UBS Downgrades Hong Kong, Upgrades India Economic Outlook

Table of Contents

UBS Downgrades Hong Kong Economic Outlook

UBS's recent report paints a less optimistic picture for Hong Kong's economic future. The downgrade reflects a confluence of factors impacting the region's growth trajectory.

Reasons for the Downgrade

The reasons cited by UBS for the Hong Kong economic downgrade are multifaceted and interconnected:

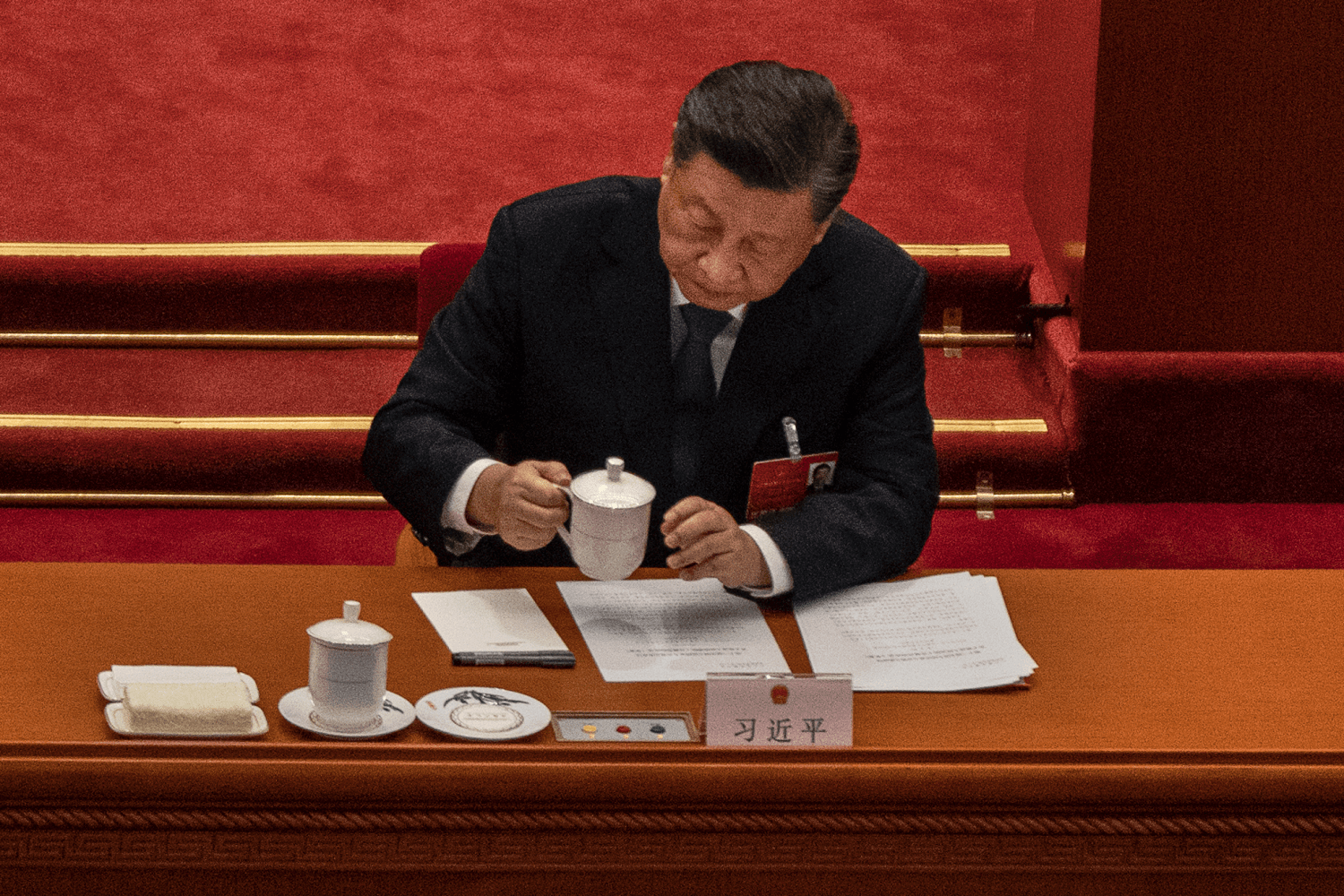

- Increased Geopolitical Risks: Rising geopolitical tensions, particularly concerning the relationship between China and the West, create uncertainty and negatively impact investor confidence. This translates to reduced foreign direct investment and hinders economic growth.

- Slowdown in Exports and Tourism: Hong Kong's export-oriented economy has suffered from global supply chain disruptions and a weakening global demand. Furthermore, the tourism sector, a crucial pillar of the economy, has yet to fully recover from the pandemic's impact.

- Tightening Monetary Policy: The ongoing tightening of monetary policy by the Hong Kong Monetary Authority, aimed at curbing inflation, may inadvertently stifle economic activity and investment. Higher interest rates can discourage borrowing and investment, leading to slower growth.

- Lingering Impact of China's Policies: While China's zero-COVID policy is largely a thing of the past, its lingering effects on supply chains and cross-border trade continue to impact Hong Kong's economic performance.

Implications of the Downgrade

The UBS downgrade carries significant implications for Hong Kong. The projected Hong Kong economic slowdown could lead to:

- Reduced Investment: Lower growth prospects may discourage both domestic and foreign investment, potentially hindering future development.

- Increased Market Volatility: Uncertainty surrounding the economic outlook could increase volatility in Hong Kong's financial markets, impacting investor confidence and asset prices.

- Lower Employment and Consumer Confidence: Slower economic growth often translates into reduced job creation and lower consumer spending, further dampening economic activity. The Hong Kong growth forecast is now significantly lower than previous predictions.

UBS Upgrades India Economic Outlook

In stark contrast to its Hong Kong assessment, UBS has significantly upgraded its economic outlook for India, projecting robust growth in the coming years.

Reasons for the Upgrade

UBS's positive outlook for India rests on several key factors:

- Robust Domestic Consumption: Strong domestic demand, fueled by a growing middle class and rising disposable incomes, continues to be a powerful engine of economic growth.

- Government Infrastructure Investments: The Indian government's significant investments in infrastructure development, including roads, railways, and digital connectivity, are boosting economic activity and creating jobs.

- Growth in the Technology Sector: India's thriving technology sector, including software services and IT outsourcing, is contributing significantly to economic growth and attracting substantial foreign investment.

- Positive Demographic Trends: India's young and growing population presents a large and dynamic workforce, fueling economic expansion and innovation.

Implications of the Upgrade

The UBS upgrade signals a positive trajectory for the Indian economy. Potential benefits include:

- Increased Foreign Investment: The upgraded outlook is likely to attract significant foreign investment into India, further bolstering economic growth.

- Job Creation: Increased economic activity will likely lead to substantial job creation across various sectors, improving employment rates and reducing poverty.

- Higher India GDP Growth: The upgraded outlook points towards a significant increase in India's GDP growth rate, surpassing previous expectations. This sets India apart from many other global economies.

Comparison of Hong Kong and India Outlooks

| Feature | Hong Kong | India |

|---|---|---|

| UBS Outlook | Downgraded | Upgraded |

| Key Factors | Geopolitical risks, slow exports, tight monetary policy | Strong domestic demand, government investment, tech growth |

| Projected Growth | Lower than previously forecast | Significantly higher than previously forecast |

| Investment Impact | Reduced investment, market volatility | Increased foreign investment |

Conclusion: UBS's Revised Economic Forecasts: Implications for Investors

UBS's revised economic forecasts for Hong Kong and India highlight the diverging paths of these two Asian economies. While Hong Kong faces headwinds from geopolitical uncertainty and slowing growth, India’s robust domestic demand and government initiatives fuel its positive outlook. Understanding these contrasting trends is crucial for investors. The reasons behind the downgrade and upgrade are complex and interconnected, emphasizing the need for careful analysis of global economic trends before making investment decisions. Stay informed about the latest economic forecasts from UBS and make informed decisions about your investments in Hong Kong and India. Understanding the shifting economic landscape is crucial for navigating the complexities of the global financial markets. Consider diversifying your portfolio and seeking professional financial advice to manage your investments effectively in light of these significant changes.

Featured Posts

-

Dope Thief Episode 7 Ray And Mannys Gritty Return

Apr 25, 2025

Dope Thief Episode 7 Ray And Mannys Gritty Return

Apr 25, 2025 -

Eurovision 2025 Analyzing The Leading Contenders

Apr 25, 2025

Eurovision 2025 Analyzing The Leading Contenders

Apr 25, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 25, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 25, 2025 -

Latest Oil Market News And Analysis April 24 2024

Apr 25, 2025

Latest Oil Market News And Analysis April 24 2024

Apr 25, 2025 -

Xi Jinping And The Increasing Pain Tolerance In Sino American Relations

Apr 25, 2025

Xi Jinping And The Increasing Pain Tolerance In Sino American Relations

Apr 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025 -

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025