Elon Musk's Net Worth Falls Below $300 Billion: Tesla's Troubles And Tariff Impacts

Table of Contents

Elon Musk, once the undisputed world's richest person, has experienced a significant drop in his net worth, falling below the $300 billion mark. This dramatic decline isn't a singular event but rather the culmination of several interconnected factors. This article analyzes the key reasons behind this substantial financial shift, focusing on Tesla's recent struggles and the increasing impact of global tariffs on the electric vehicle giant.

Tesla's Stock Price Decline: A Major Contributor

Keywords: Tesla stock, stock market, share price, investor sentiment, market volatility, production challenges, supply chain issues, competition

Recent drops in Tesla's share price have been the primary driver of the decrease in Elon Musk's net worth. A substantial portion of his wealth is directly tied to his ownership of Tesla stock. The volatility of the stock market, coupled with specific challenges faced by Tesla, has resulted in significant losses.

- Production Challenges and Supply Chain Disruptions: Tesla has grappled with production bottlenecks and supply chain issues, impacting its ability to meet demand and affecting its overall profitability. This uncertainty has shaken investor confidence.

- Increased Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This intense competition puts pressure on Tesla's pricing and profitability.

- Negative News Cycles: Negative news cycles, ranging from concerns about Tesla's autonomous driving technology to production delays and quality control issues, have contributed to negative investor sentiment and further depressed the stock price.

- Correlation Analysis: A clear correlation exists between Tesla's stock performance and Musk's net worth. Any significant downward movement in Tesla's share price directly translates into a considerable drop in Musk's overall wealth. This tight link underscores the vulnerability of his fortune to the performance of a single, albeit highly influential, company.

The Impact of Global Tariffs on Tesla's Profitability

Keywords: Global tariffs, trade wars, import/export costs, manufacturing costs, price increases, international markets, supply chain disruption

The escalating impact of global tariffs on Tesla's operations significantly contributes to the decline in profitability, indirectly impacting Musk's net worth.

- Increased Manufacturing Costs: Tariffs on imported materials and components used in Tesla's vehicles directly increase manufacturing costs, squeezing profit margins. This is particularly relevant given Tesla's global supply chains.

- Higher Prices for Consumers: To offset increased manufacturing costs, Tesla may be forced to raise prices for its vehicles, potentially reducing consumer demand in already price-sensitive markets.

- Supply Chain Disruptions: Tariffs can lead to supply chain disruptions, delaying production and increasing costs further. This complexity adds another layer to the challenges Tesla already faces.

- Regional Impact: The impact of tariffs varies across different regions. Tesla's operations in certain markets are more susceptible to tariff-related challenges than others, further highlighting the complexity of this issue.

The Broader Economic Context

Keywords: Recession fears, inflation, interest rates, market uncertainty, economic downturn, investor confidence

The broader economic environment significantly impacts Tesla's valuation and, consequently, Musk's net worth.

- Recession Fears and Inflation: Fears of a global recession and persistent inflation have created significant market uncertainty, leading investors to reassess their holdings in high-growth, albeit volatile, stocks like Tesla.

- Increased Interest Rates: Rising interest rates make borrowing more expensive, potentially hindering Tesla's expansion plans and making future growth less certain for investors.

- Market Uncertainty: General market uncertainty disproportionately affects high-growth tech stocks like Tesla, leading to increased volatility and price corrections.

Other Contributing Factors to the Net Worth Decrease

Keywords: SpaceX investment, Twitter acquisition, personal spending, philanthropy, asset diversification

While Tesla is the primary driver of Musk's net worth fluctuations, other factors also play a role.

- SpaceX and Twitter: Musk's investments in SpaceX and his acquisition of Twitter, while potentially long-term lucrative, introduce additional risk and volatility into his overall financial picture. The performance of these ventures indirectly impacts his net worth.

- Personal Spending and Philanthropy: Musk's personal spending habits and philanthropic activities, though relatively small compared to his overall wealth, also contribute to the overall fluctuation of his net worth.

- Asset Diversification: While a large portion of Musk's wealth is tied to Tesla, the extent of diversification of his assets influences the overall impact of any single factor.

Conclusion

The significant drop in Elon Musk's net worth, falling below $300 billion, is a multifaceted issue. Tesla's stock price decline, driven by production challenges, increased competition, and negative news cycles, is the main culprit. Exacerbating the situation are the impacts of global tariffs and the broader economic uncertainty. This dramatic fall underscores the volatility inherent in the stock market and the interconnectedness of global economic forces. Understanding these factors is vital for investors and anyone following the dynamics of high-net-worth individuals in the global economy. Continue to monitor Elon Musk's net worth and Tesla's performance to fully grasp this significant financial shift. Tracking Tesla's future performance and global economic trends is crucial to understanding the future trajectory of Elon Musk's net worth.

Featured Posts

-

The Importance Of Middle Managers Driving Performance And Fostering Collaboration

May 10, 2025

The Importance Of Middle Managers Driving Performance And Fostering Collaboration

May 10, 2025 -

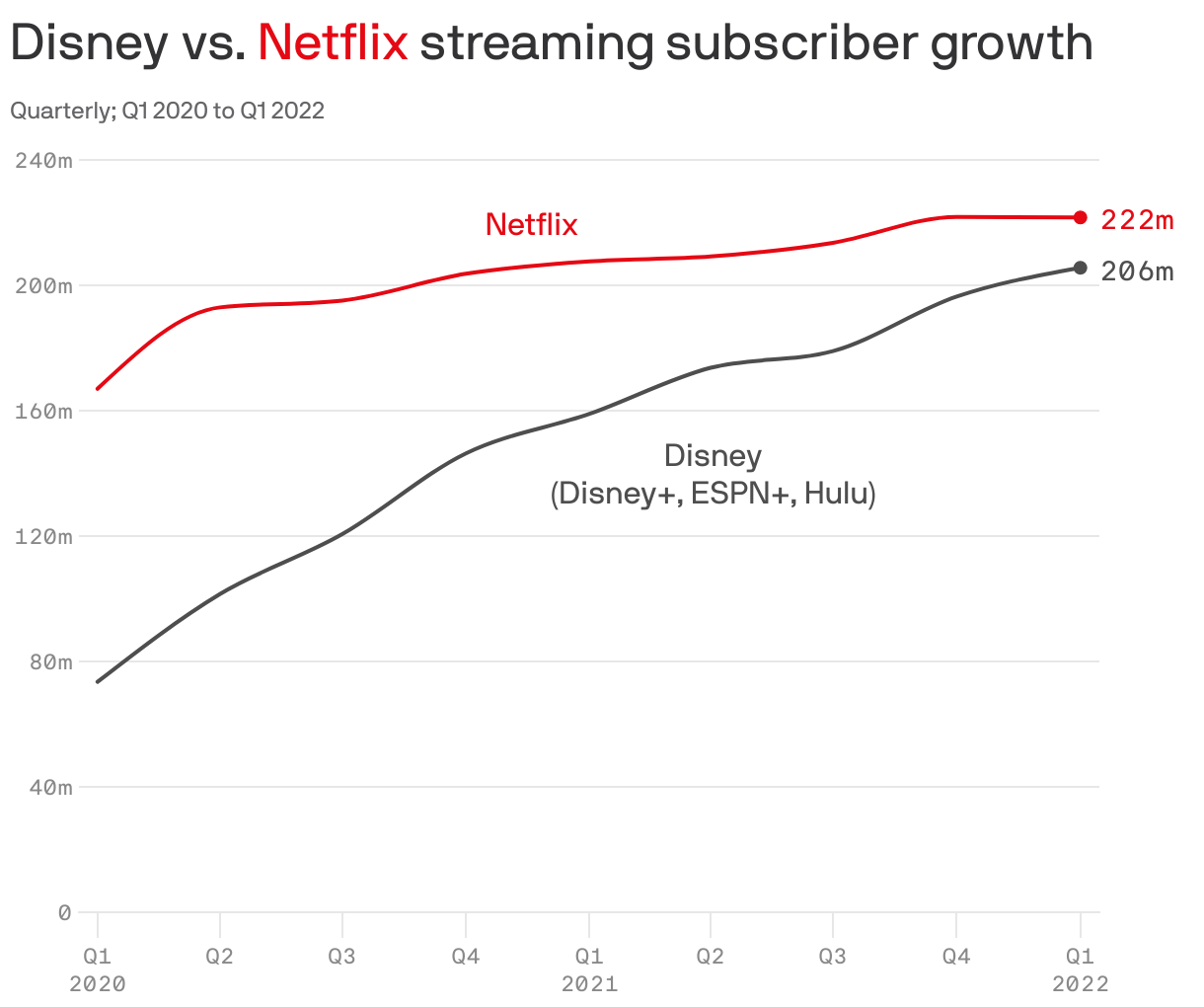

Strong Parks And Streaming Performance Fuel Disneys Upgraded Profit Forecast

May 10, 2025

Strong Parks And Streaming Performance Fuel Disneys Upgraded Profit Forecast

May 10, 2025 -

Nhs Trust Chiefs Commitment To Nottingham Attack Investigation

May 10, 2025

Nhs Trust Chiefs Commitment To Nottingham Attack Investigation

May 10, 2025 -

Pakistans Stock Market Plunge Website Outage Highlights Growing Instability

May 10, 2025

Pakistans Stock Market Plunge Website Outage Highlights Growing Instability

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Guide

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Guide

May 10, 2025