Dutch Stocks Slump Amidst Escalating US Trade War

Table of Contents

The Impact of US Tariffs on Dutch Businesses

Increased US tariffs on Dutch goods are significantly impacting export-oriented sectors within the Netherlands economy. Industries heavily reliant on exporting to the US, such as agriculture (e.g., flowers, dairy) and manufacturing (e.g., machinery, chemicals), are facing decreased demand and higher production costs. The ripple effect is felt throughout global supply chains.

For example, Dutch agricultural producers exporting flowers to the US are experiencing a sharp decline in sales due to increased import tariffs. Similarly, manufacturers relying on imported raw materials from the US now face inflated input costs, squeezing profit margins and potentially affecting their competitiveness in international markets.

- Decreased demand for Dutch products in the US market: Tariffs make Dutch goods less price-competitive, leading to reduced exports and lost revenue.

- Increased production costs due to higher import tariffs on raw materials: Many Dutch businesses rely on US-sourced materials, increasing their costs and eroding profitability.

- Loss of market share to competitors from countries unaffected by tariffs: Businesses in countries not subject to US tariffs gain a competitive advantage, stealing market share from Dutch companies.

- Potential for job losses in affected industries: Reduced exports and profitability can lead to layoffs and restructuring in vulnerable sectors.

Market Volatility and Investor Sentiment

The escalating trade war has severely dampened investor confidence and fueled significant volatility in the Dutch stock market. Uncertainty surrounding future economic growth and the potential for further trade escalation is driving risk aversion, prompting investors to sell off Dutch stocks and seek refuge in perceived safer assets.

This decline in investor confidence is reflected in stock market fluctuations, with significant daily price swings becoming increasingly common. Negative media coverage further exacerbates the situation, fueling anxieties and contributing to a downward spiral in investor sentiment.

- Increased risk aversion leading to selling of Dutch stocks: Investors are reducing exposure to perceived risky assets, including Dutch equities.

- Capital flight to perceived safer investments: Money is moving towards less volatile investments like government bonds or precious metals.

- Negative media coverage impacting investor sentiment: Continuous news about the trade war fuels uncertainty and discourages investment.

- Uncertainty about future economic growth in the Netherlands: The trade war's impact on key industries casts doubt on the Netherlands' economic prospects.

Government Response and Economic Measures

The Dutch government is actively seeking ways to mitigate the negative consequences of the US trade war. While the effectiveness of these measures remains to be seen, the government's response includes exploring potential support packages for impacted industries, evaluating changes to fiscal or monetary policy to stimulate economic growth, and actively negotiating with the US government to reduce trade barriers. Diversification of export markets away from the US is also being explored.

- Potential government support packages for affected industries: Financial aid, tax breaks, or subsidies may be offered to help businesses cope with tariff-related challenges.

- Changes in fiscal or monetary policy to stimulate economic growth: The government may adjust interest rates or government spending to boost the economy.

- Negotiations with the US government to reduce trade barriers: Diplomatic efforts are underway to resolve trade disputes and lessen the impact of tariffs.

- Exploration of alternative export markets: Dutch businesses are seeking new trading partners to reduce reliance on the US market.

The Role of the European Union

The European Union plays a pivotal role in addressing the US trade war. The EU's collective bargaining power offers a stronger negotiating position against US protectionism, allowing for a more unified and effective response compared to individual member states acting alone. The EU's actions, including negotiations with the US and implementing support measures for affected industries, will significantly impact the Netherlands.

- EU-level negotiations with the US: The EU is engaged in high-level talks with the US aiming to de-escalate trade tensions.

- EU-wide measures to support affected industries: The EU may implement measures to assist industries across member states, including the Netherlands, impacted by US tariffs.

- Potential for increased intra-EU trade to offset losses from US trade: The EU may encourage increased trade between its members to lessen reliance on the US market.

Conclusion

The escalating US trade war presents significant challenges to the Dutch economy and its stock market. Increased tariffs are impacting Dutch businesses, leading to market volatility and decreased investor confidence. While the Dutch government and the European Union are taking steps to mitigate the negative impacts, uncertainty remains. The interconnectedness of global trade highlights the vulnerability of national economies to international trade disputes.

Call to Action: Stay informed about the evolving situation regarding the US trade war and its implications for Dutch stocks. Monitor market trends closely, diversify your investment portfolio to mitigate risk, and consider seeking professional financial advice to navigate the current market volatility and make informed investment decisions regarding Dutch stocks and their future prospects amidst global trade tensions.

Featured Posts

-

Refleksiya Nad Chelovecheskoy Prirodoy Schekotanie Nervov V Rabotakh Fedora Lavrova

May 24, 2025

Refleksiya Nad Chelovecheskoy Prirodoy Schekotanie Nervov V Rabotakh Fedora Lavrova

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

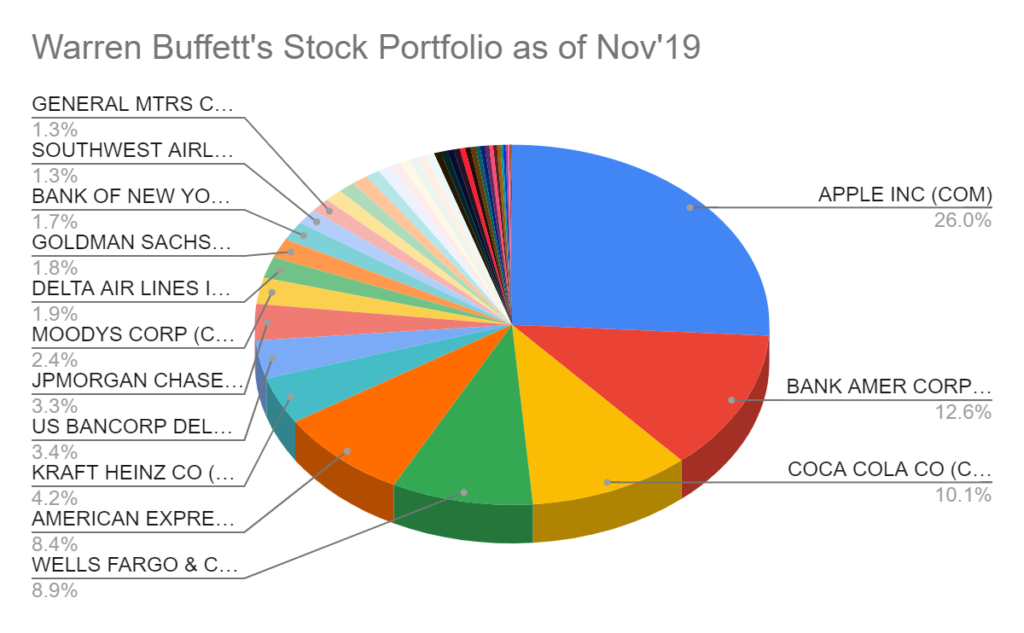

Apple Stock And Tariffs Assessing The Risk To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risk To Buffetts Portfolio

May 24, 2025 -

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Latest Posts

-

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Showcase

May 24, 2025

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Showcase

May 24, 2025 -

Open Ai Unveils New Tools For Voice Assistant Development At 2024 Event

May 24, 2025

Open Ai Unveils New Tools For Voice Assistant Development At 2024 Event

May 24, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025 -

16 Million Penalty T Mobiles Extensive Data Breach Settlement

May 24, 2025

16 Million Penalty T Mobiles Extensive Data Breach Settlement

May 24, 2025 -

The State Of Museum Programs Post Trump Administration Cuts

May 24, 2025

The State Of Museum Programs Post Trump Administration Cuts

May 24, 2025