Elon Musk's SpaceX: A $43 Billion Lead Over Tesla Investment

Table of Contents

SpaceX's Soaring Valuation: A Deep Dive into the $43 Billion Lead

The current valuation of SpaceX is a closely guarded secret, as it's a privately held company. However, recent funding rounds and industry analyses suggest a valuation significantly exceeding that of Tesla. While Tesla's market capitalization fluctuates publicly, estimations place SpaceX's worth considerably higher, accounting for the reported $43 billion difference. This substantial lead highlights SpaceX's remarkable growth and potential.

-

Recent Funding Rounds and Valuation Impact: Several funding rounds have injected massive capital into SpaceX, significantly boosting its valuation. These investments reflect investor confidence in SpaceX's innovative technologies and ambitious goals. Each successful round increases the company's overall worth and strengthens its position in the space industry.

-

Government Contracts and Partnerships: SpaceX has secured numerous lucrative contracts with government agencies like NASA, contributing significantly to its valuation. These partnerships provide crucial funding and validate SpaceX's technological capabilities, further solidifying investor trust. The reliability and innovation demonstrated in these contracts are invaluable.

-

Innovative Technologies and Market Potential: SpaceX's groundbreaking technologies, such as the Starship reusable launch system and the Starlink satellite internet constellation, are major drivers of its valuation. Starship promises to revolutionize space travel, and Starlink is rapidly expanding global internet access, creating substantial revenue streams. Both demonstrate a high return on investment potential.

-

Long-Term Growth Projections: Analysts project significantly higher long-term growth for SpaceX compared to Tesla. The space exploration market is expected to expand exponentially in the coming decades, providing ample opportunities for SpaceX to dominate and increase its valuation further. Tesla, while successful, operates in a more mature and competitive market.

Comparing SpaceX and Tesla's Investment Landscape

Investing in either SpaceX or Tesla presents a unique risk-reward profile.

-

Market Volatility: Tesla's stock is publicly traded, exhibiting significant market volatility. SpaceX, being private, lacks this direct exposure, but its valuation is still subject to market forces and investor sentiment. Understanding this difference is crucial for risk assessment.

-

Investor Profiles: Tesla attracts a broader range of investors, including short-term traders seeking quick returns. SpaceX, with its longer-term vision and higher risk tolerance, appeals more to long-term investors and venture capitalists.

-

Investment Accessibility: Investing in Tesla is straightforward through public stock markets. Investing in SpaceX is significantly more challenging, typically requiring access to private investment rounds.

-

Potential Returns on Investment: Both companies offer potentially substantial returns, though the risk-reward ratio differs significantly. SpaceX's higher risk is potentially offset by the massive potential upside in the rapidly expanding space industry. Tesla's more established market presents less risk, but potentially lower overall returns.

The Future of Space Exploration and its Impact on SpaceX's Valuation

The commercialization of space is a key factor driving SpaceX's valuation.

-

Space Tourism: SpaceX's plans for space tourism are expected to generate substantial revenue, significantly impacting its overall valuation. As space tourism becomes more accessible, demand is anticipated to increase dramatically.

-

Satellite Internet (Starlink): Starlink's success in providing global broadband internet access is a major contributor to SpaceX's growth and valuation. The rapidly expanding subscriber base and potential for future applications ensure continued revenue generation.

-

Space-Based Resource Extraction: Future ventures into space-based resource extraction, such as mining asteroids, could dramatically increase SpaceX's valuation, unlocking vast economic potential. This represents a significant long-term growth opportunity.

-

Competitive Landscape: While SpaceX currently holds a strong position, the space exploration industry is becoming increasingly competitive. New entrants and technological advancements could impact SpaceX's future dominance and valuation.

Government Regulation and its Effect on SpaceX and Tesla

Government regulations significantly impact both SpaceX and Tesla. Space-related regulations govern SpaceX's launches and operations, while environmental and safety regulations heavily influence Tesla's electric vehicle production and sales. Changes in these regulations can directly affect both companies' valuations and growth trajectories.

Conclusion

This article has highlighted the significant valuation gap between Elon Musk's SpaceX and Tesla, with SpaceX boasting a substantial $43 billion lead. This difference stems from various factors, including the burgeoning space exploration market, SpaceX's innovative technologies, and the potential for lucrative long-term growth in space-based industries. While Tesla remains a dominant player in the electric vehicle sector, SpaceX's unique position presents compelling investment opportunities.

Call to Action: Understanding the dynamics between SpaceX and Tesla's valuations is crucial for any investor interested in the future of technology and space exploration. Learn more about investing in the future of space by researching SpaceX's progress and exploring the investment landscape surrounding Elon Musk’s companies. Further investigation into the SpaceX valuation and its comparison to Tesla is encouraged for a comprehensive understanding of this exciting sector.

Featured Posts

-

Elon Musk Net Worth Dips Below 300 Billion Analysis Of Recent Market Trends

May 09, 2025

Elon Musk Net Worth Dips Below 300 Billion Analysis Of Recent Market Trends

May 09, 2025 -

The Financial Impact On Elon Musk Jeff Bezos And Mark Zuckerberg Following Donald Trumps Inauguration

May 09, 2025

The Financial Impact On Elon Musk Jeff Bezos And Mark Zuckerberg Following Donald Trumps Inauguration

May 09, 2025 -

De Cao Trach Nhiem Ra Soat Va Xu Ly Nghiem Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025

De Cao Trach Nhiem Ra Soat Va Xu Ly Nghiem Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025 -

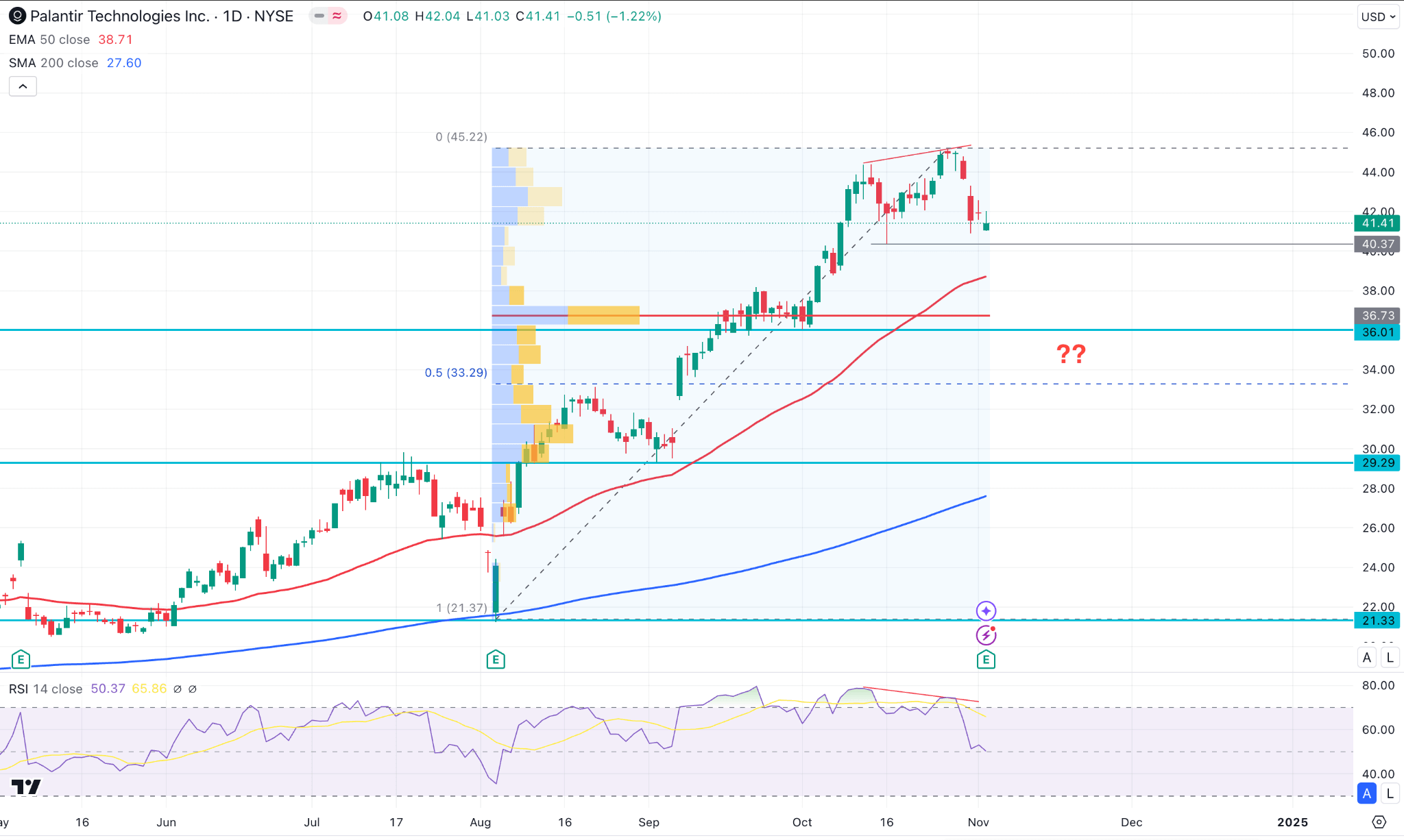

Is Palantir Stock A Buy In 2024 A 40 Growth Prediction Analysis

May 09, 2025

Is Palantir Stock A Buy In 2024 A 40 Growth Prediction Analysis

May 09, 2025 -

Bayern Munich Vs Inter Milan Champions League Clash Preview

May 09, 2025

Bayern Munich Vs Inter Milan Champions League Clash Preview

May 09, 2025