Economic Forecast: Canadian Dollar And The Next Election

Table of Contents

Potential Impacts of the Election on the Canadian Dollar

Impact of Different Political Platforms

The major political parties in Canada typically offer distinct economic platforms, each with the potential to influence the CAD in different ways. Analyzing these platforms is key to forecasting potential exchange rate fluctuations.

-

Liberal Party: Historically, the Liberal Party platform has focused on fiscal stimulus and social programs. While this can boost economic activity in the short term, increased government spending could also lead to higher inflation and potentially weaken the CAD if it's perceived as unsustainable by international markets. Market reaction will be crucial.

-

Conservative Party: The Conservative Party generally emphasizes fiscal conservatism, tax cuts, and reduced government spending. Tax cuts could stimulate investment and potentially strengthen the CAD, but it could also lead to slower economic growth if not carefully managed.

-

NDP Party: The NDP typically advocates for increased social spending and expanded social programs. Similar to the Liberal platform, this could lead to higher government debt and potential inflationary pressures, impacting the CAD negatively depending on investor sentiment and market reactions to the increased spending.

Specific policy proposals and their potential effects on the economy and the CAD include:

- Increased corporate taxes (potentially deterring investment and weakening the CAD).

- Changes to trade agreements (impacting export revenue and influencing the CAD).

- Investment in infrastructure (potentially boosting economic growth and strengthening the CAD).

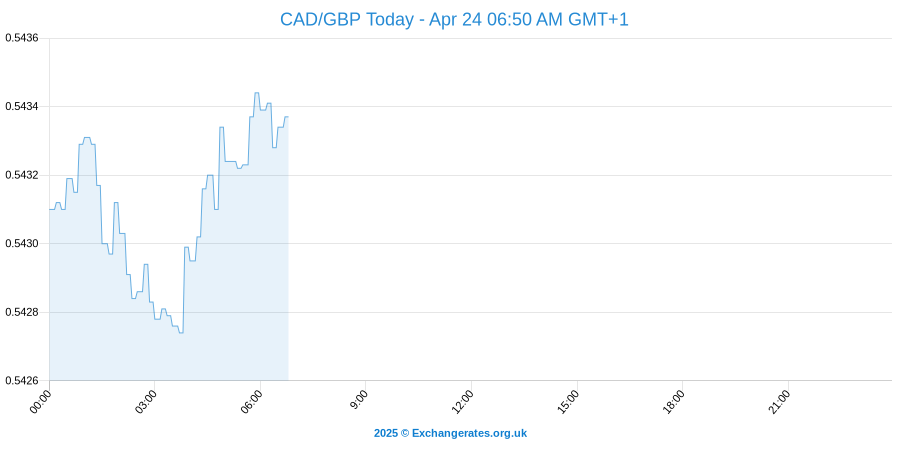

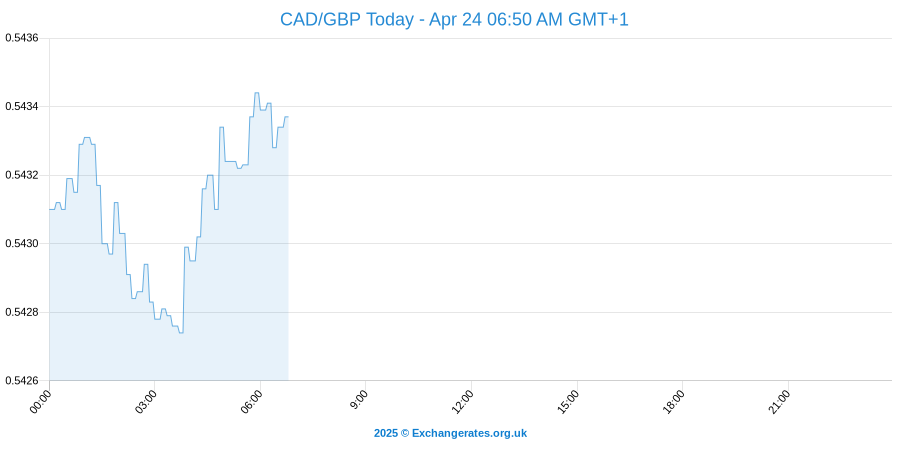

Uncertainty and Market Volatility

The inherent uncertainty surrounding any election inevitably leads to increased volatility in the CAD exchange rate. Investors become hesitant, leading to fluctuations as they wait for clarity on the future economic direction. This is particularly true in a close election where a coalition government is a possibility. A coalition government often represents even greater uncertainty due to the potential for conflicting economic policies and slower decision-making processes.

Factors contributing to market volatility during election periods include:

- Fluctuations in polling data.

- Announcements of new policy proposals by the parties.

- The impact of debates and campaigning events on public opinion and market sentiment.

Analyzing Key Economic Indicators

Current State of the Canadian Economy

Understanding the current state of the Canadian economy is vital for any accurate forecast. Key indicators to consider include:

- GDP Growth: The rate of growth of Canada's economy provides a measure of its overall health. Strong growth generally supports a stronger CAD.

- Inflation: High inflation erodes purchasing power and can weaken the CAD as investors seek higher returns elsewhere.

- Unemployment Rate: Low unemployment indicates a healthy economy, which usually supports the CAD.

- Interest Rates: Interest rate changes by the Bank of Canada significantly impact the CAD. Higher interest rates generally attract foreign investment and strengthen the currency.

- Global Economic Factors: Global economic events, such as recessions or trade wars, heavily impact the Canadian economy and subsequently, the CAD.

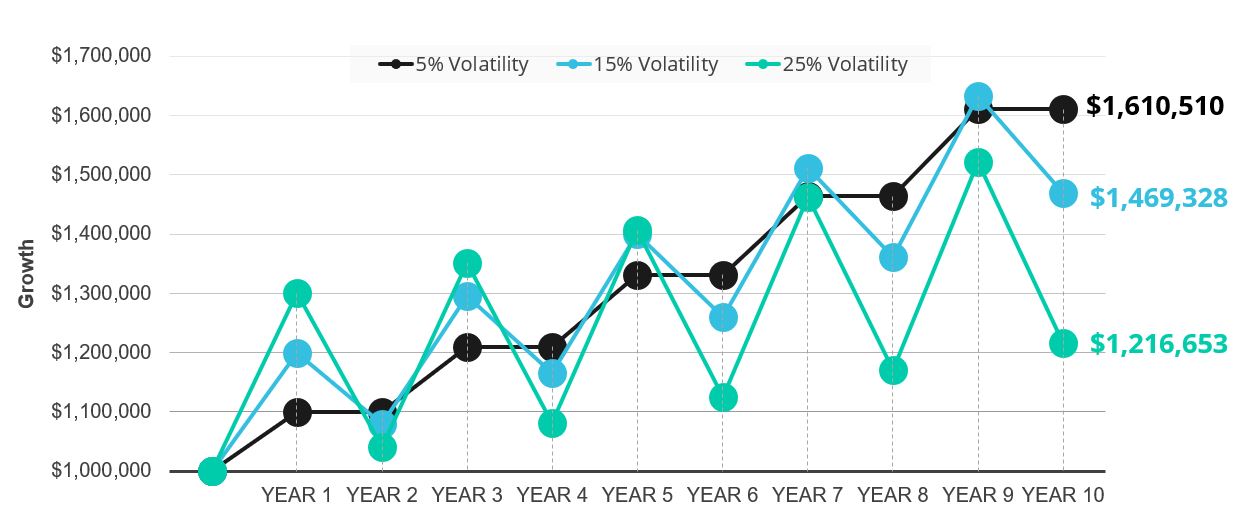

Forecasting Future Economic Growth

Based on the current economic climate and potential election outcomes, several economic growth scenarios are possible. Each scenario would have implications for the CAD's performance:

- Scenario 1 (Strong Growth): A government focused on fiscal responsibility and pro-growth policies could lead to strong economic expansion, potentially strengthening the CAD.

- Scenario 2 (Moderate Growth): A government with a more balanced approach to spending and taxation could result in moderate economic growth, with a relatively stable CAD.

- Scenario 3 (Slow Growth): A government with significant increases in spending and potentially higher taxes could lead to slower economic growth and a weakening CAD.

These scenarios highlight the crucial link between political decisions and economic performance, directly impacting the CAD's value.

Investment Strategies for Navigating Election Uncertainty

Diversification and Risk Management

Navigating the uncertainty of the Canadian election requires a diversified investment strategy. Diversification helps mitigate the risk associated with CAD fluctuations and potential economic shifts.

- Hedging: Employing hedging strategies, such as using derivatives, can help protect against losses due to CAD volatility.

- CAD-Denominated Assets: Maintaining a portion of your portfolio in CAD-denominated assets reduces the impact of currency fluctuations.

- International Diversification: Investing in assets outside of Canada reduces reliance on the performance of the Canadian economy.

Specific investment strategies will depend on your risk tolerance:

- Low-Risk Tolerance: Focus on highly rated bonds and stable, dividend-paying stocks.

- Medium-Risk Tolerance: A balanced portfolio with a mix of stocks, bonds, and real estate.

- High-Risk Tolerance: Greater allocation to equities, including potentially emerging markets and sector-specific investments.

Opportunities and Challenges

Different election outcomes present both opportunities and challenges for investors.

- Opportunities: Sectors such as infrastructure, technology, or renewable energy could benefit from specific policy changes.

- Challenges: Increased taxes on certain sectors could negatively impact returns for investors in those areas.

Identifying these opportunities and risks requires careful analysis of each party's platform and its potential impact on different industries.

Conclusion

The upcoming Canadian election presents significant uncertainty for the Canadian dollar and the overall economy. Understanding the potential impacts of different political platforms and managing risk through diversification are crucial for navigating this period. By analyzing key economic indicators and considering potential scenarios, investors and businesses can develop informed strategies to mitigate risks and capitalize on opportunities. Stay informed on the latest developments surrounding the Canadian dollar and the Canadian election to make sound financial decisions. Keep checking back for updated economic forecasts and analyses related to the Canadian dollar and its connection to the next election.

Featured Posts

-

Xrps Future Uncertain As Sec Ripple Settlement Talks Progress

May 01, 2025

Xrps Future Uncertain As Sec Ripple Settlement Talks Progress

May 01, 2025 -

Four Killed Children Included In Horrific After School Camp Accident

May 01, 2025

Four Killed Children Included In Horrific After School Camp Accident

May 01, 2025 -

Pounce Now S And P 500 Downside Protection For Volatility Wary Investors

May 01, 2025

Pounce Now S And P 500 Downside Protection For Volatility Wary Investors

May 01, 2025 -

1 Million Debt Relief Michael Sheens Generosity Impacts 900 Lives

May 01, 2025

1 Million Debt Relief Michael Sheens Generosity Impacts 900 Lives

May 01, 2025 -

Sec Vs Ripple The Impact On Xrps Commodity Status

May 01, 2025

Sec Vs Ripple The Impact On Xrps Commodity Status

May 01, 2025

Latest Posts

-

Severe Ohio River Flooding Leads To Thunder Over Louisville Fireworks Cancellation

May 01, 2025

Severe Ohio River Flooding Leads To Thunder Over Louisville Fireworks Cancellation

May 01, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

May 01, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

May 01, 2025 -

State Of Emergency Louisville Battles Tornado Aftermath And Imminent Flooding

May 01, 2025

State Of Emergency Louisville Battles Tornado Aftermath And Imminent Flooding

May 01, 2025 -

Louisville Shelter In Place Reflecting On The Citys History Of Tragedy

May 01, 2025

Louisville Shelter In Place Reflecting On The Citys History Of Tragedy

May 01, 2025 -

Louisville Residents Shelter In Place Remembering Past Tragedies

May 01, 2025

Louisville Residents Shelter In Place Remembering Past Tragedies

May 01, 2025