy and stock market.

While uncertainty remains, identifying potential opportunities for long-term investment requires careful risk assessment and a diversified portfolio strategy. Expert opinions suggest [Insert expert opinion or forecast].

Conclusion: Navigating the Uncertainties of the Dutch Stock Market

The US trade dispute is having a demonstrable and significant impact on the Dutch stock market, affecting key sectors, investor sentiment, and the overall economic outlook. Understanding these developments is crucial for investors seeking to navigate this period of uncertainty. Staying informed about further developments in US-Dutch trade relations and the resulting effects on the AEX and AMX indices is essential for making informed investment decisions. Stay informed on the latest developments affecting the Dutch stock market and the ongoing US trade dispute by subscribing to our newsletter or following us on social media.

Featured Posts

-

Amerikaanse Beurs In De Rode Cijfers Aex Blijft Positief

May 24, 2025

Amerikaanse Beurs In De Rode Cijfers Aex Blijft Positief

May 24, 2025 -

Borse In Picchiata La Ue Risponde Ai Nuovi Dazi

May 24, 2025

Borse In Picchiata La Ue Risponde Ai Nuovi Dazi

May 24, 2025 -

Demnas Gucci Designs September Reveal Amidst Kering Sales Report

May 24, 2025

Demnas Gucci Designs September Reveal Amidst Kering Sales Report

May 24, 2025 -

2nd Annual Best Of Bangladesh In Europe Fostering Collaboration For Future Growth

May 24, 2025

2nd Annual Best Of Bangladesh In Europe Fostering Collaboration For Future Growth

May 24, 2025 -

Prime Videos Picture This A Guide To The Full Movie Soundtrack

May 24, 2025

Prime Videos Picture This A Guide To The Full Movie Soundtrack

May 24, 2025

Latest Posts

-

Tva Group Job Cuts Impact Of Streaming And Regulatory Pressure

May 24, 2025

Tva Group Job Cuts Impact Of Streaming And Regulatory Pressure

May 24, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A Staggering 1050 Increase

May 24, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A Staggering 1050 Increase

May 24, 2025 -

High Profile Office365 Hack Millions In Losses For Companies Feds Charge

May 24, 2025

High Profile Office365 Hack Millions In Losses For Companies Feds Charge

May 24, 2025 -

Cybercriminal Makes Millions From Executive Office365 Account Compromise

May 24, 2025

Cybercriminal Makes Millions From Executive Office365 Account Compromise

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 24, 2025