Election Promises And The Looming Deficit Crisis

Table of Contents

Analyzing the Cost of Election Promises

Unrealistic Spending Commitments

Many election promises involve significant financial commitments that may be difficult, if not impossible, to meet without drastically increasing the national debt. These unrealistic spending commitments threaten to worsen the existing deficit crisis and jeopardize long-term economic stability.

- Example 1: Proposed Nationwide Infrastructure Overhaul: Candidate X promised a $2 trillion infrastructure investment, with vague details on funding. [Link to news article detailing the promise]. This would significantly increase the national debt and potentially crowd out other essential government spending.

- Example 2: Expansion of Universal Healthcare Coverage: Candidate Y proposed expanding healthcare coverage to all citizens, estimated to cost $1 trillion over ten years. [Link to government report on healthcare costs]. The lack of specified funding mechanisms raises serious concerns about the fiscal impact.

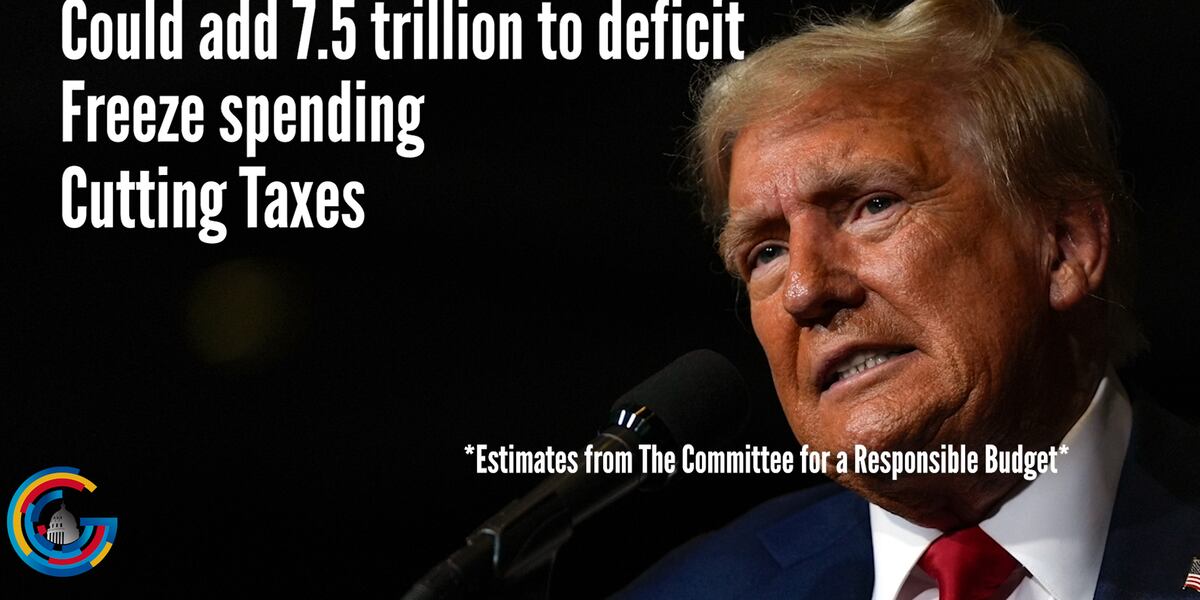

- Example 3: Tax Cuts for High-Income Earners: Candidate Z pledged substantial tax cuts for high-income earners, which could reduce government revenue by hundreds of billions of dollars annually. [Link to analysis of proposed tax cuts]. This would further widen the budget deficit.

These examples illustrate the potential strain on public finances if these promises are implemented without a clear and realistic funding plan. The resulting surge in government borrowing could lead to higher interest rates and reduced economic growth.

Lack of Transparency in Funding Mechanisms

A major concern surrounding many election promises is the lack of transparency regarding their funding mechanisms. Vague promises without concrete plans for financing raise serious doubts about their feasibility and contribute to a sense of fiscal irresponsibility.

- Reliance on Economic Growth: Many promises implicitly rely on future economic growth to offset the increased spending. However, this assumes a specific rate of economic growth that may not materialize, leaving a significant funding gap.

- Unrealistic Revenue Projections: Some proposals rely on unrealistic revenue projections from new taxes or economic activity, without providing detailed analysis to support their claims.

- Lack of Specific Funding Sources: In several cases, there is a complete absence of specified funding sources, leaving taxpayers to bear the burden of increased debt.

This lack of transparency undermines public trust and hinders informed decision-making. Without detailed fiscal plans, it is impossible to assess the true cost of election promises and their long-term impact on the nation's finances.

The Current State of the Deficit and its Implications

Understanding the Existing Deficit

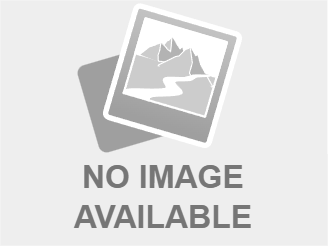

The current national debt and deficit represent a significant challenge to the country's fiscal health. [Insert chart showing national debt over time]. The deficit is primarily driven by factors like:

- Increased Government Spending: Spending on social security, healthcare, and defense continues to rise.

- Slow Economic Growth: Periods of slow economic growth reduce tax revenue and increase the need for government spending on social programs.

- Tax Cuts: Previous tax cuts have reduced government revenue, contributing to the deficit.

Long-Term Consequences of Unchecked Spending

A worsening deficit has several detrimental long-term consequences:

- Inflation: Increased government borrowing can lead to inflation, eroding the purchasing power of citizens.

- Reduced Credit Rating: A high national debt can lead to a reduced credit rating, increasing borrowing costs for the government.

- Decreased Investment: High levels of government debt can crowd out private investment, hindering economic growth.

- Impact on Essential Services: Unchecked spending can force cuts in essential services like education, healthcare, and infrastructure.

Experts warn that if the current trend of increasing deficits continues, the nation faces severe economic challenges. [Include quote from an economist supporting this point].

Strategies for Fiscal Responsibility

Prioritizing Spending

To address the looming deficit crisis, careful prioritization of government spending is crucial. This involves:

- Identifying Non-Essential Spending: Areas where spending can be reduced without compromising essential services need to be identified.

- Improving Efficiency: Streamlining government processes and reducing waste can free up resources for essential programs.

- Public-Private Partnerships: Exploring public-private partnerships can help finance infrastructure projects and other initiatives without solely relying on government funds.

Revenue Generation Strategies

Increasing government revenue is another vital strategy to tackle the deficit. Potential avenues include:

- Tax Reforms: Reforming the tax system to make it more efficient and equitable can increase revenue. This could involve closing tax loopholes or adjusting tax brackets.

- Increased Taxation on Certain Goods/Services: Increasing taxes on luxury goods or environmentally damaging products could generate additional revenue while promoting positive societal outcomes.

The key is to find sustainable and equitable revenue generation strategies that minimize the impact on lower and middle-income groups.

Conclusion: Addressing the Deficit Crisis Through Responsible Governance

The potential impact of unfunded election promises on the existing deficit crisis cannot be ignored. The consequences of unchecked spending are severe, ranging from inflation and reduced credit ratings to cuts in essential services. Responsible fiscal planning is vital for ensuring the long-term economic well-being of the nation. To avoid a worsening deficit crisis, we must demand fiscal transparency and accountability from our elected officials. Hold your elected officials accountable for their election promises. Demand realistic fiscal planning and informed yourself about the deficit crisis and its impact on your future. Responsible governance, prioritizing spending, and exploring sustainable revenue generation strategies are key to managing the nation's finances effectively. The future of our fiscal health depends on it.

Featured Posts

-

Ubs Downgrades Hong Kong Upgrades India Economic Outlook

Apr 25, 2025

Ubs Downgrades Hong Kong Upgrades India Economic Outlook

Apr 25, 2025 -

Sexual Extortion Charges Against Well Known Meteorologist

Apr 25, 2025

Sexual Extortion Charges Against Well Known Meteorologist

Apr 25, 2025 -

Win Big At Eurovision 2025 Smart Betting Strategies And Predictions

Apr 25, 2025

Win Big At Eurovision 2025 Smart Betting Strategies And Predictions

Apr 25, 2025 -

Taiwan International Solidarity Act Reintroduced In Us Congress

Apr 25, 2025

Taiwan International Solidarity Act Reintroduced In Us Congress

Apr 25, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 25, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025